Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINAn overview of the Indian Banking Industry:

The Indian banking system consists of 12 public sector banks, 22 private sector banks, 46 foreign banks, 56 regional rural banks, 1485 urban cooperative banks and 96,000 rural cooperative banks in addition to cooperative credit institutions As of November 2020, the total number of ATMs in India increased to 209,282. Asset of public sector banks stood at Rs. 107.83 lakh crore (US$ 1.52 trillion) in FY20.During FY16-FY20, bank credit grew at a CAGR of 3.57%. As of FY20, total credit extended surged to US$ 1,698.97 billion. During FY16-FY20, deposits grew at a CAGR of 13.93% and reached US$ 1.93 trillion by FY20. According to the RBI, bank credit and deposits stood at Rs. 108 trillion (US$ 1.5 trillion) and Rs. 149.6 trillion (US$ 2.1 trillion), respectively, as of March 12, 2021.

As per the Reserve Bank of India (RBI), India’s banking sector is sufficiently capitalised and well-regulated. The financial and economic conditions in the country are far superior to any other country in the world. Credit, market and liquidity risk studies suggest that Indian banks are generally resilient and have withstood the global downturn well. Indian banking industry has recently witnessed the roll out of innovative banking models like payments and small finance banks. RBI’s new measures may go a long way in helping the restructuring of the domestic banking industry. The digital payments system in India has evolved the most among 25 countries with India’s Immediate Payment Service (IMPS) being the only system at level five in the Faster Payments Innovation Index (FPII)

How the Euphoria of Yes bank affected Indusind bank?

The story of Yes Bank nothing new to the Investing community and it was a bank which sacrificed its long term growth just to enhance their short term growth and when things turned ugly, everyone was afraid of the high growth of the Private Banks just like the Public sector Bank.

Our Indusind bank was one of the Victim of the Euphoria caused by the fall of Yes bank and soon people several articles came out depicting that ‘’Indusind Bank might be the next Yes Bank’’ and the Stock price tumbled from 2000 Levels to 300 levels and some of the fall can be attributed to the Covid fall but does the Fundamentals of the Indusind bank that bad or was it just the mood swings of the Investors that caused the fall.

LET’S TAKE A DIVE INTO THE FUNDAMENTALS OF THE COMPANY:

The First Private Bank in India:

Indusind bank was the first Private sector bank in India set up in Mumbai on April 1994. Indusind Bank Ltd India was started under the chairmanship of Srichand P Hinduja, the head of the Hinduja Group of Companies with the primary objective of serving the NRI community. They offer a wide cluster of products and services to individuals and corporates includes Branch banking, Consumer finance, Corporate banking and finance, commercial and transactional banking, CMS, TSU, Depository, and treasury operation, wealth management, Microfinance, Personal and commercial loan, Vehicle loan, Credit card, SME loans, etc.

A decade after its incorporation, in June 2004, the bank was merged with Ashok Leyland Finance, which is among the largest leasing finance and hires purchase companies in India and It has emerged as one of the fastest-growing banks in the banking sector in India.

Strong Branch network.

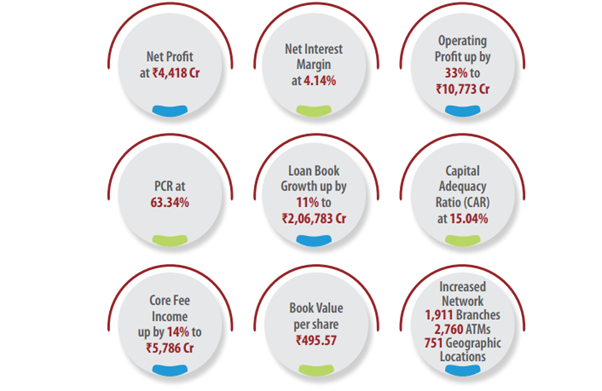

Indusind bank has a total network of 1,911 banking outlets and 2,760 ATMs, the Bank has a presence across all 28 States and 6 out of the 8 Union Territories. The Bank also has Representative Offices in London, Dubai and Abu Dhabi. The Bank has also refurbished/re-modelled 8 Branches, set up 5 Administrative offices, and relocated 13 branches and 1 Office towards better business prospects. A total of 637 new seats were added across India to cater to growth in Back-office/Controlling office requirements, distinct from branch network capacity additions. The Bank has 5 Currency Chest, one each in, Mumbai, Delhi, Chennai, Kolkata and Bengaluru. The Bank has set up 7 PIONEER branches in Mumbai, Delhi and Pune.

