Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINThe Paints and Coatings Industry is one of the most heavily regulated industries in the world. The sector consists of manufacturers of paints, varnishes, lacquers, shellacs, stains, and a variety of other specialty coatings. The Indian Paint Industry is estimated to be Rs. 50,000 Crores industry.

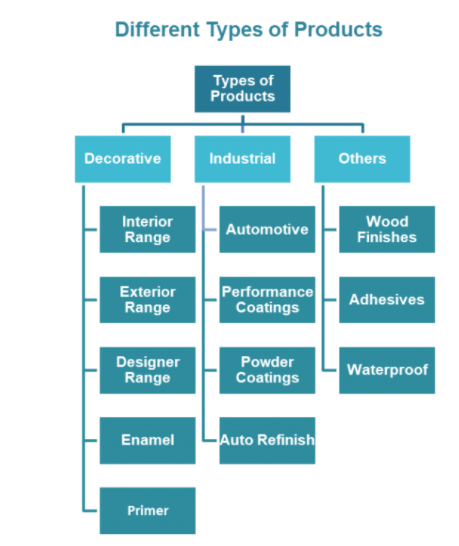

The Indian Paint sector is broadly classified into two main segments mainly

Decorative paints include exterior wall paints, interior wall paints, wood finishes, enamel and ancillary products such as primers, putties, etc. while Industrial paints include automotive coatings, powder coatings and protective coatings. The Decorative segment accounts for the majority of the Paint Industry’s value which is around 75% and the Industrial segment accounts for the rest 25%. Of the two segments, the industrial paints segment mainly comprises organised players whereas the decorative paints segment involves unorganised players too as the decorative paints segment is not significantly dependent on technology.

The Paint Industry in India is dominated by the organised players and the above chart shows the Market share of the listed companies in the Industry and Asian paints has clearly outwitted its peers and has got a huge pie in the Market share and it is followed by Berger paints which have a market share of 17% and the third position is taken by Kansai Nerolac paints and today we are going to discuss this company which is spreading its wings and is eager to grab more Market share.

How a Small unorganized company transformed into a giant company?

The company started its operations in 1920 as Gahagan Paints & Varnish in Mumbai and manufactured paints as a small-scale business and soon they changed their name to Goodlass Wall Pvt. Ltd and grew popular as Goodlass Nerolac Paints (Pvt.) Ltd. Also, it went public in the same year and established itself as Goodlass Nerolac Paints Ltd. . Goodlass Nerolac Paints Ltd. became a part of Tata Forbes Group on the acquisition of a part of the foreign shareholdings by Forbes Gokak. .

And in 1983 Goodlass Nerolac Paints Ltd. strengthened itself by entering in technical collaboration agreement by Kansai Paint Co. Ltd., Japan and Nihon Tokushu Tokyo Co. Ltd., Japan and the Kansai paint took over the company and now holds 75% stake in the company and soon the name of the company was changed to Kansai Nerolac Ltd and the company is a subsidiary of Kansai Paints Co. Ltd Japan, from whom it continuously gets support and guidance in the improvement of quality standards and getting the best technology upgrades.

Leading player in domestic Industrial paint industry

KNPL is a leader in industrial coatings. Leveraging its position as a priority supplier across various automotive OEMs and ancillaries, the company now has a substantial presence in Performance coatings & Powder coating. It has continued to venture into newer areas of Wood coating, Adhesives, Transportation coatings, Coil & Rebar coatings, Super durable powders, Construction chemicals.

Third largest player in Decorative paint industry

The Decorative paint industry is dominated by Asian Paints and Kansai also has its presence in the decorative segments across all ranges and focuses on premium innovative brands such as Nerolac Impressions, Beauty Gold, Suraksha plus, Excel Top Guard and they are the third-largest player in the segment.

Integrated Manufacturing Facilities:

Kansai Nerolac manufactures its various products at the company's six plants which are strategically located near its major OEM's thereby lending a competitive edge and is able to maintain its leadership position in the Industrial paint segment.

Its manufacturing plants are located in Jainpur-Uttar Pradesh, Bawal-Haryana , Hosur-Tamil Nadu, Lote-Maharashtra , Sayakha-Gujarat , Goindwal-Punjab. The manufacturing plants have strong Backward Integration and The plant at Goindwal sahib Haryana is its first digital plant for manufacturing Decorative paints and has commenced its operations in FY 2019-20. And the company has laid the foundation for opening its seventh manufacturing plant in Andhra Pradesh which would increase its penetration in Southern India. The plant at Goindwal sahib Haryana is its first digital plant for manufacturing Decorative paints and has commenced its operations in FY 2019-20.

