Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINShyam metallics IPO was launched recently and many of us might have applied for the IPO and some few of us would have got allotted and most of us would have read a lot of articles who submitting our bidding application and our focus was majorly towards the Listing gains as the IPO market has turned bullish than ever and the retail investors are welcoming the new companies with fireworks of participation in the IPO but due to which we have started looking at the company in a different lens altogether and we are seeing the company in terms of short term gains that we forget to see the long picture of the company.

Let me through in some statistics before making my point here:

All multi bagger stocks were once an IPO and let me share a few IPO stocks that has given phenomenal returns in the past 4 – 5 years

|

Name of the company |

The growth of your investment after the IPO |

|

Dixon Technologies |

13x |

|

DMart |

11x |

|

CDSL |

10x |

|

Happiest Minds |

9x |

|

India Mart |

7x |

|

Route Mobile |

6x |

|

Affle India |

6x |

The return generated by the above companies is really crazy and most of us who have invested in the companies even after the IPO would have also enjoyed a greater returns. However, due to the change in the landscape, we have been wired to focus on the short-term gains instead of looking at the broader picture, and due to which most of us wouldn’t have stayed put in the above companies and the opportunity cost that we missed is huge. Thus, my point here is to look at companies beyond the listing gains and start looking at the long-term growth of the company as the stock price follows the profit growth of the company in the long term and today we will discuss the long-term prospects of Shyam Metallics.

About the company:

Shyam Metalics and Energy is an integrated metal producing company based in India with a focus on long steel products and ferroalloys. It is amongst the largest producers of ferroalloys in terms of installed capacity in India and Let's have a look at the features that makes Shyam Metallics a unique company

India’s leading Metal Producer: The company is one of the leading Integrated metal producers in India and it is among India's largest producers of ferroalloys in terms of installed capacity and the fourth-largest player in the sponge iron industry.

Diversified Product Mix: The company is primarily engaged in the production of long steel products such as Ferro Alloys (31% of the revenue) iron pellets (9.2% of the revenue), sponge iron (25% of the revenue), and steel billets, TMT, structural products, wire rods, contributed 15% of the revenue. The company is planning to further extend its product portfolio by new launches like Blast Furnace, Ductile Iron Pipes, Aluminum Foil.

Source: Company website

Ferro Alloys capacity: It is the major product of the company, TheFerroalloys are alloys of iron with a high proportion of one or more than one other element e.g.: chromium, manganese, or silicon and Shyam metallics is amongst the largest producer of Ferro-alloys domestically with an annual installed capacity of 0.21 million ton as of February 2021, with 6.6% share in the capacity.

Manufacturing Facilities: The company has 3 manufacturing plants located in Sambalpur in Odisha, and Jamuria and Mangalpur in West Bengal, its manufacturing units have an aggregated installed metal capacity of 5.71 million tonnes per annum. The company is looking to more than double its production capacity from 5.71 MTPA to 11.60 NTPA by 2025

Proximity to resources: The group’s manufacturing plants in Odisha and West Bengal are in close proximity to the mineral-rich belt of iron ore, manganese ore, chrome ore, and coal. The company also has long-term linkages for coal & chrome ore with Mahanadi Coal Field and Odisha Mining Corporation Limited respectively.

Domestic Footprints: The company has its presence in 13 states and 1 Union territory and it contributes 88% of the total revenue of the company. The company sells its intermediate product through brokers and its product offerings cater to a mix of customers that consist of institutional customers and end-use consumers through our distribution network the company has established partnerships with 42 distributors

Strong Clientele base: The company strong association with its reputed clients and It’s Domestic Customers include Jindal Stainless Limited, Jindal Stainless Limited, Rimjhim Ispat Limited and many more and its International Customer includes Norecom DMCC, Norecom Limited, POSCO International Corporation, World Metals & Alloys (FZC), Traxys North America LLC, JM Global Resources Limited and many more.

Integrated Power Plant: The company has 8 captive power plants with an aggregate installed capacity of 227 MW, as of December 31, 2020. The power plants use nonfossil fuels such as waste, rejects, gas and heat that are generated by the manufacturing units, and the same is utilized to produce electricity for the operations of the manufacturing plants.

