Prozone Intu Properties Limited: Reliable Business Strategy and Digital Interventions Should Stem Growth

Summary

- Over past couple years, Prozone Intu Properties Limited amassed winning land bank in strategic emerging micro-markets.

- Focus on generating free cash flows should act as principal growth accelerator.

- Real estate sector growth should seek support principally from growth in corporate environment.

Overview of Prozone Intu Properties Limited

Prozone Intu Properties Limited was set up to create, develop and manage regional shopping centres and other mixed-use developments pan-India. The company has 17.79 million sq. ft. of fully paid-up land bank which is located in prime locations, with 1.2 million developed till date and 16.5 million+ sq. ft. being under development in different phases. In past decade, the company amassed winning land bank in emerging micro-markets. Progress has been seen in building high-quality portfolio focused on retail-led mixed-use assets. Business strategy of the company focuses on acquiring and developing land parcels in both high-growth emerging city corridors and mature Tier I cities, having an acute focus on mixed-use development. Goal of Prozone Intu Properties Limited is to capitalise on rising consumption of India. It plans to achieve this by building and operating multi-purpose leisure destinations.

Growth Enablers of Prozone Intu Properties Limited:

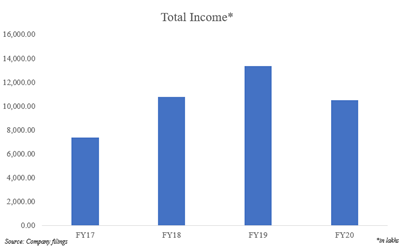

- Focused On Executing Existing Asset Pipeline: During FY20, first three quarters saw healthy performance across both its malls. Leasing at both centres was shaping up and there was growth in performance of brands. Until Feb 2020, response that was observed across the company’s malls was encouraging. Due to COVID-19, its performance saw significant impact. Full-year revenue in FY20 was INR1,052 million against INR1,338 million in prior fiscal. EBITDA was INR686 million against INR761 million which was recorded in FY19. EBITDA margin saw an improvement from 64.4% in FY19 to 80.6% in FY20. Cash profit for FY20 was INR292 million in comparison to INR405 million for FY19. For its retail assets, the company concentrated on enhancing mall destinations to provide better experiences. Emphasis was placed on ensuring right tenant mix so that correct category mix can support consumption for local consumer communities. Close watch was kept on managing capital base conservatively and in an effective manner. Plans are there to strengthen its balance sheet, with a focus on operating existing assets and exploring new growth opportunities. The company has seen ~143.05% growth in 3Q21 in total income to INR1,772.35 lakhs against 2Q21.

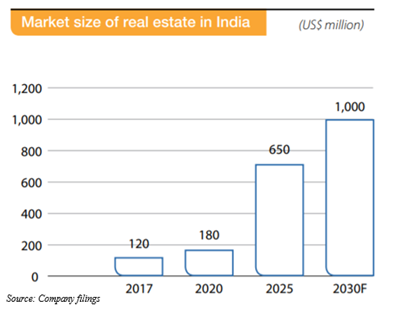

- Capitalising on Sectoral Opportunities: Retail real estate sector saw 170% annual rise, attracting USD1 billion of private equity investment in CY19. Increase in demand stemmed from foreign direct investment in multi-brand retail. Though huge investments are flowing in, organised retail is still in nascent phase in India. It has a long runway ahead of it. Residential segment contributes ~80% of real estate sector. Demand for residential properties stemmed from urbanisation and higher household income. Internationally, India is being categorised among top 10 price appreciating housing markets. In CY19, sales saw an increase of 6% year-on-year even though consumption expenditure was below expectations. Organised retail real estate players are handful and are largely developed by residential and office space developers. Country’s majorly millennial and young working-age population should drive demand. Malls are moving beyond a transaction place where people can buy and sell goods. Experiential setups and multifaceted products are aspects incorporated by malls. These aspects differentiate them and attract footfalls.

- Steps Likely to Stem Growth: As the company gradually recovers and operations get resumed, it expects business operations to ramp up because of evolving consumer behaviour, resetting of disturbed supply chain and inventory levels. Footfalls to its malls should see an improvement once there is normalcy and activities begin in its malls. With growing importance of digital tools, the company initiated several strategic digital interventions. This makes customers lives more convenient. Particularly, it has introduced a mobile app to offer consumers appointment-based safe access to shopping in stores in its malls. The company continues to work on its customer relationship management platform to strengthen its relationships with occupiers and visitors alike. The company works to emerge as destination of choice for population within its target markets. The company continues to capitalize on its balance sheet, which should enable growth. Apart from this, consumption story of India should supplement its growth accelerators.

