Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINIn 2020, ‘Health is Wealth’ became the philosophy for survival. As the COVID-19 pandemic wreaked havoc around the world, people turned towards healthier food and a sustainable lifestyle. Food consumption patterns were also modified, with the growing preference for healthy food and snacks that were perceived to boost immunity or mental health.

Rice is one of the most important consumer foods and is a staple food for half of the world’s population. An average person is expected to have consumed around 549 kg of rice in 2020-21, marginally up from the previous year. While the global rice market is projected to grow at a CAGR of 1.2%10 between 2021-26, the Indian rice market is expected to grow at a faster rate of 2.7%11 during the same period. India, the second-largest producer of rice after China12, is the biggest exporter of rice in the world. Export of rice from India increased 9.5 million MT in 2019-20 to 11.59 million MT by December 2020. In the Specialty Rice segment, Basmati Rice holds the leading share. The total Basmati market stands at 9 million metric tonnes (MT) out of which India produces c.8 million MT and Pakistan produces c.1 million MT.

You Reap what you sow

Seventy years ago a seed was sown and now it has emerged as a tree whose branches spread across continents. In the year 1978, Mr. Vijay Kumar Arora began a small company in the village of Amritsar by setting up a small rice mill. Today, LT Foods is the leading processor of rice and other specialty foods in India.

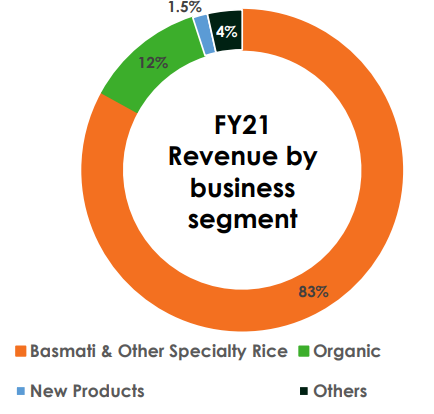

It is primarily engaged in the business of milling, processing, and marketing branded and non-branded basmati rice and manufacturing of rice food products in the domestic and overseas market.

It is also engaged in research and development to add value to rice and rice food products. The Company’s rice product portfolio comprises brown rice, white rice, steamed rice, parboiled rice, organic rice, quick-cooking rice, value-added rice, and flavored rice in the ready-to-cook segment.

The Company’s subsidiary, Nature Bio Foods Limited (NBFL) drives the ingredient-based organic food segment. It has emerged as a trusted brand, offering authentic organic ingredients to consumers across the markets of the US and Europe.

Brands

The company owns several rice brands such as Daawat, Royal, Heritage, Devaaya, Gold Seal Indus Valley, and 817 Elephant. Its Flagship Brands “Daawat” and “Royal” enjoy leadership positions in the market of basmati rice in India and the US with a market share of 27% and 50% respectively.

Flagship Brands “Daawat” and “Royal” enjoy leadership positions in India and US with market share of 27% and 50% respectively.Other brands such as Heritage, Devaaya, Gold Seal Indus Valley, 817 Elephant, Rozana also enjoy leadership position in other countries

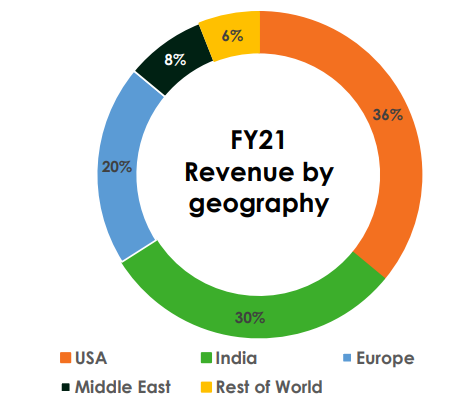

Key Markets

The company's biggest market is the US market which accounts for 37% of total revenue, followed by Indian market and the European Market which accounts for 35% and 14% of total revenues respectively.

In May, 2020, Saudi Agricultural & Livestock Investment Company (SALIC) acquired 30% stake in company's subsidiary Daawat Foods Ltd from minority interests at a price of 17 Million USD. This acquisition has evolved in a partnership among the Saudi agriculture giant SALIC and LT Foods Ltd.