Diversified Loan Book: The loans distributed by any banks mainly go into two things – Corporates, which provide loans to corporate companies, and the second one is retail, which are loans distributed on retail by the banks. The bank has a diversified loan book with 57% of the loan books in the consumer finance division & the rest 43% in Corporate & commercial banking.

The contribution of its corporate and commercial banking has come down in the loan book from 59% in FY16 to 42% in the Current Financial year and this reduces the Exposure to huge default by the Commercials.

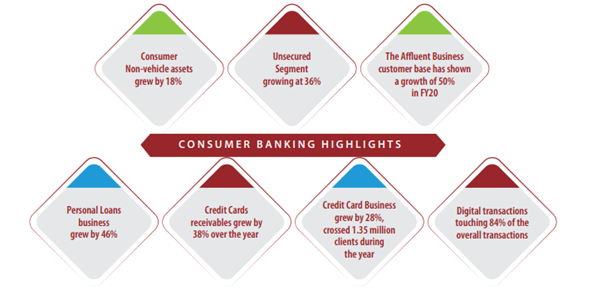

A highlight of the Consumer division Performance:

The abundance of Opportunities and New Area of focus:

The bank aims to implement key themes, such as focusing on digital banking; fortifying liabilities; scaling up domain expertise; investing in new growth engines and significantly improving its practices and policies. The key goals that the bank has adopted include increased share of funded exposure in lower tenor buckets, augmenting the share of retail and reducing the share of unsecured retail to less than 5% These are related challenges and the agency believes the bank will have to continue to mobilise increased proportion of low-cost deposits and retail deposits while reducing the cost of deposits. This could enable the bank to take higher exposure to secured assets and higher rated funded exposure, so that it maintains its margins on an overall basis. While the bank has business owner as a key customer profile, it also plans to roll out its millennial initiative that includes the introduction of a new all-in-one banking proposition for the new-age customer and build customer loyalty outside of the business owner as well. This opinion is a key challenge and would require substantial investment in brand building, digital banking interfaces and backend servicing engines.

The Business Performance of Indusind Bank:

What is the Quality of Indusind’s Loan Book?

A healthy Loan book is an important criteria to watch before investing in a Bank stock. A poor loan has made banks like Yes bank and Lakshmi Vilas bank to crumble to the ground, just waiting for someone to throw a lifeguard to keep them floating. So, is the Loan book of the Indusind bank healthy enough to sustain if there is a Covid Third wave?

The answer would be a YES!!!. The Gross Non-Performing Assets of the company stood at 2.67% and the Net Non - performing Assets stood at 0.69%, which is line with some of the top banks like HDFC, Axis and ICICI bank. So we have drawn a conclusion that the company has healthy financials and what about the valuation of the company

What is the Valuation of the bank compared to its peers like Axis bank, HDFC and ICICI bank?

|

Name of the Bank |

Price to Book value |

|

HDFC BANK |

3.97 |

|

ICICI BANK |

3.66 |

|

AXIS BANK |

2.77 |

|

INDUSIND BANK |

1.58 |

Price to Book value is one of the basic metric used to measure the valuations of the Banking stocks and it is calculated by Dividing the Price of the stock by its book value and just like our PE ratio, a lesser Price to Book value shows that the company is undervalued and when we compare the Price to Book value of Indusind bank with its Peers, the stock is clearly undervalued and has an opportunity.

Things to watch ahead before Investing

The biggest risk faced by all the banks in India is the surge of bad loans due to the increasing Covid cases due to which many businesses failed and were not able to repay their loan and so far the private banks have tackled this issue at a better and if there is any Third-wave waiting for us and if it manages to create half the impact as the Covid wave then we are in a trouble at least for the medium to short term basis. However, the bank has made many proactive measures and they are diversifying their loan book, which would enable them to tackle the uncertainties prevailing over the growth of the economy. Indusind Bank can be one of the good bet for the long term growth potential around the banking sector.

share your thoughts

Only registered users can comment. Please register to the website.