Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINIndustry Outlook:

The Current Telecom Industry has become one of the best-case study for the MBA guys and not only in India, the story has been all over the world and perhaps this has been of the best business disruptions in the business world. The entry of JIO and its offer to provide free data has marked a new era in the Industry and the entry of Reliance Jio ensured the incompetence of Aircel and the company shut its business in India and the Vodafone and Idea had merge themselves to survive in the industry and the only who managed to survive this battle was Bharthi Airtel.

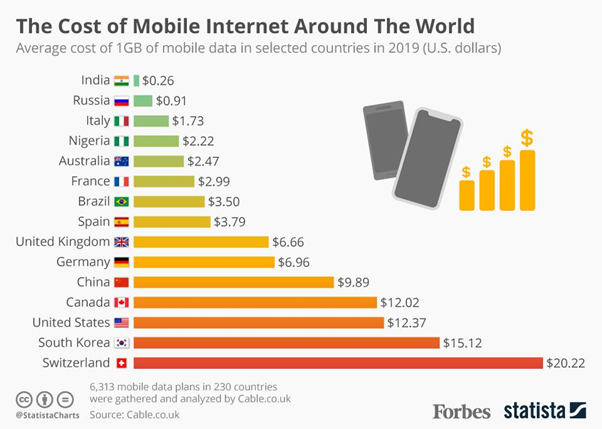

After the advent of Jio the cost of the Data pack has reduced significantly and we could see from the above statistics that India has the least cost of data in the world and this has been a good news for the consumers but it’s not a god news for the Data providers as they have to operate on a thicker margin.

About the company:

Airtel was one of the pioneers that connected India through an exceptional mobile network and the story of Airtel begun strongly 25 years ago, And after witnessing the unprecedented growth, scale and transformational impact mobile services has had on the Indian telecom landscape, Airtel is truly proud to have been at the forefront of this story! ‘AirTel’ as a brand name was finalized by Mr. Sunil Bharti Mittal himself, to reflect the technological innovation of ‘Telephony over Airwaves’. Other options like ‘Be One’, ‘Tango’, ‘Bee Tel’ and ‘BTel’ were also considered as suitable brand names. Right from its inception, the idea was to position the brand as an aspirational lifestyle brand, going beyond pricing/ tariff propositions only.

Source: Annual Report

Moat Analysis of Bharathi Airtel:

Diversified Revenue base:

Bharti enjoys a diversified presence across geographies with non-India operations (primarily Africa) contributing around 26% to the consolidated revenues in 9M FY2021. In addition, the company generates a sizeable revenue from India non-mobile operations. Both, Africa operations and India non-mobile operations provide a cushion against the weak cash flows from operations, though improving, in the India mobile operations.

Revenue Breakup

Mobile (India) – 49.8%

Africa – 25.8%

Airtel business – 12.9%

Homes – 2.1%

Digital Services – 2.7%

Towers – 6.4%

Though the Indian operations provides a sizeable chunk of the revenue but a Diversion of business act as a cushion and the company is able to tackle any uncertainties and risks.

Source - Annual report

Increasing Customers and Average Revenue Perusers (ARPU)

Since the last two-quarters Airtel has been adding more subscribers than other telecom players.

It has the highest ARPU in the telecom industry.

The trend for last 5 quarter

Total Customer Base - 418,811 ; 423,287 ; 419,996 ; 439,841 ; 457,995

Average Revenue Per User(Rs) 135 ; 154 ; 157 ; 162 ; 166

Bharthi Airtel enjoys the highest average Revenue per user among its peers and we could see the Increasing trend in the Average Revenue per user and this could increase the profitability of the company.

Resilient Management team:

Telecom price war has changed the landscape of the Industry and the entry of JIO was indeed a big blow to the company as the competition intensified and the Supreme court of India directed an yet another blow to the company by directing the telecom players to pay 10% of their AGR dues calculated by authorities and the rest in yearly instalments till March 2031. The company had already paid 18,000 crores out of 43,980 crores of dues demanded as per the ruling. The company has managed to raise more than USD 8 Bn over the year through rights issue, Airtel Africa IPO, Perpetual Bond, QIP and FCCB. This speaks volumes about the support of investors and their trust in the capability of the company.

