Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINCar pollution is one of the major contributors to the Global warming and the health risks of the air [pollution is really risky and if you are a person from Delhi or Chennai you might have had the first-hand experience of it. The situation has been more hazardous than ever and even the Government has acknowledged the situation and they want to put an end to this misery by introducing electric Vehicles in India. A couple of months ago, the Electric vehicle giant, TESLA announced its entry on the Indian Market and they have registered a Private limited company to oversee the Indian operations and this entry has market as the biggest milestone for the Dream’s of the Indian government.

This change in the paradigm will not only benefit the Auto manufacturers but also for the companies who are leading suppliers to the Auto manufacturers & the Lithium-Ion battery manufacturers. This Change means a lot for the nations growth and at the same time we are seeing a goldmine to be exploited and today we are going to see one company which is poised to lead this change.

About Exide Industries:

Every successful company had a humble beginning, Exide’s beginning started seven decades ago in Kolkata and has been one of the most trusted brands enjoying higher brand reputation and brand recall among the Automobile company and users. A leader in packaged-power technology, Exide today is India’s largest storage battery company with the widest range of both conventional flooded batteries as well as the latest in VRLA or valve-regulated lead-acid batteries. Exide designs, manufactures, markets and sells the widest range of lead-acid storage batteries in the world to cover the broadest spectrum of applications

A look into Exide’s business Moat:

Exide Industries Limited is a leader in energy storage and management solutions. It is the only company in the world manufacturing the lead acid industry’s most comprehensive range of products and services.

Source - Annual Report

Automotive segment:

The word Exide has become synonymous to the word ‘Battery’ in India and that is the kind of brand establishment that the company has created for itself its 100+ years of presence. Exide is the market leader in all automotive applications in the domestic market. Our portfolio spans batteries for four-wheelers, two-wheelers, three-wheelers, e-rickshaws, inverters, gensets and home UPS systems. Brand Exide, SF Sonic and Dynex spearhead our domestic presence, while brands Dynex, Index and SF Sonic cater to the international market.

Industrial segment:

provide reliable energy storage solutions to all industrial applications: power, solar, railways, telecom, UPS, projects and traction, among others. Our domestic industrial battery brands are Exide, SF and CEIL; while our flagship brands in the overseas market are Exide, CEIL, Chloride and Index.

Submarine:

Exide is the only company in South Asia with the capability of bulk manufacturing of high-end batteries for different classes of submarines, such as German, Russian and French, along with nuclear submarines. We are the sole supplier to the Indian Navy for more than three decades. We also export to other countries with permission from the Government of India. Batteries used in submarines are highly critical and specialised in nature, being the singular source of power in the warships.

Source - Annual Report

The company’s long presence in the industry, its brand-building initiatives coupled with its product quality provided EIL with a dominant position in the industry capturing a large pie of the Market share and operating at different segment has enabled the company to diversify its revenue base.

Manufacturing Capacity and After-sale service:

Exide Industries has 9 Manufacturing plants spread across India which a production capacity of 50 Million units of Automotive powers and 5 Billion Ah of Industrial power. The company also has a strong distribution consisting of 48,000+ direct and Indirect sellers. Exide also has a world class after-sales service infrastructure of 170 Service centres with more than 1300+ service technicians and 12 repair centres. The phenomenal After sales service of the company has also helped its customers to have high satisfaction around the products of the company.

Strong clientele base:

Source - Annual Report

Try to name of the major Vehicle Manufacturers and there is a high probability that you will see them on the above list and the company has also captured the two new entrants MG and KIA motors as their client list.

Taking an early lead in India’s electrification journey:

Exide Leclanche Energy Private Limited is the new-age JV between India’s largest battery manufacturer, Exide and Europe’s leading energy storage solutions provider, Leclanché. The JV is well placed with automotive quality certification, a robotised assembly line and a production scale of 1.5 GWh, to take a leading position in the lithium-ion battery market in India.6 production lines have been ordered for battery pack assembly for cylindrical, prismatic and pouch cells. The first line is operational and brings the world-class Leclanché technology to India. Other lines are on their way and the last one is expected to be in place by November 2020. The JV has set up an R&D centre in Bengaluru where several product development programmes are underway. Many pilot orders have been collected from multiple automotive OEMs, as well as large telecom operators, UPS manufacturers and solar PV companies.

