Nazara Technologies Limited: Sectoral Dynamics and Opportunities in Gaming Market Should Make Up Growth Story

Summary

- Plans are there to target profitable growth and Nazara Technologies Limited prioritizes growth over profit maximization so that it can achieve and maintain market leadership in all segments.

- Nazara Technologies Limited made an acquisition of majority stake in learning app Kiddopia in Jan 2020. It targets 2-7 years old kids and has gained popularity in North America, with majority share of revenue flowing from USA.

- High growth platform and sectoral opportunities should act as principal growth accelerators.

About Nazara Technologies Limited

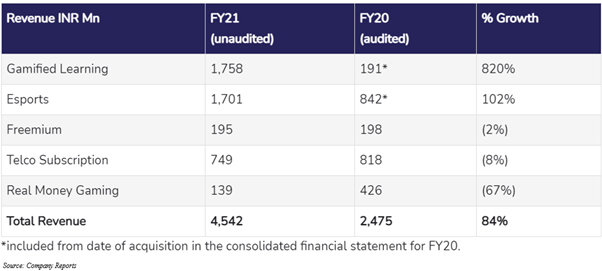

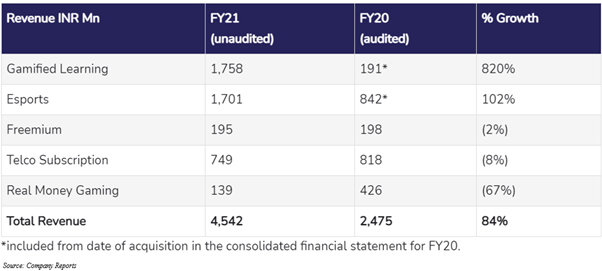

Nazara Technologies Limited is a leading India-based diversified gaming and sports media platform. Its presence spans in India and across emerging and developed global markets. These markets include Africa and North America. As of Mar 31, 2021, the company has diverse business segments and revenue generation can be seen happening across gamified learning, esports, freemium and telco subscription. Early learning business segment made up 39% of revenue in FY21, with esports and telco subscription business making up 37% and 16%, respectively.

Growth Enablers of Nazara Technologies Limited:

- Gamified Learning and Esports Segments Led This Show: Nazara Technologies Limited saw consolidated revenue of INR4,542 million in FY21, exhibiting 84% growth over FY20. Growth was principally because of gamified learning and esports segments. These 2 businesses laid foundation for predictable growth due to user engagement and retention KPIs in gamified learning and multiyear media licensing and game publisher agreements in esports.

- High Growth Platform Should Support Future Growth: Revenue in FY20 saw 41.27% growth year-over-year and there was culmination of the company’s journey of pivoting from being telco subscription company to diversified global gaming company. Growth stemmed from gamified learning and new age sports media offering, having in-house capability to create original IPs. This results in tangible accelerators of revenue and EBITDA growth. High retention rates of paying users and network effect of leadership position in esports business should help the company achieve revenue growth and consistent improvement in EBITDA margins. India is into golden age of mobile gaming and the company should be able to capitalise on India growth story. Foundation of high growth platform is laid out over last 2 years and the company should harness infinite potential of this growing sector. Revenue mix change has laid perfect platform to achieve strong growth in businesses having higher user engagement and retention. These should lead to predictable high growth revenue mix.

- Nazara Technologies Limited Eyes Significant Opportunities in Gaming Market: The company plans to accelerate growth and make progress to strengthen dominance in esports and virtual sports simulation mobile gamers, addressing large addressable segment of sports fans. These fans look at new age sports formats both as player and spectators. Plans are there to target young learners and their parents globally and build global brand and IP characters giving edutainment to early learners. The company will continue its investment spree in local ecosystem and will continue to look for inorganic growth opportunities.

