Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINIn this world, it’s always the uncommon things that draws the attention, when one does common things at a uncommon way, they demand the attention of the world. The same goes for the successful organizations, they challenge the social conventions and follow a new approach and set a bench mark and one such organization is Shree cement which chose to be uncommon and took a different path.

What’s so unique about shree cement?

Cement is one of the most essential commodities, from the house we live in, the road we ride on from the beautiful bridges we cross needs cement but then there is no difference from your cement and my cement. Of course!!! You might speak about the quality but what if I could say that I could give you a high-quality cement at a lower price than the prevailing one. Shree cement did exactly the same, they challenged the convention by providing cement at lowest price and they don’t do it by reducing the quality but by beheading the operational inefficiencies in the production of cement.

How Shree cement established a Global Cost leadership?

Let’s have a look at how a cement is manufactured, the major raw material for manufacturing cements are limestones and they have to be extracted and then it will be heated in large ovens through a large amount of fuel like pet coke. Shree cement has maintained a good rapport relationship with its suppliers through which they were able to source the fuel at the cheapest rate possible. Then we spoke about the heating process and heating a large oven requires a one hectic load of electricity, when all the cement companies were busy expanding their production capacity, Shree cement forayed into the power sector and they use the electrcity to manufacture cement at a cheaper rate than its peers and in the end they were able to sell their cement at a lower price without lowering the quality.

![]()

Being pioneer in many cost initiatives, SCL enjoys strong operating efficiency which makes it one of the low cost cement producing company in India. The strong operating efficiency of the company arises on account of being

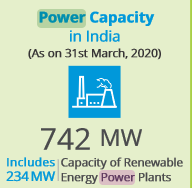

Shree cement has a total power capacity of MW per Annum and this saves them a ton of money for the company and brings in the competitive edge over its peers. Before jumping into the financials of the company let’s see the story of the Cement Industry.

About the Industry:

India is second largest producer of cement after china. Indis’s overall cement production capacity is 545 Million Tonnes in FY – 20 which accounted for 8% of the Global production. Of the total capacity, 98% lies with the private sector and the rest with public sector. The top 20 companies account for around 70% of the total cement production in India. As India has a high quantity and quality of limestone deposits through-out the country, the cement industry promises huge potential for growth.

Currently, real estate sector accounts for 65% of the total cement demand, followed by public infrastructure (20%) and Industrial development respectively. However due to the pandemic, resulting in lower income, majority of demand is expected from government infrastructure and housing projects. With a challenging economy and a less than usual government spend of Infrastructure could tamper the growth of the industry.

About the company:

Shree Cement is engaged in the manufacturing and selling of cement and cement related products. It is recognized as one of the most efficient and environment friendly company in the global cement industry. From being a mid -cap in 2010, the stock is now part of the Nifty 50 league.

Let’s quickly jump into the success story of the company:

Source – Annual report

In the past 10 years, the company has grown has across all the segment systematically and the achievement is no less than being phenomenal and the rise in the stock price is augmented by the growth history of the company. Apart from the power generation, the company has competitive edge of its competitors,

Dominance in North India

Shree cement is one of the strongest players in the Northern regions with operating units at Rajasthan, Haryana, Uttar Pradesh and Uttarakhand. The company markets its products under the brand name of Roofon, Bangur Power, Shree Jung Rodhak, Bangur Cement and Rockstrong which possess a strong brand recall. The company’s strategy to adopt split grinding units close to user markets provides efficiency in terms of logistics cost. As on September 30, 2020. Aggregate sales in Rajasthan, Haryana, Punjab, Delhi and Uttar Pradesh, which are the niche geographical areas accounted for 66% of sales during FY20 (69% during FY19).