Exide Life Insurance:

It was a small diversification idea in 2001, Exide Industries established Exide Life insurance company and now the small idea has given Exide a great life. The life insurance business contributed 33 percent of the total profit of the company.

Exide Life Insurance distributes its products through multi-channels viz. Agency, Banc assurance, Corporate Agency & Broking as well as Direct Channels. The Agency channel consists of 50,000 advisors who are attached to over 200 company offices across the country. The company has over 15 lakh customers and manages over INR 15,795 crores in assets I as on Mar 2020 and it has been operating since 2001 and is headquartered in Bangalore It deals with life insurance products, providing long-term protection and savings option. It was featured to be among the top ten most trusted insurance brands in India as per the Brand Equity survey.

Exide R&D Powerhouse:

The company thrives upon Innovation and that has become the source of the competitive edge of the company and Exide R&D centres are fully automated and has piloted multiple breakthroughs for the company by launching multiple products across various segments. Further, the company also enters into collaboration with leading battery manufacturers across the globe and this has helped the company to stay ahead of its competitors by launching products ahead and gaining the first-mover advantage.

Challenges:

Intense competition has led to thick margins:

Exide has positioned itself in the battery market but still its also a victim of the intensifying competition from the organized and the unorganized players and Currently, the Operating profit margin of the company is downwardly slopping which is not a good sign for the profitability of the company and the company is planning to tackle this issue by investing in automating its machinery to bring down the costs in the manufacturing process.

Financial performance of the company:

Source – Screener.in

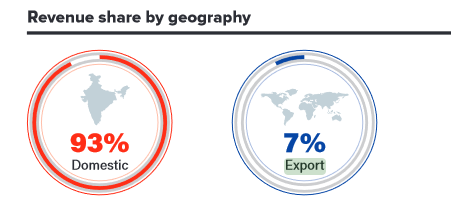

Exide Industries had phenomenal growth in the past 10 years, the sales have increased two-fold and the company has been doing significantly well even during the Covid times & slow growth in the Auto Industry. The company has a staple OPM at 10 – 12 %. In the case of the Net profit, the company has doubled its income from that of 2010. The company has been able to generate good positive cash flows through its profits and Exide also has an excellent Dividend payout percentage.

VALUATIONS OF EXIDE:

Source - Screener.in

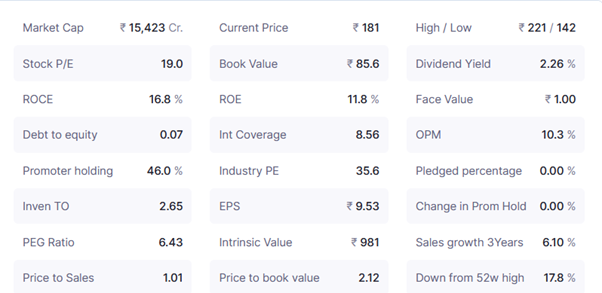

The valuations are justifiable with a Price to Earning of 19x and the stock is trading around 2.2x of the book value but given its leadership it commands, the valuations are lower than it deserves. The ROCE of the company stood at close 17%, The company is almost Debt-free which is another positive factor for the company. Exide Industries also had a 2.26% of Dividend yield. Let’s calculate the Intrinsic value for the Exide Industries and the formula that we use to calculate the same will be 16xEPSxPEG and in the case of Exide Industries, the EPS stood at 9.53 and the PEG ratio stood at 6.43 and the Intrinsic value is 981 for Exide industries and the current price is much lower than the intrinsic value of the company.

Conclusion:

India has a dream to revolutionize the vehicles that are run when the roads are tampered and with a poor infrastructure that scares the Auto manufacturers away and makes us question that whether is it possible for India to change or is it yet another unfeasible dream never turning into reality but we all know that we are a resilient economy and our economy has gone through the worst and the best of the time and we could all hope that this dream is possible and feasible. It might take a decade or it might take a century but then the change is knocking at the door of the Indian Automobiles. Exide Industries has prepared itself for the change that is about to happen and will lead our dream to change.

share your thoughts

Only registered users can comment. Please register to the website.