Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINThe saga of Indian Tyre Industry:

The Indian Tyre Industry is directly dependent on the growth of the Automobile Industry and the Automobile Industry had a tough time in the past due to the economic slowdown in India and then the disruption of business due to Covid. The domestic Auto Industry is the world’s fourth-largest automobile Industry and it is expected to grab the third position in few years. The Indian tyre industry may log 7-9 per cent growth over the next five years backed by a favourable outlook for the domestic automotive industry

Covid has disrupted the segment, The old Tyres never got old enough to be replaced they were never used due to the lockdown and due to the decrease in income, people never thought of buying a new car and the rising Petrol and Diesel price added fuel to the slowdown. However, let’s put back the History and look at the future. The slowdown is temporary but the Growth of the Indian economy is Inevitable and today let’s discuss an interesting stock from the Indian Ture Industry.

About the company:

Apollo tyres were established in the year 1972 and its first plant was commissioned in Thrissur, Kerala and it manufactures automatic bias and radial tyres, and tubes. It has plants in Kochi, Vadodara, Pune, and Chennai. The product profile includes prominent tyre brands in the T&B, light truck, passenger car, and farm vehicle segments in India, catering to both original equipment manufacturers, and the replacement market.

The Moat Analysis of Apollo Tyres:

A strong Brand Portfolio of well-established Brands

Apollo is one of the most trusted names in the Manufacture and sale of Tyres in India and Globally. The Company owns two key brands of tyres, Apollo & Vredestein. Apollo brand primarily manufactures tyres for the Indian Sub-continent. The Vredestein brand operates in Europe and is over 110 years old & has achieved premium brand status in the industry. The products cater to specific consumer segments and the product portfolio comprises tyres for passenger, commercial, off-highway vehicles and two-wheelers. Each has a distinct positioning and brand language.

Agile Manufacturing Capabilities

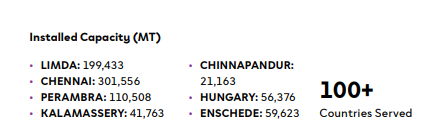

The company owns and operates 7 manufacturing facilities of which 5 are located in India & two are located in Europe in the countries of Netherlands and Hungary. Its combined capacity in Europe is 1 crore tyres Per Annum& 6.3 crore tyres Per Annum in India. The company also has two R&D centres of which one is situated in Chennai and one in the Netherlands, where they employ 420+ employees and the company has received 22 patents to date and they have spent 823 Million rupees for R&D for the FY21.

Source: Annual Report

Increasing Geographical Footprints:

The company operates in the European PCR market under the Vredestein brand. In fiscal 2021, APMEA (Asia Pacific, Middle East and Africa) operations accounted for around 60% of the consolidated revenue and European operations for around 30%; the remaining came from operations in the US. In terms of overall segmental diversity, the replacement market accounts for over 70% of the consolidated revenue, thereby assuring steady revenue flow. Due to the modest ramp-up of Hungarian operations and high production costs, profitability in Europe has been declining since fiscal 2018. In fiscal 2021, the company has restructured operations: now the Netherlands plant will only manufacture specialised tyres while most of the other products will be shifted to the lower cost Hungarian plant. The restructuring is expected to result in improved profitability from fiscal 2022. Continued growth in consolidated revenue with the sustenance of healthy operating profitability will be a key monitorable.

Presence across all segments:

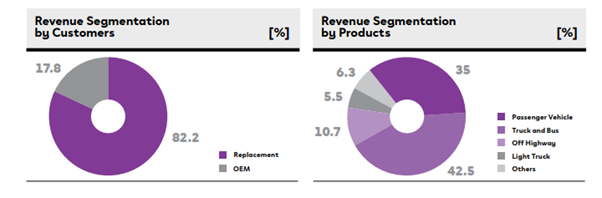

Wide range of Product- The Trucks & buses tyre accounts for the majority of revenues as 42%, followed by passenger vehicles (36%), Farm/Off-highway (11%), light truck (5%) & other products bring in the rest 6% of revenues. It is a leading player in the truck & bus tyre category & the passenger vehicles category in the domestic market.

Customer Segemntation - Replacement channel accounts for about 83% of revenues while the rest 17% of revenues come from automotive companies.

Agile Distribution Network

Its distribution network consists of 6,700 dealers across India and 7,000 dealers across Europe. It has been increasing its presence in rural India; It increased its stores in rural areas from 1,300 in FY20 to 5,300 in just 3 Quarters. Its agile Distribution Network and healthy operating efficiency have resulted in a high market share enjoyed by the company.

