Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINFor Countries like India Covid is not a pandemic but an endemic - WHO

As per Dr. Soumya Swaminathan, chief scientist of the World Health Organisation (WHO) it seems that India may be entering the stage of endemicity. In an interview with journalist Karan Thapar for the news website The Wire, she said, “India could have reached some sort of stage of endemicity in terms of the overall COVID-19 situation’’. Covid has brought several disruptions to the way we live as a society and companies to have to adapt themselves to the change else they will become obsolete and that goes for even the companies that are too big to fail and today let's speak about a Quick Restaurant company that is struggled a lot but was successful in adapting itself to the changing dynamic.

Introduction:

The IPO’s are buzzing the Dalal Street and so many companies are coming up with their IPO’s like no other time and there is a reason obvious reason for this is that the IPO market is on its bull run like no other time and the Retail investors participation is very high and people are ready to subscribe to any IPO’s for the gain post the listing and all of our are excited and today lets see about the most awaited IPO of the month Devyani International and discuss about its prospects post listing of the shares in the secondary market.

What Makes Devyani International an Unique company:

A part of RJ Corporation:

Devyani International Ltd is a part of RJ corporation started by Ravi kant Jaipuria in 1991, RJ Corp is a powerhouse multinational with thriving businesses in beverages(Varun Beverages) fast-food restaurants(KFC, Pizza Hut, Costa Coffee) retail, ice-cream, Livestock (Cream bell, Daima) healthcare (Medanta Afri care)and education with a presence across 26 Nations through its subsidiaries. RJ Corporation has played a pivotal role in bringing the various western beverage conglomerates in India and has been successful in running them in India.

About Yum Brands:

Yum Brands is an American fast food corporation and is one of the world's largest fast food companies in terms of system units. It owns several iconic brands such as KFC, Pizza Hut, Taco bell, The Habit burger Grill and many more. The company operates in 135 nations and territories worldwide, they operate 43,617 restaurants, including 2,859 that are company-owned and 40,758 that are franchised

Devyani started its first association with Yum brands in 1997 when it opened the Pizza hut store in Jaipur. Since then the company has expanded to 696 locations in 166 cities across India and is the largest franchisee of Yum brands on Non -exclusive basis.

Business segments: The company has three major business segments namely, Core Brands(73% of the revenue) International Business(10% of the revenue), Own Brands(17% of the revenue as of FY 20)

Core Brands: The companies core brands are KFC, Pizza Hut, and Costa Coffee, they currently operate 284 KFC stores, 317 Pizza Hut and 44 Costa Coffee stores as on June 21. Among the Core Brands, KFC contributed 61% of the revenue, followed by Pizza hut which contributed 27% of the revenue and the remaining by Costa Coffee brand.

International Business: As of March 31, 2021, they had 35 stores of their Core Brands outside India, comprising 32 KFC stores and 3 Pizza Hut stores. In addition, they operated two stores of another brand outside India as of March 31, 2021. They operate KFC and Pizza Hut stores in Nepal, and KFC stores in Nigeria, on a non-exclusive sole franchisee basis. Nigeria accounts for 80.82% of total revenue from operations from International Business whereas Nepal accounts for 19.18%

Own Brands: The company also runs south India QSR chain Vangoo and Food Court Restaurants and Bars vertical at Airports, Hospitals, Malls and Highways with brands like Vango, Food street, Masala Twist, Amreli, Chrussh, Juice bar, Ile bar etc. s. The company has 51 stores as of June,30th FY21 as against 64 in FY19. The company intends to create a leaner and profitable business due to which they have moved out of most concession agreements at Airports.

Business Restructuring and Rapid expansion: DIL is moving towards a leaner business model with a shift toward delivery model and smaller store formats for KFC and Pizza Hut. In line with its leaner business model strategy, the company has shut down airport concession stores and 61 nonperforming stores to improve efficiencies in the business. The company has adopted an aggressive store expansion strategy with the addition of 100+ stores in FY21, 40 stores in Q1FY22 and believes this will continue for the next 2-3 years. DIL also acquired 73 equity KFC stores in south India from its parent Yum group during the period FY19-21.

High growth in Online Distribution: The online distribution accounted for 70% of the sales of its Core brands in FY21 which is a 19% increase from FY20, The online Delivery channels include Pizza Hut & KFC mobile apps, web ordering services, telephone ordering services and other delivery providers like Zomato and Swiggy.

The concentration of stores in North and South India: North and south India accounted for 74% of its total stores of Core brands and 50% of its stores are located in its top 5 cities and as the company follows cluster-based expansion they have been able to reduce the store operating cost by centralizing the sourcing, warehousing and distribution of raw materials in a single place for all its Core brands. It has one warehouse in the corporate office and 7 other warehouses. In addition, it has its own in-house as well as third-party logistics which reduces operating costs.

Terms of the Franchise Agreement:

Each new store under the Core brands requires an Initial payment to the Franchisor. As per the Agreement, Devyani will pay 53,400 USD for opening a new KFC store and 26,700 USD for opening a Pizza Hut store and the company will pay 6.5% of its gross revenue as a royalty to YUM BRANDS and a flat 6% of its gross revenue as royalty to Costa coffee International. DIL collaborates with Yum for store selection, product innovation and development, brand strategy and technology initiatives etc. DIL pays royalty of 6.3% to YUM for KFC and Pizza Hut while it has a 6% spend obligation on advertising, brand building and marketing.

The KFC TLA is applicable for a term of 10 years from the relevant specified date and provides an option to renew such agreement for an additional 10 years in accordance with the terms thereof, and payment of the applicable renewal fee. The renewal fee for stores is 50% of the existing initial fees. The term of the new agreement will be 10 years with a right to require renewal of further 10 years and be based on the same terms and conditions as those set out in the Costa IDA including with respect to the franchise fees payable.

The issues faced by the company:

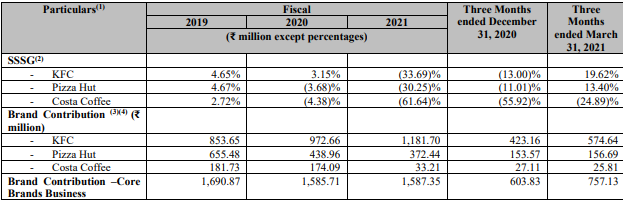

Declining Same-Store Sales Growth: Devyani's SSSG has been declining for the past three FY's. The core brands had 41% negative SSSG. The overall revenue of the company is increasing majorly due to the expansion of its store network.

Lockdown and Covid Third Wave: The QSR companies have been playing Tug of war with Covid induced lockdowns and other restrictions and this has been impeding the growth of the company and as most of the stores have been operating on the basis of the lease, they have high lease liabilities and a declining sales would increase its fixed cost which is hurt the growth and profitability of the company. The issue has been slightly reduced and thanks to the faster acceptability of ordering food online by Indians and this change in the preference has been a real saviour for all the QSR in India.

High Debt to Equity:

The companies Debt to Equity stood at 4.07 even post the funds raised through the IPO and this has been a major concern of the company and it has borrowings of around 463 Crs and the company intends to reduce them in the coming days and the future prospect looks promising and the increase in the revenue from its online sales will enable the company to manage the further covid crisis.

The Road Ahead:

The company has been with the Indian market since liberalization and with strong parentage and a better understanding of Indian Customers gives the company a better edge in the space. However, it’s prudent to buy the stock on every dip and accumulate for a longer-term gain, and once when we live a life without covid and how to further that day might be will be a turnaround for the QSR companies like Devyani International.

share your thoughts

Only registered users can comment. Please register to the website.