Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

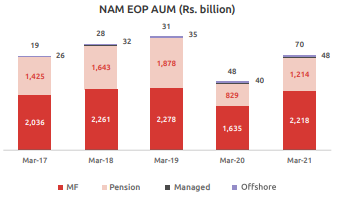

REGISTER NOW OR LOGINNippon Life India AMC limited is the 2nd Largest non-banking affiliated AMC & 5th largest AMC in India with a track record of over 25 years. Reliance Nippon Asset management has been fully taken over by Nippon Life insurance company (one of the leading private insurers in Japan) in the year 2019. It managed around 3,28,586 Cr AUM under its suite of Mutual Fund with 99.8 Lakhs of investor folios as of March 31, 2021, and commands a market share of around 42% of the industry’s folio market share in the passive segment. The AIF business of Nippon AMC manages around 3700 crores & the PMS business of Nippon AMC manages around 1,22,500 crores AUM as of March 31, 2021. Under K-Fintech RTA, Nippon AMC is the number one in Mutual funds service among the other 24 AMCs

Business Model:

The company categorizes its schemes broadly under the following four categories:

1) Mutual Funds 2) Pension Funds 3) Portfolio Management Services & AIFs 4) Offshore funds

The major revenue is contributed by mutual funds & Pension Funds.

Following is the break off of the AUM mix in mutual funds

Product Offerings: The company managed 149 schemes comprising 68 open-ended schemes and 81 close-ended schemes as of 31 march 2021 under its suite of Mutual Fund. The company has the strongest position in the passive category with 22 ETF schemes & 5 Index Funds which is considered to be the largest suite of passive products among the industry players. The fund house has launched 8 new schemes in the year 2020-21. The ETF AUM has almost tripled in the last 4 years from 13,296 crores AUM in the year 2018 to 37,272 crores AUM as of 31 March 2021. Nippon Life India AIF Management Limited manages 15 schemes of AIFs under Category II & Category III. Under PMS, currently, the AMC offers four equity strategies.

Its flagship schemes under mutual funds include Nippon India Pharma Fund and Nippon India Low Duration Fund, both of which have grown to become leading funds in India under its management with an AUM of 5474.07 crores & 8298 crores respectively.

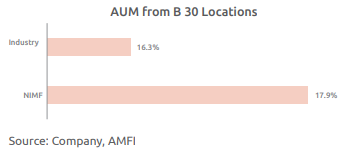

Pan India presence: It has established a geographically diversified multi-channel distribution network covering 287 locations where 84% of the AUM is from T30 cities and 16% of the AUM is from B30 cities. The company's distribution network is extensive with a significant physical as well as the digital presence and included over 78,400 Mutual Fund Distributors, and 20+ digital partners.

Growing Individual Customer base: The PMS industry grew a CAGR of 14.1% in the past five years, with AUM rising from 9.9 Lakh crore in the year 2015 to 19.2 Lakh crore in the year 2020. The company’s SIP book received around 656 crores INR inflows which will result in annualized inflows of 7900 crores approximately. The folios of Nippon MF have grown by 15% in FY2021. The Company has a strong base of retail investors. Nippon MF’s retail AUM contributes around 28% which is the highest among the Industry AAUM and they are the leaders in terms of B30 location AUM among the industry with an AUM of 41260 crores INR out of which 75% were equity assets.

Improving operating performance: Despite delivering a poor sales growth of 1.59% over the past 5 years, the SIP numbers have increased in terms of count from 28.8 lakhs count contributing 683 crores SIP in March 2020 to 33.2 lakhs count contributing 656 crores SIP in march 2021. In terms of distribution, the mix of total AUM as of march 2021 is 57% via MFDs, 22% via Banks, and 21% National Distributors.

Growth Strategy:

Geographical expansion: The company considers the under-penetration of mutual funds in India to be the biggest opportunity. A strong owned distribution network, rise in flows from smaller cities/towns & ongoing consolidation in the industry are some of the focus areas of Nippon AMC in the Mutual Fund business.

Portfolio Performance & differentiation: Nippon AMC intends to expand and diversify its fund portfolio and launch funds. The company’s ‘Investor First’ approach has always helped them to be one of the largest players in the industry. Nippon India Flexi Cap Fund was the NFO launched by Nippon MF in FY21. Nippon India Nifty Small Cap 250 Index Fund was one of the successful passive fund NFO which was launched last year.

Fund manager Team:

Equity: Sailesh Raj Bhan, Samir Rachh, Sanjay Doshi, Meenakshi Dawar, Manish Gunwani, Ashutosh Bhargava, Dhrumil Shah, Vinay Sharma, Kinjal Desai, Arun Sundaresan, Anand Gupta, Tejas Sheth, Vikram Dhawan, Aishwarya Agrawal, Nikhil Rungta, Amar Kalkundrikar, Rupesh Patel, Bhavik Dave, Prateek Poddar.

