Management of Debt and Market Leadership Should Help Gateway Distriparks Limited

Summary

- The company believes it is future ready, with plans of balance sheet management and new capital expenditure in place.

- The company has plans to invest in rail linked satellite terminals in north and should setup 2 terminals in corresponding years.

- Over next 2 years, the company plans to incur capex of INR120 Cr.

Overview of Gateway Distriparks Limited

Gateway Distriparks Limited is categorised as an only logistics facilitator in entire India having 3 verticals that are synergetic and capable of being interlinked – Container freight stations, Inland container depots having rail movement of containers to major maritime ports, and Cold chain storage and logistics. The company continues to operate two container freight stations at Navi Mumbai. One is at Chennai, 1 is at Krishnapatnam, 1 is at Kochi and 1 is at Visakhapatanam, having total capacity of 600,000+ TEUs. These CFSs provide transportation & storage, general and bonded warehousing, empty handling and other value-added services. The company targets to use land banks to extend capacities, expand presence in new locations and look at new avenues and verticals. Therefore, it plans to be an all-encompassing service provider in logistics industry in this country.

Growth Enablers of Gateway Distriparks Limited

- Rail Freight and CFS Verticals Supported 2Q22: Growth the company has registered in 2Q22 in 1H22 is yet another testimony. Though India continues to recover from COVID-19, kind of boost it has seen in volumes in both Rail freight and CFS verticals supported it to increase internal revenue and margin targets for ongoing year. Apart from growth seen in volumes and revenue, the company performed well in terms of EBITDA, PAT and EPS. Margins are supportive of growth plans in future. In ongoing 3Q22 and upcoming 4Q22, the company expects its business to see a further pick up. Gradual commissioning of more DFC corridors and growth in EXIM business should help the company. The company is quite optimistic about National Logistics Policy. Plans are there to work on expanding customer base and leverage multi-modal network to offer best experience. In 2Q22, the company saw total income of INR341.49 Cr., exhibiting 27.9% growth year-over-year and EBITDA saw 38.9% year-over-year growth to INR96.76 Cr. Net debt of the company as on Sept 30, 2021 was INR440.91 Cr. against INR470.23 Cr. as on Jun 30, 2021.

- Opportunities for Expansion: The company was operational 24/7 without any disruption since lockdown began. It executed several measures to secure continuation of operations. Port and related activities was categorised as one of essential services and the company continues to foresee opportunities for expansion and profit growth in growing containerisation in export-import trade and rail movement, higher participation of private sector in ports and movement of containers by rail, liberalization of Government policies and better foreign trade of the company. Gateway Rail Freight Limited expanded its business relating to operating container trains on Indian railways network. The company was able to put in place fleet of railway rakes/trailers and ICDs. This helped in offering end-to-end solution to customers across India. The company continues to occupy leadership position in Private Container Train Operators. Snowman Logistics Ltd. is listed company since FY15 and it has expanded capacity to become a leading player in emerging business. Though pandemic situation continues, economies continue to open up with fewer restrictions. Higher export – import trade should help in improvement of economy. Growth in port volumes should result in increasing throughput at the company’s CFSs and ICDs. Growth in demand for cold chain logistics business should have a positive impact on the company’s long-term business and profitability. This is particularly true for pharma and food businesses.

