Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINThe Indian Air Conditioning market is highly skewed towards Room Air Conditioners (RAC), with RAC contributing as much as 80% of the market. While online sales of RAC have started growing in the recent years, majority of sales still continue to be driven heavily through offline retail showrooms and distribution channels. Moreover, over two thirds of the annual RAC sales take place in the first half of the financial year. As the pandemic induced nation-wide lockdown was implemented starting March 24, 2020, Room air conditioner market experienced an estimated year on year de-growth of almost 60% during the first half of the year. The subsequent disruption to global supply chains, ocean freight, domestic logistics and overall slump in consumer demand resulted in an overall year on year primary sales decline by approx. 17%.

About the Company:

Blue Star is India''s leading air conditioning and commercial refrigeration company. The company has huge stores for room ACs, packaged air conditioners, chillers, cold rooms as well as refrigeration products and systems. Blue Star’s integrated business model of a manufacturer, contractor and after-sales service provider enables it to offer an end-to-end solution to its customers, which has proved to be a significant differentiator in the marketplace. In fact, every third commercial building in India has a Blue Star product installed.

Blue Star offers one of India’s widest range of air conditioning and commercial refrigeration products, as well as a comprehensive range of air purifiers, water purifiers, air coolers, cold storages and specialty products. The diverse air conditioning product range serves both commercial and residential segments, and includes a solution for every need. Blue Star serves homes through precision inverter, split and window ACs. Commercial complexes and condominiums are served through a wide range of state-of-the-art VRFs and ducted systems. Showrooms, offices and ATMs use the Company’s commercial solutions including a range of standard split ACs as well as mega split, cassette, and verticool ACs. Blue Star’s chillers adorn landmark buildings and mega structures such as airports, malls, hospitals, and industrial establishments.

A Detailed Analysis of the company:

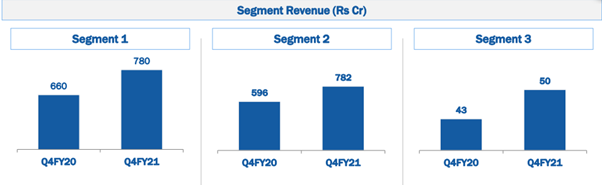

Blue Star has three Major Business segments:

1)Electro-Mechanical Projects and Commercial Air Conditioning Systems. – 48% of the revenue

During FY20, the Company won orders from Mumbai Metro Rail Corporation Limited, and the airport expansion projects at Chennai, Bengaluru, and New Delhi.

2)Unitary products – 48.5% of total revenue

The revenue in this segment comes from the sale of Room Air Conditioners.

It has a market share of 12.5% in this segment.

3) Professional Electronics & Industrial Systems – 3.5% of the revenue

Source: Investor Presentation

Electro-Mechanical Projects and Commercial Air Conditioning Systems

The Company has two sub Divisions in this segment

In this segment the company involves in the Design, engineering, procurement, and execution of MEP projects in buildings (including Airports), factories (including Data centers) and infrastructure (Metro rail) segments & ventilation projects The company takes several Mechanical EPC projects in large Industrial sector & Electrical EPC projects for Electrical substations. The companies Value Proposition Superior project delivery through intelligent engineering, modern execution practices, and committed team.

The company offers a complete range of energy-efficient Packaged and Ducted split air conditioners and an Innovative New range of Packaged & Ducted Split air conditioners with Virus Deactivation Technology(VDT) Innovative new generation Inverter ducted system and VRF V Plus, the fifth-generation VRF designed for Indian conditions and higher efficiency. It has 525 dealers in 175 towns only for this segment.

Unitary products:

Blue Star offers a wide variety of contemporary and highly energy-efficient room air conditioners for both residential as well as commercial applications. It also manufactures and markets a comprehensive range of commercial refrigeration products and cold chain equipment. The company has Installed a base of over two million units. • Products available in 7000 outlets in more than 650 locations across the country. • Focus on inverter technology, energy-efficient products, and ACs with purification technologies. • Focus on residential as well as corporate and commercial customers • Aesthetics and low noise make our products widely recommended by interior designers • Higher quality consistent performance under various Indian conditions.

