Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINThe Indian Animal Health Industry has played a vital role in safeguarding the Animal husbandry interest of the nation. The Indian animal healthcare market is estimated to be around Rs. 5,500 Crores and is projected to be valued at Rs. 6000 Crores by 2021. The species in the Animal husbandry market is 51% of the livestock, 35% by poultry, 8% by companion animals, 5% by the Aqua Animals ad the rest 1% by the remaining animals. The products which contributed to the Animal health care are Nutritions contributing 39%, 20% by Paraciticides, 17% by Antibacterials, 13% by biologicals, and 11% from the other product categories. The growth of the industry is inevitable and the Industry constitutes 50 major companies. However, the industry is dominated by the top 10 players.

Today we are going to see about India’s largest Animal Health care company which dominates the Industry and has made its position deeper in the Market.

Why Sequent is ready to reach New Horizons?

Demerger to focus on Animal Health care: In 2017, Sequent Scientific and Strides Shasun two business entities belonging to the same promoter group decided to Demerge its Human API business and transferred the business to form a new company Solara Active Pharma Science Ltd. The Demerger helped Sequent to focus on its Niche offerings in the Animal Healthcare business.

India’s Largest Health care company: Sequent Scientific, through its animal health business Alvira, is the largest animal healthcare company from India, and the company plans to build Alivira as a leading global Animal healthcare pharmaceutical brand

Acquired by Carlyle Group: In Sep 2020, Sequent Scientific was acquired by the American Private Equity player ‘The Carlyle Group’ and now the Carlyle group through its Mauritius based subsidiary CA Harbor Investments holds a 53% stake in the company

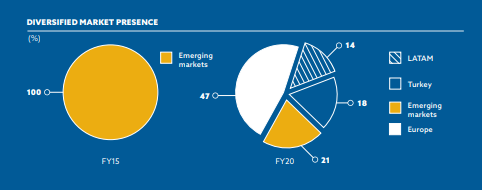

Increasing Geographical Footprints: In FY15, the company had its presence across few Emerging countries, and currently the company has its presence in more than 100+ counties. Europe (47% of the revenue) Turkey contributing 18% of the revenue, Emerging countries contributed 21% and the remaining from Latin America. The company also derives 68% of the revenue from the regulated market and the remaining from the less regulated markets.

Strategic Manufacturing Facilities: The company has three manufacturing facilities in India and Five overseas facilities. The Manufacturing units are strategically located and the company manufactures its APIs only in the Indian units to have a sustainable cost advantage for its products. The company's overseas facilities are situated in countries that contribute high revenue for the company.

Business segment: Sequent Scientific offers API, branded generic formulations, and analytical services.

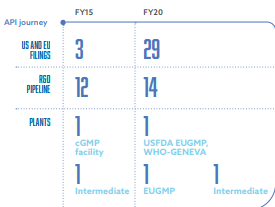

API (17% of the revenues)– Sequent has a total of 29 EU + US filings and has 14 products under pipeline. The Vizag plant which manufacturing API’s is undergoing a huge capacity expansion, wherein the production capacity will be increased to 350 KL from 225 KL.

In FY15, the API business contributed around 65% of the revenue but as the segment is a low margin business, the company has significantly shifted to other high margin segments and the API business contributes only 17% of the revenue in FY20.

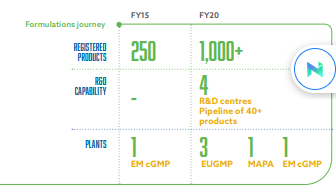

Formulation (52% of the revenue) – The formulations are sold under its 100% subsidiary Aliviria the company has 1000+ formulations and has more than 450+ products that are sold across 12 Dosage Forms and has 40+ products under pipeline.

Analytical services: Sequent has two USFDA approved state-of-the-art GLP compliant Analytical laboratories based in Mangalore and Bangalore and both its laboratories have got USFDA approval and it has comprehensive capability in instrumental analysis, wet laboratory testing & trace element analysis and the company is fast-tracking itself to deliver customized therapies to USA which is the world’s largest healthcare and FMCG market.

