New Initiatives and Growth Decisions Should Lend Support to Edelweiss Financial Services Limited

Summary

- In FY20, diversified business model supported Edelweiss Financial Services Limited as 3 out of 4 businesses saw minimal impact. This was despite ~8 quarters of market dislocation.

- Edelweiss Financial Services Limited has made a decision to divest stake in Edelweiss Gallagher Insurance Brokers Ltd.

- Market leadership and focus on gaining market share are expected to act as principal growth enablers.

About Edelweiss Financial Services Limited

As India's leading diversified financial services conglomerate, Edelweiss Financial Services Limited provides range of financial products and services. These services cater to substantial and differentiated client base such as corporations, institutions and individuals. It offers strong platform to diversified client base in domestic and global geographies. The company’s key lines of business are Credit, Investment & Advisory and Insurance. The company’s 1.2 million strong client base gets service through network of 476+ offices, with ~11,000 employees. It has a strong network of sub-brokers and authorized persons and the company is present in all major cities in India.

Growth Enablers of Edelweiss Financial Services Limited

- Fee Income Was Highlight for 4Q21: Consolidated revenue was INR4,481 crore, with consolidated PAT reaching INR637 crore. Fee income was above pre-Covid levels and was INR543 crore. The company is diversified across retail credit, asset management, asset reconstruction, insurance and wealth management and its businesses are structured under ten key entities. These businesses have strong capital base and operating platforms which should help them achieve targeted growth. In FY21, the company saw growth in customer franchisee, with customer assets up 35% year-over-year to INR2,80,800 Cr. This exhibit continued trust by customers. Edelweiss Financial Services Limited has worked significantly to improve its liquidity and balance sheet. It has strong net worth of INR8,542 Cr. While alternatives, asset reconstruction and wealth management businesses maintained industry leadership, the company’s mutual fund and retail credit have been categorised as growing franchisees. Life insurance and digitally powered general insurance businesses have seen growth and gained market share, with strong recoveries in ARC. The company concluded stake sale in its wealth management business and this was done at valuation of INR4,400 Cr. This endorses quality of businesses the company has built and value it has created. Edelweiss Financial Services Limited continued its transition to capital light retail credit model and has a focus on housing and SME businesses. Scaling down of wholesale lending book has been done over last two years and the company plans to bring it down to half of its size by FY23.

- Wealth & Asset Management- Strong Franchise Should Lend Support: Wealth & asset management business was seen outpacing market growth and this business improved industry rankings over last five years. Market dominance was stemmed from strong capabilities and scale. With an expansion in market share, these businesses improved its customer base. In FY20, leading global institutions like Kora Management, Sanaka Capital and Arthur J. Gallagher & Co made alliances. As per FY21 business structure, wealth and asset management businesses were segregated. Alternative assets, mutual funds and asset reconstruction come under umbrella of Edelweiss asset management. Wealth management business is being housed under Edelweiss wealth management.

- Capital-light Model- A Focus of Credit Business: Given market environment, the company’s credit business transitions to capital-light model, with help of co-origination partnerships with India’s renowned public sector banks. In FY20, the company’s total credit book size was INR210.32 billion, with retail book forming 52% of total book. This business saw co-origination with SBI, Central Bank of India, Bank of Baroda and PNB for priority sector lending. With focus of business on scaling down corporate credit book by focusing on sell-downs, this business continues to focus on affordable housing, SME and business loan segments. This business has high capital adequacy.

- Focus on Gaining Market Leadership and Presence: Businesses such as wealth management and asset management are businesses in which market leadership was built over time. Plans are there to capture market share and enhance its lead. Global partners such as PAG should play significant role in this journey and their experience and ability should be able to open new doors of opportunity. Businesses like retail credit, life insurance and general insurance should be able to adapt new technologies. With technology acting as backbone, the company expects to scale up these businesses and cater to larger section of population.

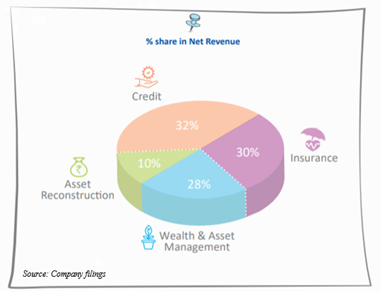

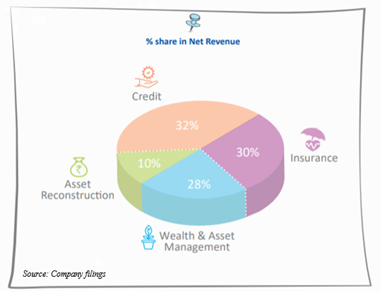

- Diversified Business Should Continue to Support Edelweiss Financial Services Limited: The company has diverse business profile in financial services, with presence across retail credit, wholesale lending etc. Wholesale segment focuses on loans to realtors and structured credit. The company focuses on reducing its exposure to this segment. It continues to make attempts to increase exposure to MSME and retail mortgage segments. With diversified businesses come diversified streams of revenue. In FY20, the company saw ~30% contribution to net revenue from credit, wealth & asset management and insurance each. Business risk profile should seek support from the company’s established position in market and several fee and fund-based products.

