Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

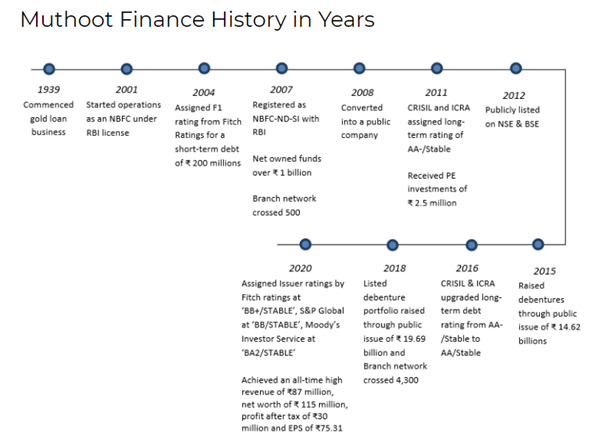

REGISTER NOW OR LOGINMuthoot Finance is an Indian Financial corporation with a history of more than 130 years and the largest gold loan NBFC in the country with its headquarters in Kerala and is engaged in the business of diversified interests in the fields of Financial Services, Healthcare, Real Estate, Plantations, Foreign Exchange, Information Technology, Education, Insurance Distribution, Hospitality, etc

Gold & Indian Households:

Gold investments in Indian households are mostly in the form of ornaments that are passed down for generations. The World Gold Council expects the gold loans market to grow at an annual rate of 15.7% and reach 4.617 trillion rupees in the fiscal year ending March 2022, from 3.448 trillion rupees in the year ended March 2020. Consulting firm KPMG said in a 2020 report that the total gold loans outstanding in the organized sector in 2019 were estimated at 5.5% of the total household gold holdings in India. Organized lenders are estimated to account for 35% of the gold loan market share, with unorganized lenders accounting for the remaining 65%, according to KPMG. This "presents the organized players with a huge opportunity for growth, the organized gold loan market has the potential to double its assets under management within the decade. People across India have a traditional affinity for gold ornaments, which makes them sentimentally attached to pieces of jewelry that are often family heirlooms. This emotional connection with the jewelry acts as a further deterrent to default and it makes gold loans different from any other kind of commodity lending.

The established strengths of the company:

Market Leadership:

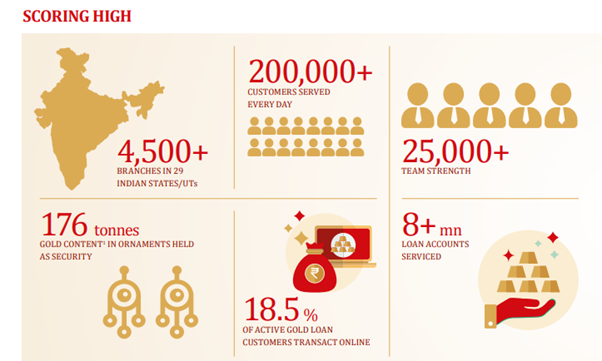

Muthoot is India’s largest gold loan focussed non-banking financial company (NBFC) with a total portfolio of Rs. 52,622 crore (of which 99% is gold loan) as of March 31, 2021. Muthoot Finance’s gold loan portfolio is the largest in India as well as around the globe. Over 200,000 people avail trusted services on a daily basis. The company endeavors to understand the specific requirements of individuals to be able to make funds available to them with speed.25,000+ employees serve 200,000+ customers every day, through 4,500+ branches, the majority of which are in semiurban and rural India.