Revenue by Therapy:

Therapy – Revenue Contribution

Antibiotic and Non Injectables – 30 %

Antibiotic Injectables – 12 %

Anthelmintics - 12 %

Pain management - 10 %

Nutritional - 26 %

Others – 10 %

High focus on R&D: Sequent has 4 Global R&D centers and till FY20 they have made investments more than $ 100 Million on R&D. Due to its high Focus in R&D the company has more than 27+ commercial API’s and has filed 23 drug master files in the US and received 11 certificate of suitability approvals in EU. It has a pipeline of 35 formulation products with more than 10 pending filings in the US targeted over the next two to three years.

High Inorganic Growth: In the past 5 years the company has made eight acquisitions which cost around 4 Billion INR. As the company has a good track record of acquiring multiple companies, the management intends to add meaningful leverage to fuel further Inorganic growth.

The major concern to watch over:

Exposure to Regulatory Actions: The company remains exposed to regulatory risks, as it derives nearly 50% of its revenue from the regulated markets. Any adverse impact on its EBITDA generation due to regulatory actions can result in a sustained increase in the leverage and be negative for the ratings. However, the diversification of product approvals across manufacturing units mitigates this risk. Furthermore, all of SSL’s and AAHL’s manufacturing facilities are compliant with respective regulatory recommendations and guidance.

The stories behind the Numbers:

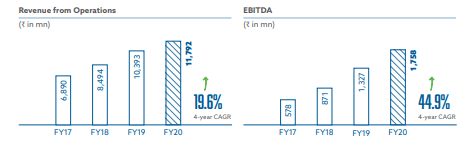

The performance of the company across the last four years is as impressive as it can get and in the FY20 the revenues stood 11,792 million, a growth of 16% on a YoY basis, and the company has grown its revenue at a CAGR of 19.6% over the past four years. The profitability margins also exhibited strong momentum with the EBITDA margin showing an increase of 210 bps. This has enabled the company to tackle its several headwinds, including currency volatility, extreme weather conditions as well as, the Brexit uncertainty in Europe and finally, the COVID-19 pandemic speaks a lot about the well-diversified business model and financial discipline that SeQuent has put in place. In FY20, revenues were driven primarily by API, which grew 21% while the Formulations business recovered from a slow start and grew 14% for the year.

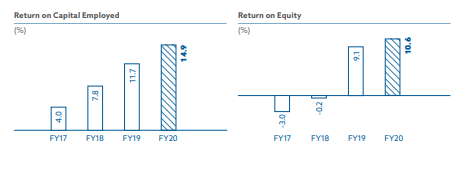

A healthy cash flow from Operations of 1,272 million not only demonstrates a high EBITDA to cash conversion, which has remained stable despite growth across segments. It also reflects that all of its Debt Servicing and some part of Capex is funded through internal accruals. the return on Capital Employed (ROCE) is now at 14.9% compared to 4.0% in FY17, a 3.7x jump in four years and shall continue to improve further as operational excellence plays out. The Return on Equity was negative for four years and now the company has played out very well and as of FY20, the ROE is at 10.6. The company has shown phenomenal growth across fronts.

Analysis of the last 12 Quarter performance of the company:

The growth is visible when we look at the numbers of 2018 and the FY21 Quarters but very recently the growth of the companies has become a little stagnant and that has become a major concern, the OPM in the Q4 quarter has been at its lowest level and which is also major criteria to look out for the future, whether is it a one poor Quarter or the company has run out of room for the growth expectations set by the company.

Sequent Scientific share price tanks 9% after the announcement of the FY21 Q4 results.

I will let you in a secret, the Price to earning Multiples of the company is 70x and the company is trading 9 times more than its Book value and the market was ready to sacrifice their margin of safety only when they expect the company to achieve higher growth and when companies with higher Price Multiples don’t grow at a pace that the market expects it grow, the share price falls as they are not ready to sacrifice their Margin of safety with the growth prospect of the company.

The Road Ahead – Maintain Buy on every dip

Sequent scientific has a well-established presence across various Geographies and its constantly launching several new products and it has got all the key ingredients of being a great company and I believe that the companies margins will pick up in the next quarter and stock is trading at a Higher Price Multiples and thus one should be cautious and the people who prioritize on value should wait for the 250 levels to start accumulating this stock and should try to buy on every possible major dip from that point and also should review the performance of the company across the quarters to ensure that the growth of the company is intact.

share your thoughts

Only registered users can comment. Please register to the website.