Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

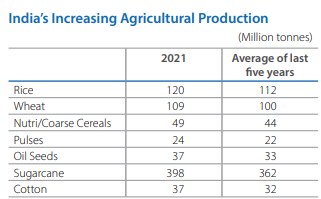

REGISTER NOW OR LOGINAgricultural activities as well as a majority of those directly engaged in agriculture other than migrant labor, have had a limited negative impact due to the pandemic. The Government took important steps to boost the agricultural sector, an important pillar of our economy, by bringing in some key reforms. These steps are expected to make the agricultural sector more organized and will attract the necessary technological interventions to improve productivity and quality of agricultural produce in the long run, thus benefiting millions of farmers and the entire agriculture value chain. The global and Indian crop protection industry has been aiming for geographic diversification of supplies to mitigate associated risks emerging out of geopolitical developments. Your Company is partnering with industry peers and the Government for appropriate policy support in building a supportive ecosystem and making India a global agrochemicals powerhouse.

Incorporated in the year 1948. Rallis India, succeeded Rallis Brothers and became member of Tata Group. From a solo play on agrochemicals, the company has come a long way to make its presence felt across the value chain of agriculture inputs – right from seeds to organic plant growth nutrients along with a suite of package of practices and services. Rallis India, a subsidiary of Tata Chemicals, has a history of over 150 years. The company is into manufacturing of Agrochemicals and is present across the value chain of agriculture inputs - from seeds to organic plant growth nutrients. Rallis is also in the business of contract manufacturing for global corporations.

Today Rallis is one of India’s leading crop care companies. It is known for its deep understanding of Indian agriculture, quality agri-inputs, branding and marketing expertise and a strong product portfolio of comprehensive crop care and seed solutions. Company has factories spread over 4 locations, with large enough capacity in the country today, producing more than 10,000 M.T. of technical grade pesticide and about 30,000 Tons/Litres of formulations per annum. Company has in use TATA Business Excellence Model which is the driving force across all the units and KAIZEN/ TPM with emphasis on analytical tools is used for continuous improvement.

Market share

Crop protection and plant growth nutrients have a market share of 6% in the domestic market and Seeds have a market share of 3% in the domestic market.

In FY20, the co. had a 12% share in the global metribuzin market which is expected to increase with recent capacity expansions.

Business Segments

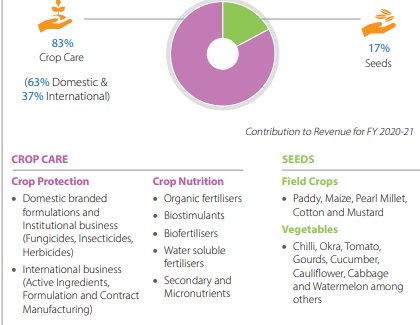

The business is divided into 2 segments:

1. Crop Care Segment (84% of revenue in FY20)

2. Seeds Divison

1) Crop Protection

Further domestic crop protection has been categorised in to three different categories.

Key Aspects Crop protection :

Crop protection Revenue breakup FY 20

Fungicide: 28%

Herbicide: 30%

Insecticides: 42%

2. Seeds Segment (16% of revenue in FY20)

Seed Division (erstwhile Metahelix Life Sciences Ltd) is an agricultural biotechnology company focusing on developing traits and technologies for crop protection & improved productivity. Hybrid Seeds and traits are commercialized.

Seed Division also provides customized research to select global Ag-biotech businesses using its proprietary technologies in crop transformation and functional genomics. Further Seed Division is developing transgenic cotton and rice for insect protection using its proprietary gene constructs and transformation protocols.Seed Division is based in Bangalore, India which is home to a growing number of new-age high technology ventures

Geographical diversification

Domestic: 70% of revenue in FY20 vs 67% in FY19

International: 30% of revenue in FY 20 vs 33% in FY19

Dealer Network

The crop care segment has around 3,812 Dealers and the Seeds segment has around 2,600 Dealers. Overall the co. exports to 70 Locations. Rallis reaches 80% of districts in India and Provides agricultural solutions to more than 5 million farmers.The Average plant utilization is 84% in FY20.

Capex plans:

Co. has planned a total CAPEX of 800 crores for the next five years to enhance capacities for formulations and new active ingredients and achieve backward integration. Capital expenditure is expected to be Rs 200-220 Cr pa for fiscal 2021 and 2022 and it will largely be funded from internal accrual.

R&D Infrastructure:

R&D Expense 1.5% of total revenue in FY20 vs 1.7% of total revenue in FY19. Innovation Turnover Index (‘ITI’): The contribution of new products to the overall revenue. ITI: 16% in FY20 vs 10% in FY19.

Rallis Samrudh Krishi Programme (RSK)

With the spark and samadhan app the company gets in touch with the farmers and solves their queries. On the samadhan app the farmer finds features like weather and mandi information, crop solutions, etc.

Focus

To increase footprint in geographies of America, Europe, Africa, and the Asia Pacific. (International-crop care). Promoting synergy of crop protection with seeds business.(seeds)

Grow market share in underserved Geographies (MP, UP & RJ) and Selected crops (Soyabean, wheat & Paddy (Blast). (Domestic-crop care).

The Co. targets a more balanced contribution of Domestic and International businesses to the overall revenues over the next 3 to 5 years. They have 92 products and 15 molecules in the pipeline.

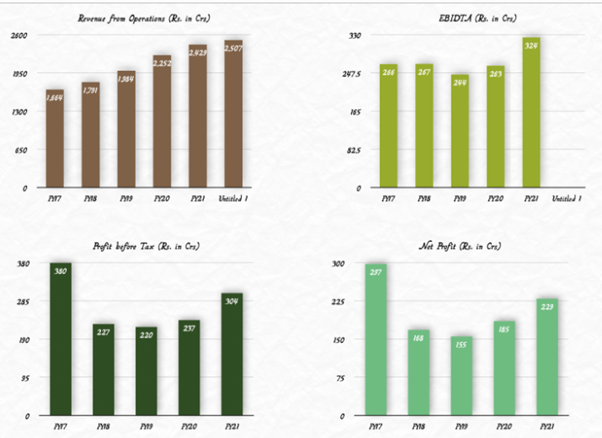

The sales of the company have been increasing at a CAGR of 11% for the past five years and the Net profit has been growing at a CAGR of 8% for the past five years and the company has been able to steadily maintain and grow its sales. However, the profits have been volatile.

For the Year Ended March 21

Conclusion:

Being a part of the Tata group acts as one of the biggest cushions for the company and the Ace Investor and also known as the Big bull of the Indian Stock market Rakesh Jhunjhunwala has been holding close to 10% stake in the company consistently over the past several quarters. The company is a debt-free high-growth company trading average Price multiples and one can consider its stock from the Agrochemical sector for long term and accumulate this stock on every dips.

share your thoughts

Only registered users can comment. Please register to the website.