Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINThe IPO frenzy in India never ceases to fascinate us, there is always a new company that promises to provide a 100% return, and the skyrocketing grey market premiums is a never-ending story for the retail investors and I clearly sympathize with them. Today I wish to share a painful story of mine, where I have tried and subscribed for many IPO’s from IRCTC to the recent Paras defense IPO. However, due to the crazy 30x to 100x oversubscription, I never got any allotment.

I thought God favored me this time when I got my first allotment in the Car trade tech IPO but only later I realized it wasn’t actually a stroke of luck. The stock opened on a 4 percent gap down and to date it has yielded a 23% negative return. Though I am disappointed the most, I have learned my lesson.

So after learning my lesson the hard way I decided to look at the business model and the Financial of the company and I found some interesting and astonishing facts which have increased my conviction to holding on to the stock.

About the company:

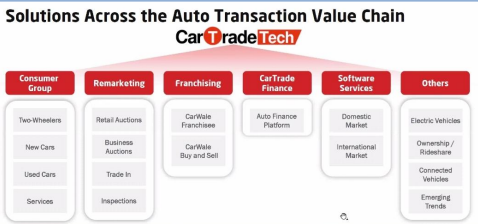

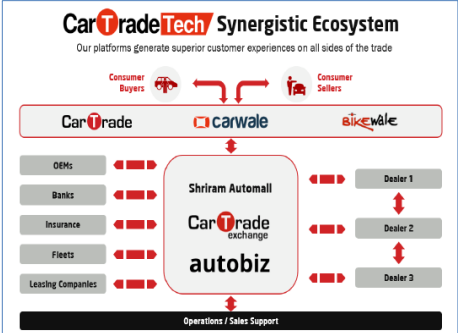

CarTrade Tech Ltd is a multi-channel auto platform provider company with coverage and presence across vehicle types and Value Added Services. The company operates various brands such as CarWale, CarTrade, Shriram Automall, BikeWale, CarTradeExchange, Adroit Auto, and AutoBiz. The platform connects new and used automobile customers, vehicle dealers, vehicle OEMs, and other businesses to buy and sell different types of vehicles. The company offers a variety of solutions across automotive transactions for buying, selling, marketing, financing, and other activities

Why Cartrade tech has the unique Business model:

Large total addressable market (TAM): CarTrade is a multi-channel automobile platform with coverage and presence across vehicle types and value-added services. The company is currently focusing on facilitating buy/sell/auction of used/new vehicles, advertisement & lead generation for new/used vehicles and provides software services, which will likely drive growth in the near to medium term. However, over the longer term, building the entire digital automotive ecosystem provides a huge opportunity for CarTrade by way of franchising and providing value-added services (like financing, insurance, car servicing etc). In FY20, the TAM for online automotive portals in India was ~US$14.3bn.

Wide Range of Service offerings

The company through its various brands provides a wide range of services that includes – Auction of Cars, a Market place for New and used cars, two Wheelers, Used Vehicle ERP Tools, Inspection and Valuation of Vehicles, Auction of Commercial Vehicles and others.

Revenue Mix

The company generates the majority of its revenue from the Transaction charge (57% of the revenue) other key revenue streams of the company are Media: Listing subscriptions and ad revenues from OEMs, dealerships and other advertisers; Software services: Marketplace and software solutions for OEMs, dealerships and banks, Auto Finance, Insurance, and other Value-added services

Brand Portfolio

The company offers services covering the entire value chain and its brands include CarWale, BikeWale, CarTrade.com, Shriram Automall, Adroit Auto.

Brands – Services Offered

CarWale and CarTrade platforms facilitates car shoppers to research and connect with dealers, OEMs and other customers to sell & buy cars from the large variety of new and used cars offered by them. It also facilitates financiers and ancillary companies to offer their products & services on CarWale and CarTrade.

BikeWale platform facilitates customers looking for new and used two-wheelers to research and connect with dealers, OEMs, and other customers for selling and buying two-wheelers.

