Strong Brand Value and Sectoral Dynamics Should Help Indian Hotels Company Limited

Summary

- Well-diversified suite of hospitality offerings and healthy growth prospects should act as growth enablers once travel and tourism sector gets back on growth path.

- Focus on cash conservation and adequate liquidity measures should lend some support and help the company achieve growth.

- In FY20, the company expanded portfolio with 12 openings at an average of 1 hotel per month.

The Indian Hotels Company Limited

The Indian Hotels Company Limited works for bringing together a group of brands and businesses offering a fusion of Indian hospitality and world-class service. These include Taj, SeleQtions, Vivanta and Ginger. Incorporated by founder of Tata Group, Jamsetji Tata, the company opened first hotel - The Taj Mahal Palace, in Mumbai. The Indian Hotels Company Limited has a portfolio of 196 hotels including 40 under development globally across 4 continents, 12 countries and in 80+ locations. The Indian Hotels Company Limited is South Asia’s largest hospitality company if measured by market capitalization.

With businesses ranging from iconic luxury to upscale and budget stopovers and in-flight catering, the company’s pioneering leadership stems from rich 115-year legacy. The company’s emerging initiatives in urban leisure, service retail, and concept travel form part of its evolution.

Growth Enablers of The Indian Hotels Company Limited

- Management of Operational Costs Should be Priority: In 3Q21, revenues of Indian Hotels Company Limited was up by 90% to INR615 crore vis-à-vis Q2 and it saw positive EBITDA of INR38 crore for first time in FY20-21. During 3Q, the company signed 6 new hotels with 1100+ rooms across brands at multiple locations and states in India. Presence was improved in Eastern part of India with signing of 3 Taj hotels, 2 in Kolkata and 1 in Patna. 3Q21 saw stronger recovery principally stemming from leisure demand and resumption of weddings. The company continued to unlock potential of its ancillary businesses, establishing alternative sources of revenue. Whilst COVID-19 is still impacting hospitality sector at large, the company’s performance showed consistent progress quarter on quarter. Quarter on quarter, the company is seeing positive revenue growth and is delivering on spend optimization. Focus is on introducing initiatives to manage operational costs and improve balance sheet’s position. Given current environment, management of operational costs should be the company’s priority and it should be in a position to cope up when normalisation occurs.

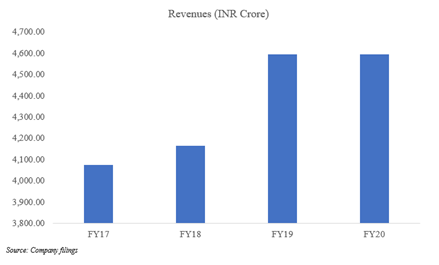

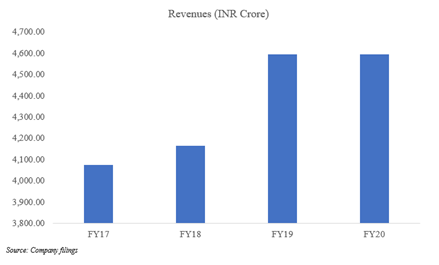

- Increased Signings Should Help Improve Scale: As a part of growth blueprint, the company has enhanced speed of new hotel launches. Signings tripled from ~1,000 rooms annually in FY16-17 to 3,700+ rooms annually in FY19-20. Likewise, the company opened one hotel every month in FY19-20, exhibiting multi-fold growth over FY16-17, when the company just opened 5 hotels. The company identifies locations having high growth potential and establishes appropriate procedures for market traction. As the company achieves higher scale with help of an asset-smart strategy, its leading position across most brands allows the company to demand premium pricing in comparison to industry average. With occupancies improving, the company’s revenues have seen consistent growth. Focus area is to improve overall profitability by enhancing operational efficiencies. These types of strategies stemmed sustainable turnaround of the company’s operations with margin expansion.

- With Sectoral Challenges, There is a Silver Lining: Travel and tourism industry makes up for ~10% of global GDP and is responsible for 1 out of 10 jobs. In India, this sector is a significant contributor to GDP and it also contributes 8.1% to overall workforce. Thus, given sector’s significance, this industry should play an important role in any economic revival. Though travel and tourism sector is yet to see its full recovery, there has been some sort of improvement. More focus on safety in post-pandemic world should help the company as travellers should prefer the company’s trusted and reputed brands. As situation gets back to normal, the company should be one of early beneficiaries from recovery. Achieving prudent expansion across segments/ locations and maximising potential of brands should act as principal growth enablers. The company has a mix of owned hotels, hotels under management contracts and ones owned by its subsidiary companies. Apart from this, the company constantly looks for strategic and value‑accretive acquisitions, allowing it to achieve higher efficiency while allocating capital and enabling it to maintain favourable risk-reward profile.

- Pillars of Aspiration 2022 Strategy: This strategy focuses on 3 pillars:

- Re-structure: This pillar focuses on scaling up inventory across multi-product and multi-segment categories, selling non-core assets, non-performing hotels having bleak prospects and simplifying holding structure and processes.

