Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

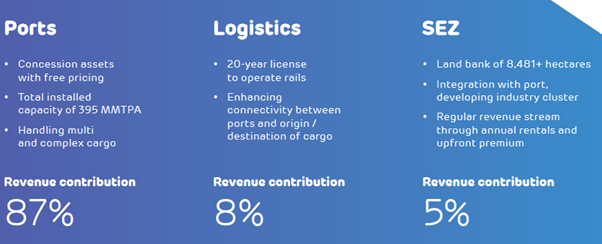

REGISTER NOW OR LOGINAdani Ports and Special Economic Zone Limited (APSEZ) is India’s largest commercial port operator and integrated logistic player in the country and is in the business of development, operations and maintenance of port infrastructure (port services and related infrastructure development) and has linked multi product Special Economic Zone (SEZ)

The Company is promoted by the Adani Group, which has interests across resources (coal mining and trading), logistics (ports, logistics, shipping and rail), energy (renewable, thermal power generation and transmission), Agro commodities and ancillary industries.

About Adani Group:

Adani Group, is a diversified organisation in India with combined market capitalisation of $21 billion comprising six publicly traded companies. It has created a world-class transport and utility infrastructure portfolio with a pan-India presence. Adani Group is headquartered in Ahmedabad, in the state of Gujarat, India. Over the years, the Group has positioned itself to be the market leader in its transport logistics and energy utility portfolio businesses focusing on large-scale infrastructure development in India with O&M practices benchmarked to global standards. With four IG-rated businesses, it is the only Infrastructure Investment Grade issuer in India.

Pro’s of Adani Ports:

Strong presence across the entire Logistics value chain:

Adani ports provide fully integrated logistics solution to its customers right from the marine, stevedoring, cargo storage, warehousing, transportation and other value-added logistics services. It manages the comprehensive logistics chain – from vessels management to anchorage pilotage, tug pulling, berthing, goods handling, internal transport, storage and handling, processing and final evacuation by road or rail. APSEZ has evolved into a provider of integrated port infrastructure services, which has enabled it to enter into alliances with leading Indian businesses to provide comprehensive logistics solutions.

Largest commercial port operator:

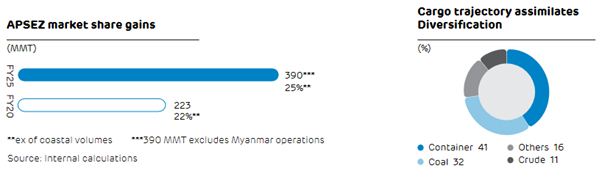

Adani Ports handles 9 ports in India and has a 22% market share in the Total cargo volume. It’s Nine ports are located in six maritime states of India such as Gujarat, Goa, Andhra Pradesh, Tamil Nadu and Odisha. Two ports are under construction one at Vizhinjam, Kerala and another one in Myanmar. The operational facilities are equipped with the latest cargo-handling equipment, and are best-in-class in handling the largest vessels that call at Indian ports.

Special Economic Zone:

The multi-product SEZ at Mundra is the largest notified SEZ in India, with notified area of 8,434.59 hectares. Exports from Mundra SEZ up to March 2020 was about ` 23,308 crore (cumulative). With its multi-modal connectivity, including road, rail, seaport and airport, Mundra SEZ is expected to attract an increasing amount of investments in the coming years. In addition to the 16 co-developers approved by the Government of India for providing various infrastructure facilities, as at March 31, 2020, total 49 entities have obtained approval for setting up their units in the SEZ. Some of them have already started operations and export activities. Some are under construction. These units have already invested about ` 13,760 crore.

Successful track record of project development and Execution:

Adani ports has evolved as a company with a high successful track record of developing and executing projects, including waterfront, onshore, back-up area, evacuation and connectivity infrastructure across greenfield, brownfield and terminal locations. Our track record includes developing and operating 18 terminals with 47 berths and two single-point mooring facilities with mechanised back-up and storage areas across Mundra Port, Dahej Port, Hazira Port, Kandla Port, Murmugao Port, Dhamra Port, Vizag Port, Kattupalli Port and Ennore Port.

Challenges:

Stiff competition:

Overcapacity at the regional level has been one of the key concerns of the port Industry Through various initiatives, the government and private players have continuously added new ports capacities, even as cargo volumes have not matched up accordingly. Resulting inter-port competitions have become challenging, leading port operators to rethink business strategies. For example, overcapacities in container terminals at the Chennai port cluster (ports of Chennai, Kattupalli, Ennore and Krishnapatnam) will likely result in stiff competition for common hinterland container cargo.

