Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGIN

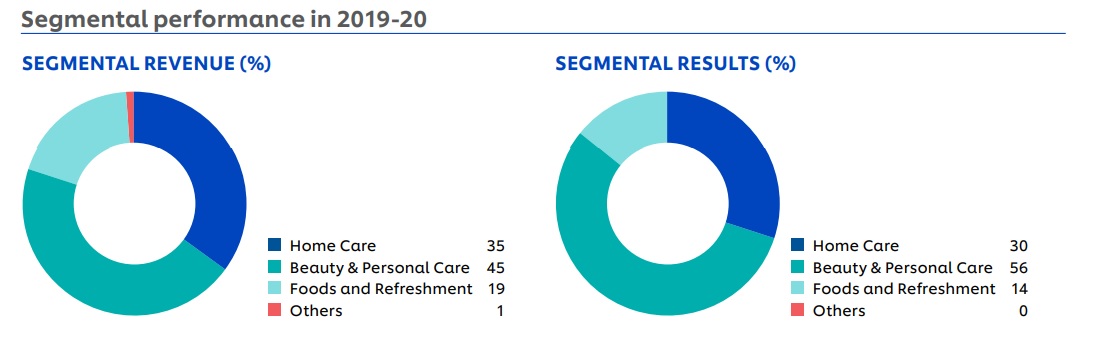

Hindustan Unilever (NSE:HINDUNILVR) is a leading consumer goods company in India. HUL is one of the world’s leading suppliers of Food and Refreshment (19% of FY 2020 revenue), Home Care (35%), Beauty and Personal Care (45%), and other (1%) products. The company has a portfolio of powerful household brands like Surf, Brooke Bond, Lipton, Lifebuoy, Lux, Lakme, etc. Few of its brands like Brooke Bond and Pond’s have histories dating back to 1900 and 1947, respectively.

HUL is a subsidiary of Unilever, one of the world’s leading suppliers of Food, Home Care, Personal Care, and Refreshment products. It has a large global presence and operates through 400 brands in over 190 countries and a 25 million-strong global network of retailers. The brand’s popularity can be gauged from the fact that about 2.5 billion people use its products every day. Strong brand visibility, leading market share, large geographic footprint, and a large portfolio of consumer products are HUL’s strong competitive strengths. The company’s name change to Hindustan Unilever Limited in 2007 reflected its Indian heritage as well as its global alignment with Unilever.

HUL Pros

i) Market-leading brands - Hindustan Unilever has a bouquet of successful and popular brands like Lux, Lifebuoy, Surf Excel, Rin, Wheel, Glow & Lovely, Pond’s, Vaseline, Lakme, Dove, Clinic Plus, Sunsilk, Pepsodent, Closeup, Axe, Brooke Bond, Bru, Knorr, Kissan, Kwality Wall’s and Pureit. The company owns 44 brands spanning 14 distinct categories such as soaps, detergents, shampoos, skincare, toothpaste, deodorants, cosmetics, tea, coffee, packaged foods, ice cream, and water purifiers. More than 80% of its brands are the top two in their markets. Its Surf Excel forms part of its Rs. 5,000 crore brand club with Wheel, Fair & Lovely, and Brooke Bond fitting in the Rs. 2,000 crore category.

ii) Extensive distribution network and market share - HUL has manufacturing facilities across the country and sells primarily in India. The company derived nearly 3.5% of its revenue from international markets. HUL operates through a network of more than 1,150 suppliers and 4,500 distributors. It has over 30 manufacturing facilities and over 8 million stores. HUL occupies the leading market share in the skincare (54%), dishwashing (55%), and shampoo (47%) segments in India.

