Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINWe make a map so we can leave things out and the phrase describes the success story of the Nestle. The company was formed in the year 1866 by Henre Nestle. Nestle became the worlds’ largest Swiss packaged food company in a short span of time. With more than 150 years of stability in the market, Nestle has marked its strong position as top nutrition, health, and Wellness Company.

Nestle is one of the world’s largest FMCG company having its presence in 190 Countries and the group makes a revenue of 1.2 Billion dollars everyday and now we have realised how big the company actually is and let’s look at the journey of Nestle of India.

Nestle India (62.76% owned by Nestle SA), began trading operations in India in 1912, as Nestle Anglo Swiss Condensed Milk Company (Exports) Ltd. Nestle India commenced manufacturing operations in 1961, by setting up a plant in Moga (Punjab). The company manufactures products under four categories: milk products and nutrition, beverages, prepared dishes and cooking aids, and chocolates and confectionery. Whether it be your dairy products, chocolates or juices, Nestle is always there in our everyday purchases. Its “Good Food, Good Life” slogan has served it right, touching millions of people worldwide, both physically and literally.

Pro’s of Nestle India:

Established brands with Leading Market position:

The company operates in various products on segments like Beverages, Breakfast Cereals, Chocolates, Dairy, Nutrition, Foods, Vending food services.

Most of the brands under Nestle India are brand leaders in their food segment.

Nestle India is a leading player in the Indian FMCG industry, with an established market position in most product categories it has a presence across various segments . The company is a pioneer in the culinary segment, with a range of products under the Maggi brand. The company is among the top two players in most of its product categories: milk products and nutrition, beverages, prepared dishes and cooking aids, and chocolate and confectionery. In these segments, Nestle India benefits from its strong cash-generating and well-established brands.

Diversified Revenue Mix:

Revenue profile is diversified, with 47% of the revenue generated from milk and nutrition products (dairy products and weaning foods), 10% from beverages (instant coffee, iced tea and other beverage vending mixes), 30% from prepared dishes and cooking aids (the Maggi range), and 13% from chocolates and confectionery (including Kit Kat and Munch) as of September 2020. The diversified revenue profile mitigates risks, as reflected in healthy performance during the ban on noodles.

Strong Parental support from Nestle Switzerland

Source – Screener.in

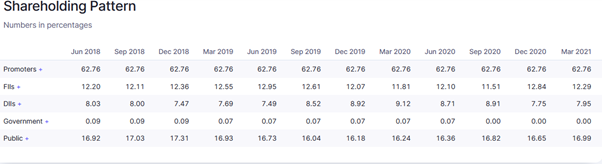

The promoter group holds around 63% stake in the company and they are one of the world’s leading player in the consumer segment and Most of Nestle India's brands are part of the parent's international portfolio. The company enjoys access to its parent's proprietary technology and strong research and development capabilities.

Challenges:

Exposed to the ferocious competition:

Nestle India is exposed to increasing and intense competition in the domestic FMCG segment, with the entry of new players, including multinationals, in various divisions such as instant noodles, packaged foods, beverages, chocolates, and confectionery. The competition is further increasing due to aggressive product launches, evolving consumer preferences, and strong marketing strategies adopted by players.

Social criticism:

During the year 2015, one of its famous products Maggi was banned in India as it failed to pass its laboratory tests and the company advertised that its Noodles had no MSG content when tested there was 1000 times more lead content in its Noodles. This soon became one of the biggest corporate issues that we have ever seen and this led to an 80% erosion of the share capital of the company in a matter of few days. Though the company relaunched its product with better quality, Nestle has already been criticized for giving misleading nutritional information on its labels. Thus the company has become one of the major targets of the social groups.

Ratio Analysis of Nestle India:

