Bilcare Limited: Sharp Focus on Pharma Sector Should Act As Growth Enabler

Summary

- Focus on cost reduction and improvement in production efficiencies should lend support to next leg of growth.

- Support of regulatory environment and opportunities offered by global clinical supplies market should help Bilcare Limited achieve reasonable growth rates.

- Bilcare Limited continued its innovations in FY20 with R&D activities and was able to cater to breakthrough solutions and added newer dimensions to existing offerings.

About Bilcare Limited

Bilcare Limited is a global leader and is an innovation-led packaging solutions provider, partnering with pharmaceutical industry to improve patient healthcare outcomes. Focus is on delivering effective and affordable solutions that enhance speed and quality of discovery of drug and help build and protect brands by assuring delivery of genuine medicines to patients. Bilcare PPI helps in providing innovative pharmaceutical packaging solutions, having wide range of specialty polymer films and aluminum foils principally used for packaging of solid dosage pharmaceutical products. Bilcare GCS offers global clinical material supplies for new drug discovery projects.

The company’s multiple manufacturing and R&D facilities on innovative pharma packaging solutions span across Europe, USA and Asia. These facilities and global sales force help the company reach and serve customers to 100+ countries with wide range of products and services. The company has global customer base and its customers comprise many largest global pharmaceutical companies like Bristol-Myers Squibb, Dr. Reddy’s, GlaxoSmithKline, etc.

Growth Enablers of Bilcare Limited

- Highlights of FY20: Bilcare Ltd has been in restructuring and realignment phase for past couple years. It has completed debt resolution of over 85%. Even though the company saw some working capital constraints, it continued to perform at almost same levels as last year. Ongoing support of customers and vendors allowed Bilcare Ltd sustain its operations and run at capacity levels of 45%. Primary focus of the company was cost reduction and improved production efficiencies. Especially during global pandemic of Covid-19, it implemented stringent cost control measures to preserve liquidity to mitigate any unforeseen situation resulting from pandemic. In FY20, the company has seen its revenue from operations of INR21,175.11 lakhs with other income of INR1,411.26 lakhs, leading to total income of INR22,586.37 lakhs. Out of total revenue from operations, revenue from sale of products was INR20,151.30 lakhs, with revenue from rendering services of INR820.61 lakhs. Sale of scrap helped the company fetch INR203.20 lakhs.

- Capable to Capitalizing on Industry Dynamics: Indian pharma market should be able to see sound growth which should stem from ageing and growing population, higher income levels, emergence of medical conditions, and new diseases, etc. as per market research report. Given that packaging plays an important role in this industry and is connector between industry and end consumer, it will have bigger role to play. India has one of lowest manufacturing costs and is seen as more economical than that of USA and almost half of Europe. Globally, it is also largest supplier of generic medicines. This country has fueled research and development of efficient packing solutions for pharma sector that shields contamination, provides drug safety, and convenience of delivery and handling.

- Pharma Packaging Innovations Business Should Lend Support: Bilcare’s pharma packaging innovations business is technologically driven and is focused on producing a range of films and foils to address most challenging requirements of pharma industry. The company works on bringing innovation to its products and services. Indian market in line with global trend is seeing voluntary use of child resistant and senior friendly lid foils. Bilcare is a global leader in CRSF market and it has natural advantage in this shift as it is qualified as CRSF supplier globally. Other trend which is noticeable was focus on cost-effective ultra-high barrier films. Bilcare is a pioneer in this segment and it has come out with a few variants. Bilcare is able to consolidate its brand - Bilcare Venus, as market leader not only in India but also in other important markets. Market shift to newer printed ideas segment is being seen which should further consolidate its position in this segment.

- Opportunities Offered by Global Clinical Supplies Market: Growth of clinical trial supplies market should principally be driven by increasing R&D expenditure in pharmaceutical and biopharmaceutical companies and globalization of clinical trials and harmonization of regulations. Rapid growth in some regions should be supported by increasing prevalence of chronic diseases, patient recruitment, lesser cost of conducting a clinical trial and government initiatives to conduct clinical trials.

- Support of Regulatory Environment: With clinical trial market seeing exponential growth, country focuses to be one of hottest destinations for global clinical trials. With implementation of new rules, CDSCO made significant changes in regulatory framework governing clinical trials in this country. New rules give predictable, clear and transparent system for clinical trials regulation. Changes like reduced approval period and online registry should be able to revive and drive growth of clinical trials industry. New rules should put clinical trials industry back on track. Condition of waiving local clinical trials under new rules will help achieve early access to drugs for patients in this country. Faster approval process should be speeding up trial procedure and promote local drug development.

Sharp Focus on Pharmaceutical Sector

Bilcare Limited has shifted and overhauled business processes so that it can adapt to changing times and exceed expectations of customer by offering innovative pharma packaging products. As part of debt restructuring plan, the company divested overseas subsidiaries in last financial year, helping the company reduce overall liabilities by INR2000+ crores, which is ~75% of group debt. Overseas subsidiaries assets were into certain non-core activities including credit card films & sleeves for FMCG packaging, dragging down the company’s value. After divesting business, the company is now more streamlined and focuses on generating value by catering to pharma sector. Indian PharmaCos have gained strength because of new world order and considering the company’s high-quality offerings, it should able to see significant growth.

