Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINAmara Raja Group is an Indian multinational conglomerate company, headquartered in Tirupati, India. The group has a presence in the automotive battery business, packaged foods, and beverages, electronics products manufacturing, infrastructure sector, power system production, and fabrication of sheet metal products and fasteners. The Amara Raja Group is known for its automotive battery brand Amaron, the second-largest selling automotive battery brand in India after Exide Industries. Amara Raja Group employs a workforce of over 15216 employees. Amara Raja Batteries was named on Asia's 'Best Under A Billion' 2010 list of companies compiled by Forbes magazine.

The automotive batteries business unit commenced operations in 2001 with a joint technology venture with Johnson Controls Inc., the world's largest manufacturer of automotive batteries. It pioneered the introduction of zero maintenance technology in India's automotive battery segment, the key differentiator in the Indian electric storage market. Amara Raja Batteries of India signed a joint venture with Johnson Controls Inc. in December 1997 to manufacture Amaron automotive batteries in India and the group terminated their partnership with Johnson Controls on 1 April 2019 and Amara Raja Batteries took on a journey ahead.

Why you should Invest in Amara Raja Batteries?

Diversified Revenue streams and dominant presence in the Domestic Battery segment:

the company is the largest player in this segment after Exide Industries Ltd. The increasing market presence in the domestic battery segment is also a result of its diversified presence across the automotive segments and industrial segments.

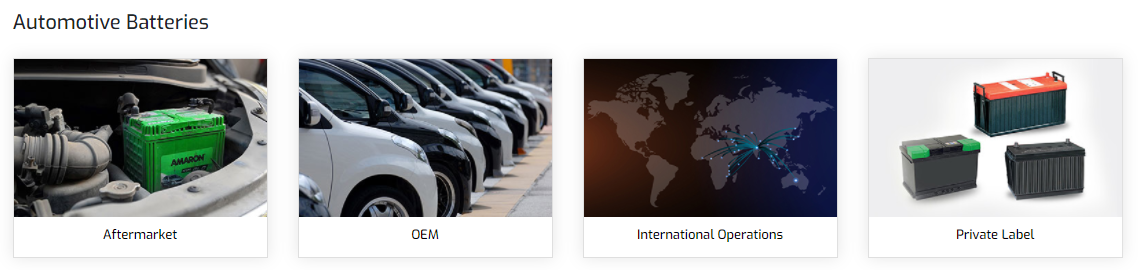

Automotive Battery Division:

The Company’s automotive batteries and home UPS/ Inverter battery brands AMARONTM and PowerZoneTM respectively are distributed through its pan-India sales & service retail network. Amara Raja enjoys healthy OE relationships with all leading automobile manufacturers. It is also a leading private label supplier to prominent brands. Amara Raja’s entrenched pan-India distribution network comprising 30,000-plus AMARONTM and PowerZoneTM retailers has helped the Company sustain its competitive dominance in the aftermarket segment.

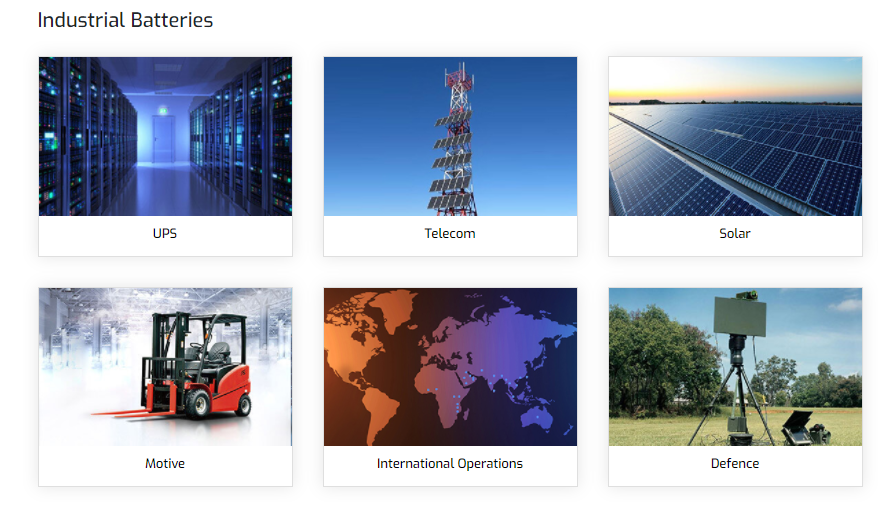

Industrial Divison:

Amara Raja’s Industrial Battery Division is the preferred supplier to major telecom service providers, telecom equipment manufacturers, the UPS sector (OEM & Replacement), Indian Railways, and to the Power, Oil & Gas, Motive among other industry segments. Its key products are marketed under various brands namely PowerStack®, Amaron Volt®, Amaron Sleek®, Amaron Brute®, Amaron Solar, and Amaron Quanta®. The Company’s products are exported to most of the countries in the Indian Ocean Rim.

