Schaeffler India - Pioneer then, Leader Now.

Summary

- Schaeffler India is part of the Schaeffler group which has more than 73 Manufacturing units across 50 Countries

- The R&D driven approach has enabled the company to provide several niche offerings to its customers

- A brief look on the financial of the company and its valuations.

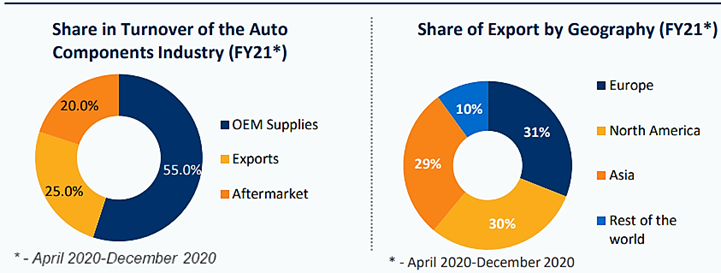

Indian Auto-Components Industry Outlook

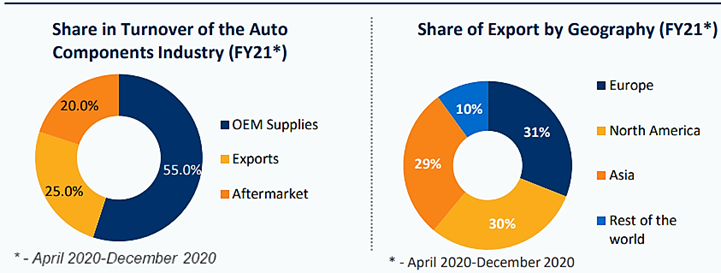

The Indian auto-components industry has experienced healthy growth over the last few years. The auto-components industry expanded by a CAGR of 6% over FY16 to FY20 to reach US$ 49.3 billion in FY20. The industry is expected to reach US$ 200 billion by FY26. Due to high development prospects in all segments of the vehicle industry, the auto component sector is expected to rise by double digits in FY22. Auto-components industry account for 2.3% of India’s Gross Domestic Product (GDP) and employs as many as 1.5 million people directly and indirectly.The Foreign Direct Investment (FDI) inflow into Indian automotive industry during the period April 2000-March 2021 stood at US$ 25.85 billion as per the data released by Department for Promotion of Industry and Internal Trade (DPIIT). The Indian auto-components industry is set to become the third largest in the world by 2025.

About Schaeffler India Ltd.

Schaeffler India is part of the Schaeffler group, a global conglomerate supplying critical components to the Automotive and Industrial sectors. The company has 73 manufacturing facilities across 50 countries. The company has sales offices in over 170 locations around the globe. Schaeffler has an extremely broad expertise in manufacturing and the technology for the highest level of cost effectiveness and high-precision products with a high level of vertical integration.

Schaeffler India

Schaeffler has a dedicated engineering and R&D support base in India to augment the product teams having one of the largest after-market networks serving both Automotive and Industrial segments. In India, Schaeffler has 4 plants and 19 sales offices with over 3,000 employees. Schaeffler India Ltd is engaged in the development, manufacturing and distribution of high-precision roller and ball bearings, engine systems and transmission components, chassis applications, clutch systems and related machine building manufacturing activities.

|

Schaeffler India – Business Segment

|

|

|

- Automotive Technologies:

- The Automotive Segment contributes around 53% of total sales for Schaeffler.

- Schaeffler’s client portfolio boasts of leading names like Maruti Suzuki, Mahindra & Mahindra, Hyundai, Tata Motors, Denso, TVS Motors, Bajaj Auto, Bosch, Hero Motocorp, Honda, Premier, Ford Motors, John Deere, Escorts etc.

- The main products under this segment include chassis components and systems, technologies for clutches and transmissions, as well as engine components and drives for hybrid and electric vehicles.

- Schaeffler’s precision products are key to reducing fuel consumption and emissions while extending the service life of engines and transmissions.

- Backed by their strong research base, the company develops products right from the product development phase to the volume production phase.

- A technology for Hybrid and Electric Drive Systems product portfolio offers the full bandwidth of electrification options- from 48-Volt hybrids and plug-in hybrids to drives for purely electric vehicles.

Thus making Schaeffler an expert partner to the various markets and customers it serves.

48V Electric Axel

Functional advantages

- Provides electric drive power close to the axle for moving off solely using electric power

- Driving maneuvers: e-creeping, e-sailing, stop and go, turning, parking, boosting, recuperation.

- It even Reduces CO2 emissions of up to 15%. Also helps improve fuel efficiency of ICEs by more than 20% by installing an electric motor as an electric axle on the rear axle.

- It enables electric driving at slow speeds such as when parking the vehicle.

-

- Considering the Futuristic Mobility, Schaeffler has developed drive solutions for purely battery electric vehicles in its portfolio like electric vehicle drive trains and ‘EWheel Drive’.