PAN India Presence

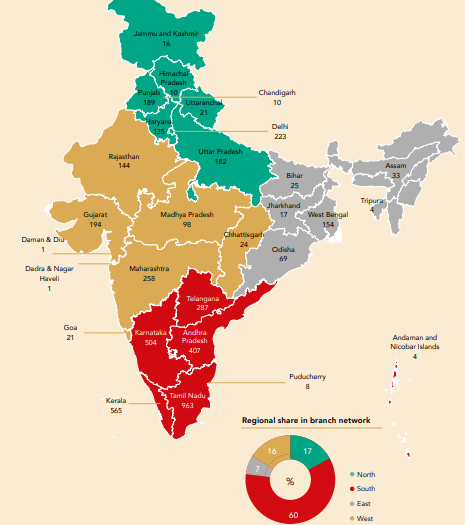

The company has wide geographic footprint, extensive pan-India branch network of 4,632 as on March 31, 2021; with 60% of its branches are operating in the South India, where it has an established franchisee and commands more popularity with its people, In south India the word ‘’Muthoot’’ is the first thing people think of when it comes to Gold loan and also the company possess highly trained and dedicated personnel and customer-centricity and is able to maintain a strong leadership position in the retail financial services industry.

Diversification through its subsidiaries:

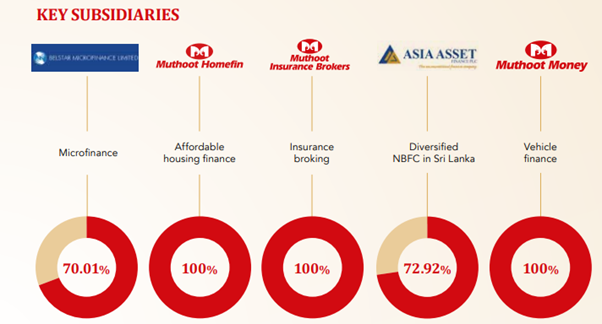

Muthoot finance's primary offering is a Gold loan, however, the company has a wide range of product offerings that are routed either directly through the company or through their dedicated subsidiaries. The company has a presence across housing loan, Insurance segment, Micro Finance, Vehicle finance and they also have a presence in Sri Lanka through their subsidiary Asia Asset. The diversification process has enabled the company to mitigate the risk involved in the Gold segment. The growth in the other segments would help the company to gain momentum and will make it a full-fledged financial company with a diversified presence.

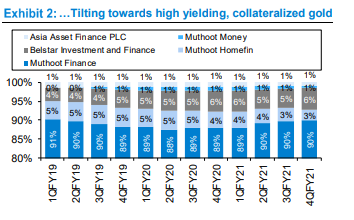

Shifting to High margin business:

Gold Loan is a safe and attractive business, where the people give the gold to get money, and if they default the company can sell the gold whose value is generally 30% higher than the loan offered making Muthoot remain in the sweet spot all the time. However, the operating margin is slightly lower compared to other financing segments and Muthoot has realized the shortcomings and is broadening its branches and has been increasing its contribution from other businesses through its subsidiaries which is playing out very well for the company and the other division the company has ventured is a high margin business and would increase the profitability of the company in the coming days.

Superior Asset Quality:

The best in class asset quality of the company can be attributed to (a) 90% collateralized gold loan focused business, (b) 60%-65% of gold loan repayments within 6 months, (c) 25-30% margin of safety on gold loans and therefore (d) lower auctions (0.3% of loans) and higher recoverability (e) 94% realized auction value. Defying pandemic challenges, Q4FY21 saw 0.9% GNPAs (down from 2% a year ago), steady-state 1.2% ECL provisions besides Rs3bn excess provisioning in books, and write-offs at a mere 0.02%. While non-gold share forms a mere 10% of the overall business, they do not stand overtly worried about asset quality.

The net NPA stood at 1.96% in FY 20 which has significantly improved compared to the NPA of 2.39% in FY19The capital adequacy ratio stood at 25.47% in FY20 with a Tier I capital of 24.30% and Tier II capital of 1.17%. Provisions declined sequentially by 81% while up 131% YoY. Stage III loan assets improved to 0.88% versus 1.30% QoQ, while the company carries excess provision of Rs 2.95 billion on the balance sheet.

Staying Ahead in Brand Building:

The major advantage that the company enjoys is the higher Brand recognition compared to its competitors, the company has established itself as a strong player through brilliant marketing strategies, partnering with one of the most successful IPL teams, Chennai Super Kings and Indians connect with cricket than anything we could think of and Muthoot has realized this and has established itself as a trusted player and we all know that ‘’Trust’’ is the essence of success in this segment and Muthoot has earned its trust with all the Indians which has paid the company well.

