Karur Vysya Bank: Distribution Network and Adoption of Digital Tools Should Support in Next Leg of Growth

Summary

- Customer-centric approach and diverse suite of offerings are expected to lend support to Karur Vysya Bank.

- In commercial banking group, Karur Vysya Bank is focused to adopt cluster-based approach to cater to MSME market specially in agro-based industries, retail, pharmaceuticals & health care, etc.

- Strong distribution network and sticky customer base should act as principal growth enablers of Karur Vysya Bank.

Overview of Karur Vysya Bank

Karur Vysya Bank is counted in one of earliest banks in this country to achieve full networking of branches under core banking solutions. This bank is a frontrunner in adopting and leveraging on technology to give products and services to customers. Karur Vysya Bank was one of pioneers in installing ATMs, bunch note recycler machines, fully automated passbook printers & cheque deposit kiosks. All these efforts were focused on self- service banking. This bank also set a blazing trail in implementing internet banking and mobile banking to customers. This bank carries with it a tradition of 103 years. Even then, it is young enough to adapt to changing scenario in banking industry.

Growth Enablers of Karur Vysya Bank

- Strong Distribution Network Should Support: Karur Vysya Bank engages with customers through strong distribution network spread across 19 states and 3 UTs. The bank’s strong foothold in India’s southern region lends this bank a distinct edge over its peers. Customers can engage with the bank across touchpoints including branches, PoS terminals and much more. Bank has seen growth in branches from 667 in Mar 2016 to 779 in Mar 2020 with PoS terminals increasing from 10,157 in Mar 2016 to 15,534 in Mar 2020, exhibiting importance of multi-channel delivery. Bank has a diverse set of offerings, with products spanning across loans and deposits. Rapid emergence of technology has necessitated Karur Vysya Bank to adopt and embrace digital tools for achieving scale and enhancing efficiency of systems and processes. In FY20, the bank saw ~85% of retail loans getting disbursed via digital mode.

- Growth in Retail Advances Lent Some Support: Despite challenges the bank faced, it saw strong performance in FY20. Healthy growth in retail advances and steady loan book in agriculture segment helped offset impact of fall in corporate credit. While the bank’s net interest income was largely unchanged, strong non-interest income growth helped achieve overall profitability. Key highlight of its performance was improvement in asset quality ratios. The bank’s gross NPA and net NPA saw contraction versus FY19. Constant focus on enhancing underwriting practices, adoption of superior risk appraisal processes and pushing recoveries have acted as growth enablers.

- Refocus on SMEs and Emerging Corporates: The bank has strong local linkages and sticky customer base which should act as its core strengths. Over near-term, the bank will re-focus on SMEs and emerging corporates, having an aim to achieve rapid growth. Digital transformation should enable the bank achieve greater efficiencies in underwriting loans and delivering other customised services. Focus is on strengthening capabilities and enhancing digital offerings and platforms. The bank has plans to leverage solid foundation and improve financial profile to bring in consistency in operational and financial performance and to grow market share through leveraging traditional strengths. In FY20, the bank digitalised entire loan portfolio and it included more loan products on tablet-based application like corporate personal loans, NRI home loans, secured personal loans and NRI loan against property. The bank formed tie-ups to focus on co-origination of loans, with multiple fintech and NBFCs to enhance last-mile connectivity. Focus of Karur Vysya Bank is on building more products and innovative solutions in retail, SME and co-lending space. Bank is working on launching new products, driving process improvements across products and platforms and making operations more efficient.

