Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINApollo Hospitals was established in 1983 by Dr. Prathap C Reddy, a renowned architect of modern healthcare in India. As the nation’s first corporate hospital, Apollo Hospitals is acclaimed for pioneering the private healthcare revolution in the country. Apollo Hospitals has emerged as Asia’s foremost integrated healthcare services provider and has a robust presence across the healthcare ecosystem, including Hospitals, Pharmacies,

Primary Care & Diagnostic Clinics and several Retail Health models.

Covid & The Healthcare sector

Covid was not easy for any us and it has slackened humanity, Business is afraid of the falling sales and they have no clue when they can expect the revival and the Government is too busy saving the lives of the people and they forgot to provide the necessary support for the falling businesses. The occupancy rates at the Hotels are miserable that those companies are finding it hard to pay their employees but the hospitals are filing up and the occupancy rate is at a lifetime high. Yes, Covid is a devil but the Healthcare remained on the sweet corner throughout the process. The sales figures are increasing at high and the stock prices are at a lifetime high only to create new highs. To conclude, the Healthcare sector is one of the major beneficiaries of Covid.

Revenue Mix of Apollo Hospitals Ltd:

Healthcare Business (53% of revenues)

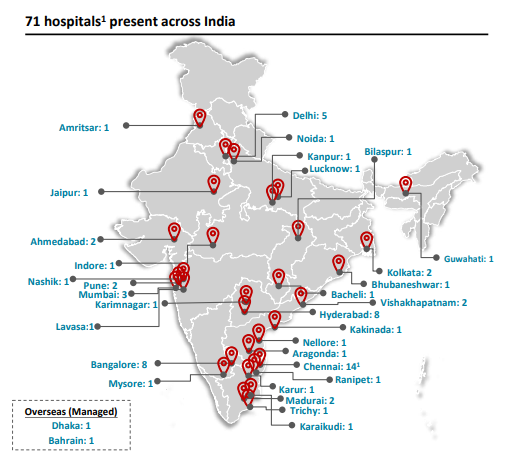

The company's healthcare business has a capacity of 10,261 beds in 71 facilities located in India and overseas. Of the 71 facilities, 45 are self-owned hospitals, 10 are cradles, 11 are daycare/short surgical stay centers and 5 are hospitals under management.

Apollo Hospitals has facilities located in large urban centers such as Chennai, Hyderabad, Kolkata, Bengaluru, New Delhi, Ahmedabad, Mumbai, Pune, Bhubaneshwar, Madurai, and Mysore among others. Presently, The company's facilities function at comfortable utilization rates at around 69-70%

Pharmacy Business (41% of revenues)

Apollo Pharmacy is India’s first and largest branded pharmacy network. It has around 3,800 outlets present in ~400 cities/towns spread across 21 states & 4 union territories. Apollo Pharmacies has widened its offerings extensively. This segment which was traditionally focused on pharmaceutical products is now equipped with a wide variety of wellness and private label products. #

Recently, the company divested its front-end portion of its pharmacy business into Apollo Pharmacy Ltd. in which the company holds a 25.5% stake. Although, it is still the exclusive supplier to pharmacy business with long-term supplier agreement in place.

Health & Lifestyle Business (6% of revenues)

The company operates in the retail healthcare space through its 70% owned subsidiary Apollo Health & Lifestyle Ltd (AHLL). AHLL was introduced with an intention to take healthcare services from a purely ‘hospital’ setting closer to the home within the neighborhood with a goal to serve the community through multiple touchpoints.ALL owns ~950 retail touchpoints undertaking various activities like diagnostics, clinics, sugar clinics, cradle, spectra care, dental & dialysis. Diagnostics account for most of the retail touchpoints with 650 centers.

The competitive edge of Apollo Hospitals:

Pan India Presence:

The First Apollo hospital was established in Chennai in 1983 and now the company has grown to become India’s largest Private hospital chain with 71 Hospitals spread across the nation and they achieved this feat within 38 years of operations. Apollo Hospitals has played a significant role in advancing quality patient care to the general populace in India. The impact is vivid in many areas. This impact is invaluable in creating a solid foundation for the emergence of a powerful healthcare ecosystem with the potential to deliver a personalized and integrated experience to consumers, enhance provider productivity, and improve outcomes and affordability.

Source: Annual Report

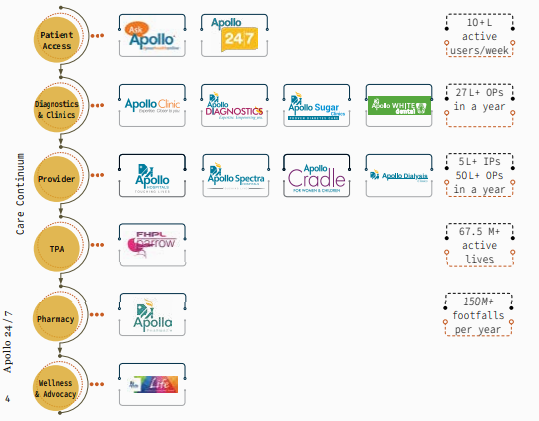

Presence Across entire Health care Value chain:

Apollo’s offerings span the entire value chain of healthcare services and are delivered through different entities with their own specialist experience. Together they form an integrated healthcare ecosystem.