iii) Large portfolio of consumer goods products - The company further benefitted from the merger with GSK CH India and added popular brands like Horlicks and Boost to its product portfolio. The integration was seamless and further helped in gaining market share especially in rural India which offers significant growth potential for these brands. HUL is expected to benefit from synergies in the near to medium term. The GSK CH business is expected to generate Rs. 4,500-5500 crore in FY2021. It also acquired Glenmark Pharmaceuticals-owned intimate hygiene brand VWash last year. The brand is expected to fortify HUL’s Beauty and Personal care segment.

iv) Benefit from the growing Indian saga - HUL has a rich heritage of 85 years in India and is the largest fast-moving consumer goods company in the country. It is one of the oldest and most common household names in India. Brands like Lifebuoy, Lux, Surf, Pureit, Domex, etc. have reached millions of people across the country through its excellent distribution system even in the remotest parts of the country. HUL is well-positioned to gain from the increasing demand for cleaning products that are safe yet effective and focusing on hygiene and holistic wellbeing in the current scenario. The long-term potential of FMCG India remains intact. Growing consumerism, rising population, and increasing awareness towards health and hygiene act as strong tailwinds for HUL’s growth in India.

Covid Impact

Most of HUL’s products fall under the essential goods category, the demand for which remained unaffected during the pandemic. The company, in fact, benefitted from increased demand for sanitizing products and consumables. It gained from portfolio prioritizations and new demand capture and fulfillment models. HUL generated resilient performance even in challenging times with 97% of its business gaining volume share. Demand for its products like Surf Excel and Domex claiming to kill more germs and viruses got more popular during the ongoing pandemic. Lifebuoy laundry sanitizer and germ kill spray were also launched during this time. HUL witnessed high double-digit growths led by Lifebuoy in the beauty & personal care segment.

HUL’s e-commerce sales accelerated during this time. Its beauty & personal care and foods & refreshment segments gained while the home care segment remained stable. Higher penetration rates and strong e-commerce supported growth. Consumer focussed innovations also yielded good results. HUL launched Nature Protect, a range of innovative hygiene products infused with natural neem extract for the current consumer requirements. In-home consumption trend continued to support portfolio growth with double-digit growth in Ketchup and Soups. However, a few of its discretionary brands like Lakme, Axe, Vaseline, and out-of-home brands like Kwality, Cornetto, etc. suffered during the pandemic.

Valuation

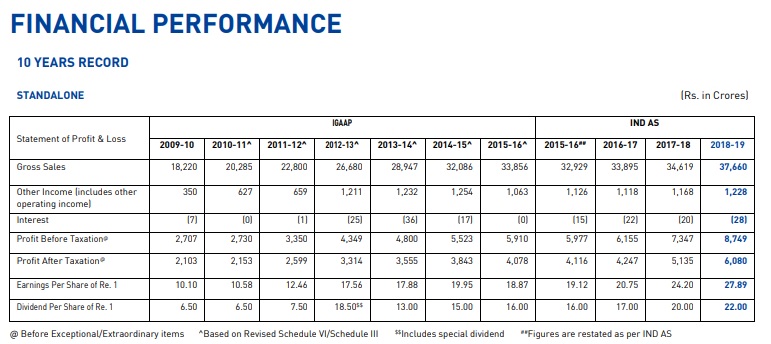

HUL has a market capitalization value of more than Rs. 565,100 crores and its shares are currently trading at ~75 times its earnings. It is the largest FMCG company in India by market capitalization value followed by Nestle India with a market capitalization value of Rs.164,690 crores. HUL shares are currently 8.5% below their 52-week high price. The company also pays regular dividends and sports a modest dividend yield of ~1% but has been maintaining a healthy dividend payout of 80%. HUL paid an interim dividend of Rs.11 per share and the total dividend for the FY 2019-20 amounted to Rs. 25 per share representing an increase of 14% YoY. Its revenues and net profits have grown at 8% and 13% CAGR, respectively in the decade.

