Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINIndia is the second-largest global producer of footwear after China, accounting for 13% of global footwear production of 16 billion pairs. India produces 2065 million pairs of different categories of footwear (leather footwear - 909 million pairs, leather shoe uppers - 100 million pairs, and non-leather footwear - 1056 million pairs). India exports about 115 million pairs. Thus, nearly 95% of its production goes to meet its own domestic demand. The major production centers in India are Chennai, Ranipet, Ambur in Tamil Nadu, Mumbai in Maharashtra, Kanpur in U.P., Jalandhar in Punjab, Agra, Delhi, Karnal, Ludhiana, Sonepat, Faridabad, Pune, Kolkata, Calicut and Ernakulam. About 1.10 million people are engaged in the footwear manufacturing industry.

The footwear industry in India is a huge market and with a lot of potentials and the greatest thing about the Industry is that though it’s the second-largest manufacturer of Footwear, 95% of the production is met by the local demand itself. Unlike any other Footwear is a necessity and the Industry has grown higher because they have changed the necessity into a fashion and has brought an enhancement of Personal style into the equation and Now people have Casual Footwear, Party Footwear and what Not!!!

Today we are going to see about the India’s Largest Footwer Manufacturer who has been Walking along with India since 1931 and why I believe that Bata will walk along with the Dreams of Millions of Indians.

World’s leading Footwear company: Bata Corporation was founded in the year 1894 in Czech Republic The company is the world's leading shoemaker by volume, and it has a retail presence of over 5,300 shops in more than 70 countries and production facilities in 18 countries. Bata Corporation forayed into India in the year 1931 and went public in the year 1973. Currently, the Bata corporation owns a 53% stake in the company.

Manufacturing Facilities: The company has four manufacturing units at Batanagar (Kolkata), Bataganj (Bihar), Peenya (near Bangalore), and Hosur (Tamil Nadu). The company has a manufacturing capacity to produce 21 Mn Footwears Per Annum and Bata India is the leading Footwear Manufacturer in India.

PAN India Presence: strong pan-India retail presence with 1,558 stores across cities, including franchisee stores and has a 3.23 Mn sq. ft. of retail 3.23 space across India and the company has sold 49.39 Mn Footwears in the FY- 20.

Multi Brand Portfolio: Bata sells footwear under several leading brands in India catering to the lower and upper segments of the demand pyramid.The Brand Includes, Bata, Power, Marie Claire, North star, Naturaiser, Scholl, Bata Comfit, Weinbreneer, Ambassador, Mocassino and Hush Puppies.

Focus on better Research & Development: In FY20, the company has spent 70.66 Mn on R&D. They have successfully launched new products with anti-microbial properties & “ortholite” for our “Power” shoes to increase comfort & fitting experience.

Technical Collaboration with GFS, Singapore: The company has entered into a 10-year agreement with Global Footwear Services Pte. Ltd., As per this agreement, Bata will receive guidance, training of personnel and services from GFS in connection with research & development, marketing, brand development, footwear technology, testing & quality control, etc,. for which the company will pay a fee of Rs. 322 .2 Million, which is close to 1% revenue of the company.

Retail Business (88% of the revenue) Bata’s focusses to expand its retail footprint with a greater emphasis towards tier 3 – 4 cities, During the FY20, the company has added 66 new retails stores and 59 Franchisee stores across India. The company has renovated its 49 stores and is aggressively continue the Revival of our Old Concept Stores into Red Concept to give our customers an aspirational experience.

Non-Retail Business (11.6% of the revenue) The non-retail business division comprises urban wholesale, industrial, and institutional business divisions and exports. Bata has added about 175 new towns in 2019 Bata won several Institutional & Distribution business orders in the current FY, to supply safety & industrial shoes to companies in the cement, steel, and railways sectors. In addition, it continued its expansion drive in smaller towns by appointing a new channel partner.

Expanding E-commerce Footprints: The company sold more than 1.8 million pairs of footwear through online channels and achieved a turnover of Rs. 1250 Million. Bata India now ships more than 95% of orders received from Bata.in through its stores. Sales through digitally-enabled platforms such as the Bata website and other online marketplaces contributed over 15% of total revenues.

Launch of Bata Club: Bata’s flagship loyalty program “Bata Club” currently has over 13 Million active members. Any customer who purchases a product from Bata can become a member and the company has taken several initiatives like Personalised campaigns and discounts and this has translated to an increased average monthly repeat rate and it has gone up by 5% percentage points and campaigns walk-ins rate has also doubled vs last year among the Bata Club Members.