Under the E-Wheel Drive (wheel hub drive), Schaeffler demonstrates how the drive technology can be relocated to the wheels and thus enabling self-driving cars.

Key products launched in 2020 -

- Introduced clutch systems to new passenger car and truck applications

- Implemented advanced wheel bearings in new platforms of Maruti-Suzuki and Tata Motors

- Started supplies of new valve train, timing drive and water pump components to major OEMs

- Developed axle box housing for Alstom India for their Mumbai line 3 and Montreal metro coaches

- Introduced clutch portfolio for pass cars, light and heavy commercial vehicles

- Developed rocker arm with HLA for tractor application

- Advanced DCT Dampers for dual clutch transmissions

- The Automotive Aftermarket

It is responsible for Schaeffler’s global spare parts business and delivers innovative repair solutions in original equipment quality.

- All components are tuned to work perfectly together and allow for replacing old parts fast and professionally. They also offer comprehensive services to garages by conducting practical-oriented training seminars, offering repair assistance via their hotline and garage portal, and by developing special tools.

Key products launched in 2020 -

- Launched a complete range of engine oil, transmission oil, grease, coolant, hydraulic oil and shock absorber oil under the Schaeffler True Power brand

The Industrial Solutions

- The Industrial Solutions business of Schaeffler makes up for ~47% of total sales.

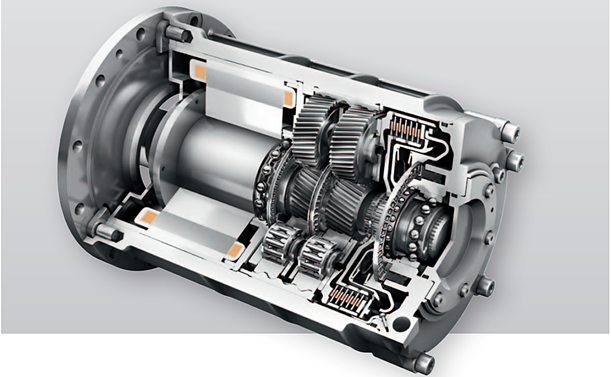

- The product spectrum of this division includes rolling and plain bearings, linear and direct drive technology as well as service features such as maintenance of products and monitoring systems. The industrial division offers a wide portfolio of bearing solutions, ranging from high speed and high precision bearings with small diameters to large size bearings several meters wide.

The focus is increasingly shifting towards smart products and on connecting components.

- The Industrial products catalogue consists of more than 40,000 products of varying sizes.

- These Products find their applications in Renewable Energy sources, Railways, Power Transmission, Pharmaceuticals, Off-Road motors, Aerospace(high precision bearing supports for the engines), Textile (for weaving machines), Food packaging and also in Mining (conveyor systems).

Key products launched in 2020 -

- Extended inner ring spherical roller bearing developed for export market

- Extended current insulated bearing local range to e-motor applications

- Extended steering races product range to three-wheelers

- Introduced starter one-way clutch with torque limiter function in various two- and three-wheelers

Special Machinery

- Special Machinery is a strategic division of Schaeffler that was established in 2006 in India to build new production machinery and also to improve/upgrade the existing automation equipment across Schaeffler Plants.

- In 2020, Special Machinery was scaled up with newly built state-of-the-art facility at Maneja, Vadodara. Now it has a total assembly area of around 1600 m2.

- The portfolio of these resourceful specialists encompasses assembly automation, measuring and inspection technology robotics and camera systems.

- Most recent highlights of 2020 include development of CRB 120 Assembly Line and SRB 920 Assembly Line for Savli Plant, robotic solution for SLHS system assembly for Talegaon Plant, set up of EK17 Clutch Line at Hosur Plant.

|

|

|

|

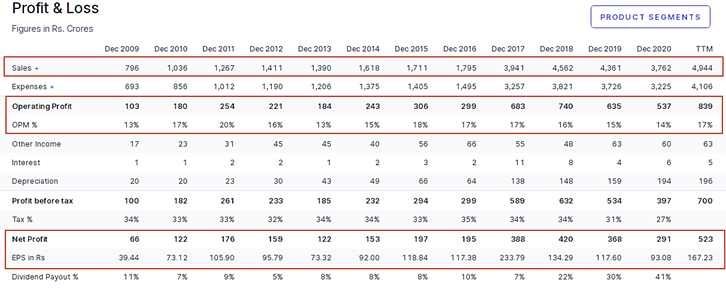

Financials:

Let’s look at the CAGR Growth rate

|

5 years - CAGR Growth (%)

|

|

10 years - CAGR Growth (%)

|

|

Sales

|

17

|

|

Sales

|

14

|

|

EBITDA

|

12

|

|

EBITDA

|

12

|

|

PAT

|

8

|

|

PAT

|

9

|

|

EPS

|

-5.81

|

|

EPS

|

2.45

|

- The company has maintained the Operating margins.