PAN India Distribution Network:

The distribution network is more important essence for the success in the paint industry as it has to meet constantly cater to the domestic demand and Kansai has got this factor right and the company has a Pan-India presence through 99 sales locations, A 500+ supply material suppliers, and 29,500+ happy customers. To promote local growth, the Company tries to source its raw materials from local vendors; but some specialized raw materials are imported as the Company has no other alternative.

One Step Ahead of its Competitors:

KNPL’s hallmark of success is technological innovation and its immense focus on R&D. It has helped the Company to deliver high-quality service with a quick turnaround, cost savings, and reduced the environmental impact of harmful chemicals and it currently has 1 R&D center in India. KNPL’s R&D center is equipped with the latest labs for testing facilities. To build a robust R&D ecosystem, KNPL commissioned a state-of-the-art R&D facility at Vashi, Navi Mumbai. The center is equipped with the latest labs for catering to various markets and testing facilities and In the automotive sector, it is the market leader and has pioneered many important technological breakthroughs. The Company has deployed cutting-edge IT tools to make its supply chain and sales process more efficient. The Company has adopted SAP Leonardo which brings together ML, IoT, Blockchain, and Big Data.

New Ventures to penetrate additional segments

During FY 2019-20, Kansai has signed an agreement with Italian major Acro Coatings to enable them to offer high-end Italian wood finish to its esteemed premium customers. During the same year, it set up a new company Neroflix which is a strategic joint venture with Polygel Industries for tapping the adhesive market.

Focusing on Backward Integration of the Manufacturing Facilities:

6 well-equipped state-of-the-art manufacturing facilities for the production of paints, resins, and other intermediates, located strategically across India, with most of them capable of serving multiple ranges of product streams, thus ensuring unwavering customer confidence through uninterrupted service, including Just-in-Time (JIT) and cost competitiveness for Industrial customers Acquisition of Marpol to scale up leadership in Powder Coating segment

Increasing Global Footprints:

During FY 2019-20, KNPL made its debut in international markets through acquisitions in Bangladesh, Nepal, and the establishment of a greenfield JV project in Sri Lanka. The company sees huge growth potential in international geographies and is ready to do more investments there.

The Major issues faced by the company:

Pricing pressure from automotive OEMs

The Raw materials cost accounts for around 60% of sales. The main raw materials include titanium dioxide, crude oil derivatives, pigments and resins. Hence, volatility in crude oil/derivative prices, coupled with fluctuations in the exchange rate, has a direct impact on the industry margins. However, players have largely been able to pass on cost increases in recent years, aided by strong demand and concentration. Besides, the group imports some inputs to ensure superior quality. Moreover, despite being a market leader in the industrial paint segment, the Kansai group has limited pricing flexibility, particularly with auto OEMs, which are major contributors to revenue. As a result, the operating margin has fluctuated between 12% and 17% over the past decade.

Limited pricing flexibility in the decorative segment

While the organized paint industry is dominated by a few large players, paint manufacturers face competition from strong regional players, especially in the mass-market product sector. Consequently, while paint manufacturers have the flexibility to pass on an increase in cost, their ability to absorb cost benefits and increase the margin is limited. Kansai Nerolac will maintain its margin, profitability will continue to be constrained by intense competition.

What does the Post Pandemic world holds for the Paint Industry:

The Indian paint industry is currently valued at Rs 50,000 crore. Globally, the paints and coating market size is expected to reach USD 236.11 billion, exhibiting a CAGR of 6.2%. However, these estimates might change owing to the fast-spreading pandemic. While the future holds great opportunities for the paint industry, the fact remains that supply chains are currently disrupted and production has been put on hold for several brands.

Historical Financial Performance of the company:

The company had a 3% sales growth in the past two years and we could attribute is due to the Covid led lockdowns which drastically brought the industrial activities but between the years of 2018 and 19, the company had a 15% sales growth which is very impressive and if the company is able to maintain its previous track record, we could see a considerable increase in the profits of the company. The company has been maintaining good margins in the past three years despite various tail wind events and apparat from that the company also has been paying out 40% of its profits as a dividend and has a dividend yield of 0.54%

The company is trading at a price multiple of 61x which is comparatively lower than its peers that enjoy a much higher price multiple and comparing with its major competitors the company is available at a lower-Price multiple and the company is also Deb free which is another advantage to look upon and the company has also been doing really well in other metrics as well.

The colorful road Ahead for Kansai Nerolac:

It takes hard work and passion. It takes commitment and courage. It means marching ahead with fearless innovation. It involves taking risks and celebrating when they work. And going back to the drawing board when they do not. The company has embraced various educated risks and because of which the company is the second-largest coating company and a market leader in industrial coatings, with time to time support from its parent organization and its resilient spirit the company can overcome any impediments and can make its further journey more colorful than ever.

share your thoughts

Only registered users can comment. Please register to the website.