- Silver Lining During COVID-19 Pandemic: Worldwide, gaming businesses have seen strong growth enablers during lockdown and opportunities generated in gaming vertical accelerated growth of gaming. The company saw sharp increase in consumer interest for gamified learning, social virtual sports and multiplayers games and in viewership of esports on OTT platforms and on TV. Digital and interactive games supported market position as a diversified interactive gaming, gamified learning and new age sports media company. It has invested its capital to lay strong platform for growth and was watchful in investment decisions, while monitoring evolving market conditions closely to ensure high revenue growth rates.

- EBITDA Analysis of Nazara Technologies Limited: The company’s business carried forward from FY19 to FY20 like telco subscription, esports and freemium saw 23.86% EBITDA margin in comparison to 14.37% EBITDA margin in FY19. New acquisition of real money gaming and early learning Paperboat saw INR617.32 million of revenue while incurring loss of INR381.87 million due to upfront investment in new player acquisition and brand building. Investment in new acquisitions led to overall EBITDA margin for FY20 of 3.74% in comparison to 14.37% in FY19. Paperboat’s app Kiddopia has long-term retention & profitable unit economics and has 9-10 months breakeven of consumer acquisition cost and should exhibit positive EBITDA in coming years.

- Rise in Paying Subscribers: Kiddopia was having 340,282 paying subscribers as of Mar 2021, exhibiting 172% increase in paying subscribers in comparison to Mar 2020. Cost per trial stayed between USD22 to USD26 in last 12 months, with activation ratio from free trial to subscription remaining ~70%. Monthly ARPU of user was ~USD6.3 - USD6.4 and monthly churn ranged 4% - 6% across months in FY21. Esports disrupts traditional sports and is an outcome of sports and gaming intersecting so that spectator entertainment content can be created. Sportskeeda saw 487% growth in monthly active users in FY21. During peak cricket season, Sportskeeda saw 68.44 million monthly active users, up from 10.53 million in Apr 2020. In India, it emerged as leading esports news and content destination. Nodwin saw its revenues grow by 75% in FY21 over FY20. Majority of revenues was contributed by media rights and game publishers made up second largest source of revenue, with Nodwin partnering with them for grass route community tournaments in India. Nodwin made an expansion into South Asia in FY21.

- Efforts Made to Improve Revenues Should Lend Some Support: The company evolved from being curation and distribution of mobile gaming content company. It has now become a developer and publisher of in-house created gaming and media content IPs. It leverages distribution pipelines globally spanning across India, Africa, Middle East and North America. Nazara Technologies Limited worked in FY20 to strengthen leadership position in esports and cricket simulation mobile game in domestic market and added Sportskeeda. It raised its stake in Halaplay to ensure several touch points with new age sports fan. The company strengthened its presence in kids vertical and made an acquisition of majority stake in Paperboat Apps in FY20. Paperboat Apps publishes subscription app carrying brand name of Kiddopia in North America. This is principally for pre-school kids, teaching everything from math, language skills to creativity through fun and exciting game play thru created gamified learning content. Kiddopia saw 3x growth in FY20 in terms of revenues and has strong unit economics as consumer acquisition cost was recovered in only 9 months and it has high life time value because its monthly subscriber retention is 14%. The company has diverse business segments and revenue generation is happening across several categories.

- Esports Business- A Promising One: Overall esports media saw 40% growth in FY20 over FY19 and this growth should continue to happen because of business dynamics. Registered players participating in tournaments organized by Nodwin in FY20 zoomed to 2.2 million from 0.45 million in FY19. Likewise, live streams from events saw 28 million live stream views in FY20 on 6 million views in FY19 across OTT platforms. Sportskeeda saw average 47.3 million visits per month in FY20, exhibiting 38% growth on FY19.

- Nodwin is engaged in esports content business, dominating esports business in India across esports content on OTT platforms, large-scale esports IP, alliances with global game publishers and brand sponsorships across endemic and non-endemic brands. Business of media rights licensing contributed to 55%+ of overall revenues and Nodwin ranks among top 5 global esports company given its revenue scale.

