Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINAbout the company:

Tata Chemicals was established in the year 1939, Tata Chemicals engages in the manufacture of inorganic chemistry products with plants spread across four continents America, Europe, Africa, and Asia. They are the world’s third-largest Soda Ash and India’s leading vacuum evaporated iodized salt producer. Their salt works, spread over 36,000 acres, are the largest in Asia. We produce soda ash using synthetic and natural mining processes. Of this, 3/4th capacity consists of natural soda ash allowing us significant cost completeness.

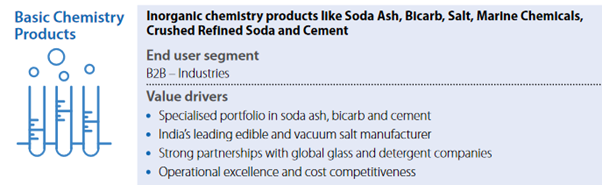

The company derives its revenue from two major segments namely:

Basic chemical business (75% of the revenue)

These are high-volume and low-value products, which caters to a wide range of downstream industries and the company engages in the manufacturing of inorganic chemistry products spread across four continents.

Soda Ash (56% of the revenue)

This remains the major contributor of the revenue for the company and TCL is the world’s third-largest producer of Soda Ash with a production capacity of 3670 KT.

Sodium Bicarbonate (4% of the revenue) The company remains the sixth largest producer of Sodium Bicarbonate in the world and the product caters to various industries like food additives, animal feed, pharmaceuticals, dyes, textiles, air pollution control and many more.

Salt (11.5% of the revenue)

TCL is India’s largest Salt manufacturer and the company produces salt which is sold by Tata Consumer product and is marketed under the Iconic brand ‘’Tata Salt’’.

The Company has made a Long-Term Supply Agreement (LTSA) with Tata Consumer Products Limited and the LTSA provides for supply of vacuum-evaporated edible salt as a take or pay arrangement for an initial period of 25 years. with the option of extending this on mutual agreement. TCL recorded the highest production of salt at 10.78 lakh tones.

Tata cement

TCL started manufacturing cement to utilize the solid waste realized through the manufacturing of Soda ash and the company expanded its product offering by launching Tata Shudh PPC and the product have captured a 4% market share in Gujarat and with rising demand for its product the company plans to increase the production capacity by another 0.33MT by the end of FY 21.

Specialty chemical business (25% of the revenue)

They are relatively high-value products which require high technical know-how and they are known for their end-use applications and some of the produces of the segments are

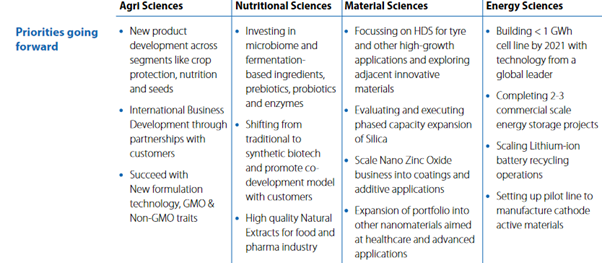

Agro Science (16.5% of the revenue)

The company has strong presence in the crop chemical business through its subsidiary Rallis India and TCL owns 50% stake in the company. Rallis India serves 5 %million+ Indian farmers covering 80% of the total districts in India.

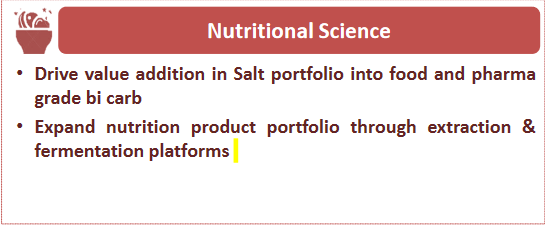

Nutritional Sciences

India’s 1st and only Nutritional Sciences business for FOS and GOS manufacturing Under this segment, the company offers science backed ingredient and formulation solutions, marketed under the brand Tata NQ, catering to human and animal health.

Material Sciences

The segment produces a wide range of precipitated silica (which is used by the Tyre Manufacturers and other non-Tyre rubber industries) and Nano Zinc Oxide (which is used by various industries like Paints, Coatings & Adhesives, Plastics & Polymers and Personal Care & Cosmetics). It also found its use in the production of face masks for the protection of Covid – 19. The company increased its silica production capacity by 900TPM by acquiring a plant in Tamil Nadu #.