- Re-engineer: This pillar stems from expanding margins by strengthening culture of operational excellence and embracing technology and digital environment, engaging closely with people and building a strong talent pipeline.

- Re-imagine: This pillar focuses on managing brandscape and grow across varied segments of luxury, upscale and lean luxe and multiplying portfolio and reach in select markets.

- External Environment Should Continue to Lend Support: Over past couple years, India has emerged as a principal destination. Favourable demand‑supply dynamics and rising consumption are principal growth enablers and these should continue to support sectoral dynamics. Considering risks emanating from pandemic should gradually abate, demand for short trips to destinations nearer to homes should increase. Technology is challenging traditional business models, resulting in emergence of new ones. Over past couple years, industry has seen a rapid growth in online transactions. Trend should accelerate further in a post-COVID world where social distancing will be a new normal. Need to maintain social distancing can result in reduced footfall and seating capacity. Restaurants and hotels with better facilities should be able to meet safety and hygiene standards, resulting in better traction. Online food ordering and food delivery can see quicker demand recovery.

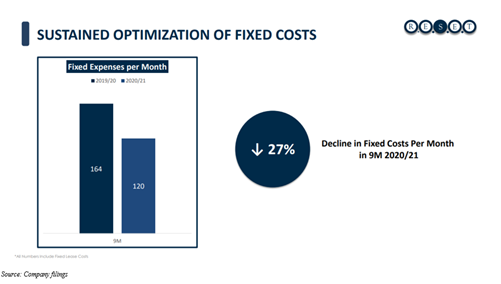

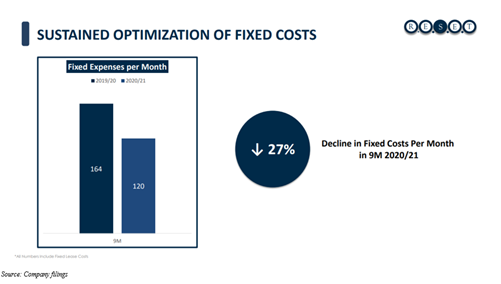

- Sustained Performance in 9M to Dec 2020: The company is able to maintain its growth and its continued focus on excellence and well-being. It has seen sustained optimization of fixed costs with these costs declining 27% per month in 9M of FY20-21. Restructuring of costs should help the company improve profit margins. The company has instituted spend optimisation programme to manage its fixed costs and rationalise its resources. While variable costs have seen reduction with lower business volume, the company’s focus is now shifted to fixed costs.

7. Maintenance of Adequate Liquidity: The company took some immediate measures so that cash flows can be kept under check during FY20 and liquidity can be maintained. These include deferment of capital expenditure and renovations, unless necessary. The Indian Hotels Company Limited has also provided liquidity for capital commitments on work which was undertaken and was completed prior to lockdown. The company has drawn down lines of credit and benefited from Targeted Long Term Repo Operation programme which was announced by Reserve Bank of India so that liquidity can be improved. In Apr’20, the company repaid debenture obligations of INR200 crore and met all debt obligations. It has not sought any moratoriums and is pretty strong on liquidity front given its strong financial ratios of debt/equity and debt/EBITDA.

8. Monetisation of Existing Assets: The Indian Hotels Company Limited has in place strategic investment platform with GIC for acquisition of marquee assets in key cities. It can leverage this platform to monetise existing assets and grow inorganically by acquisition of distressed assets that are expected to come to market over medium-to long-term.

9. Multiple Alternative Revenue Opportunities: The company’s brands enjoy tremendous trust of patrons, guests and neighbourhoods where it operates hotels. Given limitations that current pandemic situation has imposed, the company explored alternative revenue opportunities. This is done to ensure business continuity. These include Hospitality@Home programme through which hotels supply bakery, confectionery and gourmet hampers, wellness and laundry services to homes.

Exploration of digital channels is being done to make more products and services available to guests. The company expects all hotels to become operational in a systematic manner once lockdown is lifted and confidence gets restored. Business recovery should be stemming from domestic leisure tourism and domestic business travel.

Conclusion

The Indian Hotels Company Limited has a total market cap of ~INR12,48,721.37 lakhs and free float market cap of ~INR7,34,375.69 lakhs. Over FY17-FY20, the company compounded its consolidated revenues at ~4.1%, with strong economy and digital disruption acting as principal growth enablers.

Stock of The Indian Hotels Company Limited has seen an increase of ~52.54% over Mar 23, 2020 and Mar 23, 2021, with most of this growth being supported by opening up of economy and pent-up demand.

Management of costs and multiple alternative revenue opportunities should help the company maintain sound profit margins. Though weakness in demand can be extended, the company should seek some support as a result of strong brand value. Leadership position and scalable business model should act as principal growth enablers.

Exclusivity:

This article is exclusive to investoguru.

Stock Disclosures:

The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Author Disclosures:

This Article represents the Author's own personal views. The Author did not receive any compensation and do not have any business relationship with any of the companies mentioned in the Article.

share your thoughts

Only registered users can comment. Please register to the website.