Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINVaibhav Global Limited (VGL), formerly known as Vaibhav Gems, is a multi-national electronic retailer and manufacturer of fashion jewelry and lifestyle accessories. It sells its products through its home shopping channels, Shop LC in the United States and TJC in the United Kingdom. The company is headquartered in Jaipur, India. VGL was founded as Vaibhav Enterprises in 1980. It was later incorporated as Vaibhav Gems Limited, in 1989 at Jaipur, India. The company became Vaibhav Global Limited in 1994 and went public in 1996-97. VGL continued expanding its manufacturing and retail capabilities and in 2005-06 acquired STS Group of companies.

During the recession of 2008-09, the purchasing power of US consumers dropped significantly and VGL had to rework its strategy. The company brought the average price of its products down to $18 - $20 from $100 per piece in 2010 thereby, successfully transitioning from store-based jewelry business to discount retail business through web and TV channels. It has electronic retail units: Shop LC formerly Liquidation Channel in the US & Canada and TJC formally The Jewelry Channel in UK & Ireland. These are wholly owned TV channels as well as e-commerce platforms. The combined reach of these two TV channels is about 123 million households.

Industry Overview:

E-commerce Retail The year 2020 was an extraordinary one for the e-commerce retail industry, with the COVID-19 pandemic accelerating the shift of retail consumption from brick and mortar to online channels. Worldwide, retail e-commerce sales registered a sharp spike of 27.6% to US$4.28 trillion during the year. Overall, retail websites are believed to have generated almost 22 billion visits in June 2020, up from 16.07 billion visits globally in January 2020. This shift motivated e-commerce retailers to expand the use of disruptive and innovative formats to enhance user experience. By optimizing channels such as online marketplaces, social media, and OTT platforms, many retailers embarked on their e-commerce journey, while existing players in the space expanded their online presence with value additions that increased their competitive advantage.

Let’s understand the Business model of Vaibhav Global Ltd:

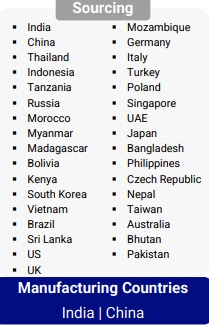

Vaibhav global sources its raw materials from over 20 countries across the world including Thailand, China, Indonesia, Russia, Morocco, Myanmar, Madagascar, Kenya & others and has manufacturing plants in India and China. This allows the company to enjoy the lower cost of labor and easy accessibility to raw materials enables the company to sell its produce at a competitive price.

Vertically integrated fashion retailer on electronic retail platforms

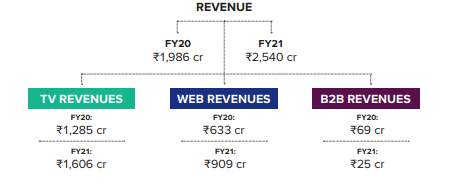

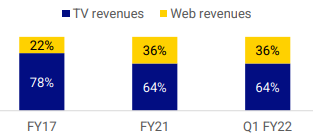

The company owns Shop LC for the USA & Shop TJC for the UK which are both 24- hour live shopping channels. It also owns proprietary web platforms tjc.co.uk & shoplc.com & has also launched applications of its retail platforms on smartphones. Presently, about 67% of revenues come from TV platforms & the rest 33% of revenues come from web platforms.

VGL reaches almost 100 million households through its TV Shopping channels – ShopLC in the US and The Jewellery Channel (TJC) in the UK. These TV shopping channels reach customers directly 24X7 on almost all major cable, satellite and DTH platforms – Dish TV, DirecTV, Comcast, Verizon Fios, Time Warner, AT&T, Sky, Virgin, Freeview, and Freesat, etc. Also, VGL’s e-commerce websites/mobile apps in the USA - www.shoplc.com, and the UK - www.tjc.co.uk complement its TV coverage, diversify customer engagement, and increase customer lifetime value.

VGL group also engages in traditional B2B wholesale distribution through STS Jewels that serves various retail chains in the USA and UK.

