Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINBajaj Auto, the flagship company of Bajaj Group, is a two-wheeler and three-wheeler manufacturing company that exports to 70+ countries across several countries in Latin America, Southeast Asia, and many more and is headquartered in Pune, India. Bajaj Auto was incorporated in 1945 as Bachraj Trading Corporation Ltd to import scooters and motorized three-wheelers from Piaggio & Company. The entity's name was changed to Bajaj Auto Pvt Ltd in June 1960, and then to its current one in August 1960, after it was reconstituted as a public limited company. Currently, Bajaj Auto has a dominant market share in the three-wheeler segment and a strong position in the motorcycle segment.

As per a scheme of demerger, Bajaj Auto formed two companies in fiscal 2008, Bajaj Holdings and Investment Ltd (BHIL) and Bajaj Finserv Ltd (Bajaj Finserv). The two- and three-wheeler manufacturing business carried out by Bajaj Auto was transferred to BHIL, while the wind energy, insurance, and consumer finance businesses were transferred to Bajaj Finserv. After completion of the demerger formalities (Bombay High Court approved the demerger on December 18, 2007), BHIL was renamed Bajaj Auto (new), while Bajaj Auto (old) was renamed BHIL.

Reasons to Invest in Bajaj Auto :

Brand Reputation

It is the world's third-largest manufacturer of motorcycles and the largest manufacturer of 3-wheelers globally.

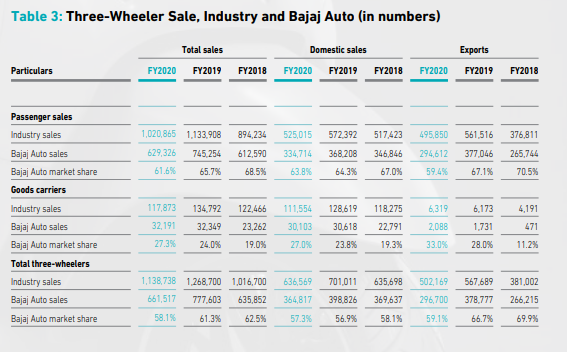

Source: Annual Report

Bajaj Auto continues to dominate the petrol and alternate fuel market — with sales of 240,467 vehicles in FY2020 and a domestic market share of 88%. In the overall diesel category, Bajaj Auto achieved leadership with a market share of 40%. In the small diesel category, our market share now stands at 89% — up by 9 percentage points. And in the larger diesel segment, our market share has grown from 26% to 29%. Last year, our quadricycle, Qute, was successfully launched in four states: Kerala, Gujarat, Odisha and Rajasthan. In FY2020, we sold 942 units of Qute within India. A partnership with Uber helped in selling 270 Qutes in the Bangalore market, with over 150 such vehicles now running on the Uber platform.

Segment Performance

Milage Segment (100cc to 125cc)- This segment consists of the product like Bajaj CT, the Platina, and the Pulsar 125.

In FY20, its volume reduced by 17.0%, and market share in this segment fell by 20 basis points to 14.3%

It launched KTM RC125 in FY20 to strengthen its presence in 125cc segment

Sports Segment (150cc to 220cc)- This segment consists of the product like Pulsars ranging from 150cc to 220cc and the Avenger

In FY20, its volume falls by 23.5% and increased its market share in the segment to 44.7% from 44.1% in FY2019

Leadership in the sports segment

This segment consists of the product like the entire range of KTMs, Pulsar RS200, and Dominar. Bajaj Auto remained the clear leader in the sports segment and, in fact, increased its market share by 60 basis points to 44.7% in FY2020. In the higher ‘super-sports’ segment, the company offers the entire range of KTMs, the Pulsar RS200, and the Dominar. In FY2019, total sales in this segment accounted for an average of 83,930 bikes per month, with it growing by 4.6% over the previous year. Bajaj Auto’s models accounted for 7.4% of the segment. l As it occurred across the industry and over each market segment, FY2020 saw an 18.5% decline in sales to an average of 68,400 bikes per month. l Here, Bajaj Auto bucked the trend. In a year when segment sales for the industry declined by 18.5%, we sold an average of over 6,930 super-sports bikes per month — or a growth of 10.9% over the previous year. Consequently, our market share in this segment increased by 2.7 percentage points, from 7.4% in FY2019 to 10.1% in FY2020

Increasing domination by KTM India:

It has acquired 48% of the KTM Brand which manufactures sports and super sports two-wheelers, which was 14% in 2007 when the company first acquired KTM.

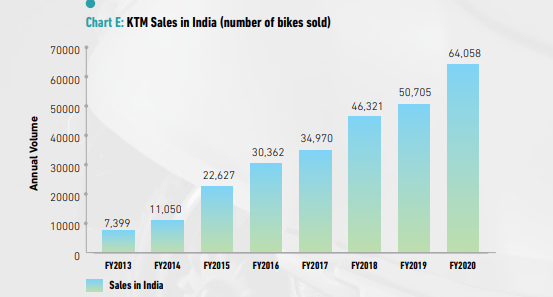

Source: Annual Report

The KTM sales in India have grown from 22,627 vehicles in FY15 to 64,058 vehicles in FY20. When Bajaj auto acquired a stake in KTM a decade ago everyone was skeptical that how a vehicle costing 1.5 Lakh would sell in India but the company has beaten all the odds has sold over 2,00,000 units.