- Sportskeeda is being counted as a multi sports/ esports news destination having 20 million+ monthly active users coming to website to read content related to WWE, esports, cricket, etc.

Support of Renowned Early-Stage Investors

This year has been a successful one for the company. While its difficult to say how remaining year will unfold, up till now this year was worth cherishing. In early Jan 2021, Plutus wealth management LLP & associates acquired shares of INR500 crore+ in the company. Acquisition was made from Westbridge ventures II investment holdings, a fund managed by Westbridge capital. With this, Westbridge ventures marked its complete exit from the company, which was an early investor since 2005.

The company acted as an aggressive investor in Indian gaming ecosystem and it has invested INR300 crore+ in last 5 years. The company has stakes in variety of gaming sub-categories. It has achieved this by making network in interactive gaming and sports space by investments and acquisitions in varied gaming categories like esports, edutainment, infotainment, fantasy sports, multiplayer games like carrom and others. In Feb 2021, the company raised INR 100 crore from Instant growth limited, which is advised by Hornbill capital advisers LLP. Leadership team of Hornbill capital was part of growth story of many consumer internet companies.

Conclusion

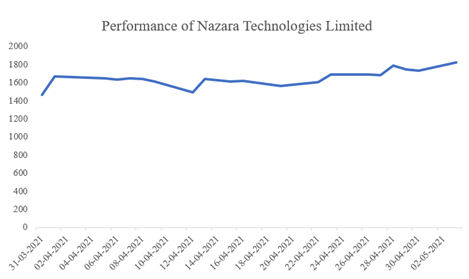

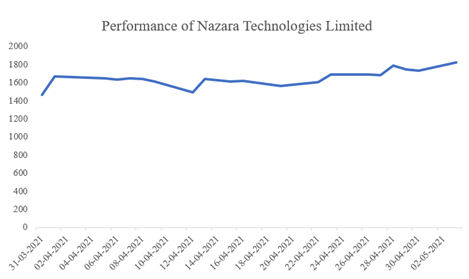

Nazara Technologies Limited has total market cap of ~INR5,08,562.36 lakhs and free float market cap of ~INR91,733.53 lakhs. While entire nation struggles through COVID-19, this company has recently made its debut on secondary market. Investors who received allotment saw strong listing gains. In short time, this company has beaten returns of NIFTY50. Between Mar 31, 2021- May 3, 2021, investors in Nazara Technologies Limited saw their capital grow by ~24.5%.

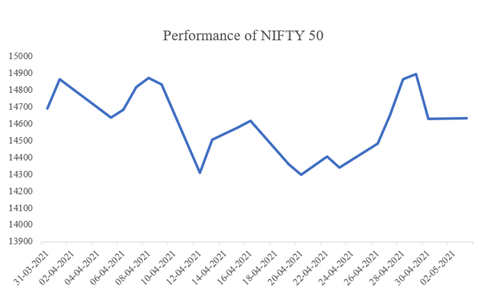

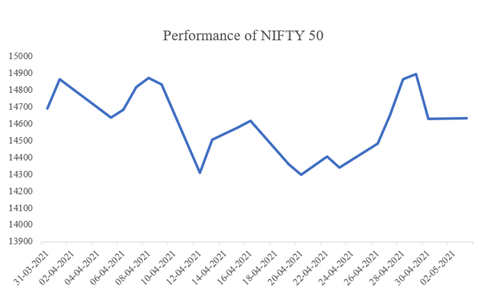

Even though there have been relaxations in lockdowns, country still battles to combat COVID-19 impact. Between Mar 31, 2021- May 3, 2021, NIFTY50 saw -0.38% return.

Exclusivity:

This article is exclusive to investoguru.

Stock Disclosures:

The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Author Disclosures:

This Article represents the Author's own personal views. The Author did not receive any compensation and do not have any business relationship with any of the companies mentioned in the Article.

share your thoughts

Only registered users can comment. Please register to the website.