Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINVoltas was created 6 decades ago when Tata Sons joined hands with a swiss company Volkart Brothers. Voltas is also one of the most reputed engineering solution providers specializing in project management and now the Tata Group of companies are the promoters of the company and are holding a 30% stake in the company.

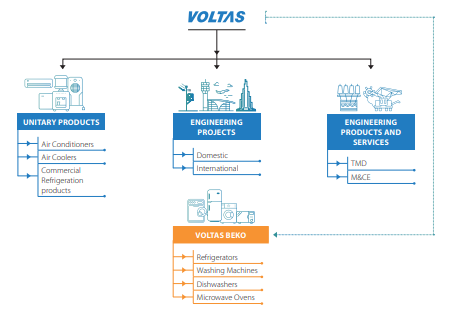

Voltas is engaged in the business of air conditioning, refrigeration, electro-mechanical projects as an EPC contractor both in domestic and international geographies (the Middle East and Singapore) and engineering product services for mining, water management, and treatment, construction equipment, and the textile industry.

Why I believe Voltas will capture the growth momentum in the Consumer durable segment in India:

Indian consumer durables market is broadly segregated into urban and rural markets and is attracting marketers from across the world. The sector comprises a huge middle class, a relatively large affluent class, and a small economically disadvantaged class. Global corporations view India as one of the key markets from where future growth is likely to emerge. The growth in India’s consumer market would be primarily driven by a favorable population composition and increasing disposable income.

The Moat Analysis of Voltas:

Diversified Product segments:

Unitary Cooling Products (36% of Revenue)

Unitary Cooling products comprise Air Conditioners, Air Coolers, and Commercial Refrigeration products and As of July 2021, Voltas is no. 2 in the Air Cooler Category with a market share of 10.8%.

Source: Annual Report

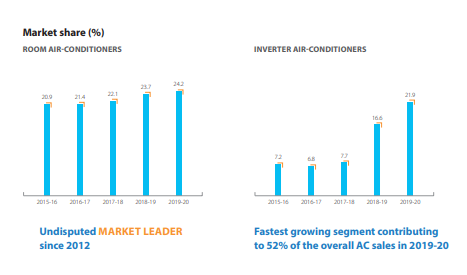

Voltas is No 1 with 26.8% market share as of August 2020 in Room Air Conditioner business, the company has 21.9% market share in Inverter Air Conditioners, selling close to 1.45 million room air conditioners with the Inverter AC volumes, contributing close to 52% of the overall AC sales. Voltas has consistently maintained its market leadership in the RAC market, despite rising competitive intensity. Over Jan-Feb’20, it emerged as the market leader in Inverter ACs as well

CWIP for the segment

The Company also invested in expanding its manufacturing facilities to increase indigenous production, and reduce the customs duty impact on its consumers. and a state-of-the-art R&D center was also opened, to be future-ready.

Engineering Projects (58% of Total Revenue)

Domestic - Voltas offers integrated end-to-end solutions in electromechanical projects. It extends Mechanical, Electrical, and Plumbing (MEP) services for metro stations, airports, malls, hotels, hospitals etc.

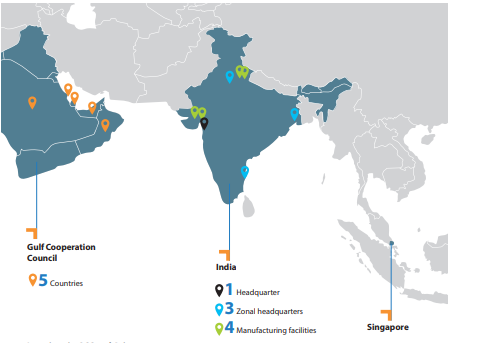

International Voltas International is recognized as a preferred MEP contractor for mid to large-size projects in various GCC countries such as UAE, Qatar, Oman, Bahrain, etc. The international project’s business has completed over 130 projects across 35+ countries.

CWIP for the segment

The HVAC product business enhances its manufacturing capacity with the launch of a state-of-the-art Commercial Products manufacturing facility in Waghodia, Gujarat.

The factory houses R&D and testing facilities that are critical to bringing in new and advanced technologies to the market.

Engineering Products (5% of Total Revenue)

Engineering Products comprises Textile Machinery and Mining & Construction Equipments.

Market Share

Spinning machinery: 55%

Reducing the dependency of Imports

The company aims to increase localization and reduce dependency on imports

Investment in moulds and balancing equipment to improve the throughput of the existing manufacturing unit in Pant Nagar, efforts to set up a South India based AC factory are being fast-tracked.

Manufacturing Facility

The company has 4 manufacturing facilities spread across India. In collaboration with Arçelik, the company commissioned a manufacturing facility in Gujarat, to boost production and capture a larger market share in the white goods segment. The capacity is Spread across 60 acres with an annual production capacity target of 2.5 million units by 2025.