Commodity issues:

Apart from the infrastructure problem, the port industry also faces issues due to the lack of commodity movements. With the government’s focus on domestic thermal coal production and fertilizer manufacturing, import of these commodities might witness substantial fall in the long run. Connectivity and operational efficiency improvement at major ports pose a challenge to APSEZ ports. Today due to global pandemic issues, we foresee there will be challenges in cargo flows across the globe, we believe that these challenges will be short-term in nature. Global Pandemic will also have local impacts on the ongoing infrastructure developments and expansions projects, which will definitely pose challenges in front, to complete projects in the stipulated time frame.

Adani Ports Q4FY21 Net profit jumps fourfold:

Source - Screener.in

The Net profit of the company jumped fourfold over the year-earlier as its acquisition of krishnapatnam port continues to drive the volumes for the company. The Net profit stood at Rs. 1,288 Cr in the three months ended March from 334 Crore a year ago and its revenue rose 24% YoY to 3,721 Cr. The company managed to show a stellar performance through Acquiring the residual 25% stake in Adani Krishnapatnam Port Limited (Krishnapatnam Port. The completed acquisition of 75% majority stake in Krishnapatnam Port in October 2020 and with the acquisition of this residual stake, Krishnapatnam Port will become a wholly-owned subsidiary of APSEZL.

Adani ports cargo volumes in the reported quarter rose 27% over the year-earlier and Krishnapatnam port handled cargo amounting to 10 MMT cargo in the Quarter ended March and the Cargo handling was higher than that handled by all the major ports in India, and due to the enhanced capacity the company managed to perform well.

Strategies for growth:

The companies main goal moving forward is to gain Market share through expanding into new markets and has a target to handle more than 400 MMT of cargo till 2025 and to balance the commodity basket by not depending too much on either coal or the container business. The company will continue to dive the growth through Acquisition and Investments and to manage an Operating profit margin of around 70%.

Source - Annual Report

Opportunities in the Logistics sector:

The logistics sector is dominated by the unorganised sector and According to a crisil report, the organised player has only 10% market share in the segment and there is a huge change in the trend which will help the company to aid the growth of the company and A year ago, the Government of India decided to disinvest Container Corporation of India, which holds a lion share in the inland rail based container transport in India and Adani Ports is planning to invest in Concor for a majority stake and gain the market share in the Inland transportation and this opportunity could bring in a lot potential for the growth of the company.

Valuations and other Metrics:

Source – Screener.in

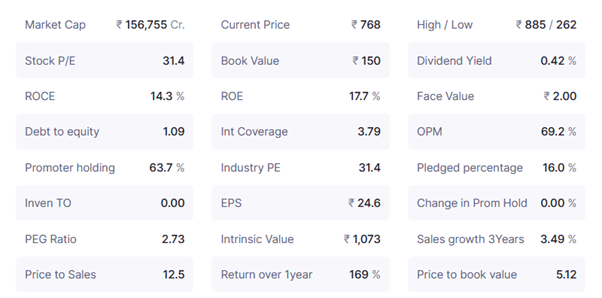

Adani ports is available at a price to Earnings of 31, and comparing to the historical PE ratio, the company is trading at a higher premium and which is due to the more than expected rally in the Adani group of stocks. The company reached a lifetime high of 885 Rs and the stock has corrected 10% from the 52 - week high. The ROCE is at 14.3% and the ROE is at 18% which is both an average return ratio. The company has a Debt to equity of around 1.09% as the company has been acquiring several ports and spending on developing the infrastructure has led to slightly higher debt. The company also has a high operating profit margin of around 70% which is a positive factor to be noted.

The Road Ahead:

Sitting where we are today, there is a lot of pessimism around and a lot of things to be worried about but the world is full of possibilities and Adani ports dreams to seize them. There is no way predicting the economic performance of our nation in the short to mid term but India after a decade or two will be more brighter than we can imagine and none of us can’t ignore it. The Covid crisis might have slowed the process but India will emerge as the world’s top consumption centers and few companies might fail in the process but the companies with a resilient business will thrive and reach the side of the success and Adani Ports will be on the other side of success. APSEZ as the country’s largest port player continued its steady journey in enhancing market share.

share your thoughts

Only registered users can comment. Please register to the website.