- Karur Vysya Bank Should Seek Support from Adequate Capitalisation: Karur Vysya Bank Limited has an established franchise in southern part of India and its adequate capitalisation and strong liquidity profile should act as principal growth enablers. The banking company had liquidity coverage ratio of 368% in Dec 2020. The bank saw steady improvement in deposit profile as CASA increased to 34.6% of total deposits as of Dec 2020. CASA has increased from 31.3% in Mar 2020. Karur Vysya Bank is focusing on changing loan book composition to more granular retail and jewel loans, allowing bank to reduce RWAs and improve capital ratios. Given its asset quality challenges in recent past, it has undertaken changes in underwriting process. This banking company carries an operational track record of 10+ decades, having an established retail franchise in south India. The bank’s branch network was 780 as on Dec 2020, of which 86% were in southern states of Tamil Nadu, Andhra Pradesh, Telangana, Kerala and Karnataka. However, total branches declined from 790 as on Mar 2018 given that bank was in its consolidation phase. With muted advances growth in last couple years, requirement to raise higher cost term deposits was lower. The bank saw steady growth in CASA deposits. Both these factors led to improvement in share of CASA in overall deposits. CASA deposits growth and decreased dependency on bulk deposits led to an improvement in cost of interest-bearing funds to 5.1% in 9M of FY21 in comparison to 5.9% in 9M of FY20.

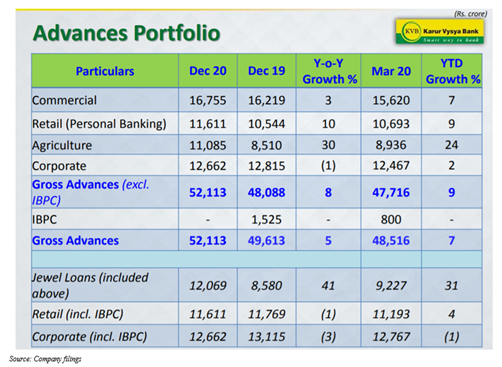

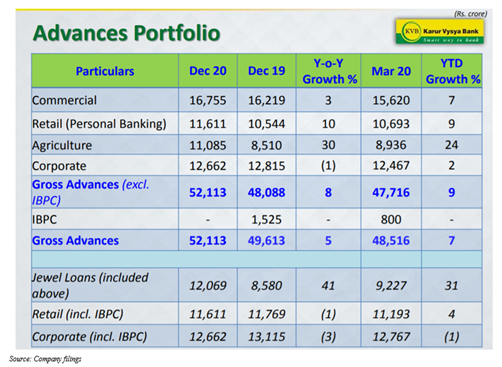

- Focus on Granular Retail Assets: Given high slippages that the bank has seen in corporate segment, changing strategy to focus on granular assets in commercial and retail segments seemed judicious to the bank. Because of this, share of corporate segment declined to 24% of gross advances as on Dec 2020 from 26% as on Dec 2019 while retail segment share increased to 22% as on Dec 2020 from 21% as on Dec 2019. Karur Vysya Bank has sizeable exposure to secured jewel loans as on Dec 2020. This was ~23% of gross advances and is largely classified under agriculture segment, having an average LTV of ~72% and yield of ~8.3%.

Granularisation of loan book should result in modest growth in RWAs in relation to overall growth in advances. This should result in limited consumption of capital in near-to-medium term.

Despite Challenges, there is a Silver Lining

Indian banking sector saw mix of opportunities and challenges in FY20. Digital technology brought major changes in banking sector. Continuing shocks in NBFC sector and trade tensions between US-China, etc. were challenges to banks during FY20. Total business of the banking company was INR1,07,591.38 crore as on Mar 2020 against INR1,10,483.61 crore of previous financial year. On CASA side, savings deposits reached INR13,002.61 crore, exhibiting a growth of 7.45% from INR12,101.39 crore of previous financial year and other demand deposits were INR5,504.10 crore against INR5,813.59 crore of previous financial year. The banking company’s total CASA reached INR18,506.71 crore as on Mar 2020, exhibiting growth of 3.30% from INR17,914.98 crore of previous financial year.

The bank’s interest income reached INR5,989.99 crore as on Mar 2020, exhibiting a growth of 2.99% from INR5,815.82 crore of previous financial year and net interest income was INR2,347.94 crore and was slightly down 0.63% from INR2,362.82 crore of previous financial year. Non-interest income reached INR1,154.62 crore by exhibiting sound growth of 19.93% from INR962.77 crore of previous financial year. Bank is focusing on containing NPAs by seeking help from better credit monitoring and follow-ups through dedicated outbound call center. Bank took several initiatives to keep a check on fresh slippages and to speed up recovery from overdue loan accounts through regular & constant follow-ups, regularly reviewing credit underwriting system using technical environment and information technology platform.