Multi Manufacturing Capabilities:

The Company has two large manufacturing facilities at Karakambadi, Tirupati, and Amara Raja Growth Corridor (ARGC) in Chittoor District, Andhra Pradesh, India. The Tirupati and Chittoor manufacturing facilities are benchmarked to the ISO/IATF16949, ISO 14001, OHSAS 18001, and EnMS 50001 standards. Business operations are managed by a team comprising a prudent mix of energy and experience and the company is in the process of setting up one of India’s largest integrated manufacturing locations for advanced lead-acid battery systems across the globe.

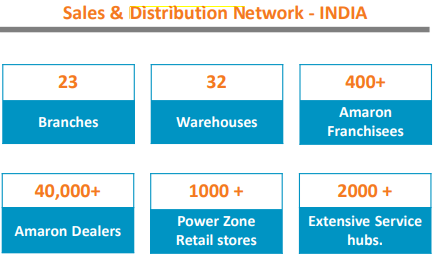

Agile Distribution Network

The Company caters to the huge demand on the Pan India level through a strong distribution network comprising of 30,000 plus Amaron and Power Zone retailers and further helped to gain and sustain competition in the aftermarket segment.

Gaining market share in Forklift truck, Railways, Defense & International energy storage

Forklift truck markets which are dominated by Electric vehicles continued to prefer companies Amaron Brute Hi-Life Batteries. In the Rail segment, Company gained its market share in VRLA batteries used in various applications. Amara Raja also became part of a prestigious NFS project for the supply of VRLA batteries for the construction of a robust communication network connecting 342 sites for the defense segment. This defense project is considered to be one of the largest projects in developing a communication network for the defense sector. In International storage space, Amara Raja supplied and commissioned the world's largest lead-acid energy storage system at three locations in Africa. The storage capacity for the entire project stood at 37.83 MWh.

Increasing Geographical Footprints:

The company derived 12% of its revenue through exports and has a presence across 35 countries and the company intends to increase its geographical footprints in the coming days. In the last four, the revenue through Exports grew at a CAGR of 25%. They have 40+ distributors in the foreign nation and has a local sales offices in Indonesia and Nigeria.

The Growth Strategy:

The company's third battery manufacturing unit at the Chittoor facility is coming up in FY21 for passenger cars and is expected to become operational by end of FY21. Further, It expanded its 4 wheeler & 2 wheeler capacity from 2.5 million to 12 million and from 4 million to 19 million units respectively. With this expansion, the total capacity for 2 wheeler battery capacity stands at 21 million units per year. Additional capacities are in pipeline for tubular battery units catering to the demand for home UPS applications. It plans to set up a lead-acid recycling plant of 1 lakh tonnes per annum capacity at an estimated cost of Rs 280 crore and a captive 280 MW solar power plant for an estimated CAPEX of Rs 220 crore.

Amara Raja has raised the bars and benchmarking for Industry by adopting and shifting to Stamp grid technology for making Plates on a continuous basis to improve the overall battery performance. The stamped grid technology in the two-wheeler segment ensured that the product exceeded the warranty periods by considerable margins. Under this strategy, it is focused on value maximization in its core lead-acid battery (LAB) business and is foraying into the new energy business in the form of lithium-ion cell/battery pack, electric vehicle charging products, energy storage solutions, etc. While the LAB business will go global, the new energy business will focus on opportunities in India.

