Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINCEAT Limited (formerly, Cavi Elettricie Affini Torino)is an Indian multinational tyre manufacturing company owned by the RPG Group. It was established in 1924 in Turin, Italy. As of date, CEAT is one of India's leading tyre manufacturers and has a presence in global markets. CEAT produces over 165 million tyres a year and manufactures tyres for passenger cars, two-wheelers, trucks and buses, light commercial vehicles, earth-movers, forklifts, tractors, trailers, and auto-rickshaws. The current capacity of CEAT tyres' plants is over 800 tonnes per day.

The company was founded as Cavi Elettricie Affini Torino (Electrical Cables and Allied Products of Turin) by Virginio Bruni Tedeschi in 1924, in Turin, Italy. On 10 March 1958, the company was incorporated as CEAT Tyres of India, in Mumbai. Initially, the company collaborated with the Tata Group. In 1972, the company set up a research and development unit at Bhandup. In 1981, Deccan Fibre Glass Limited was merged with the company

Why CEAT is an important company to watch out for in the Tyre sector?

Part of RPG Group:

The Rama Prasad Goenka Group, commonly known as RPG Group, INR 220 billion RPG Enterprises. is an Indian industrial and services conglomerate headquartered in Mumbai, Maharashtra.[3] The roots of the RPG Group can be traced back to the enterprise of Ramdutt Goenka in 1820. RPG Enterprises was established in 1979 by Rama Prasad Goenka and initially comprised the Phillips Carbon Black, Asian Cables, Agarpara Jute, and Murphy India companies. R. P. Goenka held the title of Chairman Emeritus until his death in 2013. The present chairman is Harsh Goenka, the elder son of R. P. Goenka.

Presently, the RPG Group comprises over fifteen companies in the areas of infrastructure, tyres, technology, and speciality. Some of the companies it holds are CEAT Tyres, information technology firm Zensar Technologies, infrastructure company KEC International, pharmaceutical company RPG Life Sciences, energy products company Raychem RPG, and plantation company Harrisons Malayalam.

Diversified Product offerings:

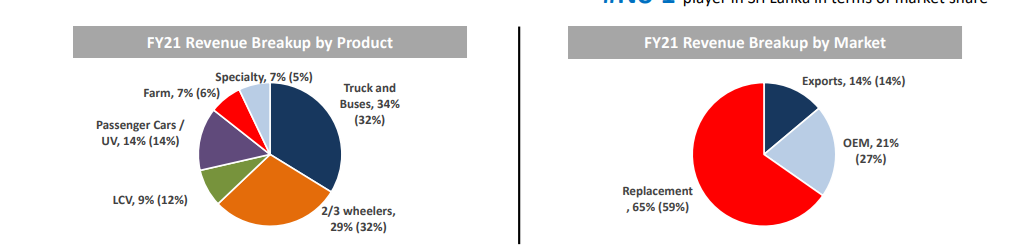

The company has key differentiated products and gives a wider range of product offerings to its customers and CEAT has established itself as a Tyre company for accessing all types of Tyres across all Vehicle Categories. Presently, the trucks & buses category contributes the majority of revenues at 34%, followed by 2/3 wheelers (29%), Passenger cars (14%), Farm (6%), LCV (9%) & speciality category contributes the rest 7% of revenues.

Revenue Breakup by Market- The Replacement business is one of the big source of Income for all the tyre company and even in the case of CEAT, the company derives majority of its revenue from the Replacement business which accounts 71% of the revenues of the company and it is followed by sales to OEMs (17%) & Exports (13%).

Brand Building

The company enjoys a high brand recall through several of their Marketing initiatives and when it comes to tyres, trust plays an important role for the success and to continue with building the brand 'CEAT', the company is associated with sports like Women's T20 & football clubs. It has appointed Amir Khan as its official brand sponsor as well. CEAT is the bat sponsor of cricketers Rohit Sharma, Shreyas Iyer, Mayank Agarwal, Ajinkya Rahane and Harmanpreet Kaur. From 2015–18, CEAT sponsored the strategic timeout for the Indian Premier League (IPL). Apart from the Marketing initiatives, the company has also taken several steps to earn goodwill for the customers, In the Wake of Covid – 19, the company has increased the previous warranty of its products during the second lockdown. Measures like these have helped the company to earn the trust of its customers.