The challenges faced by the company:

Increased competition and alternative financial products: We are not just competing against other gold loan lenders but also other financial services providers that deal in unsecured loans – providing the customers the option of availing funds without providing any collateral. At the same time, lenders are partnering with fintech companies or investing in their digital capabilities to onboard unsecured loan customers, particularly salaried professionals with high levels of financial and technological literacy, with relative ease.

Security infrastructure and operating expenses: Gold, by virtue of its physical value, requires safe handling at every stage of the loan lifecycle. Ensuring safe storage hubs at every branch is capital intensive and hinders operational profits at the branch level. Branch staff also need to be trained on how to recognize theft and other fraudulent activities, and the appropriate actions required to prevent such instances. Further, there are costs associated with the implementation of stringent electronic surveillance measures and cybersecurity policies to safeguard customer data.

The strong set of Financial Numbers:

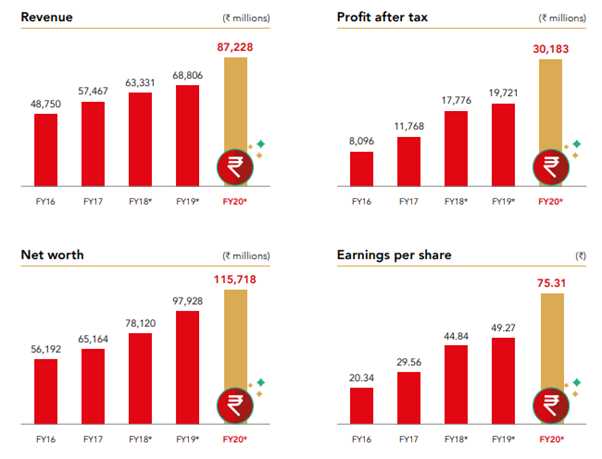

The company has been showing phenomenal numbers for the past five years. The total income grew from 76,010 millions in FY19 to 97,072 millions in FY20, registering a year-on-year increase of 28%. Profit after tax achieved a year-on-year increase of 51% and stood at 31,687 millions in FY20 vis-à-vis 21,030 millions the previous year. Earnings per share increased to `78.30 in FY20 from `51.92 in the previous year. Our consolidated loan assets under management for FY20 stood at 468,705 millions as against 83,036 million last year, registering a year-on-year increase of 22%. The Gold loan outstanding was 407,724 million in FY20, up 21% from 335,853 million the previous year. The average gold loan per branch was 89.28 million in FY20, up 19% from 74.97 million last year.

The Market capitalization of the company stood at around 63,500 Crores and is trading at a Price Multiples of 16.7, when the Industry average is around 27x, which makes the company undervalued compared to its competitors. However, we have to be cautious as the stock has rallied around 35% in the past 6 months as is trading closer to the 52-week high price, and one can wait for a little price correction and start accumulating the stock at 1400 levels to be a part of the long term growth of the company.

The Golden Road Ahead:

Muthoot Finance has been one of the greatest Business stories, the growth the company has is impeccable and As per the management, it is expected that Business AUM may grow about 25-26% with an overall growth of 15% per annum which makes it significantly attractive for the long term where one can expect an upside of about 25%+ over the long run and the company has the potential to achieve such growth despite the hindrance of the pandemic. Being the country’s largest gold financing company, it trades at significant cheap valuations as compared to its peers which trade at Average PE of 25-30 while Muthoot finance trades at a PE of just 16x which offers a margin of safety as well as a possibility of expansion in valuation multiples.

Conclusion:

The Muthoot Group began its journey in 1887 in the remote village of Kozhencherry in Kerala. It was founded as a modest trading business in a region that was geographically disadvantaged and lacking in mobility, land, resources, industry, or favorable market conditions. Today, the company has evolved into one of India’s most trusted financial services brands and the country’s largest gold financing company, and the growth they have achieved is surreal and

share your thoughts

Only registered users can comment. Please register to the website.