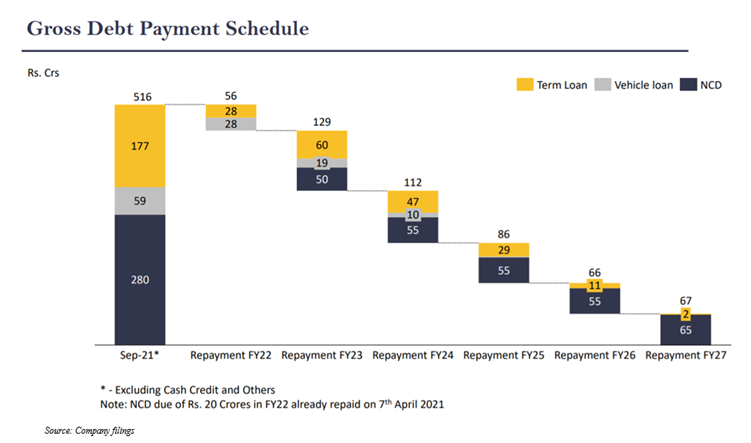

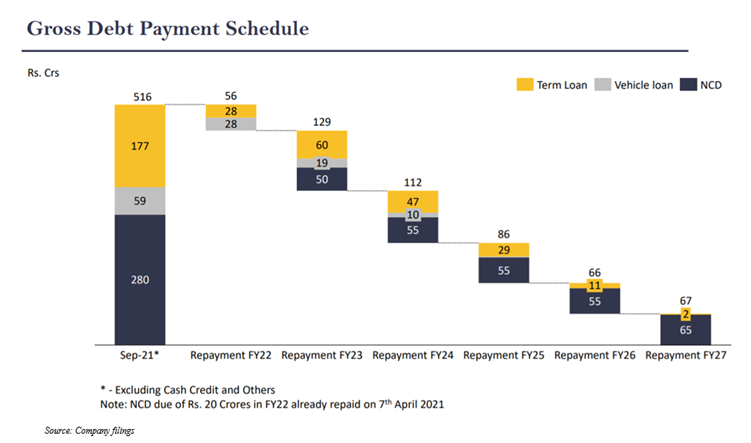

- Strong Credit Profile: Consolidated debt of the company saw a reduction at FY21 end on account of repayment of debt, principally NCDs. Sale of Chandra container freight station, proceeds of rights issue and internal accruals of the company has supported the company in repaying NCDs worth INR2.5 billion. Absence of share pledge of promoter’s stake exhibits that there is some improvement in financial flexibility at promoter level.

- Better Financial Performance: Classification of logistics as essential service supported it to continue operations, albeit at moderate levels. Impact of COVID-19 was seen principally in 1H21 and the company’s strong business profile enabled it to see growth in volumes and revenue in subsequent period. If we exclude Service Export from India Scheme income that was INR0.6 billion in FY20, the company’s consolidated EBITDA saw year-over-year growth in FY21. After considering SIES income which was reported in FY20, consolidated EBITDA was stable at INR3.1 billion in FY21. This was seen despite a fall in revenue and volumes.

- Favourable Industry Dynamics: Logistics industry was categorised as essential service across COVID-19 pandemic. This industry was useful for transportation and warehousing of goods for catering to needs of consumers across sectors. Container Freight Stations and Inland Container Depots lent support in helping with flow of goods as ports were getting congested. After initial lockdown period, volumes have risen because of an increase in manufacturing and consumption and now are at pre-COVID levels. Major development which took place was inauguration of first section of Western Dedicated Freight Corridor that should bring in needed capacity for freight movements on rail. This should stem growth for manufacturing sector in this country. Expectations are there that it will help in reducing road congestion and shifting movement of cargo from road to rail. This is expected because DFC will have ability to run faster, longer and heavier trains.

- Market Leadership Should be Maintained: The company is being categorised as a market leader in each segment. CFS business of the company has seen stabilization and should be able to improve hereon as it now offers end-to-end solution-based services which support just-in-time deliveries. GatewayRail is a market leader in private container train operators. It continues to offer inter-modal rail transportation for EXIM containers between rail-linked ICDs at Gurgaon, Ludhiana, Faridabad and Viramgam and maritime ports at Nhava Sheva, Mundra and Pipavav. Rewari-Madar section of Western Dedicated Freight Corridor was inaugurated in 1st week of Jan 2021 and terminals are now aligned with WDFC which has initiated to bring increased operating efficiency in North-West corridor because of reduction of time of transit and higher double stacking of containers. This improves service quality to customers. This should further enhance as each new segment of WDFC becomes operational.

- Optimism Around Pharma and Ecommerce Products: Snowman Logistics now has a pan-India presence, providing comprehensive temperature-controlled warehousing, transportation and distribution services. Demand continues to increase for high quality infrastructure. This principally stands true for pharma and Ecommerce products and the company continues to expect big expansion opportunities in this sector. Given its network, infrastructure and alignment with Western Dedicated Freight Corridor, the company believes that it has necessary resources for capturing growth after there is some improvement in external factors.

Conclusion

In FY21, revenue of the company was INR1,416 Cr. in comparison to INR1,532 Cr. in prior year. EBITDA saw an increase to INR386 Cr. from INR380 Cr. while the company’s PAT was INR100 Cr. against INR99 Cr. during FY20. During FY21, the company achieved throughput of 5.69 lakh TEUs in comparison to 6.52 lakh TEUs in FY20. The company saw a sharp revival in EXIM trade in 2H21, leading to sharp growth in volumes in both CFS and Rail business.

The company continues to work to manage its liquidity profile and has maintained its focus on management of balance sheet debt. The company sold Chandra CFS & Terminal Operators to Team Global Logistics and it plans to continue to operate its 1st CFS in Chennai where the company managed to handle over 87,000+ TEUs last year. Sale should help in consolidating operations in Chennai at single CFS and should help in improving cost efficiencies & reduce debt. The company has prepaid its INR50 Cr. NCDs from sales proceeds of Chandra CFS. It has also prepaid INR60 Cr. in May ‘20 and INR25 Cr. in Jun ‘20 with help of internal accruals and INR115 Cr. in Sept 2020 through money raised in rights issue. With help of internal accruals, the company has repaid INR20 Cr. in Apr 2021.