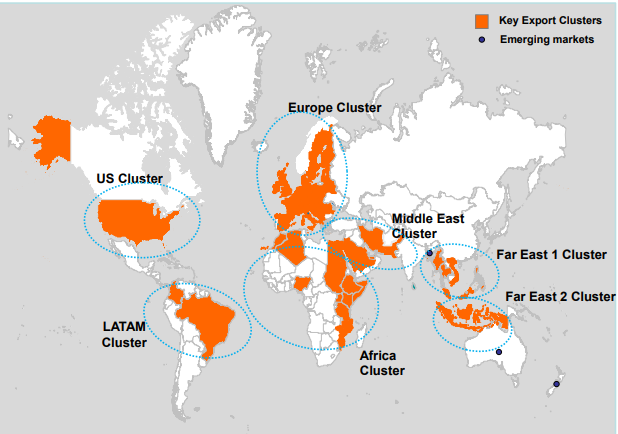

Increasing Global Presence

Company exports to 90+ countries which are categorized in 7 clusters for ease of operations. It is the market leader in the country of Srilanka with a 50%+ market share where it runs operations through a JV of 50:50.

Robust Distribution Network

We have seen that the Replacement Market plays an important role in the profitability and the revenue of the company and to be successful in the replacement market, you should have an agile and robust Distribution Network and the company has got that point and has one of the best distribution networks among its peers. The Company's replacement business operates on its distribution network which consists of 300+ distributors, 3,400 dealers & 35,000+ sub-dealers which cover about 600 districts across India.

The company also operates ~300 Exclusive CEAT outlets, 12 tyre service hubs & sells to 400+ multi-brand outlets across India.

Partnerships with major OEMs

To be successful in the New tyre market, A company has to establish a deep relationship with the original equipment manufacturers and to establish a meaningful relationship, you have provided quality products consistently and offer the same at a steep price as there are competitors who are ready to snatch the OEM’s given any slight chance, However, The company has established relationships with major OEMs like Tata Motors, Ashok Leyland, Escorts, Mahindra, Maruti, Hyundai, Kia, Volkswagen, Honda, Royal Enfield, Bajaj, Piaggio, and many companies and has embedded trust through its legacy as a leading tyre manufacturer in the past 20 years.

Manufacturing Facilities

The company has six manufacturing locations across Nashik, Mumbai, Halol, Ambernath, Nagpur & Chennai which possess a capacity of producing a total of 3.5 crore tyres per annum and a strong reach in global markets, with exports to more than 100 countries. This year CEAT produced more than 35 Million high-performance tyres, catering to various segments like 2/3 Wheelers, Passenger and Utility Vehicles, Commercial Vehicles and Off-Highway Vehicles.

In early 2020, CEAT unveiled it's 163- acre greenfield manufacturing plant in Kanchipuram near Chennai. The plant, with an installed capacity of approximately 96 Lac tyres per annum. It is CEAT's sixth plant within the country and will initially have a staff of 350, which is expected to ramp up in the near future to create over 1,000 new jobs. Within India, the plant will cater to the requirements of brands such as Hyundai and Nissan-Renault. It also envisages supplying to other automotive manufacturers in South Asia, Europe and North America.

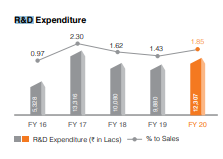

Research & Development

CEAT has a state-of-the-art R&D facility in Halol, Gujarat. Moreover, its R&D centre in Germany has helped combine the Company’s own expertise and experience with global technology capabilities for best results. The company has significantly invested in tyre testing infrastructure & focuses on upcoming technologies like Electric vehicles, Sustainability & Smart tyres.

The Issues faced by the company:

Intense Competition:

The Indian tyre industry has witnessed intense competition between the domestic players and the Chinese tyre manufacturers. The level of competition by the international players is significantly higher in the Trucks and Buses segment which is price sensitive. However, measures taken by the government like the imposition of anti-dumping duty (implemented in September 2017) and anti-subsidy countervailing duty (implemented in July 2019) on tyre imports from China have helped Indian tyre manufacturers. Diverse product offerings and a strong focus on the replacement market have enabled the company to sustain its established market position.

Slightly Elevated Debt Levels:

CEAT is undertaking CAPEX to the tune of ~Rs.3994 crore (excluding maintenance CAPEX) from FY18-FY24 towards an increase in capacities across PV radial, T&B radial, 2 wheelers and Specialty tyres. Large CAPEX under implementation which is partially debt-funded led to moderation in the capital structure and debt coverage indicator. The Debt to Equity of the company stands at 45% and the healthy accruals of the company will enable it to manage its debts.

