Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINAbout Hatson Agro Products Ltd.

Hatsun Agro Product Ltd (HAP), often referred as Hatsun, is a private sector dairy company in India based in Chennai. It was founded by R. G. Chandramogan in 1970. It had become a billion dollar company by mid-2016.

The company manufactures:

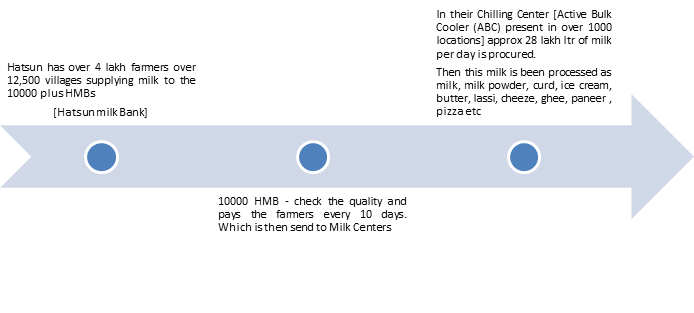

The Process:

|

For distribution, it has 3600 outlets present across 11 major states in India |

|

|||||||||||||||||||||||||||||||

|

Financials:

Let’s look at the CAGR Growth rate

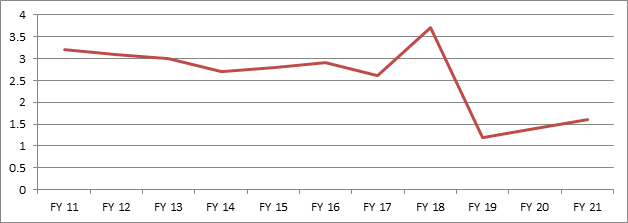

EBITDA has grown at a much higher rate than the Sales, which means the company has made great efforts in reducing their operational Expenses with respect to Raw Material Expense and other fixed expenses. This is majorly as Hatson’s Backward integration into cattle Feed segment. Thus we can witness increase Operating Profit Margins since 2016.Also if we look at the Interest Expense, which symbolizes borrowings is increasing significantly. According to the management, it’s the strategy of the company to fund their working capital with Short term Loans. Debt To Equity Ratio:

The DE was consistently maintained at 3 - 3.5 times till 2018 now its 1.6 which is quite worrying. But as discussed earlier this is strategically planned by the management. The company is comfortable managing debt and is being doing the same since last 4 decades. The promoters hold 75% holding even after 50years.

Segmental Revenue -

Milk is the largest contributor of revenues but CAGR growth rate and the margins is slightly tapering, reason being lesser shelf life. Processed Items are less perishable compared to milk also they have higher operating margins. Ratios:

Cash Cycle is most stable as compared to other peers as Hatsun has created a superb ecosystem for milk Procurement due to this the working capital days is been very efficient managed.Also the ROCE is maintained well above 15%

Peer Comparison -

The company is trading at the Highest PE as compared to its Peers. But it’s again related to debt structure. The company has Debt due to which the interest Expense is more also they are adding new plants due to which the depreciation is also increasing, these two factors are eroding the EPS due to which the PE seems high. If you overlook the Depreciation and Interest Factor the EPS will increase drastically also the PE will come down.

Some Factors that will act as Tailwinds to the Company’s Growth:

Potential Risks: A sharp increase in input prices and competitive pressures A major increase in milk procurement prices and/or increase in competitive pressures will result in downside. Delays in launch of new plants/products Any delays in the launch of new products and/or plants may result in lower earnings than estimated. Risks related to entry into new geographies Hatsun plans to widen its procurement network to Andhra Pradesh, Telangana, and Maharashtra; apart from penetrating further into Tamil Nadu and Karnataka. Since capital investment is planned across divisions, marketing costs and other manufacturing overheads could be high. Further, intense competition from established players operating in newer geographies may continue to constrain scalability, pricing power, and profitability. Susceptibility to changes in environmental conditions Prices of key products, milk and skimmed milk powder, have fluctuated in the past, owing to droughts and supply constraints. Susceptibility to failure in milk production because of external factors such as cattle diseases also impacts the business.

Status of undergoing Projects: Milk and Milk Products Plant in Shirashi, Mangalwaca Taluk, Solapur, Maharashtra: The Plant has been installed with a capacity of 6 LLPD and already started commercial production from the last week of January, 2021. Further, the Company is in the process of increasing the capacity by 50,000 LPD to produce Lassi and Butter Milk and this expansion is likely to be completed by end of September 2021. Milk Products Plant in Uthivur, Kangeyam Taluk, Dharapuram, Tamil Nadu: The Company has already installed manufacturing facilities for Paneer with a capacity of 5 MT per day and commenced commercial production from end of January 2021. In the newly commissioned Milk manufacturing plant with a Milk handling capacity of 3.5 LLPD. The Commercial Production of Milk has commenced on Monday, the 12th July, 2021. Further, the Company is now in the process of setting up a Curd processing unit with a capacity of 1.0 LLPD which is likely to commence commercial production by the end of March 2022. Ice Cream plant in Govindapur, Zaheerabad Taluk, Sangareddy district, Telangana: The construction activities are going on and the Plant with a capacity of about One Lakh Kgs per day is expected to be commissioned by the end of November 2021. The estimated CAPEX is about Rs.311 Crores which will be HAP’s biggest investment Proposed Dairy Plant in Northern Andhra Pradesh: The Company is in the process of identifying the required land to set up the Dairy Plant in the Northern part of Andhra Pradesh. Solar power generation through Swelect Sun Energy Private Limited, Tamil Nadu: This project is under progress and the Company is expected to start consuming solar power through this Project to the extent of about 2.25 crores units annually and this is expected to be completed by end of August 2021. |

|||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||

Conclusion

The company has achieved tremendous growth and there is no doubt that it has still a trick under its sleeve. However, the high Price to Earnings makes us rethink our decision toward investment as the upside is limited and however, this company can be a good buy on dips and one can follow the strategy of accumulating on every dips to enjoy the fruitful growth ahead for the company.

share your thoughts

Only registered users can comment. Please register to the website.