Scooter Segment- It is focusing on expanding in the electric vehicle segment with its electric scooter-Chetak, which was launched in FY19.

Three-Wheelers Segment- In FY2020, its three-wheeler sales declined by 14.9% YoY

It export of three-wheelers decreased by 21.6% YoY, with an export market share of 59%

Four-Wheeler Segment- It launched its first quadricycle, Quote in FY19. It has sold 942 vehicles in FY20 and has tied up with uber to increase sales in Bangalore markets

Geography-wise Revenue breakup

Domestic: 58% of Revenue in FY20, which was 60% in FY19

Its domestic motorcycles market share decreased by 20 basis points to 18.5% in FY20. It was 17.7% in FY16

World’s favorite Indian:

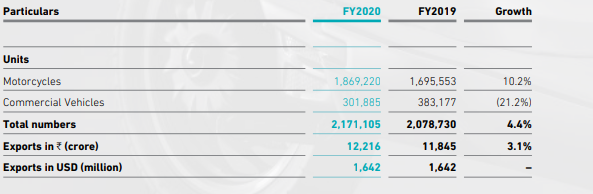

Bajaj auto has its presence in 79 countries and Of these, the company is either ranked No.1 or No. 2 in 22. In FY20, Its export grew by 4.4% YoY to 2.1 Million Vehicle. In the Motorcycle segment, its export volume grew by 10.2% YoY to 1.8 Million Vehicle with a market share of 59.6% in FY20, which in FY16 it was 66.1%.

Export, unit and revenue for Bajaj AutoMultiple Manufacturing capacities:

Bajaj Auto is ‘first-in-the-industry’ in having all its manufacturing plants certified for the ‘Special Award for TPM Achievement’ by Japan Institute for Plant Maintenance (JIPM). We continued our TPM journey and have adopted ‘TPM Next’ — Deepening, Widening and Evolving. It has three manufacturing facilities across India, 1 each at Waluj, Chakan, Pantnagar with a total capacity of 6.3 Million Vehicle p.a in FY20, which was 6.06 Million Vehicle p.a in FY1

In FY20, it signed an MoU with Maharashtra Government to set up a plant in Chakan to manufacture high-end KTM, Husqvarna, Triumph, and Chetak(Electric Scooter) and this will be the fourth manufacturing facility of the company.

R&D

The Company Spent 1.6% of its revenue on R&D in FY20, which was 1.4% in FY14

Its R&D department has upgraded 23 motorcycle variants and 12 commercial vehicle variants to BS-VI during the last two-quarters of FY2020

Reasons not to invest in Bajaj Auto:

Industry disruption due to covid:

MoM sales snapshot of the company: Total domestic sales fell 51% over last month to 60,830 units in May, The total exports too fell 4,7% to 2,11,032 units in May and the total commercial vehicle sales fell 21.4% to 31,308 units in May.

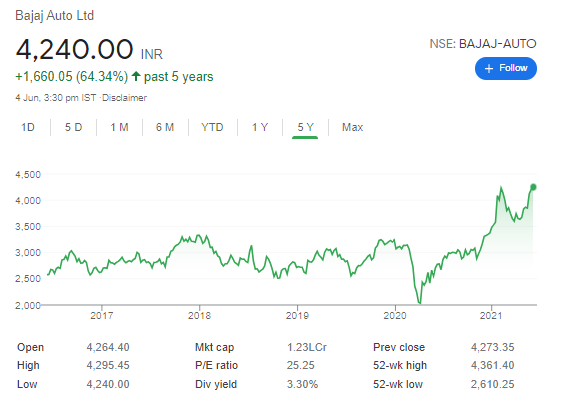

Bajaj auto sales were hit due to the Covid and the situation is same for the industry and Yes!!!, once the covid starts to stabilise the company will do well but the there is a concern of not only the falling sales but also the increasing share price of the company. The Nifty is creating new all-time highs every day and it’s amazing to see such fleets being achieved but it is also a cause of concern as the economy is not as good as how the stock markets perform and this has created a huge gap. The above chart shows us that the company has been trading near its all time high and the falling sales and an increasing share price is not a good sign and one should avoid fresh investing at this point of time.

Conclusion:

All great companies are not a great investment and there is not a slight doubt that Bajaj Auto is indeed a successful company but the question of is it a good investment at this point of time would fetch a big NO, but then we can expect some corrections in the days ahead and when the stock falls back to its previous levels of around 3800 Rs. And if there is a possibility of a third wave in India and if the market corrects prior to that, Bajaj Auto can become a splendid turnover as the company is Debt free and has enough cash accruals to meet any uncertainty.

share your thoughts

Only registered users can comment. Please register to the website.