Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINIndian Textile Industry:

Indian Textiles and Apparels (T&A) industry, accounts for approximately 4% of the global T&A market. The T&A industry is one of the largest and the most important sectors for the Indian economy in terms of output, foreign exchange earnings and employment. The industry contributes approximately 7% to industrial output in value terms, 2% to the GDP and 15% to the country’s export earnings. Exports and domestic consumption are both expected to be sluggish in the near term due to the impact of COVID-19

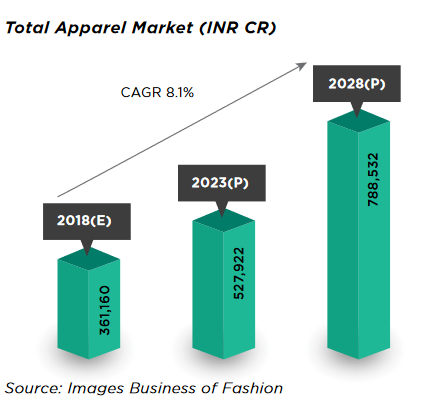

Indian Apparels market:

Indian Fashion Retail which is currently estimated at `3,61,160 crore (USD 54 billion) will grow at a promising CAGR of 8.1% for next ten years to reach `7,88,532 crore (USD 118 billion) by 2028.

The history of Jockey:

In 1876, Samuel Thrall cooper founded S.T coopers & sons, the predecessor of Jockey International, In 1878 the company was selling around 2500 pairs of Innerwear and then later on Mr.coopers son’s became experts at the business and under the new leadership the business was scaled to new levels and they were selling the Inner wear under the Brand name “Cat wear”.At some point in 1912 the company innerwear’s were sold faster than what they could actually produce and they were enjoying a good success but it was only in 1932, the future of the company took a different turn, the cooper’s received a post from the French Riveria showing a man in a bikini style swimsuit and this picture inspired the creation of the one and only Jockey briefs and the ret is all history and In 1971 Coopers company changes its name to Jockey International Inc.

The picture which inspired the creation of the one and only Jockey

Today Jockey International is active across 120+ countries and has increased its product portfolio and it is one of the most recognized brand in the world and they had a phenomenal growth in India and their success wouldn’t have been possible without the association Page Industries.

Let’s turn the pages of page Industries:

Incorporated in 1995, Page Industries Limited is the exclusive licensee of JOCKEY International Inc. for manufacturing, distribution and marketing of the JOCKEY® brand in India, Sri Lanka, Bangladesh, Nepal and the UAE. Page Industries is also the exclusive licensee of Speedo International Ltd. for the manufacturing, marketing and distribution of the Speedo brand in India. JOCKEY is the company’s flagship brand and a market leader in the innerwear category. Page Industries and Brand Jockey have pioneered the innerwear industry on many fronts. The company has established the premium segment in the innerwear category in India through brand Jockey.

Strong production Capacities

The company commenced operations in the year 1995 with the manufacturing, distribution and marketing of Jockey® products and they have a workforce numbered over 20,000 people with manufacturing operations spread over fifteen state-of-the art manufacturing complexes in Bangalore, Hassan, Mysore, Gowribidanur, Tiptur and Tirupur. Page Industries commands wide spread pan India distribution encompassing over 50,000 plus retail outlets in 1,800 cities and towns and has revolutionized the innerwear market by launching Exclusive JOCKEY® Brand Outlets across India numbering 470. In 2005 and 2009, the company was awarded the "best licensee of the year" by Jockey International Inc. as recognition for its outstanding achievement in establishing and strengthening the JOCKEY® brand as a market leader in India. In 2010, the Company bagged the "International Licensee of the Decade" award for achieving record growth year after year, offering world class products and maintaining global quality standards across all operations.

Robust Distribution Network

Jockey brand is distributed in 2,800+ cities and towns. The products are sold through Exclusive Brand Outlets (EBO), Large Format Stores (LFS), Multi Brand Outlets (MBO), Traditional hosiery stores and Multi-purpose stores. Jockey brand is available in over 66,000+ outlets spread across India. It operates a network of 810+ Exclusive Brand Outlets. Out of these, 190+ outlets are operated in malls & 620+ outlets are operated on the high streets.

Strong Relations with Jockey International Inc.

In 2011, the licensing agreement with Jockey International was extended till 2030 and the company was also awarded sole marketing & distribution rights for UAE by Jockey. The licensing agreement was again extended till 2040 in 2018 due to the strong relations with the company. The company also received an award from Jockey International in 2019 marking 25 years of partnership in which Jockey India has become the biggest and best-performing branch of Jockey International.

Partnership with Speedo International Ltd.

In 2011, Speedo International Limited appointed Page Industries as their sole licensee for the manufacturing, marketing and distribution of the Speedo brand in India. Speedo International Ltd. is a manufacturer and distributor of swimwear and swimming accessories based in Nottingham, UK and Page Industries is an exclusive licensee of Speedo International Ltd. for manufacturer, distribution and marketing in India and the products include Swimwear, Equipment, Water shorts, Apparel, Footwear and within just six years of its operations, the brand is present in over 1286 stores in 86 cities and towns across the country.

