Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINA Humble but a Bold beginning:

The inception of Emami Group took place way back in the mid-seventies, in West Bengal, when two childhood friends, Mr. R.S. Agarwal and Mr. R.S. Goenka left their high profile corporate jobs with the Birla Group to set up Kemco Chemicals, a cosmetic manufacturing unit in Kolkata, in 1974.

It was an extremely bold step in the early seventies when the Indian FMCG market was still dominated by multinationals. But against all odds with a vision for creating winning brands, the Company started its journey with a meager amount of Rs. 20,000. A dream of reaching out to the Indian middle-class consumers, a target audience, with a potential of increased consumption, the Company started manufacturing cosmetic products under the brand name of Emami from a small office (still retained) in Kolkata's business district of Bada Bazar. This business philosophy is reflected today in the mission statement of Emami Limited: "Making people healthy and beautiful naturally".

Emami Group today is a business behemoth, which is a trusted and loved brand of the nation with over 20,000+ employees.

Moat Analysis of Emami Ltd:

Wide Range of Product Portfolio:

Engaged in the manufacture and distribution of personal care and healthcare products with an ayurvedic bias in most cases and Emami has become one of the leading and fastest-growing personal and healthcare businesses in India, with an enviable portfolio of household brand names such as BoroPlus, Navratna, Fair and Handsome, Zandu Balm, Mentho Plus Balm, Fast Relief and Kesh King.

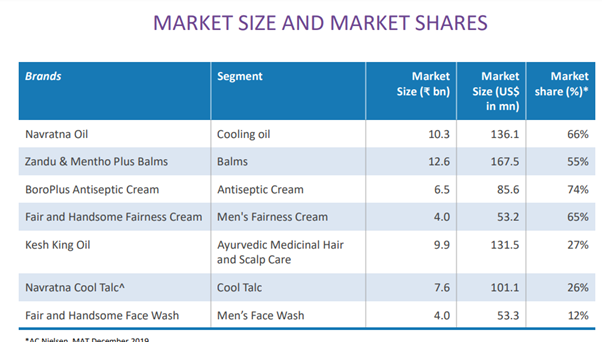

Market leadership in Niche Product Categories:

The above six brands are the power 6 brands of the company and they all enjoy a huge market share in their segment and remains as the market leader of the segment they operate in and after the initial success in their segment, the company has been doing related diversification. For instance, after the huge success of the Fair and Handsome cream, the company has launched Fair and Handsome face wash which also became a huge success endeavor of the company.

Manufacturing and Distribution strengths:

The company is Headquartered in Kolkata, West Bengal, and has 7 manufacturing facilities across India and one in Bangladesh. Emami also has Third party Manufacturing tie-ups in Sri Lanka, Germany and the Middle East. All the manufacturing facilities are certified by the World Health Organisation and the units are equipped with State-of-the-art plants with a high degree of automation.

Source: Annual Report

The products of the company are sold in 60 countries across the globe and they have deep penetration across the rural areas and their presence spread across 20,000+ Villages in India. They have more than 3250 Distributors and their products are available in more than 4.5+ Mn outlets. The company claims that 130 products of the company are sold every second across the world.

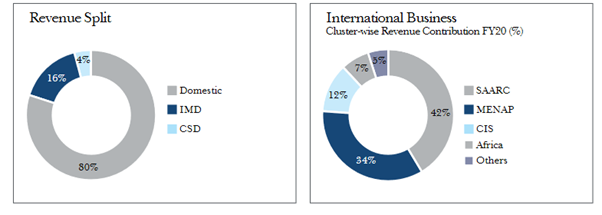

The phenomenal growth in the International business:

The company exports its products to 60+ nations and it has its presence across above-mentioned region. In FY21Q3, the International business grew by 26% and the company witnessed a whopping 82% sales growth in MENAP regions. The growth can be majorly attributed to the launch of several new products across the regions. New Launches incl. Immunity Boosters, Sanitizers and Hygiene products contributed 4% of International sales in Q3 and 6% in 9MFY21. The International business currently contributes 16% of the revenue and the company is planning to increase the revenue contribution of the International business from the current levels and it would have an overall growth in the company.