Fixed Income: Amit Tripathi, Anju Chhajer, Vivek Sharma, Sushil Budhia, Pranay Sinha.

ETF: Siddharth Deb, Vishal Jain, Mehul Dama

Industry Analysis:

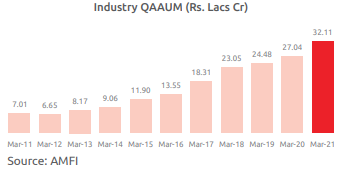

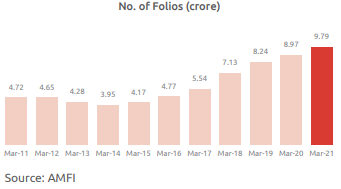

Over the last decade, the Indian MF industry has grown at a steady pace from ` 7.0 lakh crore to ` 32.1 lakh crore, an approximately 4 times increase in a span of 10 years. Further, during the year Industry saw a healthy growth of 9% in total folios largely due to increasing awareness and higher retail participation.

Increasing Participation from Individual Investors This year has seen continued growth in participation, especially from retail investors in equity funds. The MF industry added 81 lakh folios during FY 2020-21. The rise in folios was driven by higher folios in the passive and fixed income categories, taking the total number of folios to 9.79 crores. Folios in the passive category grew by a strong 130% from 32 lakh in March 2020 to 73 lakh crore in March 2021.

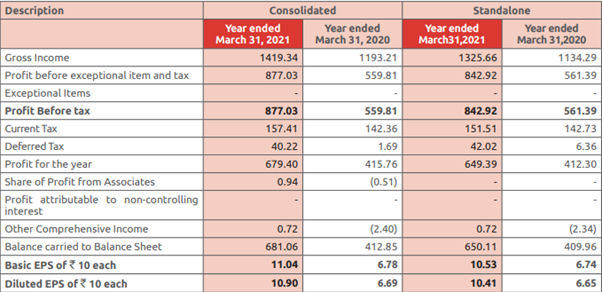

Financial Performance of the company:

The Company’s consolidated total revenue stood at ₹1,419 crore compared to ₹ 1,193 crore in the previous year. Other income stood at ₹ 357 crores as against a loss of ₹ (10) crore in the previous year. Expenditure Total consolidated total expenditure for the year decreased by 14% to ` 542 crores, as against ` 633 crores in the previous year. Fee and Commission expenses for the year were ` 43 crores against ` 70 crore in the previous year - a decrease of 39%. Employee benefit expenses for the year were ` 271 crores against ` 302 crore in the previous year – a decrease of 10%. Depreciation for the year remained at ` 33 crores as against the previous year. Other expenses for the year were ` 190 crores as against ` 222 crore in the previous year - a decrease of 14%. The Profit for the year stood at ` 680 crores as against ` 415 crore in the previous year - an increase of 64%. Total Comprehensive Income for the year stood at ` 681 crores as against ` 413 crore in the previous year - an increase of 65%.

Ratio Analysis:

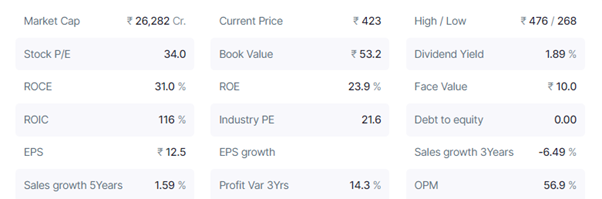

The company has a Market cap of 26,300 crs as of Oct 31,2021 and is trading at a price multiples of 34x which is above the Industry average PE of 21.6x. However, the numbers of the company is of top notch, the company has a ROCE of 31% and has a phenomenal Return on Invested Capital of 116%, and doesn’t have any debts on its Balance sheet. The OPM margin is above 56% however, the only concern remains the lower sales growth of the company and the share value can appreciate further only if the company is able to grow at a better than the current growth pace.

Huge Opportunities Ahead:

With the Under-penetration of mutual funds in India along with the Increasing per capita GDP and a huge Increase in investors for Systematic Investment Plans, the company has a strong owned distribution network with extensive reach across India and the company can leverage Nippon Life’s global network for international tie-ups and partnerships, the growth in the Industry has started now and it has still got a long way to go and the Industry is dominated by 5 to 7 players and as the Industry is not fragmented, the company can achieve growth by providing several value proposition and one can look out for this stock and can invest on every dip in the price of the stock.

share your thoughts

Only registered users can comment. Please register to the website.