Is This A Right Time to Invest in Federal Bank Limited? Let's Explore!

Summary

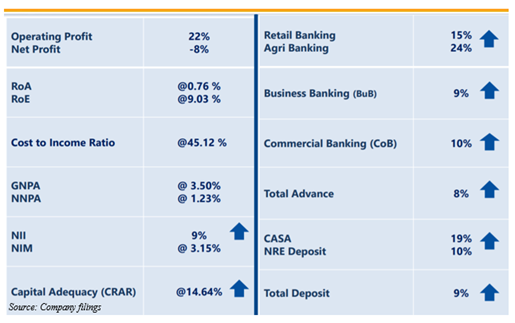

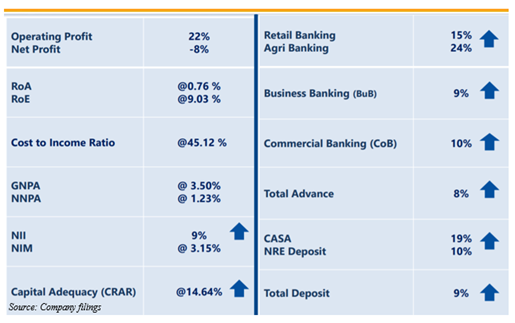

- Stable asset quality and reliable business strategy are expected to act as principal growth enablers.

- Gold loans saw a growth of 53.90% to reach INR15,764 crores in 1Q22, with retail advances growing 15.15% to reach INR43,599.03 crores.

- Commercial banking advances saw 10.23% growth year-over-year to touch INR12,865.20 crores.

About Federal Bank Limited

Federal Bank Limited is being counted as a major Indian commercial bank carrying its operations in private sector. These are spread across a variety of states in India. It is being categorised as a pioneer from a pool of traditional banks in India in area of using technology to leverage operations. This bank was among first banks in India that was able to computerize its branches. This bank offers a variety of services including internet banking, mobile banking etc. as part of the bank’s strategy to position as financial super market and enhance customer convenience. Federal Bank is an important player in list of various commercial banks and it professes a set of values and these are being nurtured over years and are now principles of organisation.

Growth Enablers of Federal Bank Limited:

- CASA Ratio Reaches All-Time High- Despite external environment being challenging, the bank kept its operating momentum intact as it delivered highest ever operating profit for 1Q22. CASA ratio is now at an all-time high and the bank continues to build a granular liability franchise with 90%+ of its deposits being retail. The bank kept its asset quality in check as there was only marginal uptick in GNPA and NNPA. Total business of the bank was INR2,99,158.36 crores, exhibiting a growth of 8.30% year-over-year as on Jun 30, 2021. Total deposits were INR1,69,393.30 crores, registering 9.33% growth year-over-year. Net advances saw 6.98% growth year-over-year to reach INR1,29,765.06 crores as on Jun 30, 2021. Total savings bank deposit saw growth of 18.71% to INR49,018.24 crores as on Jun 30, 2021. CASA deposits of Federal Bank Limited were INR58,958.79 crores, registering growth of 18.83% year-over-year. Cost savings and improvement in non-interest income lent support to Federal Bank Limited.

- Stable Asset Quality with Maintenance of Collection Efficiency: Gross NPA of Federal Bank Limited as at end of quarter was INR4,649.33 crores and this as a percentage of gross advances is 3.50%. Net NPA as on Jun 30, 2021 was INR1,593.24 crores, with Net NPA as percentage of net advances coming at 1.23%. Gross and net NPA saw impacts of mobility restrictions while PCR was 65.9%. Despite challenging environment, the bank was able to maintain collection efficiency at 95%. The bank’s corporate book has been holding well as no major accounts are in watch list. Federal Bank Limited is watchful and focuses on building loan mix skewed in favour of high-rated corporates and retail loans. Liability franchise of the bank is healthy and it has one of highest liquidity coverage ratio amongst other banks. Asset quality was managed well, despite pandemic.

- Reliable Business Strategy Should Deliver Desirable Results: With onset of COVID-19, Federal Bank Limited focused on business continuity plans. Higher priority was given to ensure that customers get sufficient support, while maintaining business continuity. This bank initiated an analysis of situation from various other stand points, with several stress testing for capital, liquidity and asset quality. As extent of this pandemic is not known, strategy adopted for FY21 was to remain nimble yet flexible and deal with dynamic, ever-changing environment. Pandemic resulted in shift in business strategy as focus was on creating value through resilient growth.