Dirt Cheap Valuation Means Go Long on Karur Vysya Bank

Karur Vysya Bank has a total market cap of ~INR4,35,546.81 lakhs and free float market cap of ~INR4,26,043.20 lakhs. Investment portfolio of the bank reached INR16,072.60 crore as on Mar 2020 by exhibiting 6.18% growth from INR15,136.52 crore of previous financial year. Investment portfolio composition was consistent with corporate requirements, risk perception and investment policy. Income earned on investments was INR1,149.67 crore for FY20 against INR1,150.59 crore of previous financial year. The bank saw profit of INR339.99 crore on sale of investments against INR70.48 crore of previous financial year, exhibiting strong growth of 382.39%. While the bank focused on preventing large volatility, modified duration of overall portfolio was reduced. The bank maintained liquidity position at comfortable levels across FY20.

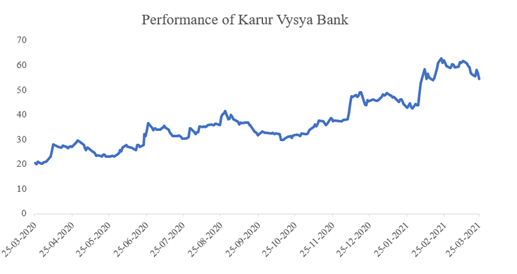

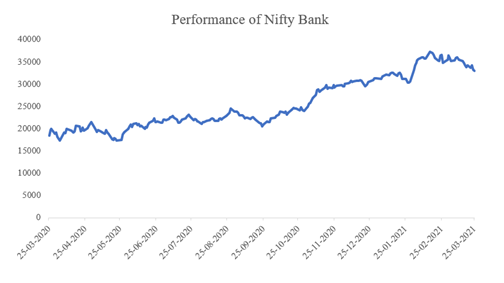

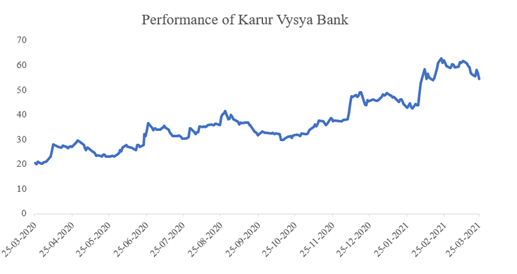

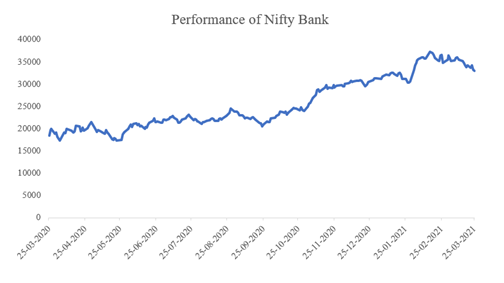

Between Mar 25, 2020 and Mar 25, 2021, stock price of Karur Vysya Bank increased by ~166.3%, with much of this growth stemming from opening up of business activities and government intervention to revive Indian economy. In comparison, nifty bank generated returns of ~78.60% between Mar 25, 2020 and Mar 25, 2021.

Let me explain this with help of an example. If an investor had invested INR1,00,000 in stock of Karur Vysya Bank on Mar 25, 2020, it would have become INR2,66,259.16 on Mar 25, 2021.

At current price of INR54.50 per share, stock trades at ~18.54x FY20 EPS, which is at a deep discount to sectoral average of ~24.64x. This suggests that investors should go long on Karur Vysya Bank.

Exclusivity:

This article is exclusive to investoguru.

Stock Disclosures:

The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Author Disclosures:

This Article represents the Author's own personal views. The Author did not receive any compensation and do not have any business relationship with any of the companies mentioned in the Article.

share your thoughts

Only registered users can comment. Please register to the website.