Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINWhy Rural India will play an important role in the future growth of India?

Rural population (% of the total population) in India was reported at 65.07 % in 2020, according to the World Bank collection of development indicators, compiled from officially recognized sources and one-third of the Rural population lives below the poverty line but things are changing, people are ready to educate themselves to live a better life and Rural India has been growing at a phenomenal pace and the Financial Institutions who has a presence in Rural India has already established their strong Foothold in the region that it has become hard for a new player to penetrate the market. The world has acknowledged the growth potential of India and it will be Rural India which will be playing a big role in the growth story of India and the Federal Bank Ltd has established itself as an inevitable player in major Rural areas of India.

About the Company:

The history of Federal Bank dates back to the pre-independence era. The Bank was incorporated on April 23, 1931 as the Travancore Federal Bank Limited, Nedumpuram under the Travancore Companies Regulation, 1916. Late K.P. Hormis, the visionary banker and founder took up the reigns in 1945 and built the bank a nationwide institution. The Bank's name was changed to The Federal Bank Limited on December 2,1949. The Bank was licensed under the Banking Regulation Act, 1949, on July 11, 1959 and became a scheduled commercial bank under the Second Schedule of Reserve Bank of India Act, 1934 on July 20, 1970. Today the bank is present in 25 States, Delhi NCT and 4 Union Territories and the bank is listed in BSE, NSE and London Stock Exchange.

WHY TO INVEST IN FEDERAL BANK LIMITED?

A strong presence and a high concentration in Kerala:

Presently, the bank operates a network of 1,272 branches and 1,948 ATMs and cash recyclers across India. The company has a high concentration in Kerala as 47% of branches of the bank are located in its home state. The company has its presence in 24 states and 4 Union Territories and also has Representative houses in Abhu Dhabhi and Dubai through they cater to the needs of Indians abroad

Source: Annual Report

Strong Product Portfolio:

The company has its presence in four major segments – Retail Banking, Agri-Business, Business Banking and Commercial Banking.

The 54% of loan book consists of retail loans the rest 46% book consists of wholesale loans and 36% of loans are given towards category corporate and institutional banking (CIB), followed by retail (33%), Agri (12%), SME - business banking (9%) and SME - commercial banking (10%).Retail contributed 55% of the revenue for the company and which is a positive factor for the company as any few defaults will not impact the company and the Corporate segment contributed 27% of the revenue and the other segments contributed the remaining revenue for the company. The company has witnessed double-digit growth across all the segments which is again a positive outlook for the company. The company operating activities has been efficiently managed.

Where does the bank earn its profit from?

The federal bank earns almost 53% of its fees from its retail operations, 29% from treasury operations, and 18% from wholesale operations. However, Treasury fees have been fluctuating a lot and have been ~370 crores in past quarters as well; while it is currently in the range of 150 crores.

Improvement in the Margin aided by Strong Income growth across segments:

FBL’s net interest margin is supported by its strong low-cost retail liability franchise, the shift in business mix, and an increase in gold loan proportion in the overall book to 11.7%. The profitability is moderate on a risk-adjusted basis; its profit after tax/risk weighted assets stood at 1.3% at 3QFYE21 on a trailing 12-month basis, largely due to the COVID-19 related provision in 9MFY21, which stands comparison with peers. The Contribution from fee income to the overall profitability remains moderate than those of the high-rated private sector banks because of the moderate diversity of fees sources, along with a moderate contribution of non-fund income. However, the growth in core fee income is higher at 22% in 3QFY21 than loan growth.

Stable and Well-Diversified Granular Funding Profile:

The Profits of the bank is the difference between the money that they receive as a deposit and the money that they provide for their clients and A bank that has the ability to procure funds at a cheaper price have a competitive advantage and Federal bank has such an Advantage that it boasts a well-diversified granular deposit profile with a low reliance on bulk deposits. Its granular deposits (i.e., deposits lower than INR10 million) constituted 92% of the total deposits in 3QFY21 with the current account savings account constituting 34.5% of the total deposits. It had a 20.8% share in bank deposits and a 27.6% share in NRI deposits in Kerala as of 1QFY21. The large granular funding helps FBL maintain lower funding costs in line with large peers. The bank's funding profile has been stable with deposits growing at a CAGR of 16.5% over the past five years.

The Deposits are further strengthened by NRI Clients:

The NRI deposits stood at 38.7% of the total deposits in 3QFY21 (3QFY20: 37.1%) and have been largely stable over the years. Of the total inflow of NRI remittances in India, FBL had a market share of 17.5% in 3QFY21. The bank has also shown stability in maintaining and gaining the share of NRI remittances in Kerala, especially from the Middle Eastern countries. Nevertheless, in light of increasing competition from small finance banks and other private banks, along with the weaker economic prospects of gulf countries, the bank’s ability to retain its share could be tested. Also, the COVID-19 related reverse migration could exert pressure on inflows, which, along with the depletion of existing float on the deposit due to economic challenges

Enhancing the Digital Footprints

The bank has seen heavy adoption of digitization of banking operations. 90% of all accounts were opened digitally in FY20 with a growth of ~80% in mobile banking volume. Digital channels now account for 86% of all banking transactions.

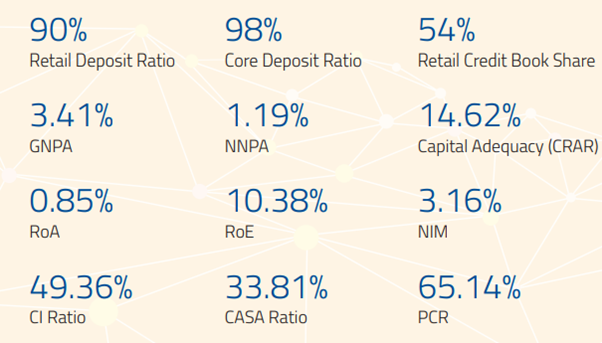

The Solid Financial ratios of the company during FY21

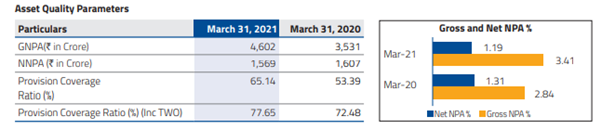

Improving Asset Quality of the company:

The Net Non Performing assets of the company have slightly improved despite the economic tailwind events that have occurred and Company has a high Asset quality compared to its peers and The provision coverage ratio has improved sustainably and this acts as a great buffer to any of the Bad debts that may arrive in the future.

A brief look at the 10 year performance of the company:

Source: Screener.in

If we are looking at a broader picture, we could the phenomenal growth of the company, the Revenue of the company has increased from 3670 Crs in 2010 to 14300 Crs in 2021 which is a 13% CAGR for the past ten years, the numbers are pretty impressive and the profit has also increased accordingly. However, the Financing Margin which is equivalent to the Operating profit margin has decreased significantly despite the benefit of economies of scale. The other income generated by the company is growing at a significant pace and apart from the low Financing Margin, the company doesn’t pose any other concern in the operational segment.

The successful Execution will remain as the key:

The company is one of the fastest-growing Mid cap bank of India with an emphasis on maintaining a higher Asset Quality, the company is in the right growth trajectory and the company is further strengthening its liability profile with reduced concentration risk and current account and savings account traction across corporate salaried, government and high net individuals segments, strong emphasis on digital migration, and entry into higher-margin segments like a credit card, consumer loans, commercial vehicle. One can accumulate Federal Bank on Every dip in the price to be a part of the growth of the company.

share your thoughts

Only registered users can comment. Please register to the website.