Professional Electronics & Industrial Systems

For over six decades, Blue Star has been the exclusive distributor in India for many internationally renowned manufacturers of professional electronic equipment and services, as well as industrial products and systems. This business is managed by the Company’s wholly-owned subsidiary, Blue Star Engineering & Electronics Limited

Lines of Business include – Healthcare Systems: MRI & CT Scanner – Data Security Solutions: Payment HSM, PKI, Encryption Communication Systems: Satellite Test Equipment, Radio Frequency recorders – Testing Machines: UTM, Hardness Testers, Chambers – NDT Systems & Industrial Automation: Ultrasonic, Eddy Current Systems, X-Ray, MPI, Bagging, Truck Loading – NDT Products: Ultrasonic, RVI, X-Ray, CT, CR, Metrology, the company evolved from being only a distributor of leading global manufacturers to a high-end system integrator and value-added reseller.

High Market Share in product segments

|

PRODUCTS |

MARKET SHARE |

|

Room Air Conditioner |

12.5% of total market share |

|

VRF system |

18% of total market share |

|

Screw chillers |

15% of total market share |

|

Scroll chillers category |

40% of total market share. |

|

Ducted system category |

45% of total market share |

The company’s overall market share increased from 10.5% in FY 16 to 12.5% in FY 20.

Increasing Geographical Footprints:

The company makes 96% of the revenue from the Indian operations and mere 4% revenue from the International Markets. However, the company is focussing more on International operations and intends to generate more revenue from the International markets. The International business is headquartered and managed by the Company’s wholly-owned subsidiary in Dubai and they Offer air Conditioning and Refrigeration products, after-sales service as well as system integration in global markets. The International Product portfolio includes Unitary products, DX Commercial, refrigeration, and Applied systems products. The company aims to build a larger international footprint by enhancing the reach of distributors, channel associates. The International projects are managed by the Company’s international joint ventures in Qatar and Malaysia. The company has state-of-the-art exclusive showroom in Dubai. Displays a complete range of our latest energy-efficient products for the Middle East.

Adapting to the Changing trends:

The current contribution of Blue Star’s unitary products from e-commerce to overall sales is less than 5%. But co. expects this to grow to over 20% by FY24. Online sales of room air conditioners and water purifiers in FY20 grew by 63% and 42% respectively over FY 19.

Agile Distribution Network:

The Channel Partners have increased to 3800 in FY20 vs 2700 in FY17. It has around 6000 stores for room air conditioners, packaged air conditioning, chillers, cold rooms, and refrigeration products and systems as well as 1060 service associates reaching out to customers in over 900 towns.

Manufacturing Facilities:

The company has 5 manufacturing sites across India. It has a Manufacturing footprint of 1 lakh square meters and over 300 models manufactured across 25 product lines.

Research and development:

The company has spent 278 crores on R&D in the last 5 years. The company spent 68 crores on research and development in FY20, which is 1.28% of total revenue.

Healthy Order book and Expansion Plans:

The total Order book as of Q3FY21 is 3039 Cr

In FY 20, Co. got one order from Mumbai Metro Rail Corporation for an air conditioning and tunnel ventilation system valued at 253 crores.

The company will soon be ready with a new range of central air conditioning solutions with in-built air purification capable of killing the COVID-19 virus. Further, to expand operations in the Middle East, Blue Star inaugurated a new office and its flagship showroom in Dubai during the year. Co.is expecting approximately Rs 150- 200 crores revenue when the private hospitals and private sector pharma companies will get permission to directly engage in the vaccination supply chain.

Analysis of the Business performance of the company:

Source: Finology

The company has shown a poor profit growth of -12.46% for the past 3 years and a stagnating revenue growth of -2.77% for the past 3 years. However, we could see that the company is maintaining a healthy ROCE of 20.13% over the past 3 years which is a positive sign. The company is trading at a high PE of 61.82x but its peers are trading with a PE of more than 80x, and from this, we can draw a conclusion that the company is not overvalued to a larger extent.

Aiming for the stars:

The company has a good product line and it has got good potential but its also important to understand how the share price functions. Though the company operates in the Engineering segment as well the share price tends to be cyclical as the need for Air Coolers goes down in the Winter, the share price bottoms out in the period and as the need for its products increases in Summer, the share price touches its peak and by which we as an Investor should buy the stock during the winter and Sell them during the summer.

share your thoughts

Only registered users can comment. Please register to the website.