High Capital Expenditures:

The company undertook a restructuring of the European operations in fiscal 2021 at a cost of around Rs 600 crore. This would help improve efficiency in European operations from fiscal 2022. Further, the company plans CAPEX of around Rs 1,800 crore in fiscal 2022, most of which would be towards the Andhra Pradesh plant. Nonetheless, given the expected healthy cash accrual, the gearing and interest coverage ratio should remain healthy over the medium term. Any debt-funded, inorganic expansion or larger-than-expected Capex will remain key rating sensitivity factors but it should also be noted that the company is maintaining a strong Financial profile despite the high Capex plans.

Clever Marketing resulted in high Brand Salience:

The company has made several Intelligent advertisements which has resulted in a high brand recall, the company has been leveraging its association with the sporting legend, Sachin Tendulkar, Apollo Tyres has launched a TV campaign, Ganga: the River of People sung by the legendary A R Rahman which has been highly successful campaign made by the company and in fact, it was one of the best in the Industry

The Major challenges faced by the company:

High Fluctuations in the raw Material prices which affects the Profitability of the company:

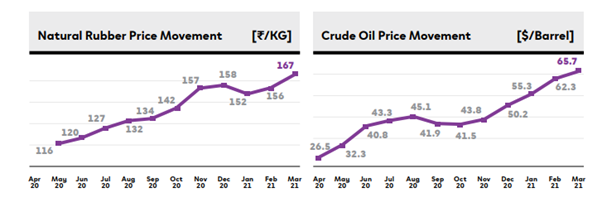

The Business remains vulnerable to the cyclicality in the tyre industry, driven by fluctuating demand from end-user CV players, the demand in the tyre industry also depends on economic growth and infrastructure development. The global pandemic also impacted demand during the first half of fiscal 2021. Furthermore, the raw material cost accounts for more than 60% of the operating cost. While the price of natural rubber depends on global demand, the area under cultivation and yield factor, the prices of carbon black and other raw materials are based on crude oil prices. While benign material prices led to healthy operating efficiency in fiscal 2021, they have since risen by 10-12% quarter-on-quarter in the first quarter of fiscal 2022. The players are able to pass on only part of the increase to end customers due to intense competition. Exposure to risks related to cyclicality in the tyre industry and volatility in raw material prices is likely to persist over the medium term.

The Strong Financial Performance of the company:

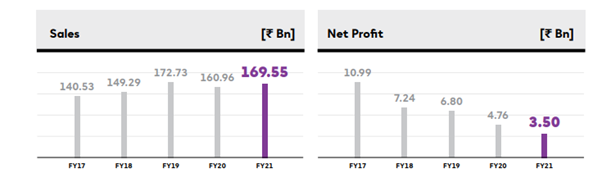

The Financial year was like no other as the FY21 began with a lockdown which poised a never like situation for the company but despite the challenges, the company has reported a 6% growth in sales. However, the company has witnessed degrowth in the Net profit due to Exceptional losses faced by the company. The company has a stable Operating Net profit Margin and the company has shown extreme operational efficiencies. There were no Red flags with the company in the operational Front.

Let’s Jump to the Valuation part of the company:

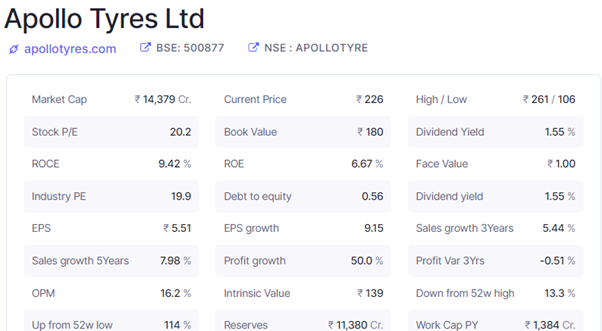

Source: Screener. in

The company has a market capitalisation of around 14,500 Crs and is trading at a Price multiple of 20x which puts the company as Fairly valued compared to its competitors and the Book value of the company is 180Rs per share, and the share has been trading 1.2x of the Book value. The company has a low ROCE and ROE which remains a little concern. The Debt to Equity of the company stood at 0.56% despite the huge Capex done by the company and they have a Reserve of 11,380Crs which is 85% of the market cap of the company. A higher Reserve also acts as a cushion as the company can meet its future growth plans through Internal Accruals than looking for outside funds.

Marching Ahead with clear conviction:

The company is vivid with its future growth plan improved outlook for its European business coupled with its strong positioning in truck and bus, passenger car radial segments in the domestic market (both of which are likely to continue to perform well). The company has laid a revenue target of $5 billion (implied compound annual growth rate 16%) under ‘Vision FY2026’ is a bit ambitious but even if the company manages to execute half of its goal, we will be witnessing huge growth and the market will celebrate the growth by appreciation in the stock price of the company.

share your thoughts

Only registered users can comment. Please register to the website.