Enterprising ability and research capability of pharma companies in India is getting global admiration. The company’s ability to offer value-based research solutions and patient-first focus of care & convenience should be able to lend some support to Bilcare and act as growth enablers. Child resistant, senior citizen friendly & anti-counterfeit security are some features growing in demand. Bilcare should be able to capitalise on sectoral opportunities and should be able to strengthen its position in sector. Products of Bilcare Ltd are approved & registered globally, including USA and Europe. Exports make up 30%+ of the company’s total turnover. Focus is on penetrating global reach with renewed energy and determination to grow exports.

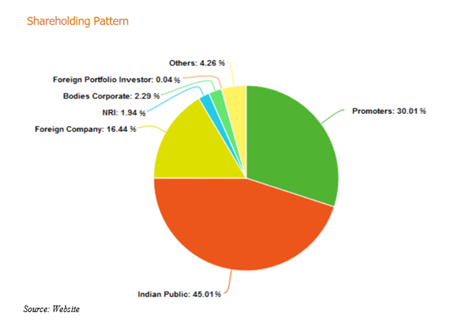

Stake of Renowned Indian Investor

Everyone has heard name of Mr. Rakesh Jhunjhunwala in investing community. His popularity in investing world stems from his stock-picking skills and from his investing experience. He is known for picking many multi-bagger stocks and has seen his wealth grow exponentially in recent past. One such stock Mr. Rakesh Jhunjhunwala holds is Bilcare Ltd. If the company’s annual report is to be believed, Mr. Rakesh R. Jhunjhunwala held 1,735,425 shares, making up 7.37% of total equity shares. This is as of Mar 31, 2020. Promoters of this company are owning ~30.01%, with Indian public owning ~45.01%.

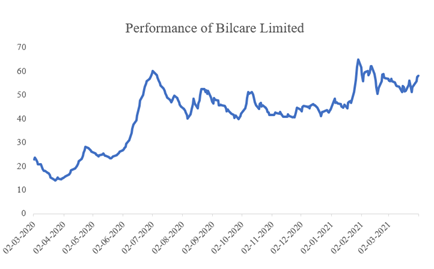

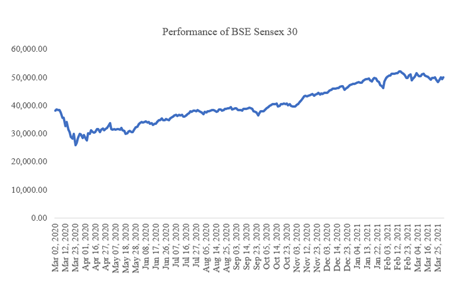

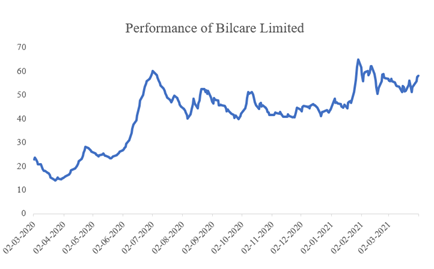

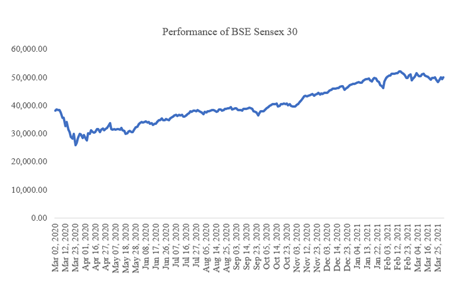

Exponential Returns Delivered

Markets have recovered significantly from lows seen in Mar 2020 and prices of most stocks have rallied. With some stocks lagging behind, there are few gems who have beaten returns seen in Sensex. One such gem is Bilcare Ltd. Between Mar 25, 2020- Apr 1, 2021, this stock has delivered a return of ~301%, with BSE Sensex 30 delivering only ~75.32%. This means that if someone would have invested INR1,00,000 in Bilcare Ltd on Mar 25, 2020, that investment would have become ~INR4,01,034.5 on Apr 1, 2021. One question popping up in mind of several investors is that what’s behind this significant rally in stock price? Let’s take a closer look to the company’s financials. It looks like rally in stock price was not in isolation, but because of improvement seen in its financial health. On a standalone basis, the company has narrowed its net loss for quarter ended Dec 31, 2020 to INR16.13 crores from INR109.97 crores in quarter ended Dec 31, 2019. On year-over-year basis, the company has seen its total income rise by ~56.6% in quarter ended Dec 31, 2020 to INR81.36 crores. Bilcare Ltd has a full market cap of INR129.15 crores and free-float market cap of INR90.40 crores.

Exclusivity:

This article is exclusive to investoguru.

Stock Disclosures:

The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Author Disclosures:

This Article represents the Author's own personal views. The Author did not receive any compensation and do not have any business relationship with any of the companies mentioned in the Article.

share your thoughts

Only registered users can comment. Please register to the website.