Expanding dominance in other regions

The company has gradually forayed into Eastern regions with operating units at Chhattisgarh, Jharkhand and Bihar as well as southern region with operating unit in Karnataka. Shree cement’s aggregate cement capacity is around 40.40 MTPA (consol. 44.40 mtpa) in a combination of integrated and grinding units. Over last couple of years, SCL’s aggregate cement sales to the Eastern region (Bihar, Chhattisgarh, West-Bengal, Jharkhand and Odisha) have increased from 21% in FY17 to 25% in FY20. SCL has successfully commissioned its grinding capacity of 2.5MT in Jharkhand on 28th June 2019, and has further expansion plans of 8 MTPA grinding units in Maharashtra (3 MTPA) West Bengal (2 MTPA) and Odisha (3 MTPA). It has already commissioned its clinker and cements capacity in Karnataka and has also acquired UCC, UAE with a capacity of 4.0 MTPA

Agile Distribution network:

When it comes to cement, the distribution network plays a pivotal role and the company established an extensive network for marketing its products. The company has a network of 22596 dealers, 980 marketing staffs and 794 sales promoters for selling the cement to the end customers in the territories operated. The extent of reliance on any particular dealer is minimal as the top 5 dealers contribute only around 3% to the sales of the company in FY20. Furthermore, in view of the established brand along with strong distribution network, the company finds it easier to expand its reach and diversify its sales.

Strong Liquidity and Cash flows:

Shree cement has been a cash rich company having significant amount of funds invested in liquid mutual funds and bank fixed deposits which provides high comfort. The company has been increasing its capacity multifold (from 9 mn tonne on March 31, 2009 to 44.40 mn (consol) tonne on September 30, 2020) and has still maintained adequate cash and liquid investments.Despite, substantial increase in term loan in FY18 for the Kodala integrated unit (term loan of Rs.1613), the solvency ratio of the company remains comfortable marked by high unencumbered cash and liquid investments of Rs.5939 crore as on September 30, 2020 against total debt of Rs.2953 crore (including security deposits from customers). The high level of cash and liquid investments have been due to the company posting decent GCA which stood at Rs.3158 crores in FY20. As on Sep 20- the company had a reserves of 13,926 Cr and the company has enough capacity to expand its operations through internal accruals rather than depending on the outside source for funding.

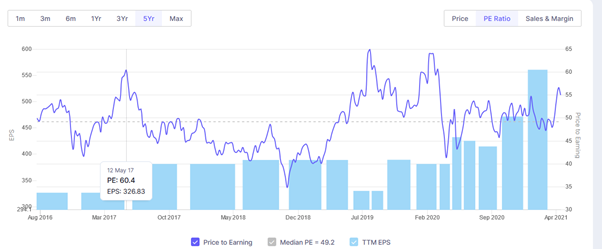

The premium valuation remains a key concern

The stock is trading 7.87 time its book value with a Price to earnings ratio of 55x, when the Industry PE is at 18 and Shree cement enjoys the highest PE among its peers for its robust performance but the premium valuations doesn’t justify a good investment. One can put the stock in the buy on dip list.

How to invest systematically in high PE stocks?

Source: Screener.in

High growth companies with no or less debts and a company with a clean balance sheet often tends trade at a high premium and they tend to stay at higher levels most of the time and correction happens very less often so here is a trick (not a recommendation) to profit out of the high PE stocks.

The current PE of shree cements is 55x where as the 5 Year median PE of the company is 49.2 which means that the stock is trading more than its benchmark valuation which is 49.2 times, so thus we can start acquiring this company when the PE ratio comes to the range of 49 and this happen in two circumstances.

One when the stock prices falls and in the other case when the earnings increase exponentially and in those cases the PE might fall below the benchmark.

Splendid financial performance of the company

Source: Screener.in

When the company becomes big achieving a higher sales growth is hard but shree cement went beyond the saying and achieved a CAGR sales growth of 17.6% and their Operating profit margin is the highest among the industry and this is achieved despite selling their produce less than their competitors. They average Operating profit stood at around 25% and they were able maintain the same despite the volatility in the cement price.

Conclusion - The growth in sight!!!

The liquidity of the company remains and they are effectively deployed in line with the growth strategy of the company, Currently, the company is targeting to increase its cement capacity to 48.40 MTPA by setting up new units in Odisha, West Bengal and Maharashtra. Other capex includes railway sidings in Jharkhand, Pune and Kodla and upcoming integrated units in Northern and Southern India and clinker unit in Raipur. Total estimated project cost for planned capex is Rs. 8,590 crores and the company have a lot of growth to harness given its highest operating efficiency. With Covid disrupting the stock market, Shree cement is a stock which cement the growth of your portfolio.

share your thoughts

Only registered users can comment. Please register to the website.