Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINThe History of the company:

Most of us know that the Tata group of companies but there is also another strategic player who built the Titan. The ‘Ti’ stands for Tata Industries and the ‘Tan’ denotes the other strategic player of the company - Tamil Nadu Industrial development corporation. The joint venture began in the year 1984 and back in those days only the Tamil Nadu corporation had the license to manufacture the watches and the Tata’s had the enough skills to turn the business into a profitable venture and the partnership was fruitful to both the parties and indeed its investors made a fortune through riding along with the success of the company.

The partnership didn’t stop with the manufacturing of the watches, they forayed into multiple segments and the one noteworthy segment was its jewelry business (tanishq).

How Titan became the crown jewel of Tata Enterprise?

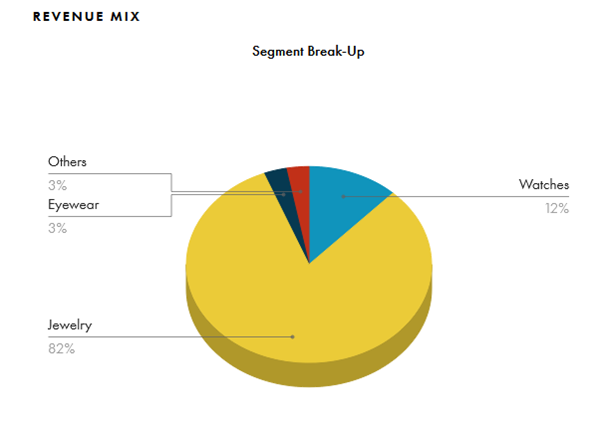

Titan is indeed a successful company but it couldn’t have scaled this height without its jewelry segment and the Jewelry segment contributed more than 80% of the revenue of the company.It was the jewelry segment which turned the fate of the company from a mere watch manufacturer to one of the India’s leading company in India with a Market cap of more than 1,30,000 Cr.

But then there was a time when the gold venture almost killed the company, they had a loss to the tune of 150 Crs and the stock price went to Rs.2 during 2001.

The turnaround story of Tanishq

When they started the business, they introduced 18 Karat gold than the usual 22 Karat gold, thinking that the less price would bring more customers but they forgot one thing about the Indian Jewelry business – Gold is not just an ornament. Hence it is considered as an Asset, a store of value and wealth. This mistake almost costed them their valuable company but soon they turned the company.

Back in 2000s, it was the unorganized sector which had complete control over the Indian gold business and in most cases they were exploiting the consumers by selling the low quality of gold under the name of 22K gold.

Titan took advantage of this issue and introduced Karatmenter – which tests the quality of the gold.

Any consumer can come to the showroom and test the quality of their gold for free and the major move was that the consumers can also exchange the gold in case if the quality is between 18 to 21 Karat by paying the difference alone and this move changed the tide of the company and all the showrooms were making an average sales of 1 Cr per day.

The Jewelry business now contributes 82% of the revenue and this turnaround made Titan one of the India’s most successful consumer brand. The story of the Titan is a great case study for the business schools but leaving the past victory of the company now lets have a look at the current business and the valuations of the company and ponder whether it’s a good company to invest or it falls under the category of “ All good companies are not good investments” criteria

The competitive edge of Titan

Undisputed leadership in the watch segment

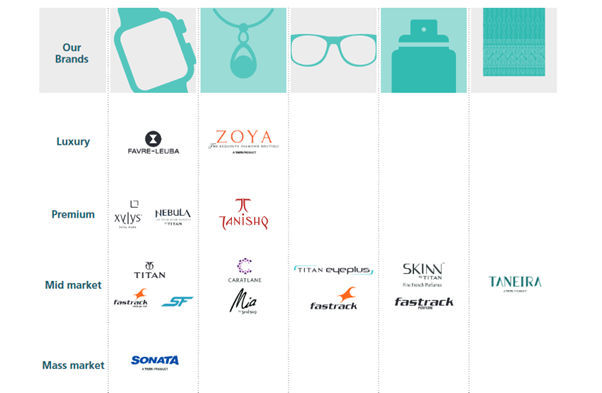

Titan is the leading domestic watch manufacturer with more than 60% market share in the organized segment and they are also the world’s 5th largest watch company. The company has a strong brand across various price segments which caters to all the customers from the bottom to the top of the pyramid.

Source – Annual Report

The Company also holds a 49% equity stake in Montblanc India Retail Private Limited (Montblanc), a joint venture entered into with Montblanc Services B.V., the Netherlands for the operation of retail boutiques in India for Montblanc products.

Titan Company Ltd is among India’s most respected lifestyle companies. The company also enjoys a good brand value by being a part of the Tata group and enjoys a good customer acceptance for its new products. `

Higher growth potential in the Jewellery segment

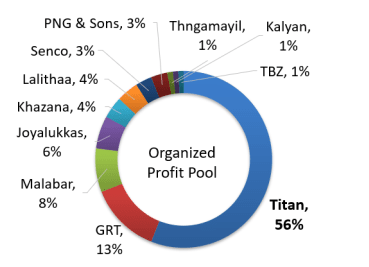

Indian jewellery market is estimated at 4.45 Lakh crores and Titan just holds only 4 percentage of share in the big pie but the company also hold 56% share in the organised sector.