Expansions and Cost Cutting Initiatives: The company continued to expand its retail network in tier 3-5 towns via franchisee route by opening 10 new franchisee stores, taking the total to 228 franchise stores, and appointing new distributors to serve multi-brand stores. The company continued to optimize its retail network and took appropriate measures to rationalize cost in terms of rentals, operations, and manufacturing to drive efficiencies in its value chain to mitigate the impact of the Covid.

The Threats faced by the company:

The adverse impact of COVID-19

BIL’s accruals have been substantially affected by the closure of stores and manufacturing facilities, while its fixed costs have to be serviced during this period (barring waiver given by the lessors for rentals). There also remains uncertainty concerning the extent of the impact on the revenues and cash flows in FY2022.

Increase in competition

BIL has been facing intense competition in all product categories as established players have been setting up new manufacturing facilities, besides increasing capacities in their existing plants. Further, multinational majors like Clarks, Zara, etc. have made inroads into the organized footwear market in India. Moreover, the sales of branded footwear through e-commerce platforms have increased competition as new brands can now enter the Indian market without having to create a large nationwide distribution network.

Volatility in raw material prices may put pressure on profitability

The margins of the company are affected by raw material price fluctuations. Any adverse movement in the prices of raw materials may negatively impact the company’s margins, considering its limited ability to pass on the price hike to customers owing to intense competition. Any major debt-funded capex shall also be a key monitorable going forward.

Beating the Expectations:

Bata India Share price surges to 14 - month High after the FY21Q4 results. The shares rose as much as 6.49%, the most since April 8, 2020, to trade at Rs 1,659 apiece.

Source: Screener.in

The company beat analyst estimates in the quarter ended March, mainly driven by a sharp decline in raw material cost, though its profit and revenue fell fell on a sequential basis. Consolidated net profit dropped 11.5% sequentially to Rs 29.4 crore, against the Bloomberg consensus forecast of Rs 26.8 crore. Its revenue from operations declined 4% to Rs 589.90 crore.

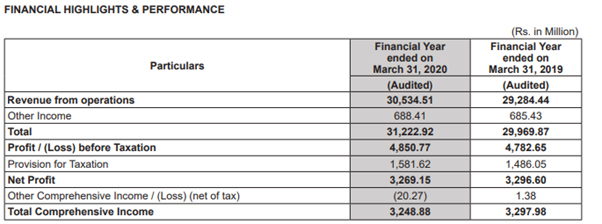

A financial snapshot of the company:

Source: Annual Report

During the financial year ended March 31, 2020, Bata has achieved a turnover of Rs. 30,534.51 Million as compared to the turnover of Rs. 29,284.44 Million recorded during the previous financial year ended March 31, 2019. Revenue from operations for the financial year ended March 31, 2020, has increased by 4% over the corresponding period last year. The Net Profit of the Company for the financial year ended March 31, 2020, stood at Rs. 3,269.15 Million as against the Net Profit of Rs. 3,296.60 Million for the financial year ended March 31, 2019. The Profit before Tax for the financial year ended March 31, 2020, reflects a growth of 1% over the corresponding Profit for the financial year ended March 31, 2019.

The company has done a pretty job when we take the Covid Induced lockdowns into account where the shops were totally shot for a couple of months and despite that the company managed a nominal growth in the Revenue. This was attributed to the companies approach towards the Online Markets, and the company ramped up its online marketplace presence. It has a robust e-commerce network that delivers to over 1,300 cities and towns across India. In addition, your Company also sells its products through partners like Amazon, Myntra, Tata Cliq and Ajio, amongst others. Your Company has also introduced purchases via WhatsApp chat with the neighborhood stores for its customers. The ability of the company to adapt itself to the changing environment has proved to be a success for the company.

Conclusion:

The hard times are nothing new for BATA organization as they have been in the times of second world war and they have seen many recessions across various countries during its existence and they have found a way connecting with its customers and come out of the hardship and getting better and better. The covid crisis is also one such hardship in the phase of the company and I believe even if the Covid third wave hits the economy, Bata India will manage to survive the hardship but its stock price may not be as immune as the company if ever the third wave ever arise and it should only be treated as a blessed opportunity in disguise.

share your thoughts

Only registered users can comment. Please register to the website.