Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINThe First Mile:

Duringg the year 1947,Mr.G D Birla envisioned that the country would face an acute shortage of cotton, and man-made fibres will be needed to supplement textile fibre availability for clothing. and he laid the first brick to his thought by incorporating Grasim just 10 days after India’s independence and thus began Grasim’s journey which mirrors India’s growth story.

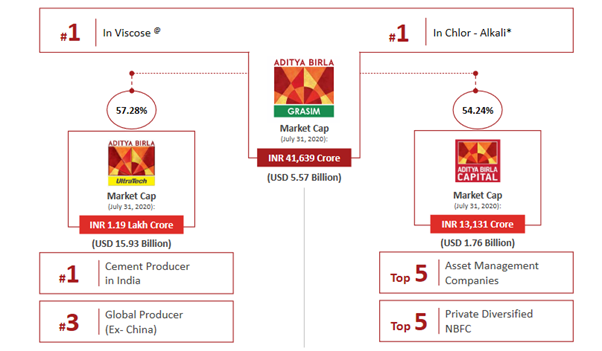

They begun their first production of fabric in Gwalior in the year 1950 and from there started their VSF production and then they set up in the first mill and so on. Today, it has evolved into a leading diversified player with leadership presence across many sectors and It is a leading global producer of Viscose Staple Fibre, the largest Chlor-Alkali, Linen and Insulators player in India. Through its subsidiaries, UltraTech Cement and Aditya Birla Capital, it is also India’s largest cement producer and a leading diversified financial services player. Grasim has also announced foray in decorative Paints business

Grasim has become on the strong conglomerate in India and has market leadership acrosss various verticals.

Let’s analyse the multiple business verticals of the company:

Cement vertical (54% of the revenue)

Grasim Industries is the holding company of the Ultratech cement Ltd. It is the largest manufacturer of grey cement, Ready Mix Concrete (RMC) and white cement in India. The company has a consolidated capacity of 116.75 Million Tonnes Per Annum (MTPA) of grey cement. It has 23 integrated plants, 1 clinkerisation plant, 26 grinding units and 7 bulk terminals. Its operations span across India, UAE, Bahrain and Sri Lanka.

Ultratech cements has many achievements to boast about:

Financial Services (22% of the revenues)

The company is the primary promoter of Aditya Birla Capital Ltd, which is the holding company for the financial business of the A.B. Group. It has a strong presence across investing and financing solutions with presence in Housing finance, insurance, broking, private equity, insurance advisory, etc. It has a pan-India presence with a network of 850+ branches, 200,000+ agents and channel partners, & a tie-up with ~90 banks

Source - Annual Report

Viscose segment (12% of the revenues)

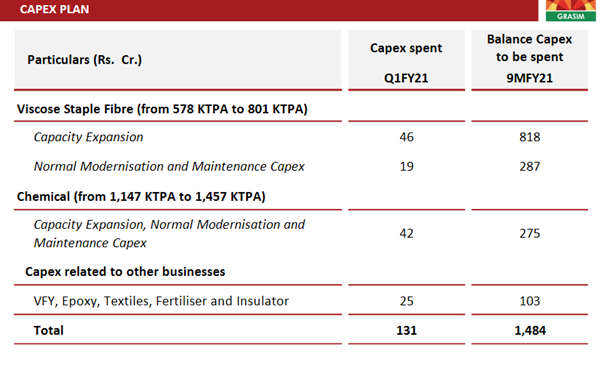

The company is the largest producer of Viscose Staple Fibre (VSF) in India with a leading share in the global market. It derives 90% of its revenues from the local market and the rest 10% revenue comes from exports. Presently, the vertical is operating at its peak capacities across its facilities. It has on-going CAPEX plans in the VFY segment to increase its capacity from 578 KTPA to 801 KTPA by FY22. The company also entered the Viscose Filament Yarn (VFY) segment following the merger with Aditya Birla Nuvo Ltd in 2017 and acquisition of rights to manage Rayon division of Century Textiles. Presently, it is the largest exporter of VFY in India. The current manufacturing capacities of the segment stand at 48 KTPA.

Chemical segment (7% of the revenues)

The company is India's largest caustic soda producers and is a market leader in the chlor-alkali segment. In 2016, its caustic soda capacity increased by ~95% post its merger with its sister company Aditya Birla Chemicals Ltd. Presently, it operates 8 manufacturing units of caustic soda with capacities of 1,147 KTPA of caustic soda & 123 KTPA of epoxy plant. Presently, its capacity utilization rates stand at ~90% in its caustic soda production facilities. The Net Revenue of the Chemicals unit for FY20 stood at 5,504 Crore and EBITDA at 1,008 Crore.

Other business (5% of the revenues)

Textiles - Company set up Jaya Shree Textiles in 1949 which in today's date is one of leading linen and wool manufacturers in India. It sells its products in over 50 countries across 6 continents.