Near term focus of Federal Bank Limited was on creation of flexible plans to deal with dynamic environment. Relentless emphasis was placed on digital migration and making internal processes digitised. Federal Bank Limited made sure that focus remains on higher margin business. With deposit franchise becoming stronger and granular, significant watch was kept on possible slippages and focus was placed on strengthening balance sheet. Strong operating performance supported the bank to increase coverage ratios and set aside higher provisions. During FY21, average cost of deposits of Federal Bank Limited saw a drop to 5.00% from 5.88% as on Mar 31, 2020. Interest paid on deposit was INR7,805 crore with year-over-year drop of 4% and other interest expenses were INR420 crores with year-over-year drop of 9%.

- Favourable Industry Dynamics: Like any other sector, COVID-19 disruption and subsequent lockdowns in India saw significant pressure on multiple fronts in banking sector. Uncertainty arising out of its direct impact on the banks and impact on debt servicing ability of borrowers and challenges about asset quality impacted risk appetite of lenders, negatively affecting credit uptick. Since lifting of lockdowns in India, there was faster-than-expected rise in economic activities. This growth stemmed from pent-up demand, fuelled by festive season in year gone by. With economic growth being impacted, deposits saw a moderate growth rate of ~8% in FY20. Pandemic made customers conserve their money and reduce private consumption. FY21 saw deposits growth crossing 10% and registering 11.4% year-on-year growth for fortnight ended Mar 26, 2021. In FY22, given growth in economy and with base effect coming into picture, the bank credit should see an increase. Several research firms opined that higher deposit growth is expected between 9-11% in FY22 to lend support to credit growth of 8-10% in FY22. Another surge in COVID-19 cases resulting into localised lockdowns in key states can impact industrial and service segments and this also poses downside risks to deposit and credit growth. Systemic support from RBI and Indian Government at various levels should provide much-needed fillip for growth.

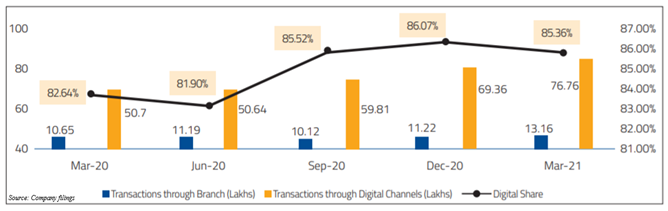

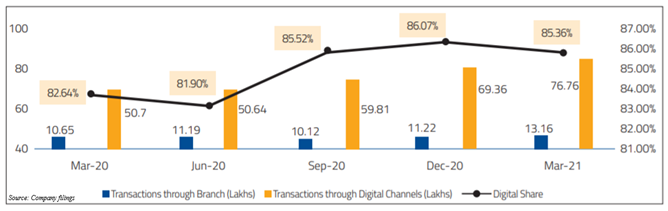

- Digital Adoption at Rapid Pace: In 1Q22, digital dominance of Federal Bank Limited was visible as there was launch of new initiatives. The bank launched credit card for ETB customers and there was seamless end-to-end digital onboarding. The bank topped digital scorecard which was published by Ministry of Electronics & Information Technology (MEITY) for Feb and Mar 2021. In FY21, digital share of transactions crossed 85%, of which corporate digital share of Federal Bank Limited reached 73.50%. 92% transactions were done by retail customers with help of digital channels. Total number of digital users of Federal Bank Limited were 27.83 Lakhs at FY21 end, with total number of merchants reaching 37.66 lakhs. Digital users went up by 21% year-over-year and monthly mobile banking volumes crossed INR10,000 crore mark during FY21 to reach INR10,645 crores as on Mar 31, 2021.

