Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINWhat is Indian Energy Exchange and what's so special about it?

IEX is the first and largest energy exchange in India providing a nationwide, automated trading platform for the physical delivery of electricity. The exchange platform enables efficient price discovery and increases the accessibility and transparency of the power market in India while also enhancing the speed and efficiency of trade execution.

What does Indian Energy Exchange do?

The product segments of the company:

Day Ahead Market (DAM) – IEX allows its participants to transact electricity on 15-minutes block basis, a day prior to the delivery of electricity. The buyers and sellers submit their bids electronically and IEX matches the bids on a double-sided auction mechanism with a uniform market clearing price.

Term Ahead Market (TAM) range for buying/selling electricity for a duration of up to 11 days. It enables participants to purchase electricity for the same day through intra-day contracts, for the next day through day-ahead contingency, on daily basis for rolling seven days through daily contracts,

Renewable Energy Certificate (Rec) - Rec market facilitates transactions in environmental attributes. The Renewable Energy (RE) generator can opt to get RECs against green attributes of their generation. These generators can sell RECs through the exchange.

Energy Saving certificates (EsCerts) ESCerts are the tradable certificates under the Perform, Achieve, Trade (PAT) Scheme of Bureau of Energy Efficiency (BEE), a market-based mechanism to incentivize energy efficiency in large energy-intensive industries.

Market participants in the Power Exchange:

IEX has 6600 registered participants from 29 States, 5 Union Territories (UTs). Over 4,800 registered participants were eligible to trade electricity contracts and over 4,400 registered participants were eligible to trade RECs, as of Feb 2020. Out of participants registered to trade electricity contracts include 56 distribution companies, over 500 electricity generators and over 4,200 open access consumers.

The Moat Analysis of IEX:

Monopoly status: There are two energy exchanges in India, IEX and PXIL are the two exchanges where electricity is traded and IEX enjoys a market share of more than 95% and this statistics translates that the company controls the whole market. There are two energy exchanges in India -- IEX and PXIL -- where electricity is traded and IEX clearly dominates its competitor and enjoys a high market share in the segment.

Clearly,IEX is an undisputedly India’s largest and No. 1 Energy Exchange.

Key statistics: The daily average traded volume is 134 Million units in FY20 and a total of 53.8 billion Units of electricity traded in the FY20. More than 4200+ commercial and industrial consumers across India representing varied industry sectors such as textiles, metals, chemicals, automobiles, home products, food, cement, institutions, commercial consumers, etc, leverage the day-ahead market on Exchange platform to buy low priced power and the company witnessed a 30% YoY in the procurement of power the commercial sector.

Launch of Indian Gas Exchange – IEX launched the first gas exchange in India on June 20 and this will be India’s first automated national-level trading platform for physical delivery of natural gas. It is also working on modalities related to the potential formation of a coal exchange and the potential diversification will reduce the dependency on a single segment.

Growth strategy employed by the company:

IEX is steadily investing in technology and deepening the power market through new products such as Real-Time Market (RTM) IEX is expected to launch some new products like Long-Duration Contracts, Cross Border Trade, Green TAM and DAM, Exchange-based ancillary market.

Industry Outlook:

India is ranked as the third-largest power consumer in the world and has the world’s largest transmission system. The per capita electricity consumption is expected to go up from 1,181 units currently to 1,616 units over the next 5 years. To support this growth, an investment of Rs 11.75 lac crores has been envisaged by the government as a subset of Rs 100 lac crore vision for investment in infrastructure by 2025. The share of exchange markets in the overall power market in the developed countries is around 50%. Whereas in India the share is around 5% and this can change the fortune of the company when the trend changes and IEX has a greater technological advantage and has the first-mover advantage.

The threats faced by the company:

The major threat faced by the company is the Regulatory issues, The Power sector is regulated by the Central Electricity Regulatory Commission (CERC) and the Ministry of Power and they are clearly not happy with the Monopoly enjoyed by the IEX and they wanted to put an end to the domination by passing a bill in the parliament. On Jul 20, the CREC came out with a draft regulation that suggested a need for change in the power market in India. In the draft, they proposed the implementation of the Market coupling authority. The implementation of the market coupling will enable the buyer/seller to match their order both the exchanges and this would challenge the IEX’s domination in the segment.

What is Market coupling and how will it affect the business of the company?