Source: Annual Report

Pioneers in Technology Adoption:

Since its inception, Apollo has been embracing technology and has been fast at adapting to advanced technologies and this has been one of the reasons behind their success story and this has enabled them to always stay ahead of their competitors. Apollo is one of the first to adopt robotics precision in minimally invasive surgery and they have Eleven robotic surgical systems that enable robotic precision in minimally invasive surgery. By adapting itself to the advanced technologies the company is all set to take a huge share in the future growth in the Health care sector

Huge Opportunities Ahead:

Increasing Medical Tourism:

India has been attracting a lot of medical tourism in recent days which is due to the cheap and affordable cost of treatment and yet with top-notch facilities and highly skilled doctors. Health care tourism in India is a growing sector. In the year 2015 India's medical tourism sector was estimated to be worth US$3 billion. India is rooting in its feet faster and firmer in the medical tourism sector. A major crowd from different parts of the world come to India every year for various surgeries and post-surgical treatments as well due to its cost-effectiveness and treatment from accredited facilities and Apollo hospitals being the Market leader of the industry is set to get a huge share in the pie of increasing medical tourism.

Improving Infrastructure and penetration of Health insurance:

Yes, the Infrastructure of the industry is below the standards of the developed nation, and 76% of the Indians don’t have health insurance but this issue also promises a huge opportunity ahead. Indian’s are looking at health insurance as a good investment as people have started to demand better treatment and the government has been constantly working on improving the infrastructure of the industry and due to the covid, people have realized the importance of the heath insurance and when the insurance penetration increases, people would start shifting to the hospital which provides a better infrastructure and better quality of treatment and this change in the paradigm will hugely benefit the likes Apollo hospital, who provides one of the best quality treatment in the nation.

Challenges:

Elevated Debts remains a concern:

`Financial risk profile remains constrained by high debt levels. Significant capital expenditure (capex) towards new hospitals led to increasing in consolidated debt to Rs 3,627 crore in fiscal 2020 from Rs 1,345 crore in fiscal 2014. While improvement in EBITDA, sale of investment in Apollo Munich, and completion of greenfield capex led to improvement in leverage and gearing over the past two fiscals (2.7 times and 1.1 times, respectively, in fiscal 2020, from 4.2 times and 1.2 times, respectively, in fiscal 2018), the same remains moderately high. Also, the interest coverage ratio improved from 2.7 times in fiscal 2018 to 3.4 times in fiscal 2020.

Highly regulated industry:

AHL is exposed to regulatory risks in the healthcare business. Government policy on capping of prices for medical procedures and devices such as cardiac stents and knee implants impacted the revenue and profitability of players such as AHEL in fiscals 2017 and 2018. Any regulatory action and its impact will remain monitorable.

| Every year the government the puts a high sealing for essential medicines. |

| The price of the remaining medicines will be determined by Demand and supply |

| The government penalises the organisations who sells the classified medicines above the sealing price. |

Performance across years:

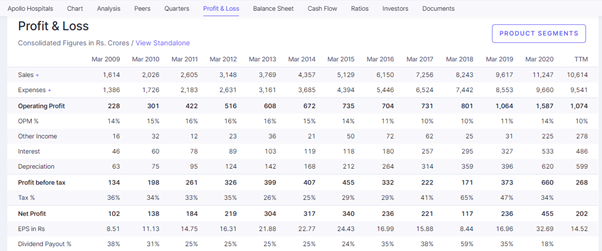

Source: Screener.in

Apollo has shown a phenomenal Compounded sales growth of 19% for the past 10 years and maintains a double-digit growth across the years is splendid and they also have 16% compounded profit growth for the last 3 years. There is no doubt that the company had a phenomenal run in the past 10 years and which is likely to continue in the future and in the last two years, Apollo’s sales have been increased more than the usual rate and thanks to Covid and the possibility of the third wave is the cause of concern for all of us but it would further increase the sales and profitability of the company. The Dividend payout is also good for the company, though it isn’t stable across the years, the average payout looks attractive nonetheless.

Valuations and other key Metrics:

High growth companies tend to enjoy higher prices to earning multiple but Apollo hospitals have gone a step ahead and are trading at a PE of 227 and the justifying that PE is hard and apart from the PE ratio, the company is also trading at 14.6 times to its book value. The other key financial metrics are Average and the company has an Average Operating profit margin of around 11% and another red flag is that the promoter holding of the company is at a lifetime low when the stock price hits a lifetime high. The current promoter holding of the company stood at 29% and they have diluted 1% of their in the previous quarter and to add a blow to it, the promoters have also pledged 29% of their stake in the company.

The Road Ahead:

The growth of the company has been synonymous with the growth of the Health care industry in India and it will continue to be in the forefront of this growth journey and yes thevaluation part is little tricky and given that the nifty is at all time high while I write this article and it's not wiser to invest at a higher levels but then stock markets are tricky, they also give you the wildest opportunity from time to time and we have grasp it while it lasts and we should improve our foundation to differentiate between a trap and a growth and a proper analysis will give you the wisdom and courage to make your wise decision.

share your thoughts

Only registered users can comment. Please register to the website.