The FY22 Q1 performance of the company:

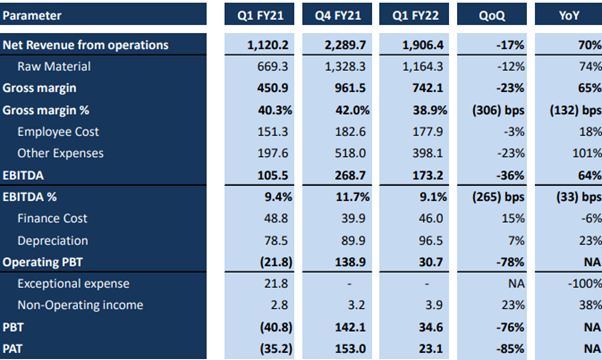

Revenue declined ~17% QoQ to ~Rs19bn due to a sharp decline in OEM production in May’21 due to the Covid shutdown. Gross margin decline was curtailed at 38.7% (down 315 bps QoQ) due to better fixed-cost absorption on account of higher finished goods inventory. EBITDA margin was down by 248bps as employee costs rose (by 131bps QoQ) and other expenses fell by 198bps due to tight cost control and potentially lower ad spends. Adjusted PAT wad down ~86% QoQ to Rs200mn. As per earlier commentary, CEAT took a blended price hike of ~3-4% in Q1FY22.

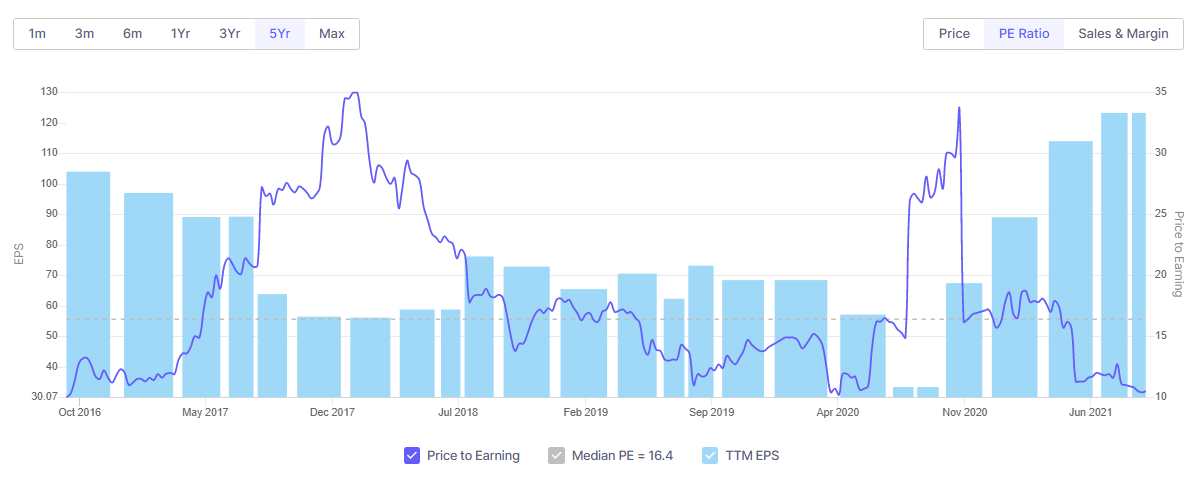

Increasing EPS and Falling Price to Earnings:

The Earnings per share has been increasing on a consistent basis and has been on an upward journey and theoretically speaking the Price to Earnings should sustain or Increase accordingly. However, in the case of CEAT, the share price has been falling when the EPS has increased and this is pure opportunistic play and one should have the conviction to hold and remember that the share price always follows the Profit trend in the long run.

Conclusion:

CEAT’s plan to drive growth via market share gains (product innovations, new customer additions) while improving its margin trajectory Management focus is to achieve above industry growth, which we believe could be driven by: a) Faster growth in the high growth compact SUV segment aided by the new capacity coming on stream at Halol plant; b) new product innovations are likely to drive market share gains in across OEMs (e.g. Hero Motocorp, Mahindra) which would aid replacement market share; and c) strong CAPEX push for FY22-23 (~ Rs18-19bn) with focus on the expansion of TBR capacity would be a key driver for market share gains in CV segment and one can follow monthly SIP’s to invest in the company and to tackle the volatility in the market.

share your thoughts

Only registered users can comment. Please register to the website.