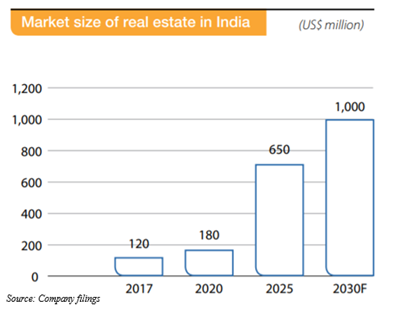

- Industry Overview: Growth of real estate sector is supported by growth in corporate environment and demand for office space. In India, real estate sector is tagged as second-highest employment generator, while first spot is given to agriculture sector. Real estate sector should bring in more non-resident Indian investment, both in short term and long term. Retail, hospitality, and commercial real estate have seen strong growth, providing much-needed infrastructure for this country’s growing needs. Housing launches were 86,139 units across top 8 Indian cities in 2H20. Home sales volume across 8 major cities in India saw a jump of 2x to 61,593 units from Oct 2020-Dec 2020 in comparison to 33,403 units in previous quarter, exhibiting healthy recovery post strict lockdown. According to data by Department for Promotion of Industry and Internal Trade Policy, construction has been categorised as third largest sector in terms of inflow of foreign direct investment, with this sector seeing USD42.97 billion of investment between Apr 2000-Sept 2020. Blackstone is one of largest private market investors in India as it managed ~INR3,694 crores of market value in real estate sector. This asset manager expects to invest INR1,625 crores+ in next 10 years. Several initiatives from government should also lend some support to real estate sector. Under recent union budget, tax deduction of upto INR1.5 lakhs on interest on housing loan and tax holiday for affordable housing projects are now extended until end of FY21-22. To revive ~1,600 stalled housing projects across top cities in India, union cabinet approved setting up of INR25,000 crore alternative investment fund. SEBI gave approval for real estate investment trust platform, allowing all kind of investors to invest in Indian real estate market. This should create an opportunity worth INR1.25 trillion in Indian market in coming years. Expected growth in number of housing units in urban areas should be able to increase demand for commercial and retail office space. Current shortage of housing in urban areas is pegged at ~10 million units. Additional 25 million units of affordable housing are required to meet growth in India’s urban population. Growing flow of foreign direct investment in real estate sector promotes increased transparency. Developers revamped their accounting and management systems to meet standards of due diligence. Indian real estate should attract significant amount of foreign direct investment over next two years, with capital infusion of USD8 billion by FY22.

Conclusion

Renowned investors hold their stakes in Prozone Intu Properties Limited and one of them is Mr. Rakesh Jhunjhunwala. Promoters of the company hold ~30.07%, with Intu holding ~32.4%. As on Dec 31, 2020, balance is being held by public. At the company level, Prozone secured investment from Intu Properties. It is categorised as one of UK’s largest retail real estate company. Mr. Rakesh Jhunjhunwala is known for picking value stocks and has built his name in Indian investing community. He holds ~2.06% in this real estate company.

Prozone Intu Properties Limited’s business strategy is strong and is relied upon by several investors. This company develops large scale land parcels for mixed use development, with ~75% of land being used for development as residential & commercial. In this, principal focus is on building and selling. Remaining 25% of land gets used as retail. In this, focus is on building and then leasing. It follows this model so that cash flows from building & selling portfolio are able to facilitate building and leasing model. This results into debt-free annuity assets and free cash flows for future developments. Locations are selected by the company in high growth corridors within limits of city. Later, it develops and sells mixed-use assets so that retail investments can be seen. Strategy for residential projects is that the company invests and develops entire clubhouse and site infrastructure for project upfront, before project launch. Better cash flows can be seen because this strategy accelerates project sale.

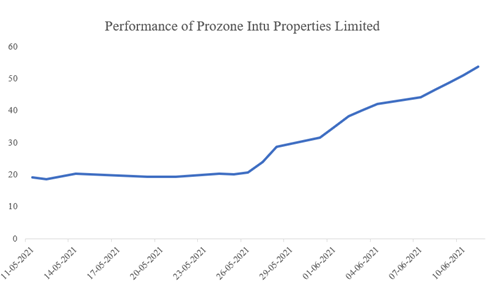

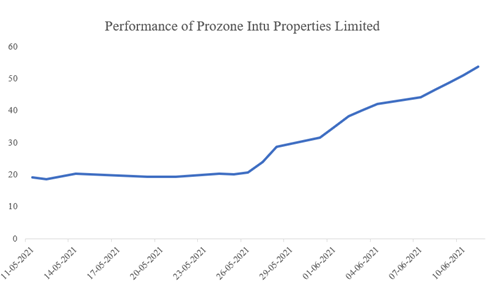

This stock has delivered strong returns in one month. Between May 11, 2021-Jun 11, 2021, this stock has seen a run up of ~180.42%. This means that an investor who would have invested INR1,00,000 on May 11, 2021, that investor would have seen capital grow to INR2,80,417.76. In comparison, Sensex has delivered only ~6.7% return between May 11, 2021-Jun 11, 2021. The company’s plans are to participate and dominate retail space in Tier 2 and 3 cities in which strong urbanization is expected. This should result in growth of consuming middle class from 300 to 500 million in next 5 years.

Exclusivity:

This article is exclusive to investoguru.

Stock Disclosures:

The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Author Disclosures:

This Article represents the Author's own personal views. The Author did not receive any compensation and do not have any business relationship with any of the companies mentioned in the Article.

share your thoughts

Only registered users can comment. Please register to the website.