Energy Sciences

Lithium-Ion cells are produced in this segment and it is one of the critical components for the battery of Electronic Vehicles. The Company has partnered with leading battery makers around the world for contemporary commercial cells, global R&D labs for next-generation technologies and has invested in a plant site of over 127 acres of land in Dholera, Gujarat. This site can house the manufacturing of actives, cells, and batteries up to 10 GWh per annum

Moat Analysis of Tata chemicals:

Growing and Diversified global footprint:

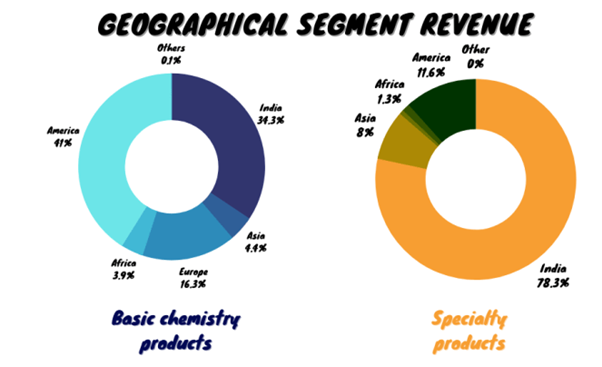

TCL’s business is well diversified with its leadership position across various products and diverse geographical presence across four continents, that is Asia, America, Europe and Africa. TCL’s revenue in FY20 on a consolidated basis primarily included revenue from two segments namely Basic Chemistry Products and Specialty Products, which contributed about 77% and 23% respectively in FY20on a consolidated basis. Apart from Soda Ash, TCL is also the sixth largest producer of sodium bi-carbonate in the world. TCL is also one of the leading agri-services and crop protection chemicals companies. The diverse presence across various segments has enabled the company to do well even during the Covid times and a slowdown in one segment will not impact the company.

Advancing science and Creating values:

Source – Annual Report

Tata Chemicals has been nurturing innovation and has pioneered various cut edge technologies which have increased the efficiency and the customer experience for the company. The Innovation Turnover Index has increased 16% YoY. In total, the company has filed a total of 152 patents.The company has been partnering with various organizations of various institutions which are specialized in their segments and the company has been focusing on developing new technologies for business sustainability.

Huge opportunities Ahead:

Source - Annual Report

In the Agriscience segment, the wider portfolio and continuous expansion will help the company gain traction. Recently the company has launched a crop protection product viz. Zygant (pesticide) and Ayaan (fungicide) were introduced, and a Rapid regeneration technique for rice was implemented. The growth momentum in the remaining segments will aid the future profitability of the company.

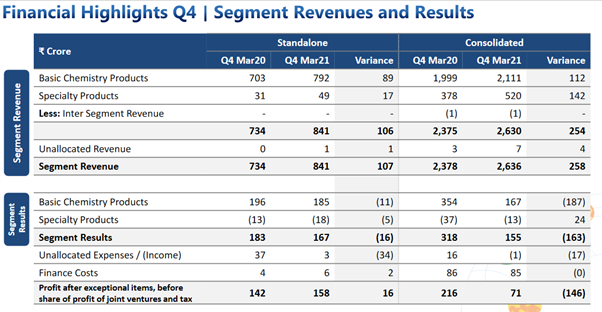

Financial snapshot Q4FY21:

Source – Investor Presentation

Tata Chemicals has done really well in the Q4, both the segments has witnessed significant growth and the Management has been focusing more on the specialty chemicals segment where there is high margin business. The growth in the specialty chemical division can yield a better fortune for the company. Tata Chemicals has an average Operating profit margin of around 12 – 15% and they are a little cyclical in nature owing to the change in price of their raw materials.

Strong liquidity and Superior Cash flows:

Source - Screener.in

Tata chemicals continued to have a comfortable financial profile marked by moderate debt coverage indicators and the Debt to Equity of the company stood at 0.40 which is a positive point and the company has utilized most of its debt for Acquisitions and being a part of the Tata group, the company can finance its future operations without any trouble. The company has a negative Cash flow but given that the company is focussing on growth and we could see that the company has churned out most of its cash for the purchase of fixed Assets and other investments. In the Cash from Financing activities, we could see a negative Cash flow of – (1456) Cr most of which is was directed towards the repayment of its previous loans. A negative cash flows are good if the company is redirecting those funds for future growth and that is exactly what Tata chemicals has been doing, the company has been steadily investing the money towards its future and time will tell whether the investments were worth the risk or not?

Balance sheet Analysis:

Source – Screener.in

The Balance sheet has more than doubled in the past 10 years which shows the incredible growth that the company had and the company also maintains a healthy reserve of 14,035 Cr as of Mar 2021 and the borrowings are at 5,600 Cr which is within the capacity of the company. The Fixed Assets has been constantly increasing YoY. The Capital work in progress is at an all-time high of 1035 Cr and if we have close look at the balance sheet, we could see that the company has been constantly investing in expansion every year which is a positive sign and we could the company’s strong belief on its on-growth possibility.

The Road Ahead:

The pandemic has not only has brought tensions to the companies but also to the stock markets, the markets have become uncertain like never before, Optimism is battered by increasing Covid cases and the threat of lockdown is worrisome and during those tough times, it's important to have invested in the safe and stable companies who have no or fewer debts, whose businesses are more resilient and flexible to the dynamic changes and Tata Chemicals is one such stock which you comfortably add to your portfolio for greater stability.

share your thoughts

Only registered users can comment. Please register to the website.