Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINIndia being the second most populated country in the world, there is no doubt that India is a big market filled with a lot of consumers and India is totally a different country when it comes to spending, Though we have improved and progressed a lot, still in some parts of India spending is seen as evil and In some part of the village, people will frame you as evil if you spend more money than the what the society prompts you to but the things are changing and the change is happening rapidly. Most Indians are now comfortable having a Coffee in Starbucks and have Popcorn in PVR, though the price is 100x than what it costs.

The Increasing consumption pattern is helping the Fast Moving Consumer Products (FMCG) While fast-moving consumer goods have a low share in GDP, FMCG products make up the largest volume of traded goods. The Country’s FMCG market consisted of food and beverages, household and personal care, and healthcare. Although rural and Urban areas shared the markets equally, the former drives the market in terms of growth rate.

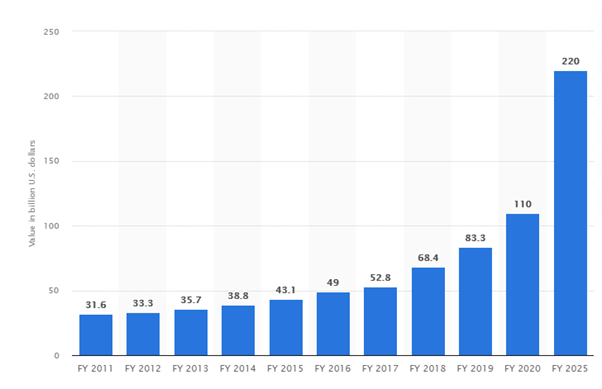

The market size of fast-moving consumer goods in India from the financial year 2011 to 2018, with estimates until 2025

India's FMCG market was valued at 110 billion U.S. dollars in 2020. Compared to 2012, the market size of fast-moving consumer goods had tripled. By 2025, the market was expected to grow to 220 billion dollars. The growth of India is visible though the Covid might have delayed the progress, but the growth of India is inevitable and the FMCG sector will have a good share of profits in the growth process of the nation and today we are going to see one company which is poised to harness the growth of the sector and has a business model which is scalable in the long run.

The Brawn Behind our Brands:

Hindustan foods is a principal contract manufacturer for a range of leading FMCG products including processed foods, personal care, home care, and leatherwear. The company along with the associated group companies is one of the most diversified contract manufacturers in the country and works with various FMCG majors. The company strives to become India’s largest FMCG contract manufacturer diversified across product categories & geographies.

The second life of Hindustan Foods:

Incorporated in 1984, Hindustan Foods Ltd (HFL) started manufacturing in the year 1988 with the launch of Joint Venture between the Dempo Group and Glaxo (now GlaxoSmithKline) India with the objective of manufacturing nutritional food product (Farex). But as the sales of the brand Farex declined, the company went into losses and continued the losses for many years. Between 1988 and 2013, Hindustan Foods Limited was dependent on one factory and a single baby food brand(Farex) with very limited product SKU’s

In order to leverage the manufacturing capacity, in 2013, Dempo Foods Pvt. Ltd., the Holding Company of Hindustan Foods Ltd got acquired by Vanity Case India Pvt. Ltd. and the latter bought 74.45% of the paid-up share capital. We can say that the history of the company should start to be from 2013 as there was a complete change in management and business model. In order to turn around the loss-making operations of HFL, the new management first increased the capacity utilization of the plant by diversifying the customer base, adding new products from existing clients. And later they started acquiring & adding more capacities to fuel the growth as well as maintain the first mover's advantage in India.

Why do I believe that the contract Manufacturing Business is for a Big Bull run?

Diversified contract manufacturer: HFL is not only a contract manufacturer to the FMCG segment but they are also in the contract manufacturing of leather products, detergents, pest control products, beverages, etc. which makes them the most diversified contract manufacturing company in India.

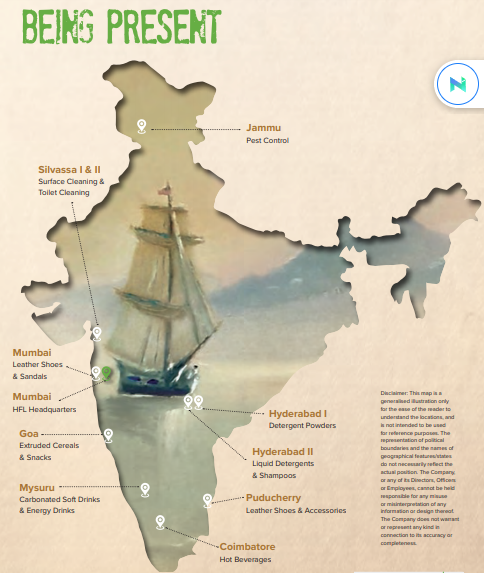

Manufacturing facilities: The company has 9 manufacturing facilities spread across India and each plant having its own specialization across the different segments. Goa (extruded foods); Coimbatore (tea); Puducherry (leather); Jammu (pest products); Mumbai (leather); Hyderabad (home & personal care); Silvassa (home care) and Mysuru (beverages- associate company plant).