Conclusion

Variety of stimulus measures globally is helping countries put economies back on growth track. Yet, recovery is uneven. In India, higher-than-expected growth of GDP of 1.6% in 4Q21 did moderate this challenge created by pandemic to some extent. At time of projecting revival for Indian economy to 9.3% growth in FY22, Moody’s Investor Services said that risks to country’s financial sector were exacerbated by 2nd wave of pandemic. Led by focus on digital enablement and support from operational strength, Federal Bank Limited saw strong performance during FY21 to see exceptional numbers. Total business crossed landmark figure of INR3 lakh crores, exhibiting 10%+ growth, with net interest income growing 19% year-over-year to touch INR5,534 crores. Annual operating profit grew 18% over previous year, with low GNPA and NPA putting the bank in list of top-tier commercial banks in terms of credit quality. Collection efficiencies reached 95%+ levels as on Mar 31, 2021. In 4Q21, the bank was able to see strong quarterly profit even though environment was extremely challenging. Some segments of Federal Bank Limited led show in 4Q21 like gold loans and CASA, with gold loans exhibiting a staggering growth of 70.05%.

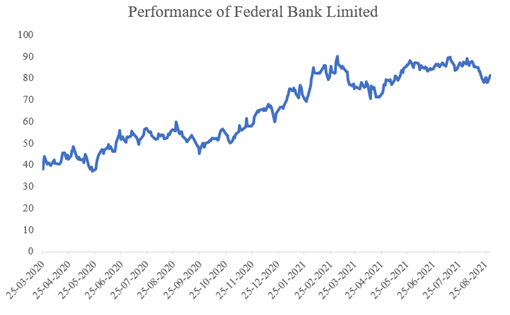

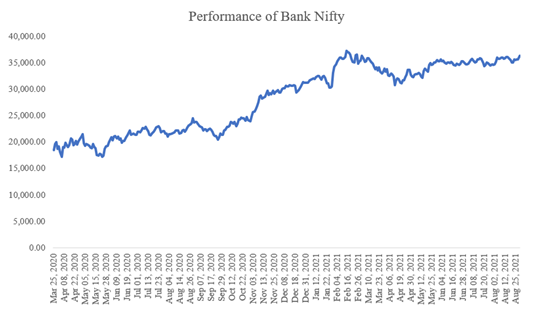

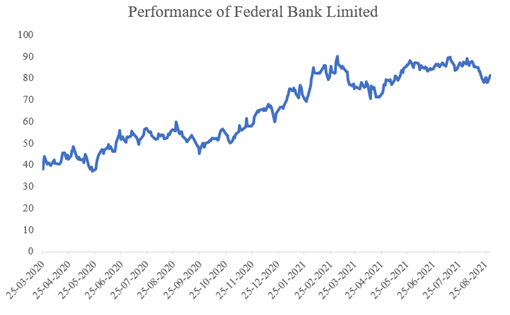

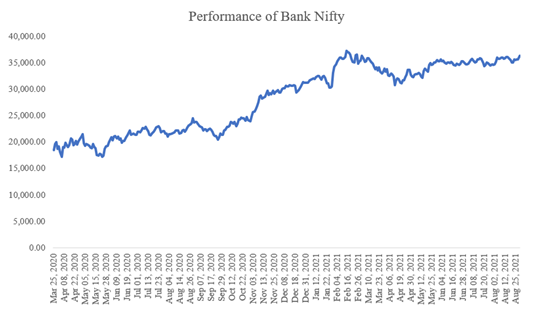

Stock of Federal Bank Limited saw a strong run up of ~114.12% between Mar 25, 2020- Aug 30, 2021. Banking sector was among sectors which saw a brunt of lockdown due to COVID-19. Restrictions in various states resulted in financial institutions fearing that economic progress can be hampered, leading to economic losses. This could increase loan defaults.

Despite opening up of Indian economy and lifting of restrictions, Bank Nifty failed to exceed returns delivered by stock of Federal Bank Limited. Bank Nifty saw a run up of ~96.68% between Mar 25, 2020- Aug 30, 2021. This highlights importance of stock selection and how important it is to analyse in depth. Stock of Federal Bank Limited is expected to see support from its market presence. As on Jun 30, 2021, the bank had 1,272 branches and 1953 ATM/recyclers. Federal Bank Limited has cheap valuations, favouring long position on this stock. This stock currently trades at ~10.43x FY21 EPS, which is at a deep discount to sectoral average of ~18.21x.

Exclusivity:

This article is exclusive to investoguru.

Stock Disclosures:

The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Author Disclosures:

This Article represents the Author's own personal views. The Author did not receive any compensation and do not have any business relationship with any of the companies mentioned in the Article.

share your thoughts

Only registered users can comment. Please register to the website.