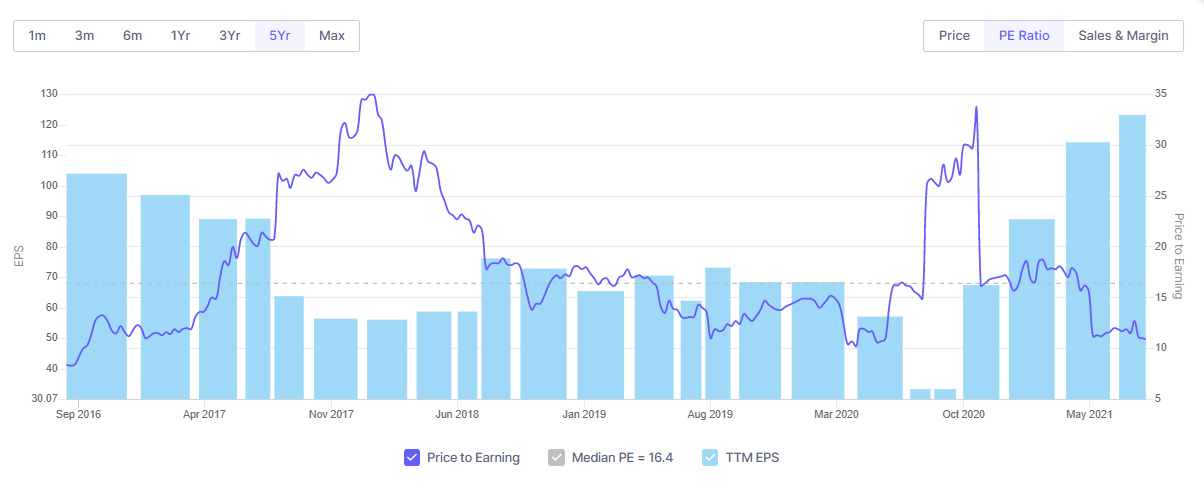

Available at the better Valuation:

Source: Screener.in

The company is currently trading at a Price Multiples of 19x which is far lesser than the previous years Price Multiples which was around 30x, The EPS however to the contrary is increasing and the Price to Earnings decreasing which is a rare scenario and presents a golden opportunity for investing and apart from the numbers the future growth potential of the company also looks promising and the ROCE of the company stood at 21.6 % and the Debt to Equity stood at 0.02 and the company has a healthy reserve of 4200 Crs which is also a positive sign and now you might wonder why is the stock price falling despite all the positive factors, Let’s comprehend the reason beyond the numbers

Why is the stock price falling despite the various stated positive factors?

The closure of the Manufacturing units due to Non-Compliances!!!

In April, the AP Pollution Control Board (APPCB) issued a closure notice to two Amara Raja Batteries Limited’s manufacturing units at Karakambadi and Nunegundlapalli in Chittoor District, citing pollution in land and water surrounding them. “Reports by both APPCB and Hyderabad-based EPTRI (Environment Protection Training and Research Institute) mentioned that dangerous levels of lead have been identified in air, water, land, and even in the blood samples of the factory staff. Based on the reports, the High Court asked Amara Raja Batteries to initiate measures to address the lead pollution from its factories, which the management failed to do. On May 6th, 2021, the High Court of Andhra Pradesh has directed interim suspension of closure orders till July 5th or until further orders, whichever is earlier. While the company had sufficient inventory and did not suffer major revenue loss due to the temporary closure, any potential or prolonged disruption in operations has to be monitored. Amara Raja Industries stated that it had initiated measures to comply with APPCB and HC orders and also presented its plans to officials to control pollution.

The other issues faced by the company:

Logistical disadvantages arising from geographical concentration in operations: ARBL currently operates from 2 locations within Andhra Pradesh (Tirupati and Chittoor), while demand is spread across the country, thereby restricting distribution logistics. The single-state-location facilities expose the company to risks relating to geographical concentration of operations, like natural calamities and others. However, ARBL’s closely linked facilities do offer benefits in the form of economies of scale because of their large size. The plants are completely integrated with all critical components, including plastics battery cases which are sourced in-house.

Exposure to intense competition: The telecom segment has been going through a tough consolidation phase, wherein the telecom operators/ infrastructure players continue to exert pressure on vendors to reduce prices. Competition is also intensifying in the auto aftermarket battery segment and small-to-mid-sized organized players operating only in the industrial segment and now increasing focus on the auto segment) offering products at competitive prices. During periods of subdued end-market demand, the increase in lead prices cannot be fully transferred to end customers especially in the after-market segment. Nevertheless, ARBL has performed better than its peers, largely because of its diversified revenue streams and product quality.

Conclusion:

The turbulence faced by the company is temporary but the growth is permanent and as the company is available at a better valuation and one can start accumulating the stock from the current levels and follow the Rupee cost averaging method to benefit in the long term and also to make use of the short term volatility in the broader index and from time to time we might get opportunities to accumulate strong fundamental stocks at a better price and this stock is one such opportunity.

share your thoughts

Only registered users can comment. Please register to the website.