Insulators - The company is India's largest and world's 4th largest manufacturer of electric insulators. It produces the widest range of insulators in India including insulators for transmission lines & substations up to 1200 kV voltage level, as well as equipment & railways. It owns 2 manufacturing facilities in Gujarat & West Bengal with a manufacturing capacity of ~55 KTPA of insulators.

Fertilisers - The company was a leading agri-solutions provider to the agro industry in India but On November 12, 2020, the board of directors approved the sale of company's fertilizer business –Indo Gulf Fertilizers on a going concern basis to Indorama India Private Limited through slump sale for a lump sum cash consideration of Rs. 2,649 Crore, subject to working capital adjustments and requisite approvals. The deal is expected to be closed in 9 months.

Weakness and Threats for the company:

Exposure to risks related to cyclicality in the VSF business

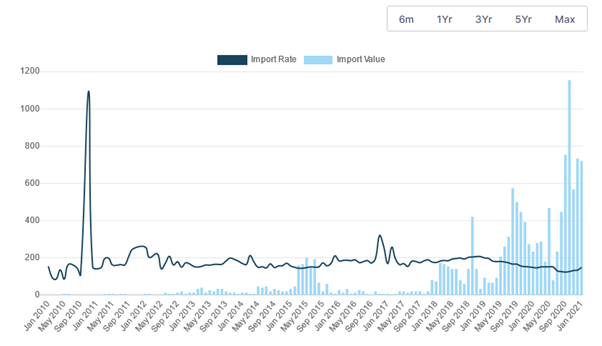

The VSF demand remains impacted by any downturn in the economy. Besides, it faces intense competition from other fibres, mainly cotton and polyester staple fibre leading to fluctuation in profitability. VSF improves the moisture absorption of blended yarn however cotton can be used instead of VSF in the manufacture of blended yarn. Hence, demand for VSF will be influenced by movements in cotton prices. Grasim’s strong market position aided by largely backward integration of operations should help it manage any downturn in the industry.

Source - Screener.in

The above charts shows the prices of the viscose over the past 10 years and from that we could that the commodity is very volatile and any decrease in the price of the artificial cotton might impact the profitability of the concern.

The burden of Vodafone Idea – Grasim industries holds 11.75% stake in the Vodafone India ltd and the company has no other choice but to financially support Vodafone to keep it a floating company. In the FY-20, Grasim Industries made an investment of 2886 crore in the company. Vodafone Idea had a Net loss of 78,000 crores in the FY- 20, though the company is functioning but it might take a long time for the company to see any kind of profits in the coming years and any other huge financial support to the company might hurt the financials of the company

Litigations against the company – The company has a outstanding litigations worth 5287.5 crores and the company has two outstanding cases which are still pending:

Opportunities for the company:

Huge Capex plan:

The company is all set for increasing its capacity and expand in the above-mentioned segment. The company is counting on its monopoly status in the Viscose Staple fibre and enhancing its production in the current Financial year.

The chemical business of the company still has the potential and given the boom in the chemical sector in the recent times, the company is also trying to capitalise its presence and has allocated 275 Crores for the financial year.

Foray into the Paint business:

Grasim Industries came up with a recent announcement that it is all set to foray into the decorative paints business, with initial capital amount of Rs.5000 crore. The company has laid down a mission of becoming the Number 2 player in the decorative paints segment in the upcoming three years.

The market was very happy with the announcement and the stock skyrocketed 12% on the very next day after the announcement.

But the major question remains whether the company can make the desired disruption in the paint segment or not?

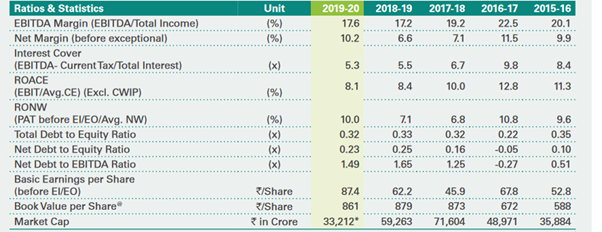

Valuations and other key metrics:

The company is trading at a Price to Earnings multiple of 21.9 times and as on Apr 6 2021, the company had a Market cap of around 98,000 crores and the book value of the company is 861 and the company is trading 2x of the book value.

The company enjoys good market position in all the sector that it operates in and thus enjoying a higher and stable EBITA margin of 17.5%. The company has a low return on equity of 6.51% for the last 3 years.

The company has laid down a high capex plan and because of which the Debt to equity of the company stands at 1.49% and it might hurt the company when there is an prolonged economic downturn.

The Birla group: In perspective

Tough times don’t last but tough companies do!!!

Over a longer historical arc, the Aditya Birla Group has witnessed dramatic disruptions across periods, businesses, and geographies. And yet, the company have come out stronger. Always. Grasim today, is home to world-beating fibre and cement companies. The unmatched global scale built across diverse sectors like fibre, chemicals and cement is on the back of decades of relentless innovation, soaring and fearless ambition, incessant cost consciousness and nimbleness and With a strong management and the monopolistic business will aid the growth of the company in the coming days..

share your thoughts

Only registered users can comment. Please register to the website.