Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINIt was on late 1990s, the well known value investor of India Mr.Radhkrishna Damani started the first store of D – Mart in Mumbai. Through his investing style, he had developed a very keen understanding of the Indian consumer sector and its psyche. He was anxious to start a business beyond investing, which would enable him to test his hypothesis about the Indian consumer. After a couple of years of introspection and research, he decided to start a grocery retail chain, focusing primarily on the value segment.

DMart took eight years to start its first ten stores. This wasn’t because of dearth of investment opportunities, but more because of his belief in the importance of validating the business model from a perspective of both profitability and scalability. For a number of years since inception, DMart’s corporate operations were run from a small space, carved out from one of the early stores.

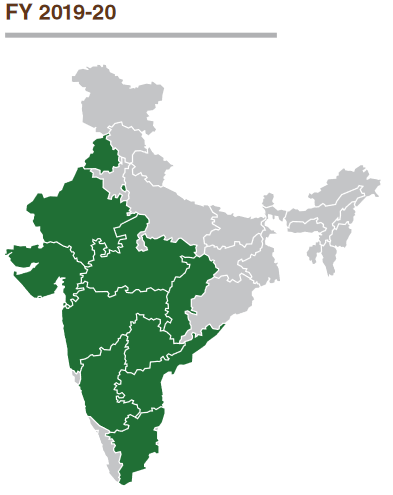

Now Avenue Supermart operates 214 stores across 11 states and one union territory with a 11.8 million square ft retail business area. AVL has its highest presence in Maharashtra with 58 stores and followed by Gujarat with 26 stores. Presence is limited to western and southern Indian States as the company follows cluster based expansion resulting in low cost structure.

Revenue breakup

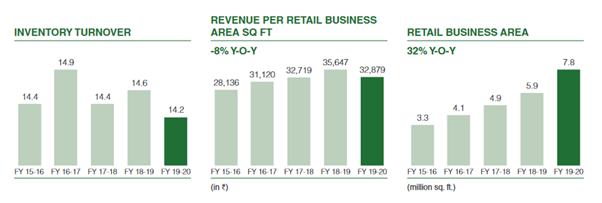

The company derives 52% of the revenue from Food segment, 20% from the FMCG segment and the remaining is contributed by the General Merchandise and Apparel segment. The company Sales revenue per retail business per square ft is Rs 32,879 for FY20.

Industry Overview:

Over the years, retailing in India has been one of the most dynamic and fast-paced industries, which has travelled through different phases. In 2019, India‘s GDP is estimated at `141 trillion, of which private consumption constituted 57%. Retail sectors forms around ~80% of private consumption at constant prices. India‘s GDP growth will therefore translate to an increase in the merchandise retail market, from 34 trillion in Fiscal 2014 to 66 trillion in Fiscal 2020. Organised Brick & Mortar retail accounted for ~7.5% of total retail market in Fiscal 2019. Overall, organised retail grew ~21% on-year in Fiscal 2019, with B&M retailers registering growth of ~18% on-year.

Pro’s of Avenue Supermart:

High Market share among the organized segment:

Strong procurement abilities, lower priced products along with strong cost control have led to strong footfalls in past. This leads to high inventory turnover and revenue per Sq ft and translates into industry leading retail store productivity. Aggregate revenue per square foot at about Rs. 32970 in fiscal 2020, is significantly higher than most retailers in the same segment. The operating profitability of the company had seen improvement over the years though fell to 7.6% in fiscal 2020 due to impact on operations in March 2020 due to COVID. Operating margin to moderate in current fiscal by up to 150 bps on account of sub-optimal fixed cost coverage and restriction on sale of high margin non-food products during Q1FY21.

Currently, ASL's operations are largely concentrated in West and South India. Expected large cluster focused store addition over next 3 years will benefit to diversify geographic reach of the company.

Unique business model:

D- Marts has its own property rather than the rented one which means the company doesn’t have to make a monthly payment as rents and thus there is a less cost of products. The uniqueness of D- mart is that unlike others retailers D- mart makes timely payment to its suppliers and thus they enjoy higher bargaining power than its peers. DMart’s core business model is driven by Value retailing and the company has opened 38 new stores in the FY20 and the company is focusing on penetrating into Tier 2 & 3 cities where there is an absence of Organized large retailing.