It is a leading partner of Sustainable Rice Platform (SRP), a UN Environment and International Rice Research Institute initiative. LT Foods has a score of 96/100 and is among the best-growing companies as per Sustainable Rice Platform standards.

Capturing the Organic food growth trend:

Nature Bio Foods Limited (NBF), the organic subsidiary of LT Foods started in 1999, has emerged as a trusted partner, over the years, offering authentic organic ingredients to consumers in US and Europe. It offers a range of organic products including rice, pulses, beans, and ancient grains sourced from Asia. The Company also exports organic soya meal and meal, a nutritious protein supplement, sourced from farms in India and African countries in Togo and Uganda. With over two decades of existence and experience, NBF now partners with over 64,000 farmer families and over 94,000 hectares of organic villages across India.

During the year, the segment grew by 51% in revenues and is contributing 12% to the overall revenue. The Company has incorporated two subsidiaries in the US and Europe to strengthen its position in these geographies via the stock and sell model. Investment at the backend, strong supply chain, and expansion in product portfolio has helped the company gain market share across its product portfolio across geographies. During the year, the Company has also launched its product in India across online platforms.

Agile Distribution Network: Well entrenched distribution network in 60+ countries with 800+ distributors across globe. Adopted Go-To-Market Strategies across geographies Enabled tele-ordering and partnered with delivery partners to reach consumers in these unprecedented times Strengthened presence across digital platforms and launched digital campaigns to strengthen the brand share.

The issues faced by the company:

Working capital-intensive operations: Gross current assets (GCA) were high at around 250 days as of March 31, 2021, mainly driven by an inventory of 198 days, primarily on account of higher stocking at year-end. Going ahead, CRISIL Ratings expects operations to remain working capital intensive because of higher inventory procured at year-end.

Susceptibility to volatile raw material prices and changes in trade policies of key importing countries: The group usually enters into an understanding with customers for the supply of rice, though this is not binding. Hence, exposure to risks related to any steep variation in paddy prices, subsequent to procurement, remains high. Additionally, the group is exposed to changes in the trade policies of the countries to whom the group exports basmati rice from India. However, having strong brands, wide geographical reach and sourcing capabilities have helped the group maintain profitability.

Financial performance of the company:

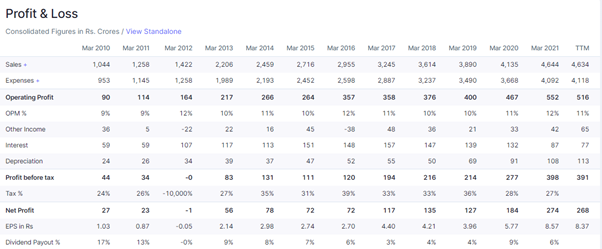

Source: Screener.in

The sales of the company have grown at 14% CAGR for the last ten years and the profit has grown at 28% CAGR for the last ten years and the OPM has increased slightly over the years. The dividend payout remains marginal across all the years. In the past three years, the companies growth has had a poor sales of growth of 9%. However, the profits have grown 27% and by this, we can believe that the company can increase its earnings even if there is a marginal increase in the sales of the company.

The company is trading at a lower price multiple of 8.6x. Its listed peers are KRBL, GRM Overseas, and Chamanlal Setia Ltd, and compared to its peers, L T Foods trades on the least Price to earnings. However, the company has the highest sales growth and dividend yield compared to its above peers and this is clearly an opportunity to exploit. The stock price is trading 20% below its 52-week high price and offers a good deal of margin of safety for the value investors.

Conclusion:

India's Basmati market stood at 2.5 million MT and is growing at a CAGR of 8% as consumers are shifting from Regional Rice to Basmati Rice. Exports of Basmati rice reaching 4.63 million MT during the year 2020- 21. The Arabic regions are the major importers of Indian rice and the company has a well-established presence and tie-ups with the UAE region which will positively help the company and enables the company to have an edge over its competitors, the company has satisfied all the criteria and is suitable for investors who are looking for both value in the stock price and the growth of the company.

share your thoughts

Only registered users can comment. Please register to the website.