Increasing regulatory restrictions in the jewellery segment, aimed towards greater transparency and higher compliance costs have been resulting in a sizeable churn in the unorganised segment, thus benefiting the organised players such as Titan. Titan’s jewellery business has been consistently gaining market share on the back of its strategies of increasing its revenue share from wedding and high-value studded segments.

Moreover, its expanding presence in geographies with low-market share and enhancing customer value proposition through Golden Harvest scheme and gold exchange programme have increased its revenue base. Titan currently has 340 Tanishq stores and they have plans to expand at a large scale in the Tier 2, 3, 4 cities where there is an immense growth potential waiting for the company.

Continuing its success charm in new business

Apart from its presence in the watch and the company also has its presence in the Eye wear segment, under the brand Titan Eye plus and it continues to be priority channel, along with our presence at multi-brand outlets and departmental stores for our sunglasses. Keeping the textile growth opportunity in mind, the company has forayed into the field under the brand Taneria and they also have license agreement with various brands for selling their products apparels

.

.

The Covid challenge:

Covid was not easy for any of the industry and we all edged forward but it looks like the worse is yet to show its face and as most of the products of the company needs a touch and feel before buying the product and going online was not a good alternative for the jewellery division.

Source – Screener.in

The falling economy and the raising gold prices kept the people away from the showroom and the company had 56% de- growth in the June quarter and slowly the sales picked up in the next two quarters and the upcoming quarter can be hard for the jewellery division. Due to the Covid hiccups, the company also lost the wedding demand.

The Watch segment also had a worst time in the June quarter and then the sales have slowly picked up but the eyewear segment has surprisingly performed phenomenally over the last couple of quarters. The raising covid cases will pose a new challenge to the company but Titan is known for its agility and the company has always comes up with its out of the box solution for all its problem and we have to look out how the company is overcoming its big obstacle.

Low Margin of Safety due to High Valuations

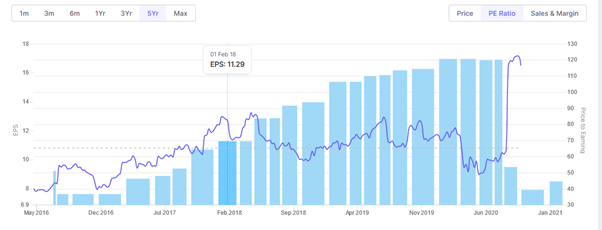

The PE ratio of the company is 180 times on TTM basis and trading 21.6 times its book value and a better way putting this is that the Investors are ready to pay 180 Rs for every one rupee the company earns and that offers no margin of safety. One major reason for the high PE ratio is that the earnings of the company took a big hit due to the covid.

Source – Screener.in

From the above chart, we can see that the earnings has fell more than 60% than the average earnings of the company and thus, the PE ratio is at all time high and one can get a better margin of safety when the stock prices falls or the earnings increase to the previous level but due to the raising covid cases and the products of the company is not essential, it would take a longer period to see a uptick in the earnings of the company.

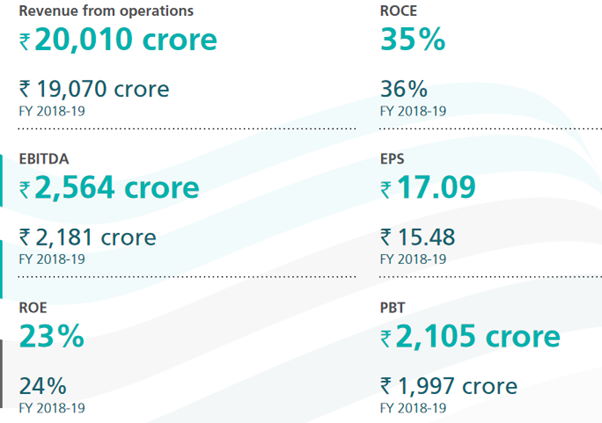

Financial performance of the companSource – Annual report

The above is top line numbers of the company during FY -20, The revenue of the company has increased despite the Covid and the company was able to maintain its ROCE at higher levels and apart from the above numbers. The Debt to equity of the firm remains at 0.55% which is another positive sign and the average OPM of the company is at 10% which is above its peers. Despite the hardships in the operating backdrop, the company has delivered a satisfactory financial performance.

Conclusion:

Indian continues to tackle the health crisis unleashed by the pandemic and the struggle is going to continue for a couple of months. Malls & Stores are going to be closed and as most of the products are under ‘’Touch and Feel” category sales are going to be under pressure. The transformed economic situations necessitate the company to look for new opportunities and reduce the cost at every possible way. Titan is poised to gain traction after the dust settles but the uncertainty will remain over the company.

share your thoughts

Only registered users can comment. Please register to the website.