One should clearly understand this concept before investing in the company and before moving on to understand what is Market coupling, Let's understand the role of IEX

IEX serves two functions

1) Order matching and price discovery

2)Clearing and Settlement

The reason why IEX enjoys a monopoly is that this “order matching” and “price discovery” happens at the exchange level. This means that both the buyer and the seller have to be on the same platform (either on IEX or PXIL) for their orders to be matched and get executed. Electricity buyers know that all the electricity sellers are on IEX and not on PXIL. Even if the buyers are willing to pay a very high price for electricity, they cannot buy it on PXIL because there are no sellers and it’s the same case for electricity sellers. The sellers know that all the buyers are trying to buy electricity on IEX. If the sellers want to sell on PXIL, they won’t be able to sell the full quantum even if they sell the electricity dirt cheap. It is a chicken and egg problem and IEX is a clear winner.

Now, this function of “order matching” and “price discovery” will shift to the proposed “Market Coupling Authority”. This simply means that a buyer on PXIL will be able to buy electricity from a seller on IEX. He does not have to bother if there are sellers on PXIL or not. As long as he is willing to pay the price, he is assured of the transaction getting executed and his demand getting fulfilled.

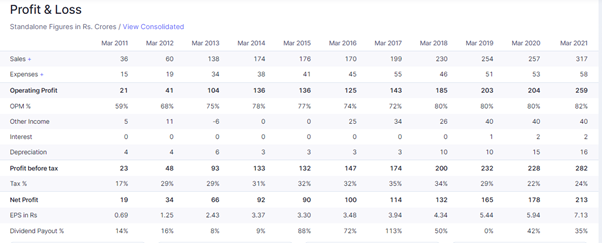

Financial performance of the company:

Source - Screener.in

IEX has a phenomenal growth story to tell us and they have had a smooth journey as they have the whole Energy exchange of India in their control. IEX is not only a market but they are the market themselves and they also have high OPM of around 80% and they are huge money making company and where do they put the money when their dividend is as low as 0.69%. They do what an ideal growth company does, they invest in their growth, and the company as on Mar21 and their investments stood at 710 Cr and they also have a healthy reserve of 502 Cr as of Mar21. The company has a negligible debt of 12 Cr. The EPS has been steadily growing YoY basis which is also a good sign for the company.

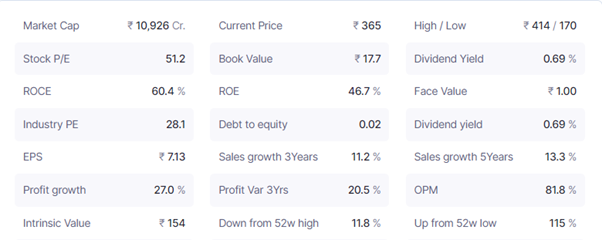

Ratio Analysis:

Source: Screener.in

IEX has a set number to boast about, The current market cap of the company is around 11,000 Crores and the Return on Capital employed stood at a whopping 60% and the Debt to Equity ratio of the company is only 0.02 %, which is another positive factor added to the feather of the company. They have a decent Sales growth of 11% over the past three years and a sales growth of 13% over the past 5 years and in this case, we can maintain a neutral stance but the Profit has grown 27% when the sales growth was just 13% and this tells us the operational efficiency of the company and the Operating profit of the company is at 82% which deserves the highest ever positive point which we could offer but then there is always a catch and the catch here is the Price to Earnings Multiple of the company which is at 51x and yes, a monopoly-like IEX deserves to enjoy a higher PE multiple but if you are looking for a margin of safety at the higher levels, then it’s a concern but one can consider the stock below 350 levels and the stock is currently trading 11% lower to its Lifetime high.

Conclusion:

One would love the company as soon as they understand the monopolistic nature and its ability to upscale itself but don’t hurry yet, one has to clearly understand how serious are the regulators in implementing the Market coupling Authority and its impact thereupon and yes, the markets will not take the news in a good manner if its implemented but the management believes and emphasizes that it’s not going to happen anytime soon and even if its implemented the company has the technical edge over its competitor even if the Market coupling is implemented and the company is right, they have progressed very well and they are investing their profits into their growth and it’s bet on the growth will be paid of in the days to come.

share your thoughts

Only registered users can comment. Please register to the website.