- Capitalising on Future Opportunities: Long-term growth story of India and trend of compounding should continue to stem growth for Edelweiss Financial Services Limited. In FY21, the company should be able to see some improvement. Financialisation of household savings in India, low credit penetration and consumption demand continue to present newer opportunities. These opportunities should come in areas of credit, asset management, wealth management and insurance. These are major businesses of Edelweiss Financial Services Limited. Credit democratisation and increased availability of credit for SME sector should benefit the company as it has strong position in retail credit segment. In FY21, focus should be on productivity and efficiency, strengthening and consolidation. The company plans to prepare itself for FY22 and for its future aspirations as it gets back into growth mode. To achieve next leg of growth, the company has raised equity in its NBFC named ECL Finance Ltd. Now, it has significant opportunities for growth once improvement in business environment becomes certain. Strategic investors have flowed in advisory businesses where its franchise remains strong. Plans are there to improve operating efficiency by reducing costs and using technology.

- Focus on Life and Non-Life Insurance Businesses: Edelweiss Financial Services Limited plans to make investments and scale up fast-growing life and non-life insurance businesses. To achieve this, the company has made a decision to divest its stake in Edelweiss Gallagher Insurance Brokers Ltd. This decision also supports the company to reallocate capital. Gallagher plans to acquire all remaining shares and take its stake to 100%. Previously, Gallagher was holding 30% in this business. Edelweiss Gallagher Insurance Brokers Ltd is in business of offering general insurance solutions to clients in India.

Conclusion

In FY20, Edelweiss Tokio Life Insurance expanded its distribution footprint across agency and alternate digital channels. Over FY16-FY20, life insurance business compounded its individual annualised premium at ~24% to INR3.23 billion while it has compounded AuM at 52% to INR27.07 billion. Edelweiss Financial Services Limited has made progress in doing wholesale book reduction. This reduction stemmed from organic repayments and asset sell-down transactions like real estate completion financing platform with Meritz. Focus is on more reduction in wholesale book. ECL Finance Wholesale Loan Book saw a reduction of 43% from peak levels. Plans are there to take this number to zero by FY22. In FY20, the company focused on making its capital base strong through both reduction in credit book and raising of equity capital.

The company raised equity in both Credit and Wealth & Asset Management businesses. This supported the company maintain healthy capital adequacy in its various businesses, even after impairments it took in 4Q20. The company termed FY20 as a year of consolidation as economic environment and Covid-19 pandemic made it focus on strengthening core rather than actively seeking growth. FY21 should be similar and focus is on building on successes it achieved in FY20 to further create stronger structural base. In past, NBFC industry has been volatile and fear of liquidity crisis was seen. Focus was on liquidity management rather than asset growth. Healthy capital position, focus on asset quality and strong liquidity management practices should continue to provide comfort. The company should be able to capitalize on opportunities offered by retail finance industry.

India is counted as a country having lowest credit penetration among larger economies and retail credit presents huge growth opportunity. This opportunity is driven by long-term trends in democratisation of credit, rising household income and increased consumption. Financialisation of assets, wealth democratisation and increasing sophistication are few emerging trends in Indian wealth management industry.

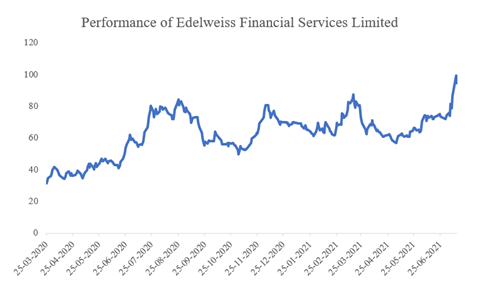

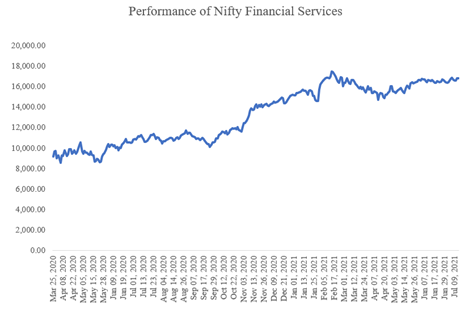

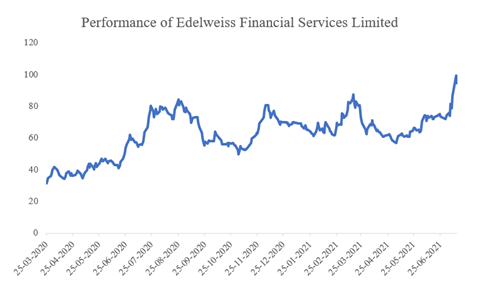

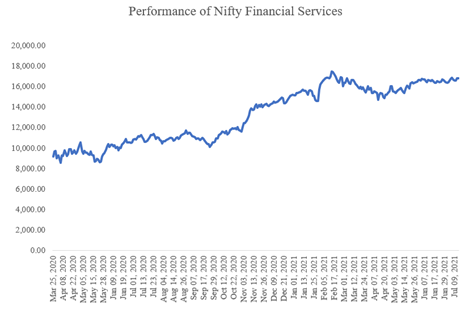

Stock of Edelweiss Financial Services Limited has seen a strong run up of ~202.20% between Mar 25, 2020-Jul 14, 2021. In comparison, Nifty Financial Services saw a growth of ~83.92% only. Simply put, an investment of INR1,00,000 on Mar 25, 2020 would have become INR3,02,203.9 on Jul 14, 2021.

Exclusivity:

This article is exclusive to investoguru.

Stock Disclosures:

The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Author Disclosures:

This Article represents the Author's own personal views. The Author did not receive any compensation and do not have any business relationship with any of the companies mentioned in the Article.

share your thoughts

Only registered users can comment. Please register to the website.