Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGIN

In the above picture, the body of the giant lion has many wheels inside them and the walking lion with many wheels depicts the courage, wisdom, tenacity and strength of the nation and this indicates the peaceful progress that the company could make its way into the future.

We all know that China, the Red dragon is manufacturing mammoth of the world and we are trying to catch up with them and most importantly emerge as a better alternative.The valuation of the Manufacturing sector of china is pegged at 4 trillion dollars which is more than the total GDP of our nation and this fact tells us that we still have a long way to go but then the world has started seeing the foul game played by the Chinese and they are looking for a better alternative and the Indian Government wants India to be that alternative.

INTRODUCTION OF PLI SCHEME:

Prime Minister Narendra Modi announced Production Linked Incentive (PLI ) scheme which is aimed at domestic manufacturing and this policy is expected to increase the country’s production by 520$ billion dollars in the next 5 years.

To summarize it all, India has given an official invitation to the world and has shown its interest in becoming the savior of the world.

One major beneficiary of this saga is our home - grown manufacturing giant Dixon Technologies.

The rise of Dixon Technologies:

Today, we will be seeing the astonishing journey of a colour Tv manufacturing company of 1994 and how it became the leading services and product manufacturer of 2020, the journey of delivering 697% returns to its shareholders in just three and a half years.

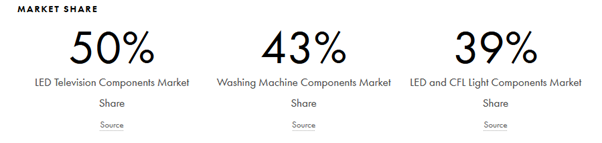

Dixon is a contract manufacturer. In fact, they are the biggest manufacturer of LED TVs in India producing stuff for the likes of Samsung, Panasonic, Xiaomi, TCL, OnePlus and many more. They also manufacture lighting products for companies like Philips, Havells, Syska, Bajaj, Wipro, Orient and more. They happen to be the leading contract manufacturer of semi-automatic washing machines for clients like Godrej, Samsung, Lloyd, Panasonic. And they also dabble with manufacturing mobile phones.

The Manufacturing edge of the company

The Diversified product portfolio:

Their diversified product portfolio includes (i) consumer electronics like LED TVs; (ii) home appliances like washing machines; (iii) lighting products like LED bulbs and tubelights, downlighters; (iv)mobile phones/smart phones; and (v) CCTV & DVRs (vi) Medical Equipment. Dixon also provides solutions in reverse logistics i.e. repair and refurbishment services of set top boxes, mobile phones /smart phones and LED TV panels.

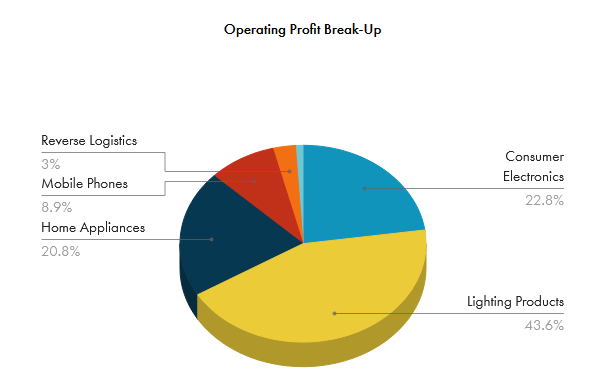

Where does Dixon get most of its money from?

Established track record and market position in EMS business – DTIL has more than two decades of experience in the EMS business and has an established track record as well as leadership position in the key segments in which it operates. Over the years, the company has augmented its manufacturing capacities alongside acquiring cost competency to become one of the largest and cost-efficient EMS players in the country. These strengths have helped DTIL in adding new principals as well as maintaining healthy relationship with its clients, resulting in repeat business.

Dixon derives 50% of its revenue from only two clients and 85% of the revenue from the top 5 customers and it’s still a huge risk to have such a concentration but then the Dixon is really good at what it does and unless and until there are any conflict which may arise in the future can take the company towards the wrong direction.

The impeccable growth story of the company

Source - Annual report

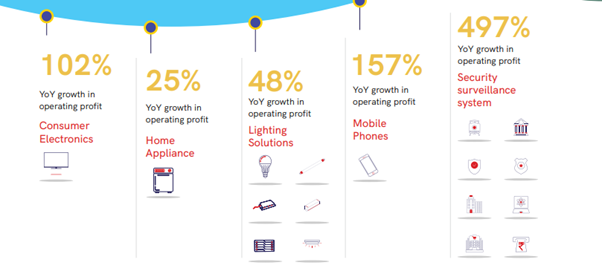

From the above picture it is clearly visible that the company had an impeccable growth achieved by the company. It has clocked three digit growth on three segments when the Indian economy was growing at a mere 4% and Their revenue numbers have grown six times between FY13 to FY20 — from 726 crores to 4,400 crores. Net profit has grown by a whopping 24 times from 2 crores to 120 crores. The growth has been so remarkable that since its listing in September 2017, the company’s share price has grown by 570% from Rs 531 to Rs 3,600.The investors poured money into the stock like there is no end for the company.

Does the valuations justify the growth of the company?

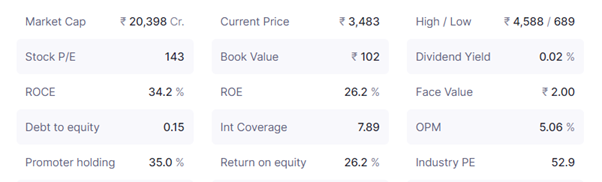

The company is trading a price to earning multiple of 143 and if you are expecting any Margin of safety in your investment, Well the truth is you are not getting any margin of safety in your investment.

But Hold on….

The Price to Earning doesn’t include the growth factor that the company has achieved or the potential which can be transcended. Hence, lets have a look at the PEG ratio of the company and the PEG ratio would solve the mystery around the valuation

The PEG ratio of the company is 2.40, which is a reasonable valuation and if you are not satisfied with the above valuation lets have a look at the EV / Sales ratio

EV/Sales - is a financial ratio that measures how much it would cost to purchase a company's value in terms of its sales. A lower EV/sales multiple indicates that a company is more attractive investment as it may be relatively undervalued.

Source - Screener.in

Leaving valuations aside, the company has performed well in most of the metrics, The ROCE and ROE is terrific and the company doesn’t have any significant debts. The promoter holding is low at 35% and the major issue remains of the thick margins, the OPM of the company is 5.06% and as the margins are low and any issues can vaporize the profits.

Opportunities Ahead

Dixon still has big aspirations to grow and succeed and the focus of the company is moving towards being the big smart phone manufacturer and the company as it stands is the biggest manufacturer of feature phones in the country. They have the capacity to produce 32 million units. But features phones are dying a slow painful death and smartphones are pervading all walk of life. And while the company still produces 3 million smartphones right now, they want to up it to 20 million units in the next couple of years.

To this end, they have also bagged orders from Motorla worth an estimated 3000 crores and another from Nokia which is expected to fetch them around 4000 crores. And while production is likely to begin this quarter, it seems like a decent start. So yeah, Dixon has a lot going for it and it seems poised to do well. But like all high growth companies, they still have to contend with some very real existential threats and we will just have to wait and see how the company progresses from here on in.

share your thoughts

Only registered users can comment. Please register to the website.