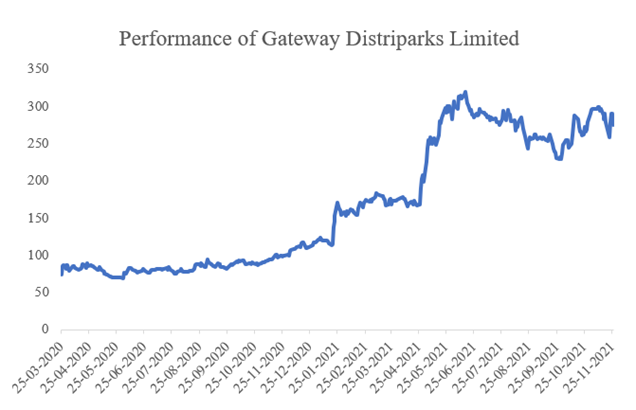

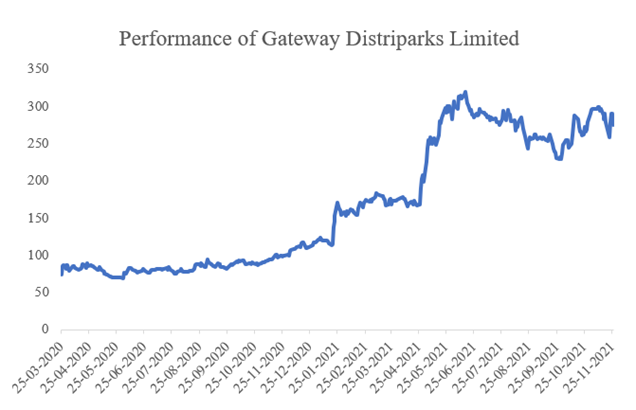

Stock price of Gateway Distriparks Limited saw a run up of ~273.10% between Mar 25, 2020- Nov 26, 2021. Removal of restrictions and pick up of economic activities have supported increase in stock price of the company.

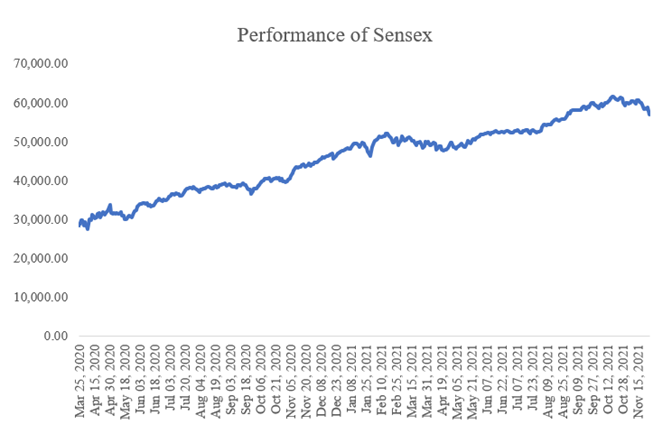

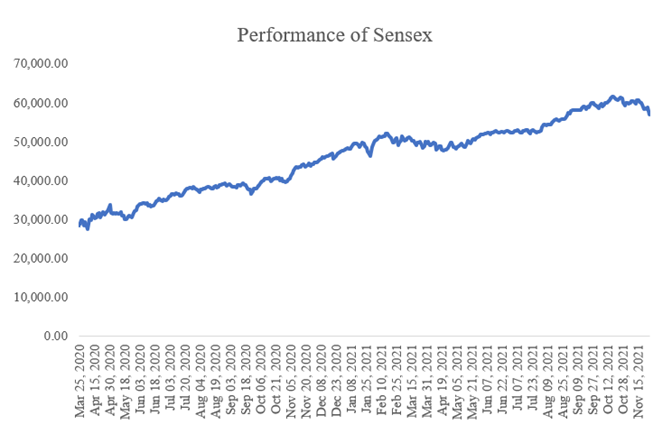

Even though market has improved and has reached new highs after removal of COVID-19 restrictions, Sensex was unable to match returns delivered by Gateway Distriparks Limited’s stock. Sensex has risen only ~100.1% return between Mar 25, 2020- Nov 26, 2021.

Exclusivity:

This article is exclusive to investoguru.

Stock Disclosures:

The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Author Disclosures:

This Article represents the Author's own personal views. The Author did not receive any compensation and do not have any business relationship with any of the companies mentioned in the Article.

share your thoughts

Only registered users can comment. Please register to the website.