Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGIN

Mutual Funds were created so that people don’t have to worry about picking stocks, Now people are getting big headache about picking the right Mutual funds

On Average, the top 5 Asset management company has more 150 schemes with catchy names which makes it more confusing, day by day the financial jargons used the financial analysts increasing at a CAGR of 20% which is quite more than the returns generated by the Mutual funds themselves, with all these it has become a difficult life for the investors who doesn’t have sound finance knowledge.Though mutual funds sometimes look hard I believe ‘’Mutual Funds Sahi hai’’ for those who don’t have knowledge about the markets but want to be a part of India’s growth journey. It also provides diversification of our funds and allows the investors to grow their money without much risk of losing them all.

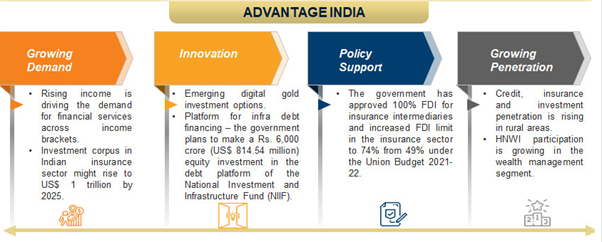

Industry Outlook:

As of June 2021, AUM managed by the mutual fund's industry stood at Rs. 33.67 trillion (US$ 449.29 billion). In June 2021, the total number of accounts stood at 102.6 million. In May 2021, the mutual fund industry crossed over 10 crore folios. Inflow in India's mutual fund schemes via systematic investment plan (SIP) was Rs. 96,080 crores (US$ 13.12 billion) in FY21. Equity mutual funds registered a net inflow of Rs. 8.04 trillion (US$ 114.06 billion) by end of December 2019

How do Mutual Fund houses make money?

To understand broadly, MFs charge two kinds of fees from the investors of their fund –

About the company:

HDFC Asset Management Company (HDFC AMC) is Promoted by HDFC Ltd (52.72% of share) and Standard Life(21.24%), is one of the largest AMCs in India with total assets under management (AUM) of 406800 Cr. as of Dec 2020. The company offers a large suite of savings and investment products across asset classes. The company also provides Portfolio Management & separately managed account services to HNIs, family offices, domestic corporates, trusts, provident funds, and domestic and global institutions.

A deep dive into the business of the company:

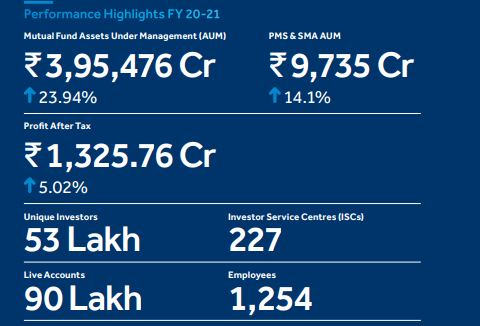

HDFC AMC is the Largest AMC and most profitable AMC in India. It managed around 3,95,476 Cr AUM under its suits of Mutual Fund & 9735 Cr AUM for PMS & SMA as of March 31, 2021, and commands a market share of around 12.6% in terms of Closing AUM.

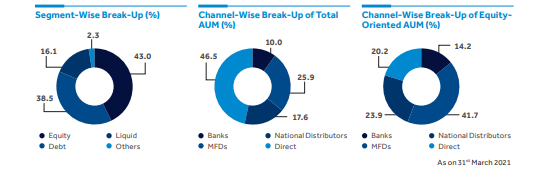

Business Model: The company categorize its schemes broadly under the following four categories: 1) Equity Oriented Schemes - 43% of AUM2) Debt Oriented Schemes - 38.5% of AUM 3) Liquid Schemes - 16.1% of AUM 4) Others – 2.3% Arbitrage Funds, ETFs, FOFs

Product Offerings: The company managed 101 Schemes comprising 24 Equity oriented Schemes, 68 Debt Oriented Schemes, 02 Liquid Schemes, 07 ETF, FOF & Arbitrage Schemes as of March 31, 2021.

Its flagship schemes are HDFC Small Cap Fund & HDFC Short term debt Fund with an AUM of 12,913 crores and 19,011 crores respectively as on 31 Aug 2021, both of which has grown to become leading funds in India under it’s management.

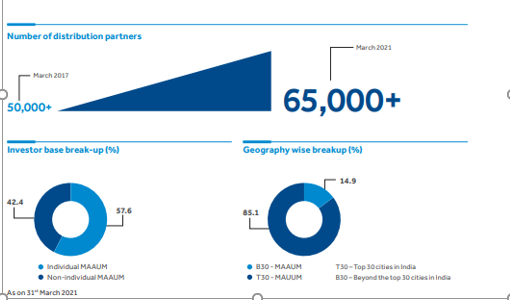

Pan India Presence: The company has established a geographically diversified Pan India Presence distribution presence covering 200 cities and 65000 impaneled distributors making the distribution network extensive and multi-channeled. The distribution channel includes Banks, National distributors, MFDs, and direct.