Control over the pricing:

D –Mart from time to time makes a study about which products sells faster and based upon the conclusion the company manufactures their own products and sells them under their own brand. Some of their brands include D-mart Minimax, D-mart Premia, D Homes and Dutch Harbour etc.. This strategy has enabled the company to have a control over the pricing of the product and D-mart provides extensive offer on these products and try to lure the customers.

Slotting fees:

D- Mart revolutionised the retail system in India by innovating and bringing new changes to the Industry. Usually, the retail sellers were at the mercy of the margin which were given by the big corporates for selling their product but D-Mart changed the fate of the system by introducing Slotting fees and that is if a company wants to sell its product on the D-Mart stores, then they have to provide a fixed fee for the D- Mart apart from the usually margin that they get for selling the product. This has enabled D- Mart to procure products at a competitive [rice and they have been passing on the benefit to the customers as well.

Growth opportunities through E-Commerce:

AVSL through its subsidiary Avenue E-Commerce Limited provides online grocery retail under the brand D mart ready in selected areas in Mumbai. The segment has reported a 354cr revenue for FY20 which is 147% growth on YoY basis. The company has closed down two of its stores in Mumbai on Aug, 20 and converted the same into a local fulfilment centre for E-commerce deliveries and this is the first time where the company has closed down its stores since its IPO.

The challenges:

Increasing competition from E–retail

With the advent of the pandemic, E–retail has made its mark with the Indian consumers and Amazon pantry and Jio mart have established their presence in major cities and the competition is increasing. Now D- Mart had to battle with the big guys and has to shed out a lot to discounts to retain and attract customers and that would leave a big hole in the financials of the company.

Covid hurts the growth D-Mart:

The company has its highest number of stores in Maharashtra and Gujarat and the Covid has high penetration at the states and due to the high restrictions most of the stores are allowed to operate only for 4 hours and this will hurt the recovery stage of the company and we cant expect any further growth in the revenue of the company in the short to medium term.

High Valuations:

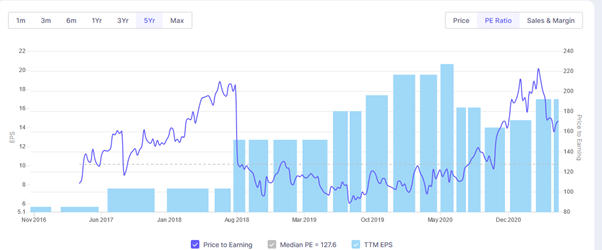

Source: Screener.in

Walmart, the American retail mammoth which surmounted the world is currently trading at a Price to Earnings multiple of around 30 but our company here has never traded below the Price to Earning of 100 and the Currently, it is trading at a PE of 171x and the company is trading 16 times its book value, no one sane value investor would want to go near this stock. Despite the overvaluation of the stock, Avenue Supermart has been a multi-bagger even after the IPO and the stock has given a 97.6% return over the past three years.

Financial performance of the company:

Source – Screener.in

The company has been performing well in the operational level and they had a 23% Sales CAGR in the past three years but the company has a lower OPM due to its providing products at a lower price business model. D- Mart has performed really well despite the Covid lockdown and the company has been recordings its highest ever sales and this comes due to the fact that people start hoarding the products due to the fear of lockdowns and also the company has adapted at a faster pace with the E – retail and has been actively delivering the products across the home. Over the span of the last three year, the company has scaled up its operation and has been doing everything right and the growth is expected to continue as its expand its Domestic footprints in the future and foray into the northern zones as well.

Growing with India’s consumption story:

D-Mart opened a record of 38 New stores for the year and the company intends to grow within its cluster and the company continues to deliver reasonable growth across various parameters with rock-solid fundamentals and truth be told, the market has given the company too much beyond the possible growth. Though the products of D-mart comes cheap the stock trades at the highest possible Valuation. One should avoid investing in this stock for the long term based on the fundamental data but one can look at the technical indicators for possible entry and exit in a short span of time

share your thoughts

Only registered users can comment. Please register to the website.