Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGIN

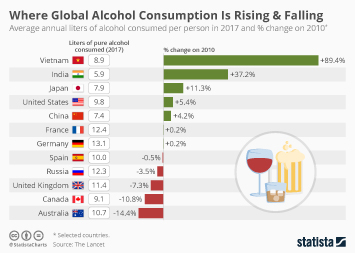

To start off, it has been assessed by the World Health Organisation that an individual consumes about 6.2 litres of alcohol per year. According to the World Health Organization (WHO), average alcohol consumption in India was 5.7 litres per person above the age of 15 per year in 2016, up from 4.3 litres in 2010. India is ranked 101 as per capita consumption of Alcohol. The statistics reveals the growth potential in India. Earlier, consuming Alcohol in India was considered only for rich and in some rural area, you will be tagged as a bad person if you consumer Alcohol but now things are changing rapidly and consuming Alcohol has become the new normal and is seen as a higher status of Living and this change in the perception is playing out well for the like of the industry.

The dynamics of the industry looks promising and the growth prospects are high and today let’s have a look at one of the leading company in the Alcoholic Beverages sector.

About the Company:

Diageo India incorporated in India as United Spirits Ltd. USL is the country’s leading beverage alcohol company and a subsidiary of global leader Diageo PLC. The company manufactures, sells, and distributes a wide portfolio of premium brands such as Johnnie Walker, Black Dog, Black & White, VAT 69, Antiquity, Signature, Royal Challenge, McDowell’s No.1, Smirnoff and Captain Morgan

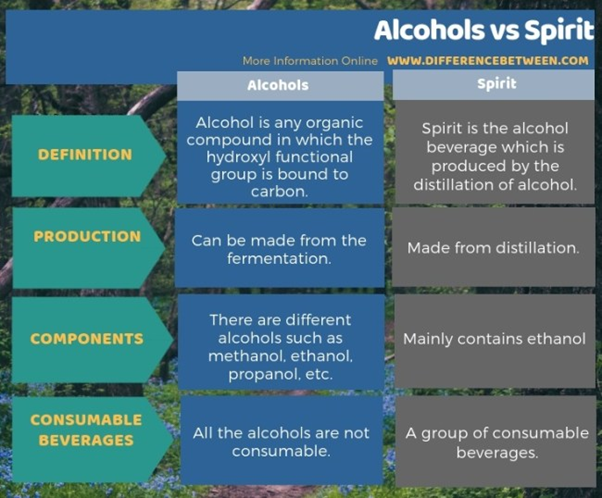

What is the difference between Alcohol and Spirits?

Let’s bring in some science into the equation, Alcohol is any organic compound in which the hydroxyl functional group binds to carbon while the spirit is an alcohol beverage which we can produce via the distillation of alcohol. The key difference between alcohols and spirit is that we can make alcohol from fermentation whereas the spirit comes from distillation. Moreover, another difference between alcohols and spirit is that, all the alcohols are not consumable while spirits are the group of consumable beverages. Moreover, spirit mainly contains ethanol (it is an alcohol). However, when considering all the alcohols, there are different compounds such as methanol, ethanol, propanol, etc. Further, the strength of the spirit is measured by the amount of alcohol they contain.

Indian whiskies, including scotch, will be among the largest contributors of growth to the global whisky market over the next five years, according to the latest forecast by International Wine and Spirits Research (IWSR). Whisky, gin and tequila along with Chinese rice wine or baijiu will contribute the most to growth of the total spirits market worldwide. The global spirits market is forecast to be at 3.19 billion cases by 2021, with whiskey, gin and tequila expected to make gains of 55.2 million, 7.1 million and 5.8 million 9 litre cases, respectively, between 2017 and 2021.

The Reincarnation of the company:

Do you remember Vijay Mallya, the great business tycoon from Bengaluru who is now a fugitive who took Debts worth more than 6000 Crs from the State run banks and fled the nation without paying a penny back. Well, United spirits was owned by Vijay Mallya and the Banks sold the share help by Vijay Mallya to recover their money and Diageo PLC came as a saviour of the company and Banks were more than happy to sell the Vijay Mallaya’s stake to the company and Diageo PLC took over the majority stake in 2013. It started restructuring the company by selling off non-core assets over next few years. This included sale of entire stake in United Brewries (UB) to Heineken.

Diageo PLC has since targeted the premium spirit segment by launching new products. It has also reduced the debt over the years and has focused on better working capital management and the new management is focussing on its core business and is bringing in its international expertise which is poised well for the growth of the company.

Market leadership

USL has the highest market share of 32% in the Indian spirits industry and it is the 2nd largest spirits company in the world

The company has ~45% market share in the Indian Whiskey market. Whiskey accounts for over 60% spirits sale in India USL has 11 brands that sell more than a million cases each year. Of this, 2 brands sell more than 10 million cases each per annum. Its premium brands include as Johnnie Walker, Black Dog, Black & White, VAT 69, Antiquity, Signature, Royal Challenge, McDowell’s No.1, Smirnoff and Captain Morgan and many more. Its brands are much loved by consumers. We are relentless in our pursuit of excellence through innovation, and curate experiences in keeping with evolving consumer preferences.