Source – Screener.in

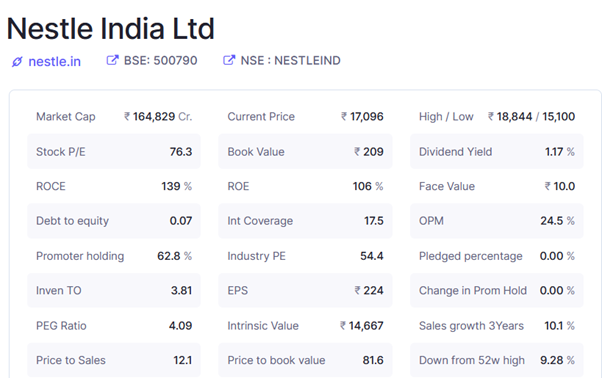

The Market Cap of 1,64,829 Cr as on Apr 21, 2021 and the company is the second largest FMCG company in India next after Hindustan Unilever Ltd and the company has the highest ROCE and ROE among the Industry, and the company virtually Debt free with an Interest coverage ratios, The operating profit margin of the company stood at 24.5% which is also high among its peers and theoretically speaking, the company has got a world-class performance ratio but as well all know that the downside to the upside performance of the company and that is the high valuations of the company. Nestle India is trading at a Price to Earnings of 76x when the Industry Average is around 54x and the company is trading 82 times above the book value of the company. Being a market leader of the segment, it does make sense that it trades on such a higher valuation but the investment offers no margin on safety to the investment.

Source - Annual Reports

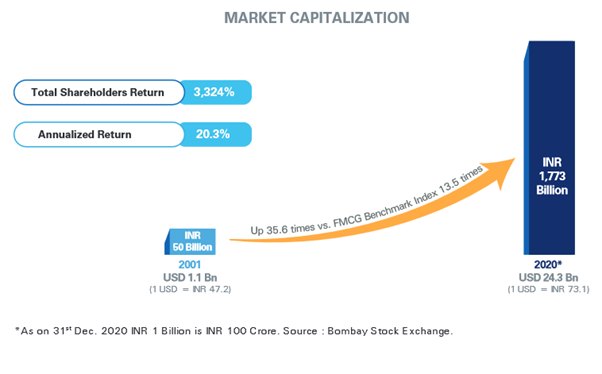

Nestle has rewarded its stock holders handsomely, the Market cap of the company has increased 35.6 times as against the FMCG benchmark Index which has increased 13.5 Times. The Shareholders wealth increased 3,324% with an Annualised return of 20.3% for the past two decades.

Financial performance across the years:

Source – Screener.in

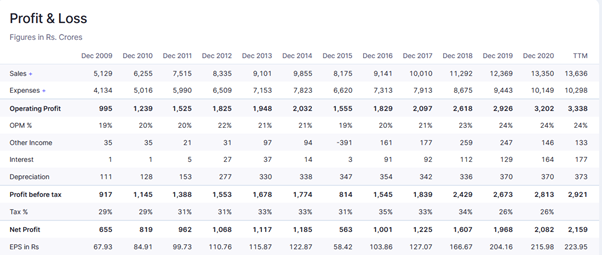

From the above picture, we could see that the company has done pretty well consistently and efficiently over the years. During the year 2015, Maggi was banned for a short span of time across the nation and during that year the company had a degrowth of sales but then they have managed the crisis well and got back on track and that shows the resilience of the company. As the sales increased, the Expenses of the company reduced due to the large scale of economies and the Operating profit has quadrupled over the decade. However, in the past five years the company has given only a 10.5% sales growth, which is a concern given its higher valuations.

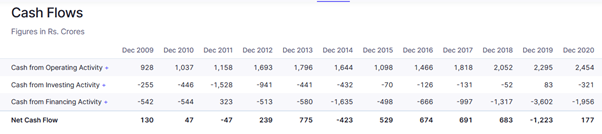

Cash Flow statement Analysis:

Source – Screener.in

For a business to be successful, it should have enough cash all the time and it show also have enough cash generating methods and analysing cash flow statements tells us the cash positions of the company i.e., Cash inflows and outflows. In the case of Nestle India, the company has maintained a positive net cash flow at most of the years and the company has been constantly paying out dividends and thus there is a major outflow in the financing activities of the company. The company also had a free cash flow (FCF) of 1980 Cr and FCF is calculated by subtracting the Capital Expenditure with the Cash flow from operating activities. Nestle has enough cash flow to generate meet its day-to-day requirements without any impediments.

Conclusion:

Nestle is a company that keeps innovation close to its heart, the company has introduced a wide range of products across the division, with a capacity to suffer and take any setbacks, the company is poised to gain from the growth of the nation. The Covid 2 wave is bringing a lot of waves in the stock market and the global indices are also witnessing severe volatility and when the Indian market corrects along with its peers, we might be able to acquire the company at a fair valuation to build a strong portfolio.

share your thoughts

Only registered users can comment. Please register to the website.