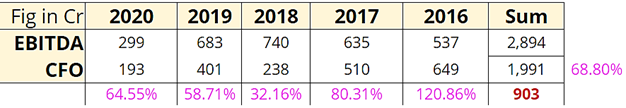

- Even after making acquisitions, company manages to pay dividends. This defines that company generates ample amount of cash. Company extracts Approx 70% Cash from its EBITDA.

- Sales and Profit seems to be growing at a decent rate.

- TTM numbers looks attractive.

Operating Profits Vs. Cash Flow

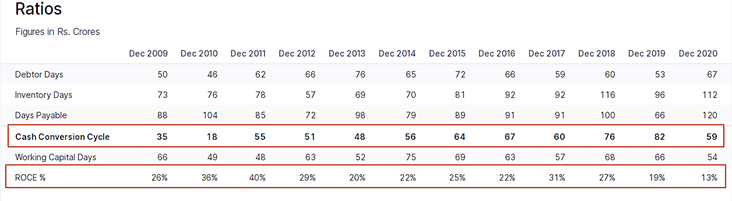

- The Cash Cycle is reducing, which is a positive sign. Decline in the ROCE is majorly due to Acquisitions as they are yet to unlock value to the Schaeffler India.

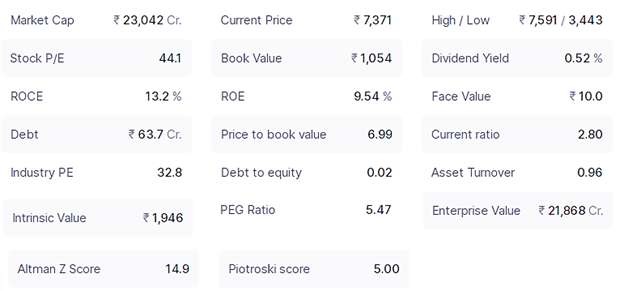

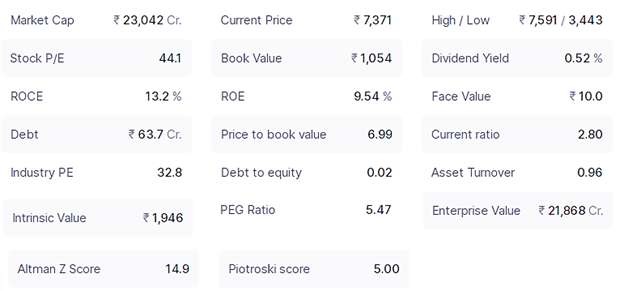

Valuation Parameters:

- It is trading at 7 times its book value.

- Considering PE and PEG ratio, the stock price seems to be overvalued at this time.

- As per Warren Buffett’s Valuation Model the price should have been somewhere between 2100 – 2300

Peer Comparison -

- Schaeffler India has the highest Operating Margins.

- Among the Peers, SKF India seems to be Dominating

Some Factors that will act as Tailwinds to the Company’s Growth:

- In the automotive OEM segment, the company is witnessing increased content per vehicle in the petrol passenger vehicle segment post the implementation of BS-VI emission norms.

- In the industrial OEM segment, the company is witnessing strong growth from the railways segment and wind-power division.

- The railway division’s business is driven by introduction of new products and supplies to metro railways, while the wind-power business is aided by new client acquisitions.

- Aftermarket is also poised for healthy growth, driven by new product introductions.

- It has launched the lubricant business under ‘True Value’ brand, which is gaining momentum. The company aims to introduce more products in the segment.

- SIL is part of the German Schaeffler Group. The Schaeffler Group has a strong research and development (R&D) DNA. In CY2019, the group filed 2,400 patents, making it the second-most innovative company in Germany. SIL would benefit from its strong parentage and is expected to receive new businesses going forward. Moreover, SIL’s parent has identified it as a manufacturing base for supply to Asia-Pacific region. This provides a huge growth potential for the company in the long run.

|

|

Conclusion

The Schaeffler Group is a well-established player in the automotive components and Industrial bearings segments. Its approach towards R&D is what sets Schaeffler India apart from its peers. Schaeffler works closely with its customers to design and develop new technologies which are critical in making their customers’ industries more productive and reliable. The company enjoys better margins and valuation as compared to other auto ancillaries.There are plenty of Industry headwinds for the Automobile sector such as slowing demand, liquidity crunch, higher acquisition costs, changing regulations and the threat from electric vehicles But, Schaeffler is uniquely positioned as its sales mix is well balanced between Auto and Industrial businesses. So while the Auto business is down, the Industrial business has grown and this diversity provides Schaeffler with a good hedge.Delayed approval from industrial customers and late launches by automotive players can impact growth.

Exclusivity:

This article is exclusive to investoguru.

Stock Disclosures:

The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Author Disclosures:

This Article represents the Author's own personal views. The Author did not receive any compensation and do not have any business relationship with any of the companies mentioned in the Article.

share your thoughts

Only registered users can comment. Please register to the website.