Healthy Forward and Backward Integration: To enhance operational performance, the company has been focussing on backward & forward integration to improve cost efficiencies. The company further intends to integrate its operations by using the existing waste by-products to introduce high-end margin products

The company is one of the integrated metal producing companies in India with captive railway sidings and they have a captive railway siding at 2 of its integrated manufacturing units which ensures a more optimized freight cost given that nearly three times of raw material is to be transported for every tonne of steel produced.

Growth Strategy:

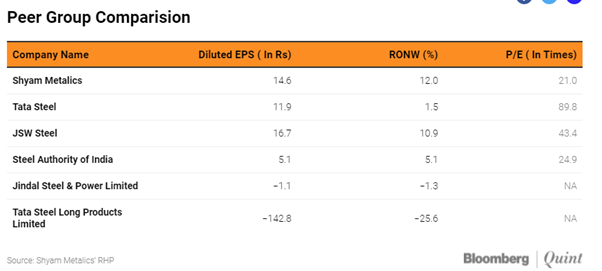

PEER COMPARISON:

Source: Bloomberg Quint

The above table is a peer comparison of the company with its major competitors and the company has an EPS of 14.6 which is the second-highest among its peers and The company has the highest Return on Net worth of 12%. However, the company is trading at a lower-Price multiple of 21x which is lower than the state-run SAIL and we could see a perfect opportunity for growth.

Strong Financial Performance of the company

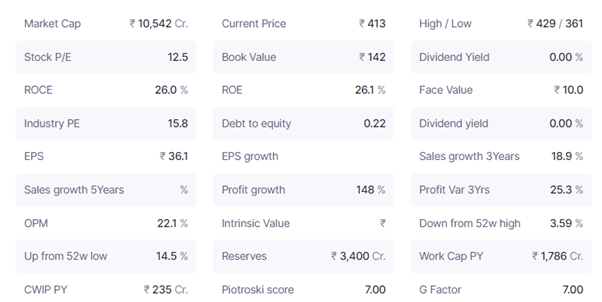

Source: Screener.in

The company has performed exceptionally very well and their sales have almost doubled within the past two years and they also have a healthy Operating profit margin due to their healthy Backward and forward integration which has brought the costs significantly down and the Net profit of the company has doubled in the past three years which shows makes the growth potential of the company unquestionable.The borrowings of the company stood at 792 Crs as of Mar 2021 and the Debt to Equity stood at 0.22 and the liquidity of the company remains strong and the company has Reserves of 3400 Crs as of Mar 2021 and which is also a positive sign as most of its competitors have huge debt burden and a lower debt also helps the company acts as a cushion during the downturn of the economy as the steel business s highly cyclical in Nature.

Weaknesses:

High concentration in Eastern India:

The Manufacturing plants and sources of raw materials are primarily concentrated in eastern India and any adverse developments affecting this region could harm business as the company is having a total of 3 manufacturing plants in West Bengal and Orissa and also the company has a heavy Dependence on the top-10 Customers which will put pressure on the receivables of the company.

Valuation and Other Key Metrics:

Source: Screener.in

The market cap of the company stood at 10,500 Crores which makes it a quality Mid-cap company and As discussed earlier in the Peer comparison, the company is trading at a lower price multiple compared to its competitors and in the Valuation front we could conclude that the company is undervalued and in the performance front, the company has been doing very well, the ROCE and ROE of the company are at 26% and the three years sales growth of the company is 18.9% and they have achieved the same despite the economic Turbulence due to Covid and all in all the company has huge potential for enhancing their profit growth and remember that the stock price follows the profit growth of the company in the long term always. Period.

Conclusion:

The growth potential of the company is large. However one should also keep in mind that the company operates in a cyclical sector and stock prices might take a reversal if the sector starts its downturn but the fundamentals of the company are intact and that would help the investors ride the cycle without any fear and if you are holding the stock from the launch of IPO then one can hold the stock for a long run when the external factor is favorable for the Industry.

share your thoughts

Only registered users can comment. Please register to the website.