Data Source: Money Control

HUL’s EBITDA has also improved by 890 bps in the last decade. Its market capitalization value has also multiplied by four times since 2013. The company generates strong cash flow from operations and is almost debt-free. It has a good return on equity track record with the three-year ROE standing at 80.97%. The current ROE and ROCE metrics are also impressive at 85% and 117%, respectively.

Unilever has 61.9% shareholding in HUL. The promoter shareholding has declined by 5% in the last three years.

Future Opportunities

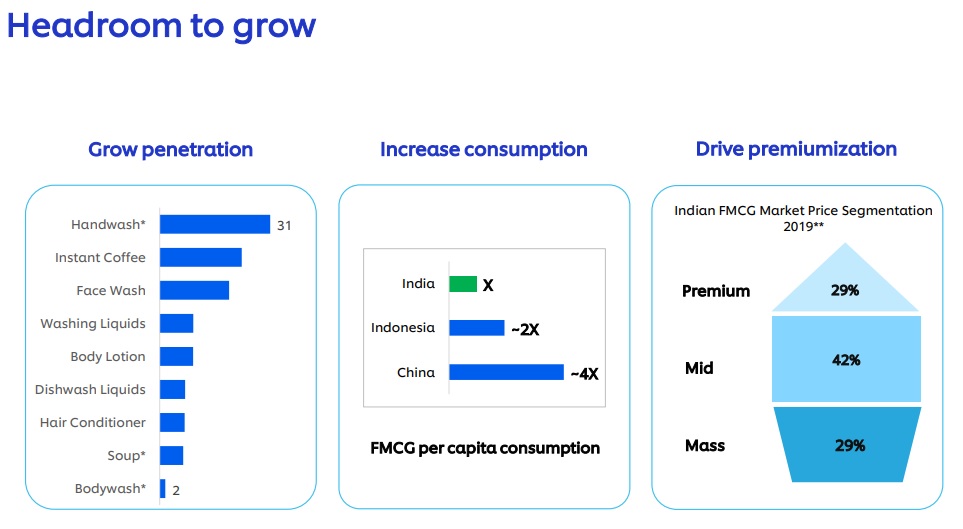

Given a rich heritage, experience in consumer goods, and a large and evolving portfolio of consumer goods, Hindustan Unilever is well-positioned to leverage on the mega-trend of health and wellness. There is a growing awareness for health amongst the masses and HUL should gain from this trend. The company will continue to build demand by increasing relevance and affordability. HUL is also focusing on volume growth to capture market share. It has opportunities to increase physical reach by covering more stores. HUL is focusing on entering the fast-growing segments of the future in the premium beauty and personal care category. It is also launching successful brands and products in select geographies.

Source: Investor Presentation

Challenges

Hindustan Unilever Limited operates in the FMCG industry which is highly competitive and dependent upon the prices of commodities and raw materials. Any inflation in commodity prices will have a direct impact on the cost of the finished products and hence on the company’s profitability as it leads to an increase in input costs. Inflationary pressures continue to weigh on HUL’s margins in the short term. The company is implementing calibrated price hikes to combat input price inflation. Moreover, product mix normalization, product price hikes, and operating leverage benefits should also offset HUL margin concerns.

Hindustan Unilever is one of the five largest FMCG companies in India and faces intense competition. The other four being Britannia Industries, ITC Ltd., Nestle India, and Godrej Consumer Products Ltd.

Bottom Line

Access, relevance, and new product development should help the company grow its reach. HUL is well-positioned to adjust to evolving customer needs such as clean living, preventive immunity, e-everything, and value-seeking. HUL’s growth fundamentals remain robust. The company continues to strengthen its coverage, expand rural reach, and take e-route to market. HUL is witnessing improved domestic consumer growth and higher business penetration rates. In-home consumption trends should continue to support growth in foods and refreshments while increased demand for hygiene should act as a tailwind for the home care segment. HUL is investing in consumer-centric innovations, market development, and capabilities on the back of improving demand outlook.

share your thoughts

Only registered users can comment. Please register to the website.