Agile Distribution Network

There is an Expansion program going on in distribution channels and 180 EBOs, Company is also setting up exclusive outlets that will act as an ‘Experience Zone’, providing a hands-on feel for the complete range of Voltas and Voltbek products.

New Joint venture to enter into a new Product market:

Through its 50:50 Joint Venture with a Turkish company Arçelik, Voltas entered the home appliances industry under the brand, Voltas Beko in 2018. Currently, the company has a decent bouquet of well-priced SKUs across various categories:

50% in Washing Machines,

30 %in Frost Free refrigerators,

6 % in Dish Washers

6 % in Microwaves

New Product launches:

The challenges faced by the company:

The slowdown of the economy due to covid is tampering the growth of the company:

The ongoing pandemic and consequent lockdown have significantly impacted demand for consumer durables with the closure of retail outlets Additionally, there could be a delay in project execution given the lockdown and consequent slowdown in fresh orders as well as delay in collections, given that the fiscal situation of the Government could remain constrained in the current year

Subdued order inflow in international project business:

Over the past five to six years, the order booking by the international projects division has been slow on account of the absence of value-accretive projects in the target geographies. Voltas adopted a cautious approach to bid for a project in these geographies, given the past experiences of delays in claim settlement impacting its cash flows and profitability.

The financial snapshot of the company:

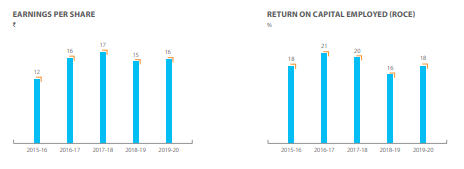

Voltas Revenue from operations stood at 7,800 Crores for the FY20, attaining s YoY sales growth of 7.5% and the Profit after Tax for the year was 521 Crores and the company has a steady operating Profit Margin pegged at 9% and the company has been to maintain the margin for most of the years. If we look at the company in a 10-year time frame, the companies Sales growth remain a concern as the 10 years Compounded Sales growth is only 4% and we are looking at the growth from 2010 to till date and those where the year where India has grown exponentially and the company was not able to increase its sales despite the huge growth in the Economy and as the growth of the economy in the short term is questionable and the growth of the company remains as a concern.

The Earnings per share have been at the levels of 16 Rs per share and as the company is unable to increase its sales, the EPS is also consolidating and the Return on capital employed has been reduced across the years which is also a concern to be noted. However, the 10-year stock price CAGR of the company is 20%, the sales have grown at 4% but the stock price has grown at 20% CAGR, due to which the Company is trading at higher Price Multiples of 65x and is trading 10 times more than the Book value of the company.

|

Debt to Equity |

0.05 |

|

Sales growth 3 years |

5.67 % |

|

Profit growth 3 years |

( 2.81)% |

|

Dividend Yield |

0.49% |

|

Reserves |

4960 Crs |

|

52 Week High/low |

1132 / 529 |

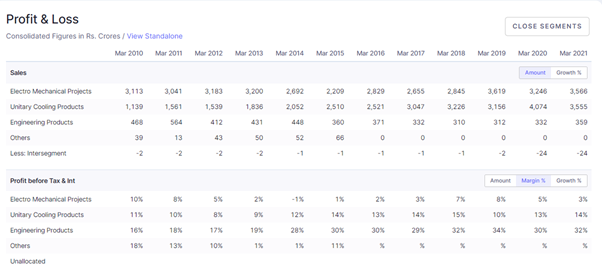

Segment Performance of Voltas Ltd:

The Electro-Mechanical projects contributed 70 % of the revenue during 2010. However, the Unitary cooling products have grown significantly and their contribution to the total revenue has witnessed a double-digit growth across the years. The engineer product segment has shown a muted performance across the years.

Source: Screener.in

The order book for the Electro-Mechanical projects stood at INR66.4b, of which the domestic/international order book stood at INR42b/INR24.3b. : With recent lockdowns, there has been some labor migration and problems with labor availability. The company has made arrangements at various project sites for labor housing. It is doing its best to execute projects, wherever possible to mitigate unnecessary cost escalations.

The Tough Road ahead for Voltas:

The ongoing lockdown in the peak summer season presents downside risk to air conditioner industry sales and as its products are not classified under the essential goods and due to the closure of its stores across several states tampers the growth of the company in the short term. However, the company will remain as the market leader as it has all the ingredients of a great brand and its new Joint venture will stimulate some growth in the slowing economy and the JV couldn’t have come at a better time for the company. Yes, the threatening third wave will also slow down its growth significantly and the company is trading a higher price to earnings multiples and one can wait for a good correction in the stock to get a better margin of safety for the Investment.

share your thoughts

Only registered users can comment. Please register to the website.