Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINThe First feather of the Tata groupTata Iron and Steel Company (TISCO) was founded by Jamsetji Tata and established by Dorabji Tata on 26 August 1907. TISCO started pig iron production in 1911 and began producing steel in 1912 as a branch of Jamsetji's Tata group The first steel ingot was manufactured on 16 February 1912. During the First World War (1914-1918), the company made rapid progress. By 1939, it operated the largest steel plant in the British Empire. The company launched a major modernization and expansion program in 1951. Later, in 1958, the program was upgraded to 2 million metric tonnes per annum (MTPA) project. By 1970, the company employed around 40,000 people at Jamshedpur, and a further 20,000 in the neighbouring coal mines. In 1971 and 1979, there were unsuccessful attempts to nationalise the company. In 1990, the company began to expand, and established its subsidiary, Tata Inc., in New York. The company changed its name from TISCO to Tata Steel Ltd. in 2005.

Source: Annual Report

Now, Tata Steel Ltd has its presence across 5 continents and employs more than 65,000 people, the company has presence across the entire value chain of steel manufacturing from mining and processing iron ore and coal to producing and distributing finished products. The company has a target to increase domestic steelmaking capacity to 30 MnTPA by 2025.

The Moat Analysis of Tata steel:

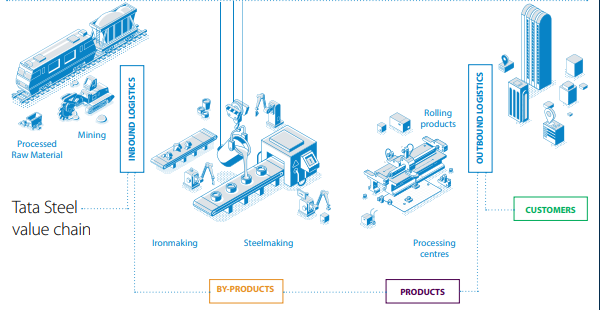

Presence Across entire value chain:

Source: Annual Report

Tata steel’s business model involves converting raw materials such as iron ore and coal into customized steel products for its customers. The Company is focusing to cater to customers in the automotive, construction, industrial, and railway sectors. It is one of the few companies that has its operations fully integrated from mining to manufacturing and marketing of finished products. TSL has always focused on ensuring a steady supply of coal and iron ore for producing steel. This gives an competitive edge for the company as it cost advantage over its competitors and it also ensures that there is no issue in the supply of raw material required for its operation.

High Brand recalling and diversified Product Portfolio:

The company offers a broad range of steel products including a portfolio of high value added downstream products such as hot rolled, cold rolled, coated steel, rebars, wire rods, tubes, wires, etc.

In India, every 4th stainless steel utensil is made from Tata Steel chrome ore and 50% of LPG cylinders are made from Tata Steel HR (Hot-rolled) coil. Its products include flat products, including HR, Cold-rolled (CR), Construction products, Agricultural implements, and Auto assembly components.

Share of Revenue from Value Added Products

Over 50% of the company's sales are in the value-added product categories which helps it fetch higher realisations and support its profitability.

The major competitive edge of the company:

Increasing Global Footprint

The company has a wide international footprint. It has operations spread across 26countries and commercial presence in 50 countries. Presently, India accounts for ~51% of revenues, followed by Europe excl. UK (26%), UK (9%), Asia excl. India (7%) and other regions (7%).

Captive Sourcing of Raw Material

The company owns leases to various captive mines that meets 100% and 30% requirement of company's ion ore and coking coal needs respectively.

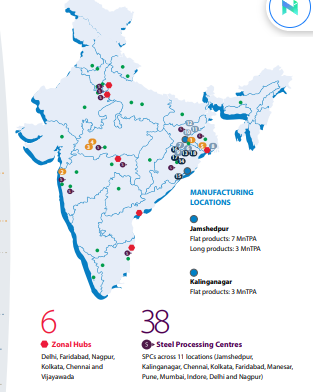

Many competitors does not have the same captive sources that gives the company an edge over its peers. Its captive iron ore mines are collieries are located near its manufacturing facilities in Jamshedpur and Kalinganagar.