Growing Individual Customer Base: The AUM has grown at a CAGR of 19.02% for the past 5 years. The Active Equity AUM has grown at a CAGR of 21.31% for the past years. The actively managed equity-oriented AUM at the close of FY 21 was 1.65 Lakh crores as against 1.20 Crores at the end of FY20 with an increase of 38%. The user base has almost doubled from what it was at the beginning of the financial year and grew in-house channel volumes by over 25% on a month-to-month basis.

Improving Operating Performance: During the year 20-21, the SIP flows continued to be resilient. But for the past years, the SIP flows grew 3X from April 2016 to 9182 crores in march 2021. The number of SIP transactions processed in march 2021 was 3.73 crores as compared to 1.01 crores in April 2016. In terms of distribution, the mix of AUM as of June 2021 is 46.5% via Direct, 10% via Banks, 25.9% via MFDs & 17.6% via national distributors.

Growth Strategy:

Geographical expansion: The company’s strong distribution reach is one of the major drivers of growth. Currently, the top 5 cities contribute 69% of the AUM. The next 30 cities contribute 17% AUM. Whereas B30 Cities contribute rest 14% of the AUM.

Portfolio performance & differentiation:

HDFC AMC is aimed at having a comprehensive product portfolio catering to the needs of a large diverse customer base. They had planned to expand the equity product portfolio by launching sector/thematic funds, international FOFs, and passive strategy funds in the FY21-22. As of Oct 03, 2021, they have launched HDFC developed world indexes Fund of Fund which is an international FOF, HDFC Nifty 50 Equal weight index fund which is a passive strategy fund & HDFC Banking & Financial Services Fund which a sector-based Fund.

Fund Manager Team:

Equity: Amit Ganatra, Chirag Setalvad, Gopal Agrawal, Rakesh Vyas, Krishna Kumar Daga

Fixed Income: Anil Bamboli, Anupam Joshi, Shobhit Mehrotra.

Financial Performance of the company:

The Company’s closing AUM as of March 31, 2021, rose by 24% to 3.96 Lakh Crore as against a closing AUM of 3.19 Lakh Crore as of March 31, 2020. During this period, actively managed equity-oriented AUM rose from 1.20 Lakh Crore to 1.65 Lakh Crore. Our Company’s total mutual fund AAAUM rose by 3% to 3.84 Lakh Crore for FY 20-21, as against 3.73 Lakh Crore for FY 19-20. AAAUM for actively managed equity-oriented assets fell by 9% to 1.48 Lakh Crore for FY 20-21 as against ` 1.62 Lakh Crore for FY 19-20.

HDFC AMC remains the most preferred choice for individual investors, with the highest market share in assets from individual investors at 13.7%. We had about 53 Lakh unique investors at the close of the year as against 2.28 Crore unique investors in the mutual fund industry. In other words, 23 out of every 100 mutual fund investors in India have invested in one or more HDFC Mutual Fund schemes. We have a market share of 12.6% in total closing AUM and a 12.9% market share in actively managed equity-oriented funds. Equity-oriented assets form 43% of our total AUM. The number of live individual accounts we serve stood at 88.6 Lakh as of March 31, 2021. HDFC AMC processed 3.6 Crore systematic transactions from April 2020 to March 2021, amounting to ` 11,100 Crore. About 84% of all systematic transactions have been signed up for over 5 years and about 73% for over 10 years.

PEER COMPARISON:

Source: Finology

HDFC AMC takes the 1st spot and is the largest AMC by Market cap and the company demands a higher PE compared to its peers and has a strong track record of having a higher ROCE and ROE. However, the company is trading 12.15 times above its book value. The company has higher operating efficiency and its no doubt that the company is strong fundamental stock. However, the market has given a higher valuation and offering less margin of safety for new investors. New investors can monitor this stock with an intention of buying at every fall and accumulating.

Conclusion:

India has around 4 crores Demat account and a study says that 70% of the account is inactive. The USA also has a 4.7 Crore Demat account. However, if we take the population of both the nations, USA has 34 Crore population and India is somewhere above 415 Crores and we could the potential beholds for the Indian future. The Financial literacy penetration in India is low, however, the growth that India is witnessing is tremendous and is right in front of us and HDFC AMC will be the major player to harness the growth that awaits for the Industry.

share your thoughts

Only registered users can comment. Please register to the website.