Business model: HFL has three manufacturing business models – Dedicated, shared, and Private label manufacturing.

Dedicated Manufacturing: In this model, the company dedicates one entire plant exclusively to the principal company and this model contributes 85 % of the revenue of the company.

Source: Annual Report

Shared Manufacturing: The manufacturing facility is shared by various companies for a longer period of the agreement. The Goa unit of the company manufacture under this model various extruded food products for various companies such as Pepsico, Danone & Marico.

Source: Annual Report

Private Label Manufacturing: HFL owns the product formula made for Private Labels and ensures that Customers are provided with complete turnkey private labelling solutions. Under this model, the company can even choose the raw material of its own to manufacture the product, and hence, this model is the most profitable business model.

Source: Annual Report

Strong clientele base: HFL enjoys a wide range of both domestic and international marquee clients like HUL, Bata India, PepsiCo, Wipro, Godrej Consumer, Hushpuppies, US polo, and many more.

Own Brands: the company also has its own private label brands from some of its plants, its brand includes Bonny Mix- Porridge brand, Cnergy- Cereal Brand, Unorthodox- Shoe brand. The company is planning to launch its own products across various segments to harness its manufacturing expertise

Expansions: HFL has started building a Personal / Homecare plant in Mysuru and this plant will be a share manufacturing facility and the company has also started a greenfield project in UP, where the company has also acquired the land and the project has commenced, the production will be expected to begin from the Q4FY22.

The factors to consider before investing in the company

High operational risks: Failure to adhere to the quality standards and/or delivery schedule specified by clients could lead to a breach of contractual obligations, putting HFL at risk by damaging its reputation and exposing the company to legal consequences. The company’s inability to complete greenfield facilities under the dedicated unit model within specified timelines could attract penalties from its clients. Timely contract renewals are crucial, as HFL is heavily reliant on the dedicated-unit model with dedicated facilities for a specific client.

High Valuations: The growth of the company is forged with the growth of the nation and both are inevitable but the question remains that whether the Valuations justify the growth of the company and Currently, the company is trading at a Price multiple of 116x which doesn’t offer any Margin of safety for the investment and with the markets trading at higher levels, one can wait for a healthy correction to invest in the company and to ride the growth of the company.

Financial Performance of the company:

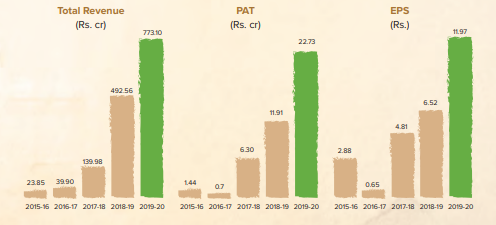

Source: Annual Report

The company shown great growth within a short gestation and the company has grown at CAGR of 125% for the past five years and the CAGR Profit growth of 90% in the past five years and this growth has been phenomenal and the quick growth can be attributed to both Inorganic and Organic growth and the Promoters long term relationship with the major FMCG giants has helped the company to scale its business at a faster pace. The emphasis on self-reliance and localization of sourcing should further help in generating new opportunities for the Company. In addition, any shift of the global supply chain away from China and towards India should also create further opportunities.

Balance sheet Analysis:

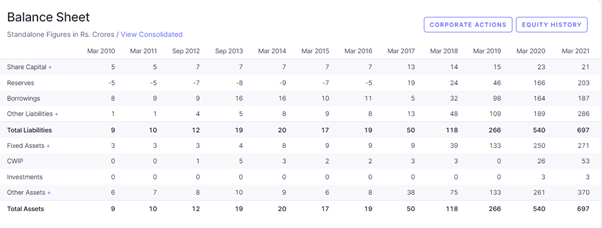

Source - Screener.in

The company had a frequent Equity infusion from time to time and the company has limited reserves of 200 Cr as they have invested their profits in the Expansion and the companies Debt is around 190Cr which translates to a Debt to Equity of 0.8% which is manageable by the company. The Debts may further rise if the company plans to expand its Manufacturing units as it has fewer Reserves at the moment. The Capital Work in progress is at a high of 53 Crs and once they become operational, they might generate decent revenue for the company and the Company has a solid Balance sheet as the Balance sheet size has been increasing across the years.

The Road Ahead for the Contract Manufacturer:

The company has leveraged its competitive edge and laid the foundation that has helped them to turn its vision into reality. By leveraging on their competencies, they had profitable growth while being consistent with their services. Their business solves a real-time problem of the major MNC’s as it becomes hard for those companies to set huge manufacturing units and to manage them on daily basis and instead outsourcing the Manufacturing part helps them to focus on their other activities and this ability to solve problems of major MNC’s will drive the growth of the company.

share your thoughts

Only registered users can comment. Please register to the website.