Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINA True Made in India story:

Hero Moto Corp earlier also known as “Hero Honda” is one of India’s first motorcycle manufacturers.

The company started in 1984 as a Technological collaboration with Honda, Japan. Before this collaboration, Hero was selling Cycles under the brand name, Hero Cycles.

In 2011, Honda group sold its 26% stake in the company to the Munjals (promoters) and ended the Joint venture. Post the termination of the Joint venture, the name of the company was changed to Hero Motocorp Ltd and the journey afterwards is a motivational story that makes us proud of the company.

Pro’s of Hero Motocorp:

World’s largest Two – wheeler Manufacturer:

Hero MotoCorp continues to be the world’s largest manufacturer of two-wheelers, in terms of unit volumes sold by a single company in a calendar year, for 19 years in a row. Hero Motocorp has a 35.7% market share in the Indian two-wheeler Industry and has 51% Market share in the Indian Motor cycle Industry. The operations span more than 40 countries in Asia, Africa, the Middle East, South and Central America, with eight manufacturing facilities spread across three countries and state-of-the-art R&D facilities in India and Germany.

Established Brands and market share

It is the world’s largest manufacturer of 2 Wheelers, in terms of unit volumes sold by a single company in a calendar year, for 19 years in a row. In FY 20, it sold 64 lakh two-wheeler units. Sales grew at a CAGR of 39% over the past decade. The overall market share of the company in the two-wheeler segment stands at 35.7% as of FY20.The company has some strong brands under its names like Splendor, Passion, Glamour in the bike segment and like Pleasure, Maestro in the scooter segment and others, etc

Segment-wise performance

Entry Segment (100 -125 cc): In FY 20, the Co. gained market share by 12.5%, to 68.9%. This has grown from 51% in FY 16.

Deluxe Segment (125-150 cc): In FY20, the market share in Deluxe 100cc category has declined by 3.8%, to 74.8%. In the Deluxe 125cc category, market share has declined by 11.3%, to 49.8%

Premium Segment(150 cc and above): It is focusing on the Premium segment with the launch of XPulse200T, Xtreme 200S in FY20, and Xtreme 160R in FY21.

They have been losing market share in this segment for the last few years. The share declined 21% and is at 1.6% in FY 20, compared to 4.8% in FY 16

Scooter Segment: In FY20, the market share went down by 17%, to 7.2%.

One of its product, Destini 125 becomes no 1 brand under 125cc (first to get i3S technology in scooter).

To regain market share on 125cc segment, it has launched and Maestro Edge 125 (India's first Fuel Injected Scooter) and it has also launched Pleasure+ 110 in FY20

Electric Vehicle

Hero has taken various initiatives to strengthen its position in the emerging EV segent .The Company has been focusing on expanding its business to EV’s for which it has tied up with Ather (in which the company owns 34.58% as of July 2020) and with HeroHatch (an internal start-up).

Ather (the first Indian electric vehicle company) currently has 2 product offering- Ather 450 and Ather 450X and has also established EV charging infrastructure in Bengaluru and Chennai

High Global Footprints

In 2012, the company had a presence in 4 countries only, which has expanded to 40+ countries in FY 20 and has 9000+ Customer touchpoints (in FY18 it had 6500) across the globe

It plans to sell one million units overseas annually in the next 3-4 years and expects overseas sales to contribute 10% to its revenue from 3% at present in coming years.

Hero Joins hand with Harley Davidson:

Hero motocorp and Harley Davidson announced recently that they will ride the Indian market together. As per the agreement Hero will sell and service Harley-Davidson motorcycles along with spares, accessories, merchandise, riding gear and apparel through a network of brand-exclusive Harley-Davidson dealers and Hero MotorCorp’s existing dealership network in India.

This JV has enabled the company to enter into the higher CC segment where the company lacked its presence. This arrangement is mutually beneficial for both companies and riders in India, as it brings together the iconic Harley-Davidson brand with the strong distribution network and customer service of Hero MotoCorp. This JV will compete with the joint venture between the Bajaj Auto – KTM alliance and the TVS – BMW venture.

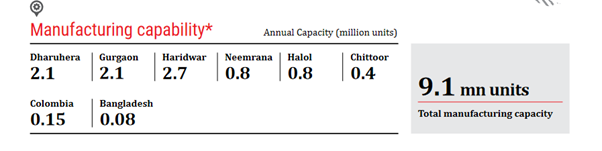

Manufacturing Capabilities:

It has 8 manufacturing units, 6 in India and 1 each in Columbia and Bangladesh with a combined capacity of 9 million units in FY20( which was 8.1 million units in FY16). Average Capacity utilization stood between 72.5% and 88% (peak) in FY20.