Manufacturing Capabilities

Presently, the company has a total crude steel capacity of ~33 MnTPA :

India :-

1) Jamshedpur - 12 MnTPA

2) Kalinganagar - 3 MnTPA

3) Tata Steel BSL - 5.6 MnTPA

Source – Annual Report:

The capacity at Jamshedpur includes 1 MnTPA alloy-based manufacturing capacity in long products at Jamshedpur which was acquired by Tata Steel Long Products Ltd (subsidiary) from Usha Martin Ltd.

Material Acquisitions made by the company:

Reorganization of the Indian business:

The company is reorganising its India business into four clusters with a view to simplify its corporate structure. It transferred half of stake of 2 of its subsidiaries to Tata Steel Downstream Products Ltd which is another wholly owned subsidiary of the company.

The Issues faced by the company:

Unstable International Operations

The company has been reporting low and volatile profitability from the European and South-East Asian operations. It is also under negotiations to sale its south-east asian steel business, the business is classified as discontinued operations. The company was in talks with thyssenkrupp AG to form a JV to combine their steel business in Europe. However, the European Commission evaluated the arrangement and then prohibited the proposed JV.

High debt:

The total debt level was at its peak after the acquisition of Bhushan Steel (Tata Steel BSL). The Company’s consolidated gross debt increased significantly and the Debt to Equity stood at 1.20% and the total Debt of the company as on Mar 21 was around 88,000 Cr. Tata steel reduced its gross debt by about INR270 billion at the consolidated level and they have been taking various initiatives to reduce costs and initiated measures to reduce debt by tightening up cash flows through working capital releases and reduction in Capex as much as possible.

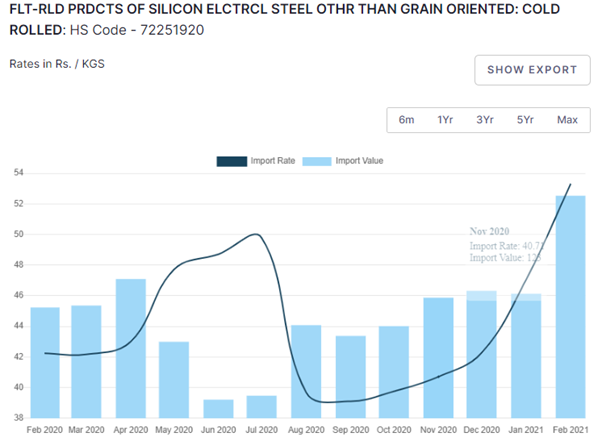

Victim of the commodity cycle:

All metal companies profitability is highly dependent the price of the commodity and the prices of their raw material thus, their profits are volatile just like the volatile movements in the commodity price. This makes the companies profitability to inadvertently to decline when there is a disruption in the commodity cycles. Currently, the commodity cycle is in the favour of the steel manufacturers and due to which the Metal Index has outperformed all the other Indices and Tata steel price also hit a new life of 1260 /- per share. But then when the cycle turns its tide against the Industry, they would fall and thus there is no such thing as long term investing when its comes to the cyclical stocks like Tata steel whose profitability is pegged on the price of the commodities, instead one has to invest based on trend of the commodity cycle.

Quarterly result analysis:

Tata steel has been performing well despite the economic issues prevailing all around the world and the Operating profit margin of the Q4FY21 has been more than amazing a margin of 28% is something phenomenal and though it would be hard to maintain the margins at a higher levels would be hard in the future but if the company is able to maintains margin above 20% and if the sales are expected to sustain at the higher levels as the economy is getting back on its track after the Covid second wave and in this case we are speaking about a operating of around 15,000 crores in the upcoming financial year.

Conclusion:

The cyclical stocks perform based on the price of the commodity and the current cycle is in the favor the steel and other metal-related companies and thus the stock return have been magnificent and we can’t predict when the bull run for the commodities are going to cool down but the next phase of the down run is inevitable. Thus, when it comes to cyclical stocks there is no such thing as long term investing instead it’s prudent to invest in the stocks based on the cycle i.e. to buy at the bottom of the cycle and hold them till the next bull run but it is also important to select companies which has the capacity to battle the hard times and avoid companies with high debts and decreasing sales and if you wonder what will be your next pick when during the Bull run in the commodity space and Tata steel can be in the top of your list.

share your thoughts

Only registered users can comment. Please register to the website.