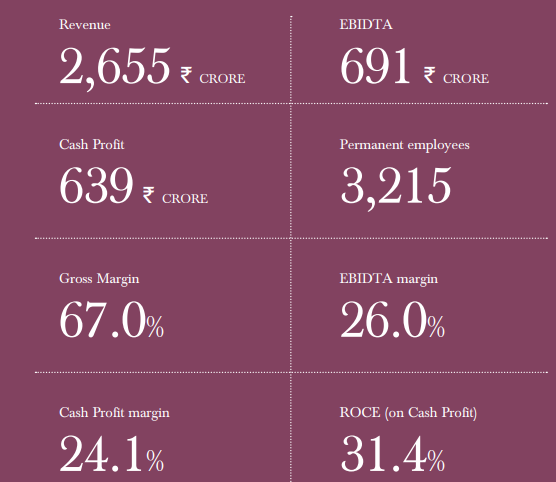

Heathy operating Efficiency:

Efficient supply chain management and a judicious mix of contract-own manufacturing have led to high capacity utilization, strong operating profitability, and healthy return on capital employed (RoCE). Healthy operating efficiency is reflected in an operating margin of 26.1% and adjusted RoCE of 18.3% in fiscal 2020. Emami also benefits from a large proportion of its production coming in from cost-favorable locations across India (about 60% of the production is carried out in tax-exempt zones; four of its nine manufacturing plants enjoy fiscal benefits).

The company has also relied on the acquisition of brands such as Zandu and Kesh King, complementing its current portfolio to diversify into new segments and strengthen the market position. Successful integration of these acquisitions has helped the company enhance its operating profitability. Working capital management is efficient, as Emami, like its peers, operates on a negative working capital cycle.

The king of Advertising:

Emami is a pioneer in engaging celebrities to endorse its brands. These comprise renowned names from India’s film industry, sportspersons, and performing artists. Emami brands have been associated with more than 60 celebrities over the years. And has Invested ₹ 2284 cr in Advertisement and Publicity in the past 5 financial years Bollywood icons like Amitabh Bachchan and Shah Rukh Khan have been endorsing Emami brands for more than a decade and the company has left no stone unturned, from Salman Khan to Dhoni the company has made several celebrities to endorse their various brands.

The Challenges:

Exposure to intense competition

The FMCG industry has organized as well as unorganized players across segments. Also, the growing popularity of herbal and natural products has led to other strong FMCG players launching products with similar positioning. An increase in competition necessitates higher advertising and promotion expenditure. Also, some of the products are seasonal, and any disruption in weather conditions can result in volatility in sales of these products.

Volatility in raw material prices

Mentha oil and polymers, comprising half of the company's raw materials, are crude-linked, exposing their prices to sharp volatility. Despite significant variation in raw material prices in the past three years, profitability has sustained above 25% because of Emami's market leadership. However, competitive pressure may limit the ability to pass on increasing input costs to customers. Focus on cost efficiency and continued price leadership will help mitigate the impact of volatility in raw material prices.

Opportunities:

Emami looks to tap shift to homegrown brands after Aatmanirbhar Campaign:

The company is planning to cash in on Indian consumers slowly leaning towards homegrown brands following the government cry for Aatmanirbhar Bharat. The company which has recently forayed into home hygiene category which was dominated by the likes of Hindustan Unilever Ltd., is looking to become a serious player in the segment with plans to introduce more products in the future. The company has entered into the segment with products under ‘EMASOL’ range of products with the disinfectant floor, toilet and bathroom cleaners along with the antibacterial dish wash gel and an all-purpose sanitizer products, the overall market size of which is estimated to be around Rs4000,cr.

The famous Fair and Handsome controversy:

In 2007, the company attracted controversy with an advertisement for its skin whitening cream for men, Fair and Handsome. Emami and the star of the campaign Sharukh Khan were accused of perpetuating racism. In July 2013, WOW a Chennai-based NGO launched a campaign against Emami asking them to remove the Fair and Handsome advertisement starring Khan, saying that it is discriminating against people on the basis of skin color. The campaign has been supported by celebrities like Nandita Das, Tannishta Chatterjee. More than 22,000 people have signed an online petition launched by them

Financial Performance of the company:

The company reported a revenue of 2655 Cr for the FY20, a degrowth of 3 percent compared to the previous year and the company has performed really well if we take Covid into account and the company managed to perform well by launching new products like sanitizers and other hygiene-related products related to Covid. This has prompted the company to manage the crisis better than its peers and its ability to adapt faster to the change in environment is fascinating nonetheless. The company has an EBITA margin of 26% which is also above the industry average and the company has performed well in all the metrics and all the ratios are top-notch but the major issue remains the valuation.

The FMCG company usually enjoys a higher valuation and the Average PE of the Industry is around 40x but the company is trading at a price Multiples of 58 and the valuation remains a little concern of the company but given its leadership across various segments, the company is expected to trade at the premium valuation.

Challenging Times and Impressive responses:

Through its performance, the company has proved that the Disruptions are temporary but the resilience is forever. The company enough moat to ensure further growth in the future and one can wait for a little correction in the stock to ensure that there is some margin of safety in the investment but the company has established its footprints stronger and is all set to mover higher and higher.

share your thoughts

Only registered users can comment. Please register to the website.