Factors that impact the growth of the company:

High dependence on single brand and segment; geographical concentration of manufacturing facilities:

While PIL has expanded its product portfolio over the years to offer a complete range of innerwear and leisurewear, it continues to be present in a small segment of the overall branded apparel industry, with a single brand accounting for most of its revenues. While the company has taken steps to diversify its product as well as brand presence by venturing into the swimwear segment through a tie-up with Speedo brand, its scale remains modest. Further, while its manufacturing capacities are spread across multiple manufacturing units, these remain concentrated in Karnataka. The resulting geographical concentration of its manufacturing base is a concern, given the highly labour-intensive nature of the industry with instances of labor-related troubles affecting operations of established players in the past.

Vulnerability to consumption trends and increasing competition:

PIL’s sales, growth prospects, and in turn profitability and cash accruals, like other apparel retailers are linked to macro-economic conditions, consumer confidence, and spending patterns. Besides, intensifying competition from the branded innerwear players with increased spending on brand building, entry of foreign brands through the franchisee route, and foray of large domestic branded garment manufacturers into the innerwear segment, will continue to have a bearing on PIL’s growth prospects going forward. Nevertheless, the company has an established track record of having fended off the competition in the past, which provides comfort.

Snapshot of the Financial performance of the company:

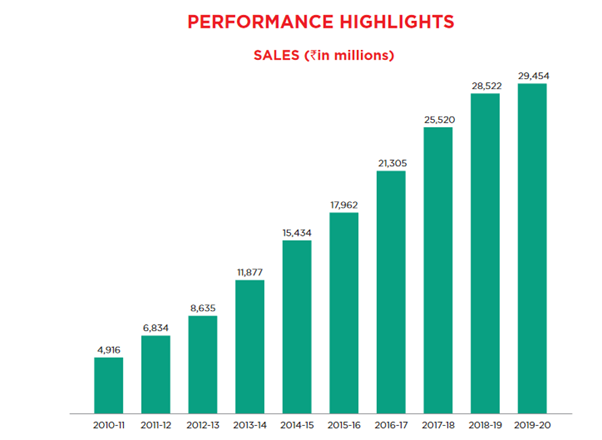

Source – Annual Report

It’s hard to see such a linear growth and the sales growth of the company looks fascinating as the company has grown every year and what it amazes more is that the company managed to improve its sales even during the Pandemic and the future growth is still visible gives the growth track record of the company.

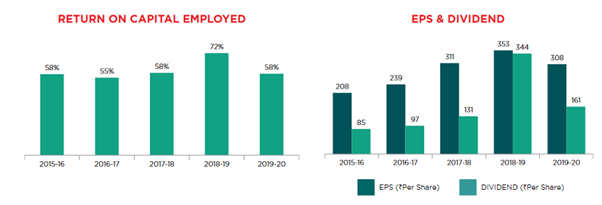

The company has a solid track record when it comes to performance and the company has been able to maintain an average ROCE of around 55% and that’s a real high feat achieved by the company and also the profitability of the company and they have been maintaining healthy dividend payout of 77% and all the financial statement is rock solid though the stock price has considered being expensive.

Page Industries has a market cap of around 34500 Cr and has is trading at Price multiples of 101x and the valuations is the biggest hammer that has shattered all the positive points that the company beholds and the company is trading at 38.79 times its book value and offers no margin of safety in the investment and the valuation is a big concern. However, if the market falls due to the fear of the Covid crisis, one can have a look at the stock further.

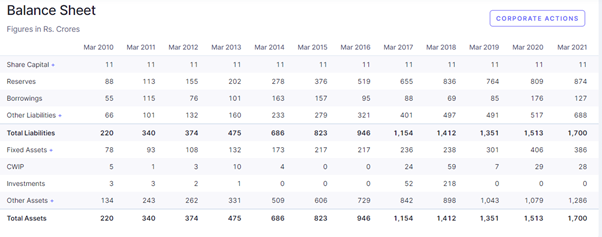

Balance sheet Analysis:

The Balance sheet of the company is rock solid and has seen magnificent growth in the past 10 years. The company has a healthy reserve at 874 Cr and that they have negligible debts and thus they are also able to enjoy profit margins. The total Assets has been growing every year and that is another positive sign and I would like to conclude that Page industries are indeed a successful company and the growth is indeed impeccable and has a lot of opportunities ahead in its journey and would be a good stock to accumulate whenever there is a dip in the price of the stock.

The Road Ahead:

It’s hard to establish a brand in the mind’s of the people and it, even more, harder to convince people that the product made by them is superior to what is available in the market and Jockey has been one such brand that has established itself as a superior product and page Industries is a huge benefactor, The company has been resilient across all the years and the management is always able to come up with unique solutions to every problem, The economic slowdown, and the Covid is enough to shatter a company which is in the apparel segment but page Industries was always ahead of the problem that is thrown in its path when the outlets were closed due to lockdown, the company focussed on the eCommerce channel and was able to maintain its sales and this ability to find the solution for every problem will surely aid the growth of the Company and the next few pages of Page industries will be fruitful as ever.

share your thoughts

Only registered users can comment. Please register to the website.