Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINThe Silver screens of PVR is not back yet

Let's face the reality, The virus is still raging and its shaking our economy and Covid is here to stay longer than we all expected and the Hotels,the Tourism Industry is all shaken up alteast they are allowed to operate at full capacity in most of the places but theatres are dieing a slow death not only because of the covid but also the willinges of the people to change to the OTT platform.

The Unlock 5.0, Covid Second wave, Night lockdowns,Weekend lockdowns have become the most common words.Some times there is a vaccine hope and sometimes there is a fear of new virus variant but in the end, it all comes down to how you, I and the rest of us feel and ow ready are we to go to a restaurant and a shopping mall.Most of us are readu to go outside and explore just because we are fed up staying at the home but

are we ready to take the risks again and again,The most probable answer that we might get is a big - NO.

We will see why the second wave can be deadlier for the PVR cinmea

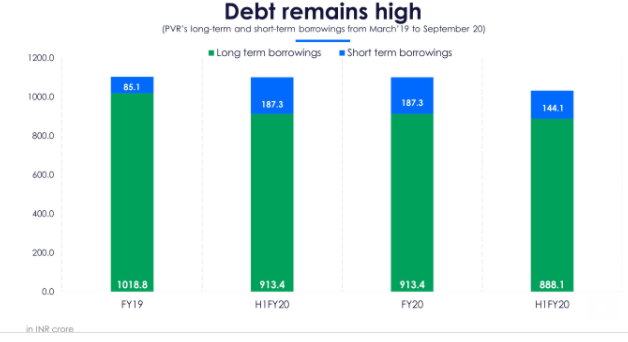

Raising debts and falling revenues

Source - Trendlyne Markets

The companies debt has been increasing significantly and the Debt to equity of the company stands at 3.58%, despite the fact that the company has recieving outside investment to the tune of 1,1000 crores in the previous financial year but all the efforts made by the company goes in vain because of the falling sales but a fixed expenditure.The company has to borrow more to meet up with the expenses and it had a long term impact on the companies financial.

The debt position is high and the cash flow being tight, PVR is stuck between a hard times and with the future offering less hope and we are all excited to see the climax of the PVR cinmeas and can only pray that the thinghs will turn bighter again and the screens of the PVR begins to glow again.

Proliferation of the OTT platforms:

The major villlian for the company is not the Covid or the raising debts ateast they seem defendable to some extent but the change in the trend is ineed making the business bleaky. Enternainment is inevitable and its soothes the tired soul but then people started realising that you can be happy by watching the movie in a OTT platform as much you go and see in the theatre.

Why OTT platforms are gaining the edge.

1.Cost effettiveness

If you are living somwhere in any of the metropolitan cities, you probably know about the cost involved in watching a movie at the PVR screens, its not about the movie tickets but about the Food & Beverages which are sold at probably a 900% above the cost. In the end, if you have a popcorn and a small coke - the cost comes around 800 - 1000 INR. If you compare the same with the OTT platform, Netflix mobile plan comes at 2388 per annum and the cost of the basic plan is 5988 per annum. Amazon and Netflix comes way cheaper than Netflix and we can conclude that the OTT platofrm are cost effective than the Theatre.

Though, we can't discount the pleasure that we derive going to a theatre and then the big budget producers can't make money producing the movie in a OTT platform and we can't totally conclude that the era of OTT platform is closing the curtains on the theatres but there is indeed an impact on the growth of the company though the impact is not measurable but the impact can be felt.

2.Time and Convenience

A family can watch the movie in the living room of the home and can enjoy a movie at a lesser cost and you don't have to travel and stand in a queue wasting your time.Thus the convenience that the OTT platforms provide over the traditional theatres is overwhelming and thus this is one of the edge that the OTT's has over the theatre.

3.Wide range of choices

You don't have to sit at a boring movie just beacuse you have paid for the tickets.The OTT platforms comes up with a wide range of contents and has a contents which suits any of your mood.They also come up with constant new content more often and gives user a lot of choices to choose from and the OTT platforms has been a boon for the low budget but good content as they get a good profits and a wider reach through the OTT platforms. This wide range of choices has been one of the factor which has aided he growth of the OTT platforms.

The other story of the rise in the OTT platforms

We are all afraid that the OTT platforms might win the battle against the theatres but the Cheif content officer of the world's largest OTT platform has a different view:

Ted sarandos, the CCO of Netflix said:

His words does offer some sort of hope in the pessimism around us and it offers a different persception but the reality is slighlty different and we will know the reality only when the covid dust settles.