The Product Portfolio:

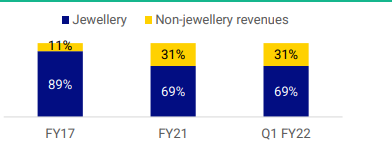

The company has been diversifying and now, its jewelry items consist of 78% of revenues while the rest 22% revenues are contributed by non-jewelry items like fashion accessories, makeup items, body care items, edibles, etc

Awards & Recognition:

High Customer Retention:

The company has a reach of more than 144 Mn households Consisting of TV - Linear/OTA Web – proprietary web platforms, mobile apps, social media sites, market-places and OTT, and the companies customer Retention rate stood at 51.5% by building enduring relationships and providing convenience through last-mile delivery. The company had 5 lacs+ Unique customers in FY21 – 38% higher than FY20.

The Major concerns around the company:

High competitive intensity – VGL sells its products primarily in the US and the UK regions, where it competes with several large and established players like Qurate Retail (QVC), Shop HQ as well as other e-commerce players like Amazon. It also faces stiff competition from traditional retail formats. Further, the operations of the company remain exposed to local regulations applicable to the online retail industry in these operating countries.

Exposure to Raw Material Prices

Gemstones along with diamond, gold, rough stones, and silver are the key raw materials for the company's gems and jewelry products. The prices of gold and silver have experienced high volatility in the past. Any adverse change in prices of these commodities and in prices of gemstones will have an adverse impact on VGL’s margins. Being a 100% Export Oriented Unit is also highly susceptible to risk associated with fluctuation in foreign exchange rates.

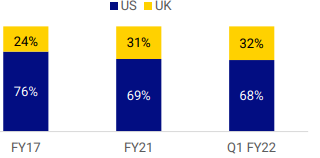

Geographic Concentration in USA and UK might pose a huge risk if there is a slowdown in the economy:

VGL faces a high geographical concentration risk as almost all its revenues are derived from its online retail operations in the US and the UK regions. Further, given the discretionary nature of spending on fashion jewelry and lifestyle products, its demand prospects remain susceptible to the economic slowdown in these markets. ICRA notes that the company, in a bid to diversify its geographical presence, is planning to launch a new channel in Germany by Q2 FY2022.

The Financial Performance of the company:

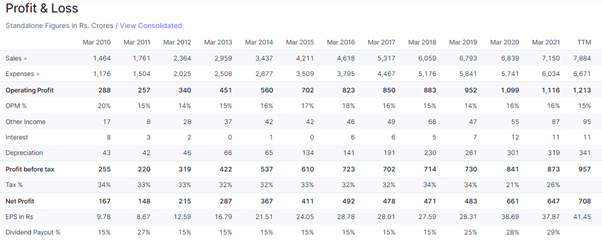

Source: Screener.in

The company has achieved a Compounded sales growth of 15% in the past 10 years and the company was immune to the Covid led lockdowns as the company derived a majority of the revenue from the E – Retail business and in fact, Covid has further enhanced the growth of the company and the company is able to maintain steady Operating profit margins despite the volatility in the price of the raw materials which suggests that the company has been able to pass on the increased cost to its customers and The Company had a compounded Net profit growth of 16% in the past 10 years which has been in line with the sales growth which means the company can increase its profits if it is able to successfully increase its sales.

Ratios & other Metrics:

The company has a market capitalization of around 12,600 Crs and is trading around 770 Rs and the stock has been down 30% from the 52- week high. The company has a Price to Earnings of 40x which can’t be compared across other companies as Vaibhav Global has a unique business model and operates outside of India and the company is trading 13 times its book value. The ROCE and ROE of the company are top-notch and as the business model is in such a way that it can be expanded without any high capital requirement and the Debt to Equity of the company stood at 0.13 which is another positive sign and the several other fundamental parameters show us the financial soundness of the company.

Huge Opportunities Ahead:

The Growing customer preference for e-retail due to disruptions caused by the pandemic and the Convenience gaining more ground, with greater acceptance of retail players with omnichannel presence. The company has Increased scalability in adjacent categories including home, beauty, and textiles and enhanced Greater collaboration among suppliers, retailers, customers, and digital ecosystem players and with the company venturing into Germany and Canada will aid the growth of the company in the company and with the stock price correcting from its high levels, the opportunity looks attractive and one can start accumulating the stock at lower levels and with the intention of holding the stock for another 2 -3 years.

share your thoughts

Only registered users can comment. Please register to the website.