Shriram Automall facilitates sales of pre-owned cars, two-wheelers, commercial vehicles, three-wheelers and farm & construction equipment.

CarTrade Exchange is an online auction platform and a used vehicle enterprise resource planning (ERP) tool. It is used by consumers, business sellers, dealers and fleet owners to sell vehicles to automotive dealers and fleet owners. Automotive dealers also use CarTrade Exchange to manage their processes for procurement, inventory management and customer relationship management.

Adroit Auto offers vehicle inspection and valuation services used by insurance companies, banks and other financial institutions.

AutoBiz provides new car dealers a CRM solution to manage their customers in an efficient manner.

Strong brand recognition and leadership position: CarTrade’s platforms - CarWale, CarTrade, and BikeWale - collectively had an average of 27.11mn unique visitors per month for 1QFY22, with 88.14% being organic visitors, indicating its strong brand equity. Both CarWale and BikeWale enjoy leadership positions in their relative online search popularity when compared to their key competitors.

Asset Light Business Model

The company has invested significantly in building technology platforms that can manage considerably increased offerings without requiring sizable additional investments and their growing scale has resulted in a decrease in the share of fixed costs. The company also has offline store facilities where buyers and sellers can visit. These offline stores are currently available in a few of the major states like Gujarat, Maharashtra, Tamil Nadu, etc.

High Focus on Marketing

Marketing is one of the key components of the company's operations and its advertisement, marketing, and sales promotion expenses stood at 25 Crs representing 7.5% of the total income of the company.

Increasing Number of Visitors and Conversion rate

The company's websites and apps handled approximately 2.05 million user sessions per day and the Average Monthly Visitors (including Apps) was 2.57 Crs in FY 21, The Number of vehicles listed for auction stood at 814,316 and the Number of vehicles sold through auctions stood at 156,689 with a conversion rate of 0.67% as on FY21. The company has significantly expanded its business, with the total income increasing at a CAGR of 45.94% between financial years 2018 and 2020.

Muted listing:

The company has successfully raised 2998.5 Crores through the IPO and made its debut on 20/08/2021 with a 7 percent discount. The 100% of the IPO amount is an Offer for sale. The promoters OFS accounted for only 103 Crores. However, the Anchor Investors Offer for Sale accounted for 2896 Crores.

Key risks

The prospects for CarTrade are directly linked to the fate of the automobile industry and thus any trends that affect demand for cars might have an adverse impact on the company. The company is thus prone to cyclicality.

The shift in trend towards ride-hailing services, public transportation, and shared mobility services may continue or even intensify post-Covid, which can affect demand for new as well as used cars.

Financial performance of the company:

The sales growth achieved by the company is tremendous and once again the company was able to achieve great sales growth only because of its asset-light business model. A few years ago the company was just a start-up but now it's making sales worth 250 Crs and had a net profit of 91 Crs. The company might not be able to achieve growth of this scale in the future but the company has enough potential as India is adapting and embracing itself towards the technology. Favorable tailwinds in terms of rising digitalization, the rising share of used cars to new cars, rising digital ad spends by original equipment manufacturers and dealers, and large total addressable market, combined with a reputed brand name augur well for CarTrade to deliver sustainable growth and profitability.

Valuations:

The company is trading at a Price to Earnings of 70x which might indicate that the company is trading at a higher multiple. However, the new-age companies don’t seem to care much about the age-old Price to Earnings as they have high growth potential and this doesn’t mean that you can enter at any price but one should always look at the industry dynamics and ensure whether the company is in a position reap the benefits in the Industry.

Conclusion:

The company has the potential to be a turnaround and one can initiate a fresh buy at the levels of 1200 – 1300 and the people who are holding it since the IPO can hold it and can wait for the company to publish its first quarterly results before investing in the company for averaging the price. But the major takeaway of this article is not just to blindly follow the Grey Market premium but also to try to understand the business of the company and the Industry dynamics.

share your thoughts

Only registered users can comment. Please register to the website.