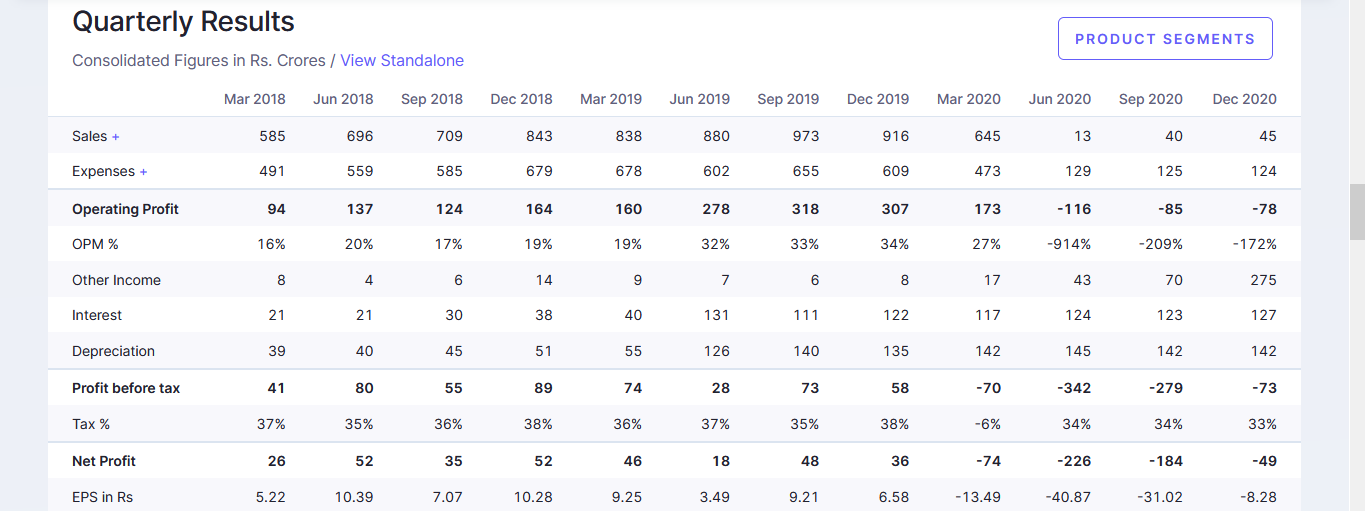

Financial performance of the company:

Source - Screener.in

The FY - 20, has been a total distaster for the company and the sales has been meagre, the expenses outwitted the sales by three times and a huge operational loss and after including the Interest cost the loss has increased substanially and it's a no brainer that the company can survive onl if there is an increase in sales and the company can't count on raising the funds again and again.

Currently, we can leave the growth story and focus whether the company can survive if the sales are down for the next two upcoming quarters.

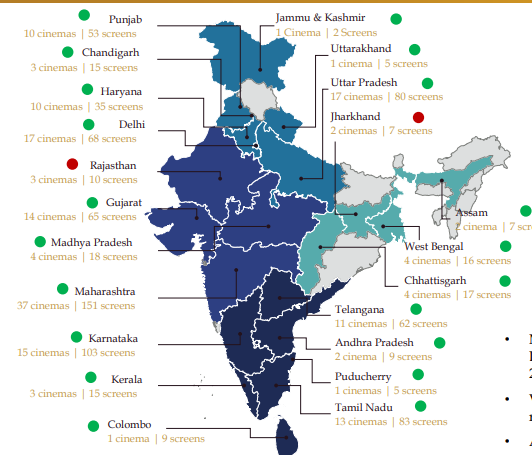

The screening capacity of PVR cinema's

Source - Investor presentation

The company has a total of 835 screens of which there is a high concentration in Maharashtra, Karnataka and Tamil nadu and all of these states has imposed a strict lock down measures and 50% occupancy rate has to be strictly foloowed in most of the other states and theatres will be last place that the governemnt wants to unlock at the moment.The company is negotiating with the landlords for debt reduction and the reductions are helping the company but the small cuts isn't gonna help the company in maintaing the good financial of the company.

Technical outlook on PVR cinema's

The above chart is the one day chart of the company and just like the broader market, PVR has increased significantly from the March 2020 lows but the stock has als corrected from its recent highs when the broader index is still at elevated levels.In the recent days,we can see that the trend has been bearish and there is sell on rise seen in stock and the 50 DMA is cutting the 100 DMA moving average from above which is a bearish crossover and based on the analysis we could see that the stock is in the bearish zone and the next support zone of the stock is at 1045 zone.

There is a ample of pressure on the stock both technically and fundamentally and we could see a depreciation of the price in the upcoming days and there is a possibility of the retracement from the above support zone and if its broken then we could see the stock price in triple digits.

Conclusion:

PVR cinema's is indeed a good company but just that they got caught in an episode which is beyond their control and we can't let the raising market lure us into investing in the company, we have to wait till the golden curtains open and not fall in the value trap and get wounded by catching the falling knife.The Debt burden of the company will impact the future and in the end PVR is at the mercy of the Covid 2.0 and the governments relaxtion measures, Will the curtains be opening and functioning fully at the end of the year? Do you think that the company can survive to see the end of the year?

share your thoughts

Only registered users can comment. Please register to the website.