Beating Jio in its own game:

The telecom regulatory Authority of India has released its monthly data on subscribers for Feb 2021 and the Industry active subscribers rose 3.2 Million with Bharti Airtel Ltd net additions strong at 3.7 million subscribers and Reliance Jio lost 0.2 Million subscribers and by this Airtel beats Reliance Jio to add most active users for Third straight month. Airtel’s MBB subscriber market share rose 40 basis points to 49.8%. So, clearly, we could see that Airtel is gaining back its lost ground and gaining an edge over Jio. Though the battle is far from over, we could conclude that Airtel is ahead of Jio as of now and if the momentum continues Airtel will remain as the largest operator in the telecom Industry for the days to come.

High stake in Indus towers:

The company currently owns 42% stake in the Bharthi Infratel or the Indus towers directly and through its wholly owned subsidiary Nettle Infrastructure Investments Ltd.

Indus Towers Limited has over 175,500 towers and 318,300 co-locations and a nationwide presence covering all 22 telecom circles. Its leading customers are Bharti Airtel, Vodafone Idea Ltd and Reliance Jio Infocomm Limited. In December 2020, the company, through Nettle Infrastructure bought ~5% stake in Indus Towers for 2,900 crores.

Challenges:

High Leverage:

The company has a debt of 1,59,667 Cr and the Debt to equity stood at 2.69 which is a negative factor about the company. Though the company has been taking several initiatives to deleverages its balance sheet, those initiatives have failed and with the AGR liabilities, it would take more than a couple of years for the company to bring its debts to a normal level and the company is participating in the auctions for 5G network, the debts are expected to rise. However, the company has the potential to manage the debts given its high market share and the Operating profits that the company earns.

Highly competitive Industry:

The competition is intensive and ferocious as JIO has a deep pockets and can manage to run at a lower costs for a longer period of time while Bharthi Airtel is struggling to survive due to the higher debts. The competitive intensity in the Indian telecommunications industry remained elevated over the last few years leading to pressure on realisations for all players, leading to decline in ARPU level.

Opportunities:

Getting an early lead in the 5G race:

Bharti Airtel Ltd became the first telecom service provider to demonstrate its capability to roll out 5G wireless services in India. The company marched past ahead of its rival Reliance Jio Infocomm Ltd, which plans to launch the service later this year but hasn’t completed trials. The next-generation wireless service will pave the way for blazing fast internet speeds and power internet of things (IoT) applications, such as driverless cars and smart cities. Airtel’s ability to run 5G services over its existing commercial network is a win for the company, which has been struggling to play catch-up with Mukesh Ambani’s Jio for the past few years and has ceded its leadership in the Indian telecom market.

Profit & Loss statement

Source: Screener.in

Airtel has a phenomenal growth story and the sales growth is remarkable and the company had a CAGR sales growth 8% for the last 10 years and the company has been able to maintain a high operating profit margin of around 40%. In the last two the company had a high other expense pertaining to the AGR dues and thus the company has posted a net loss in the previous two financial years and the company is expected to be profitable in the upcoming financial year and with the company capturing its market share and a healthy operating profit margin will aid the company to gain its lost mojo back.

The PE ratio can’t be computed as the company is currently running in a loss and thus calculation of the ratio is not possible but looking at other metrics the company is trading below 10% below its 52 week high with a book value of Rs.108 and the company is trading 5 times its book value.

Crisis reveals true leadership:

The 25 year growth of the company has become synonymous to the growth of the India telecom industry, In this backdrop, telecoms and digital technologies have become the bedrock of our lives – be it work from home or virtual classrooms, telecom networks are ensuring that the world does not come to a standstill. Telecom is the oxygen for the digital world.The worst might be over the Industry but yet the company has a long way to emerge out of the woods. The company is fighting a two tough battles, one with the rising debts and one with the Richest man of India and this Crisis will reveal the true resilience of the company.

share your thoughts

Only registered users can comment. Please register to the website.