Source – Annual Report

R&D

The company's investments in R&D over the past five years have been twice that of other players in the industry and currently has 94 patents under its name.

It has 2 R&D facilities, 1 each in Jaipur(Rajasthan), and Munich(Germany) and in FY20 it has spent 2.4% of Total Revenue, which in FY18, it was 1.4%

Challenges:

Intense competition in the Industry:

HMCL has maintained its leadership position backed by new products and refreshes, introduction of five-year warranty, and an enhanced dealership network. The company will continue to focus on in-house research and development (R&D) to launch new models with its own technology. The company faces intense competition in the scooter segment, wherein revenue declined 43% in fiscal 2020. Impact of the lockdown to contain Covid-19, consumer preference for mobility and the extent of revival in rural demand will remain key monitorables.

To increase its technological prowess, HMCL had entered into a strategic alliance with Magneti Marelli, headquartered in Milan, Italy, to develop and manufacture new-generation fuelling systems. Launch of new models and continuous investment in R&D will be crucial for sustaining its leadership position in the Indian two-wheeler market.

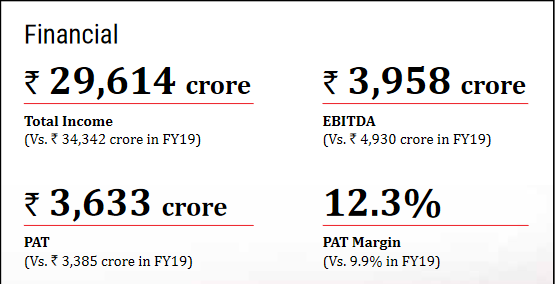

Financial performance of FY – 20:

Source – Annual report.

The company posted a robust result despite the economic slowdown and the impact of Covid – 19. The Profit After Tax (PAT) grew by 7.3% in FY20 and the company maintain an attractive and leading edge dividend policy by declaring an overall dividend of ` 90 per share for FY20.Most importantly, your Company continues to remain debt free and maintains a strong balance sheet. Its reserves have now reached 14,096 Crore. The financial strength of the Company augurs well and will help the Company to successfully navigate itself into the future despite these trying times. Most importantly, your Company continues to remain debt free and maintains a strong balance sheet.

During the FY- 20, the company has launched 5 new products in the Premium motorcycle and the scooter segment which has a significant growth potential. The company was the first two-wheeler manufacturer in India to launch BSVI compliant motorcycles six months ahead of the deadline, leading the industry as it transitioned to BSVI emission norms. Hero Motocorp is retaining its core and at the same time the company is ushering into the new segments.

Impact of Covid:

Hero Motocorp said on April 20 that its going to halt operations at all its plants across the country amid the deadly second wave of Covid- 19 infections. Covid has hit the Auto industry harder and Hero Motocorp was also one among the many victims but Covid was also a hidden boon the company as there is a significant change in the trend of personal mobility as people are afraid of taking public transport and we have to see how far the change in the trend has results in the sales Numbers.

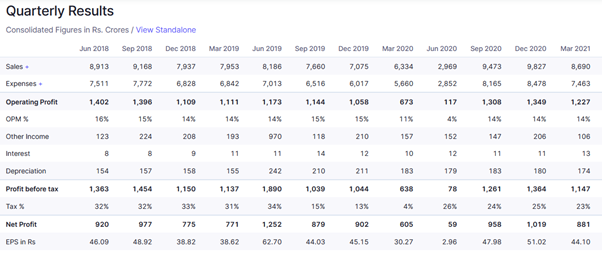

HERO Q4FY21 Review: Beating the streets expectations:

Source: Screener.in

Hero Motocorp Ltd. performance was better than expected and the company reported a strong quarterly performance with a Revenue of 8690 Crore which was a growth of 39% YoY. The revenue growth was led by 18% YoY volume growth as the company manged to sell 15.7 lakh units. The Operating profit margin stood at 14% and the company achieved the same despite a huge increase in the raw material price.

Leading with Performance, Forging ahead with Purpose.

In the journey of the company, Hero has been risk-takers, pioneers, unafraid to question the status quo and their ability to take educated risk has helped them create a rich legacy in the Industry. The going has gone tough for all of us but the tough forges ahead relentlessly and our company has been doing the same and will continue do the same in the days to come because they are a Resilient, compassionate and a caring Hero.

share your thoughts

Only registered users can comment. Please register to the website.