Agile Manufacturing facilities:

The company has 15 Manufacturing facilities spread across India and The Group has also entered into arrangements with Tie-up Manufacturing Units (TMUs), wherein TMUs manufacture and sell beverage alcohol on behalf of the Group. Under such arrangements, the Group has exposure to significant risks and rewards associated with the sale of products i.e. it has the primary responsibility for providing goods to the customer, has pricing latitude and is also exposed to inventory and credit risks.

Did You know?

Hard alcohol, it turns out, is the greediest, guzzling 34.55 litres of water for every litres

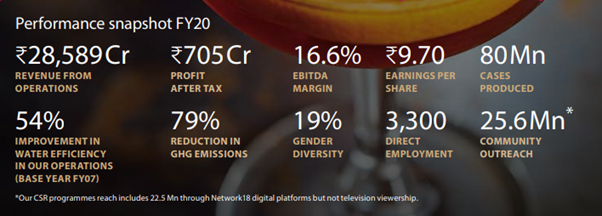

At a time when preservation and replenishment of water has emerged as a serious issue for the country against an impending 'water crisis', we have improved water efficiency in our manufacturing units by 54% (in lakh/litre when compared to our FY07 baseline). Our water replenishment initiatives have benefited ~70,000 people this year through community-focused projects across severely water-stressed areas in Rajasthan, Uttar Pradesh and Maharashtra.

Generating Income through Franchisee and other Contractual agreement:

The company general revenue in respect of fixed income brand franchise arrangements is recognised proportionately in each period. Income from variable franchise arrangements is recognised based on the terms of the respective contracts upon sale of products by the franchisees. The Group earns revenue from central rights, prize money, sponsorship, digital income and transfer fees through its BCCI–IPL franchise. Revenue from providing services is recognised in the accounting period in which services are rendered. For fixed price contracts, revenue is recognised based on the actual service provided to the end of the reporting period as a proportion of the total services to be provided. This is based on the number of matches played.

Risks & Concerns:

High Regulatory Issues:

The industry is exposed to multiple regulatory risks emanating from state taxes, adverse ruling from courts and changes in regulations with respect to pricing, licensing, working of operating facilities, manufacturing processes, marketing, advertising and distribution. l Increased tendency towards prohibition in an election year. Apart from the political vagaries, the business is also prone to seasonal variations. During the summers, a chilled beer provides the perfect respite from the scorching summer heat. And sales naturally rise during the months of April, May, and June. But once the monsoon sets in, sales stagnate. In most cases, breweries are left with excess capacity that they simply can’t put to good use. Capacity utilization hovers anywhere between 60–70% and it’s generally not a very pleasant time for these people.

But it doesn’t stop at that. They also have to contend with prohibition — the act of banning the manufacture, sale, and transportation of alcoholic drinks within a particular location. Gujarat is a state that has had prohibition in place for a good number of years. There are a couple of other states that followed suit. But the problem here is that you never know if a new state is going to adopt prohibition.

Impact of Covid:

And amidst all these uncertainties you had Covid last year. As soon as the first wave hit India, all liquor outlets were shut down for good. But as cash strapped governments realised they were losing millions in revenue, liquor stores were permitted to operate post May 2020. However, the effect of this policy decision hasn’t entirely been robust. For starters, states doubled down on taxation. We saw excise duty rise and a Covid cess on liquor products. Ultimately, taxes alone contributed about 70% to the price.

The Performance of the company:

UBL’s sales volume was about 79.7 million cases resulted in a volume decline of 2.3% compared to prior period. After adjusting for the franchise model changes in Popular segment, underlying volume declined 2.1% compared to prior period. Net sales from operations of your Company grew 1.2% in the financial year ended March 31, 2020 and stood at INR 90,909 million net of duties and taxes. Adjusted for the franchise model changes and one-off sale of bulk Scotch, net sales/income from operations declined 1.5% for the year. Sales volume of the Company’s brands in the ‘Prestige and Above’ segment declined 1.5% in the financial year ended March 31, 2020 and stood at 40.9 million cases (previous year 41.6 million cases). Net sales of the ’Prestige and Above’ segment grew 0.4% and stood at INR 59,311 million net of duties and taxes (previous year INR 59,095 million).

Valuation remains a concern:

The company remains one of the best in its industry, and its Debt Free and it has other supportive parameters and true to its name the market participants are highly spirited and has made the stock overvalued. The company has a market cap of 47,600 and is trading at a Price Multiples of 124x and offers very less margin of safety for the investment. However, one can see this stock as a buy on Every dips.

Strong! Steady! Spirited!

Over the course of this year, the company has navigated several unknowns, including disruptive waves of state-level lockdowns, the impact of recent tax hikes on consumer demand and the effects of economic turmoil. They will continue to dynamically manage the situation in the near term while staying true to our longer-term strategy. The company is enhancing its profitability despite several headwinds and the company has been focusing on renovating its several brands and relaunching them to gain new popularity among its customers. All is well with the company, the growth is visible and is well-positioned to tackle any threats that may appear one has to be wary about the high valuations of the company. One can wait for a slight correction to enter the stock with a high spirit.

share your thoughts

Only registered users can comment. Please register to the website.